Have you recently experienced an accidental injury and are unsure about how to navigate the claims process? You're not alone; many people find themselves overwhelmed by the complexities involved in verifying their injuries for a claim. This article will guide you through the essential steps and provide handy templates to make your claim submission seamless. So, let's dive in and empower you with the knowledge you need to strengthen your case!

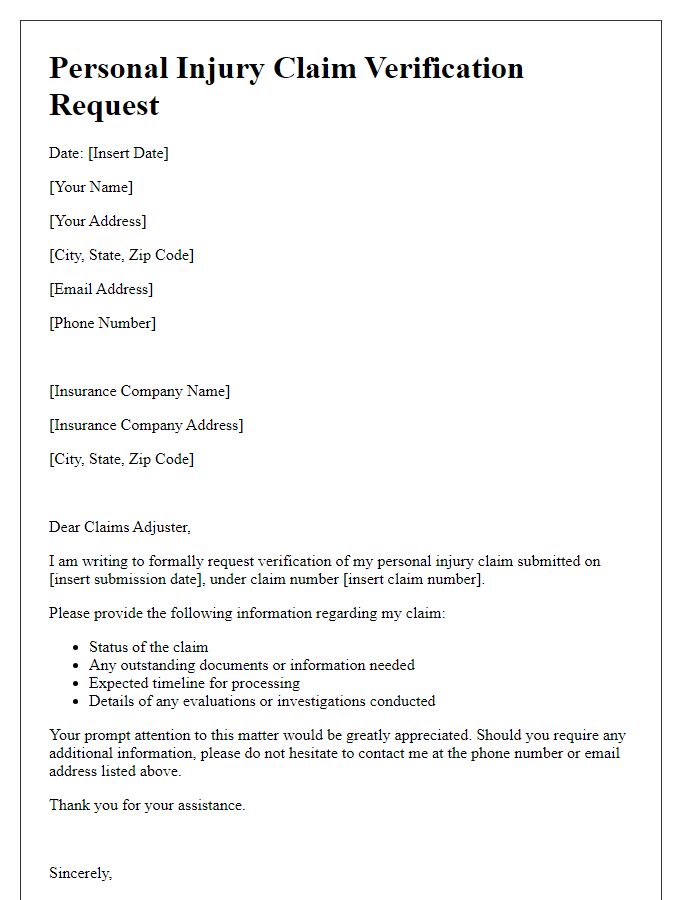

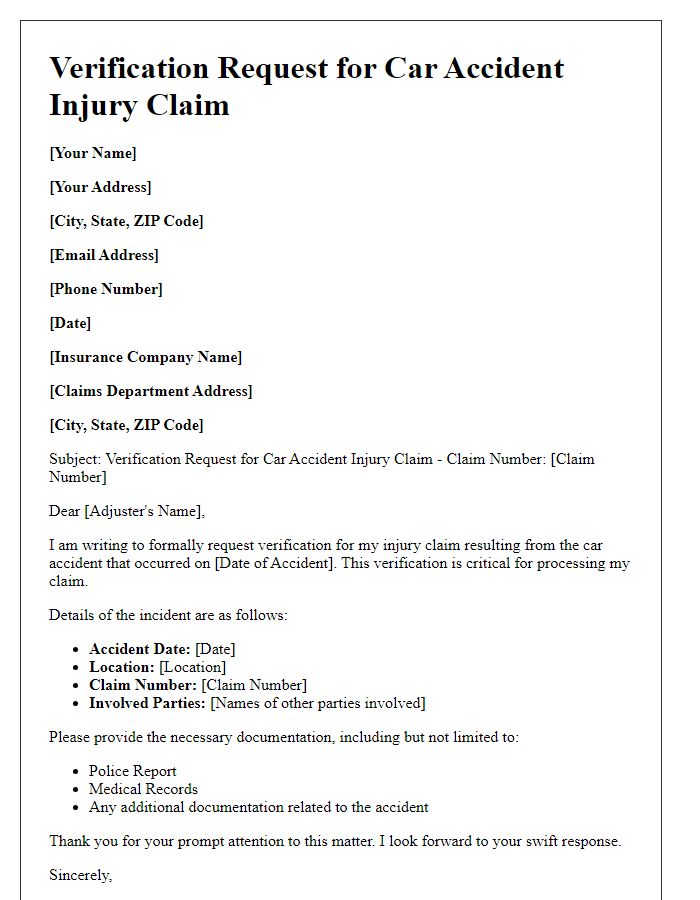

Claimant's Personal Information

Accidental injuries often occur in various environments, impacting individuals' lives significantly. The claimant's personal information, including full name, address, contact number, and date of birth, plays a crucial role in the verification process for injury claims. Accurate details ensure that legitimate claims, often arising from incidents like slips at shopping malls or car accidents on Interstate 95, are processed efficiently, allowing for appropriate compensation. Documentation, such as medical records and accident reports, further substantiates the claimant's experience during these distressing events, leading to fair evaluations by insurance companies and legal representatives. Comprehensive verification helps maintain the integrity of the claims process and supports those seeking justice and reimbursement for medical expenses or lost wages after an injury.

