Are you navigating the intricate world of liability claims? Understanding how to effectively notify the responsible parties is crucial for a smooth process. In this guide, we'll break down essential elements, tips, and examples that will empower you to craft a clear and concise liability claim notification letter. Stick around as we dive deeper into this topic and equip you with everything you need to know!

Clear identification of parties involved

In a liability claim notification, it is crucial to clearly identify the parties involved to establish accountability and context. The claimant, who is the individual or entity pursuing the claim, must provide their full name, address, and contact details. The respondent, who is the individual or organization being accused of liability, should also be clearly listed with their full name, address, and any relevant identifying information, such as a business name or registration number. Additionally, include details of the incident that led to the claim, including dates, locations, and circumstances surrounding the event to create a comprehensive background that supports the claim. This precision aids in the efficient processing of the claim by insurers or legal entities.

Detailed description of the incident

A liability claim notification must accurately capture the specifics of the incident to ensure a comprehensive understanding. On October 5, 2023, at approximately 3:00 PM, at the intersection of Maple Street and Oak Avenue (a high-traffic area known for its frequent accidents), a silver sedan (license plate number ABC1234) collided with a pedestrian, John Doe (age 34), who was crossing the street at the designated crosswalk with a green pedestrian signal. Witnesses, including three nearby individuals and a bus driver, reported that the sedan was exceeding the speed limit of 25 miles per hour (traveling at an estimated speed of 40 miles per hour) before the accident occurred. The pedestrian sustained severe injuries, including a fractured leg and multiple contusions, necessitating immediate medical attention at City Hospital, where he remained for three days. The incident was documented by local law enforcement, with a report filed under case number 56789 detailing the events leading up to the collision. This notification serves as a formal communication to initiate the liability claims process regarding these events.

Specific claim amount or compensation sought

In a liability claim notification, a specific claim amount is essential for outlining the compensation sought by the claimant. For instance, if an accident occurred on March 15, 2023, at Main Street, Springfield, leading to medical expenses of $7,500, lost wages totaling $2,000, and additional damages estimated at $1,500, the total claim amount would equal $11,000. Accurately detailing these figures helps establish the extent of the financial impact, making the notification clear and concise. Comprehensive documentation (like medical bills and wage statements) supports the request, ensuring a thorough review by the liability insurance company or responsible party.

Relevant legal references or policy details

A liability claim notification must include specific legal references and policy details to ensure it meets necessary requirements. Relevant sections might refer to local statutes such as the Tort Claims Act, which outlines procedures for filing claims against governmental entities, or the specific insurance policy number associated with a homeowner's liability insurance, detailing coverages under sections like Personal Liability and Medical Payments. Additionally, it could include references to the Insurance Policy Act, as well as any applicable state statutes regarding negligence. Policy details should specify coverage limits, deductibles, and exclusions defined in the contract, ensuring clarity on the entitlements covered under the policy's terms.

Contact information for follow-up

Submitting a liability claim notification requires detailed contact information for effective follow-up. Essential components include the claimant's full name, complete mailing address, phone number, and email address for electronic correspondence. Additionally, the date of the incident, the location where it occurred (such as a specific venue or address), and a brief description of the event leading to the claim enhance clarity. Specific details, like the claim number, insurance policy information, and names of witnesses or involved parties, provide necessary context for quicker resolution. Accurate and organized documentation facilitates communication between all parties involved in the claim process.