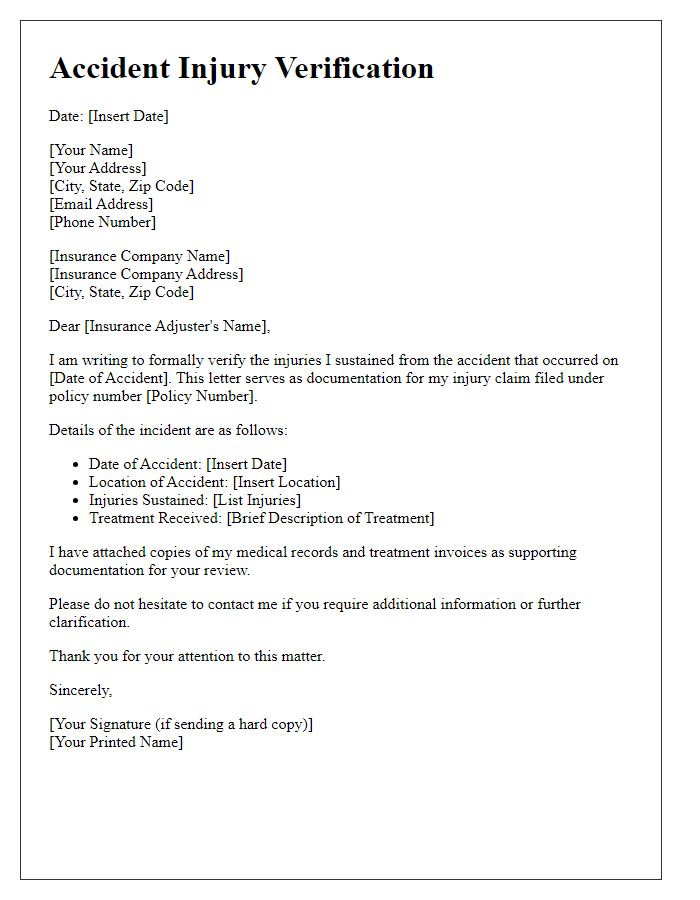

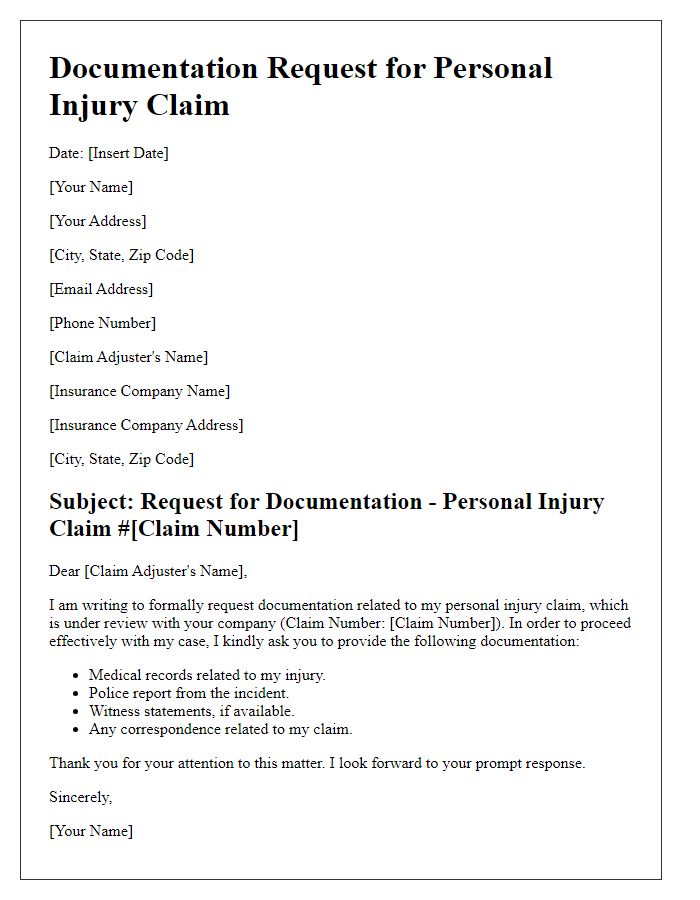

Details of Accident

Accidental injuries can stem from various incidents, such as vehicular collisions on highways, slips and falls in grocery stores, or mishaps during recreational activities, like hiking accidents. Specific details, such as the date (e.g., October 12, 2023), time (around 3 PM), and precise location (Main Street and 5th Avenue in Springfield) are crucial for verifying claims. Witnesses, such as nearby pedestrians or employees, can provide testimonies to support the claimant's account. Medical reports documenting injuries, like fractures or sprains, and photographs of the scene add further credibility. Insurance policy numbers will also play a key role in the verification process, determining coverage and claims eligibility.

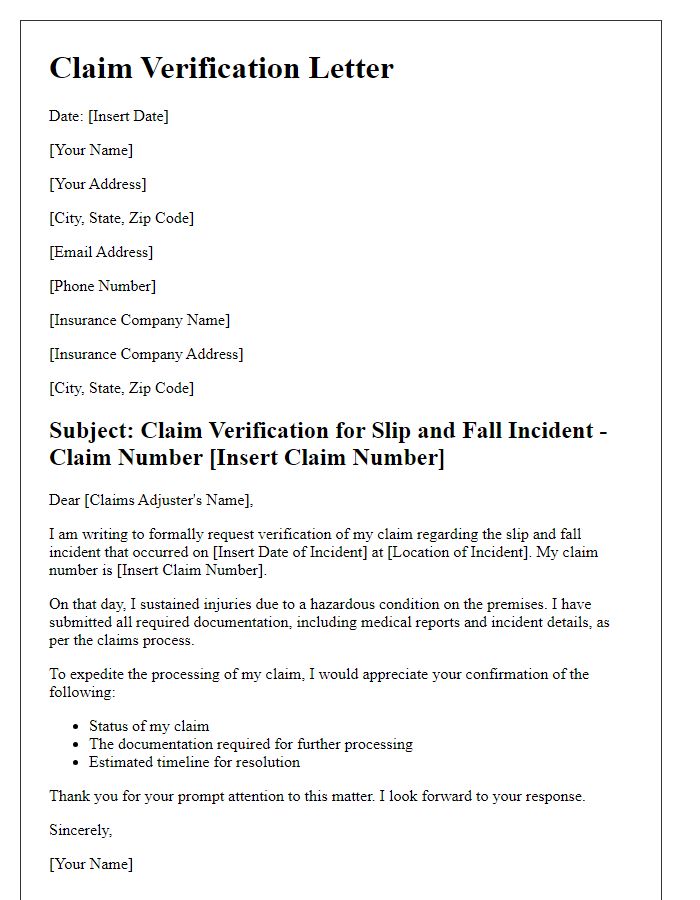

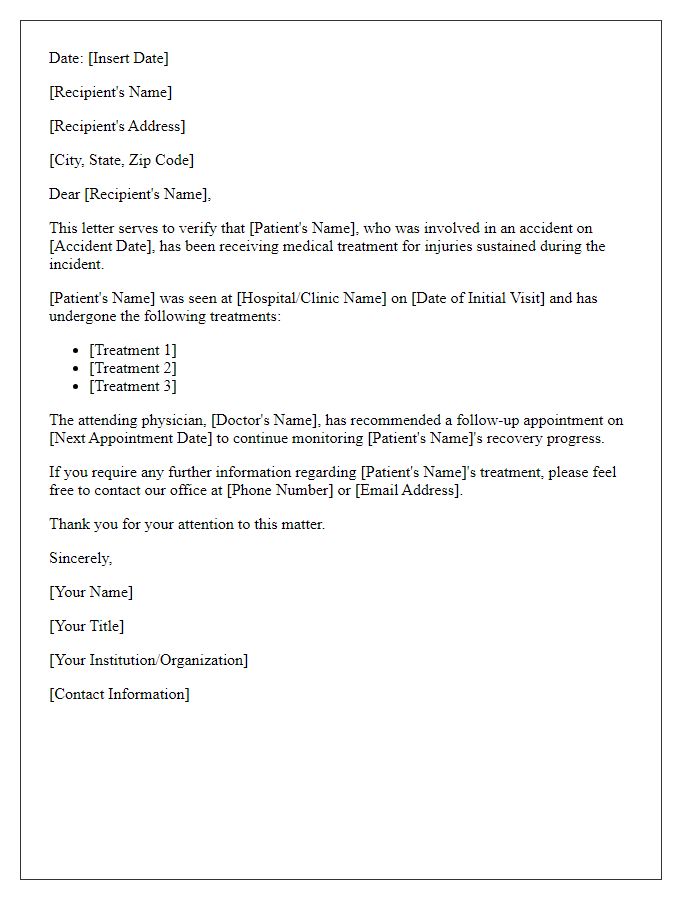

Medical Documentation

Accidental injuries often require thorough medical documentation for claim verification in insurance cases. Such documents include medical records detailing the incident (date, time, and place), treatment received, and prognosis from healthcare providers. Specific information like the attending physician's name, hospital details, and diagnosis codes (ICD-10) enhances credibility. Detailed treatment plans, including dates of follow-up visits and any prescribed medications, can support claims further. Photographic evidence of injuries, along with written statements from witnesses, may provide crucial context to strengthen the claim. Accurate and comprehensive medical documentation is essential for ensuring smooth communication between claimants and insurance adjusters.