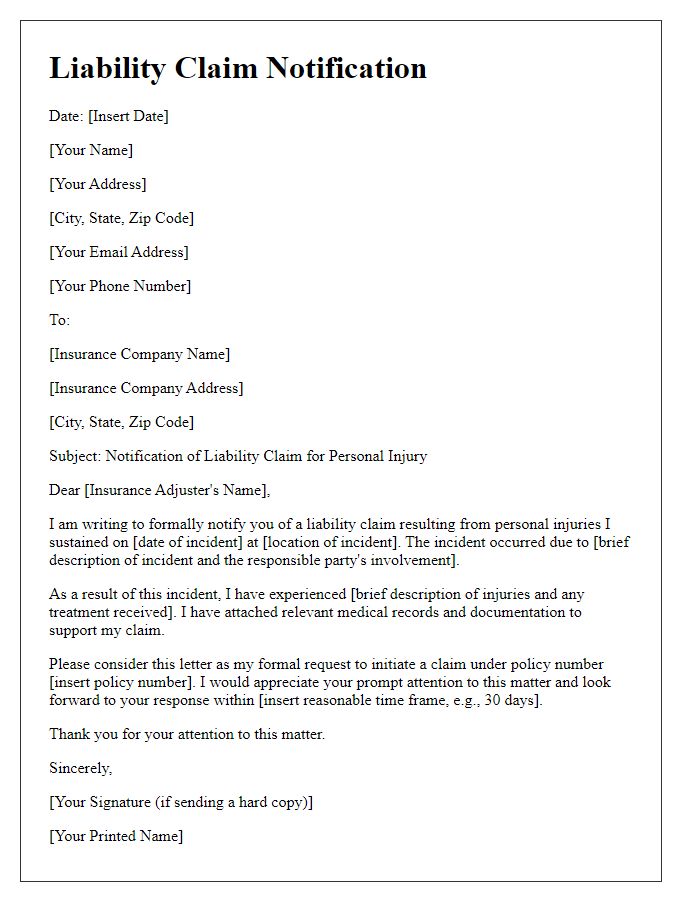

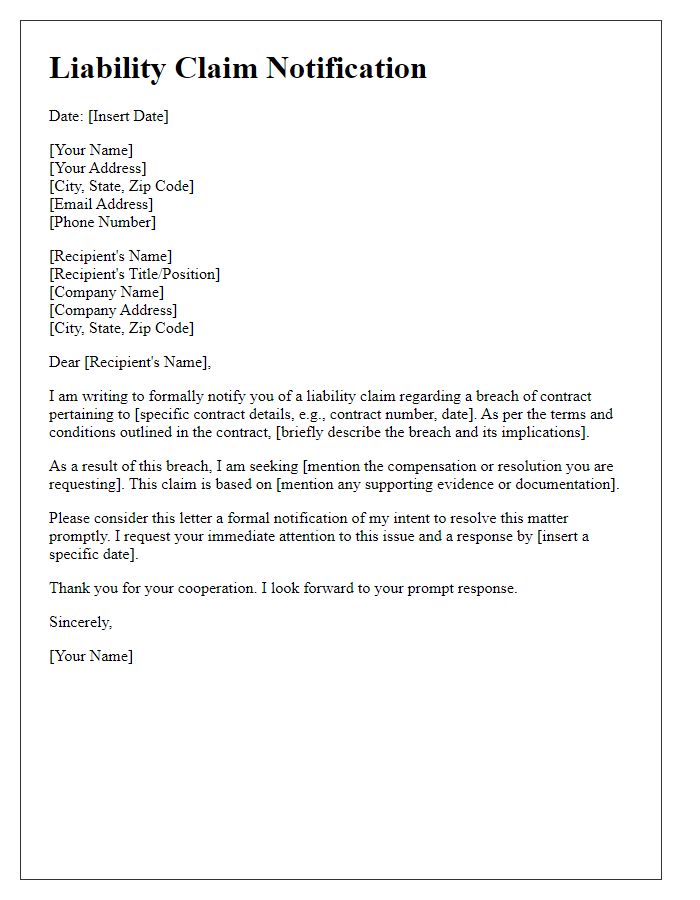

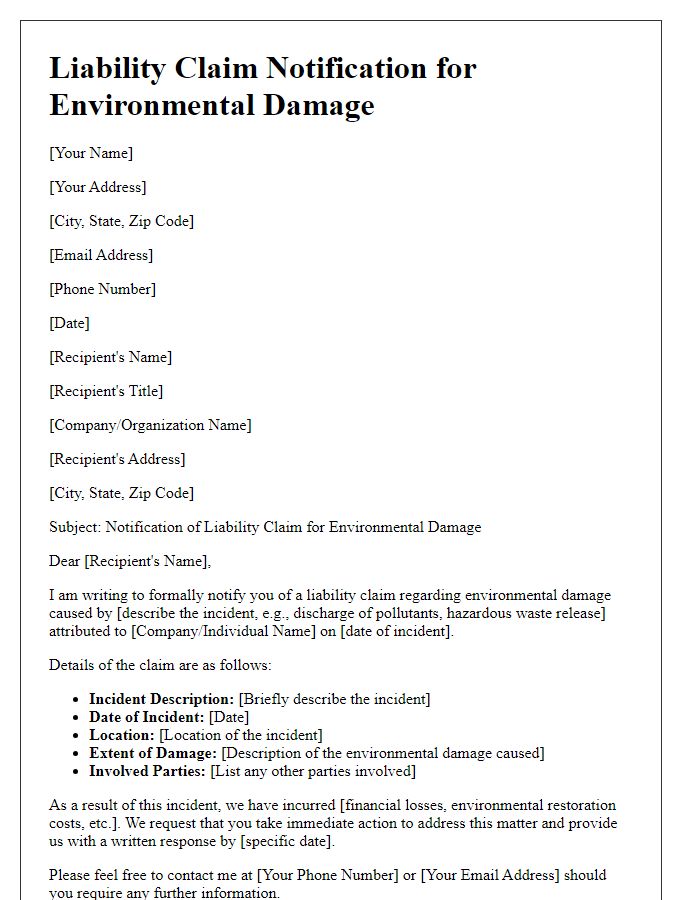

Letter Template For Liability