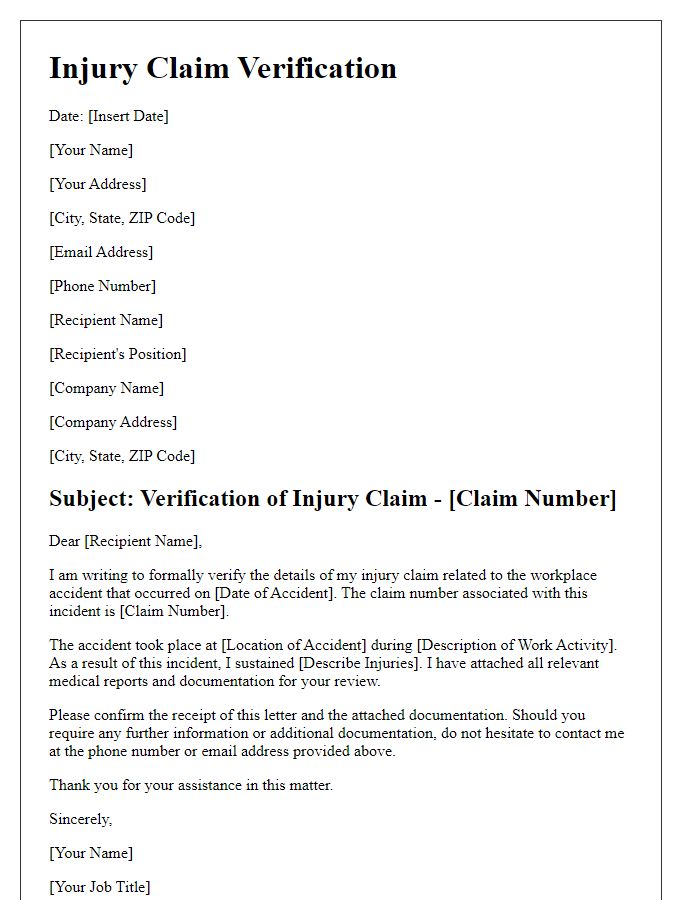

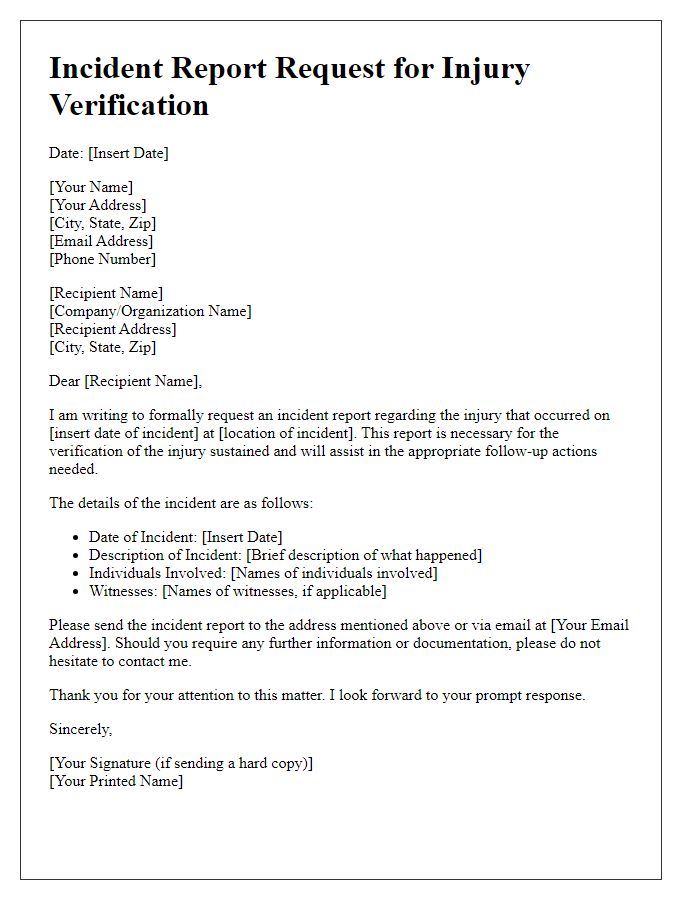

Witness Statements

Witness statements play a crucial role in supporting accidental injury claims, providing firsthand accounts of the incident. These statements often include vital details such as specific dates (e.g., March 15, 2023), precise locations (e.g., Broadway Street, New York City), and descriptions of events leading up to the injury. Witnesses may describe factors like weather conditions (e.g., heavy rain leading to slippery surfaces) or equipment involved (e.g., malfunctioning scaffolding at a construction site). Furthermore, statements might include observations of the injured party's behavior (e.g., how they were interacting with their surroundings before the incident) and any immediate actions taken post-accident, such as calling emergency services (e.g., dialing 911) or rendering assistance. The credibility and detail of these statements significantly enhance the claim's validity, providing essential context for legal and insurance processes.

Insurance Policy Information

Accidental injury claims often require thorough verification of insurance policy information to ensure valid processing. This includes documenting relevant details such as the policy number, which identifies the specific insurance agreement, and the insurer's name, responsible for covering potential claims. Important dates, such as the policy inception and expiration dates, provide context regarding coverage validity during the incident. The type of coverage, whether it's liability, personal injury protection, or medical expenses, must be clarified to ascertain what damages are eligible for reimbursement. Additionally, the claimant's personal details, such as full name and address, should match the information on record to support the legitimacy of the claim and expedite evaluation by the claims department.

Comments