Claim Notification Samples

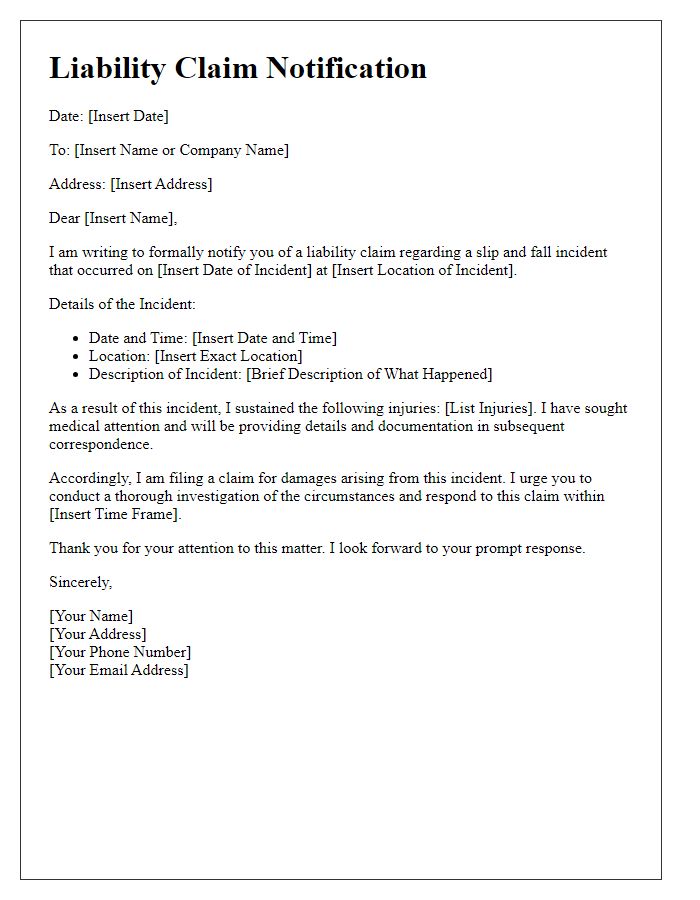

Letter template of liability claim notification for slip and fall incident.

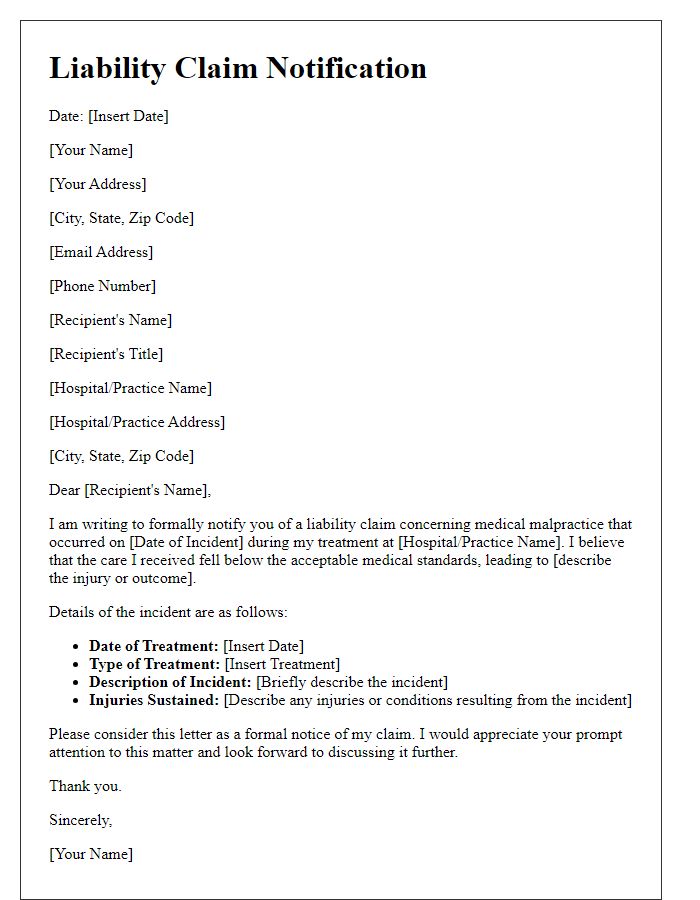

Letter template of liability claim notification for medical malpractice.

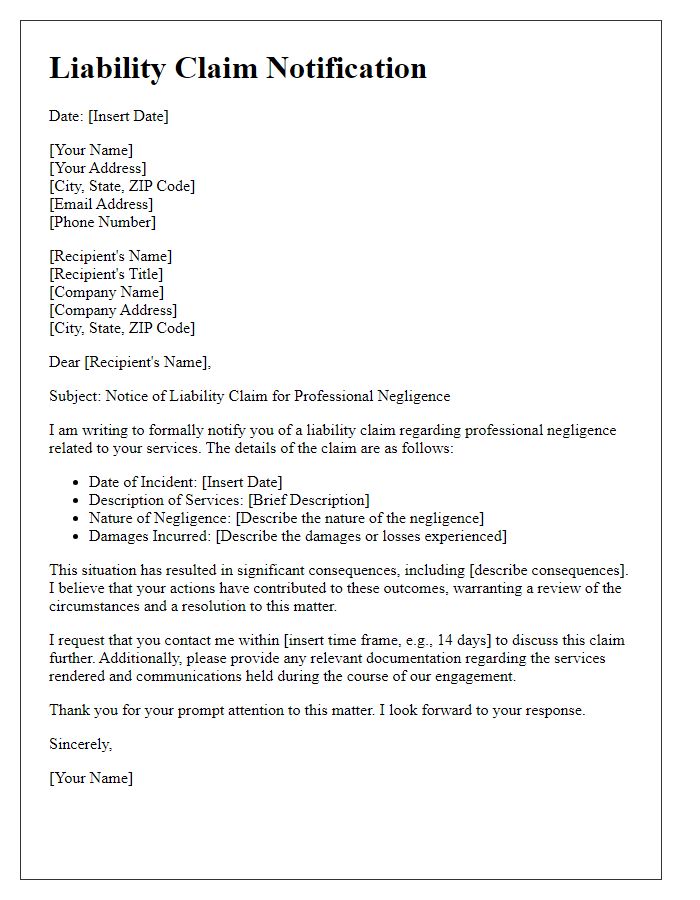

Letter template of liability claim notification for professional negligence.

Comments