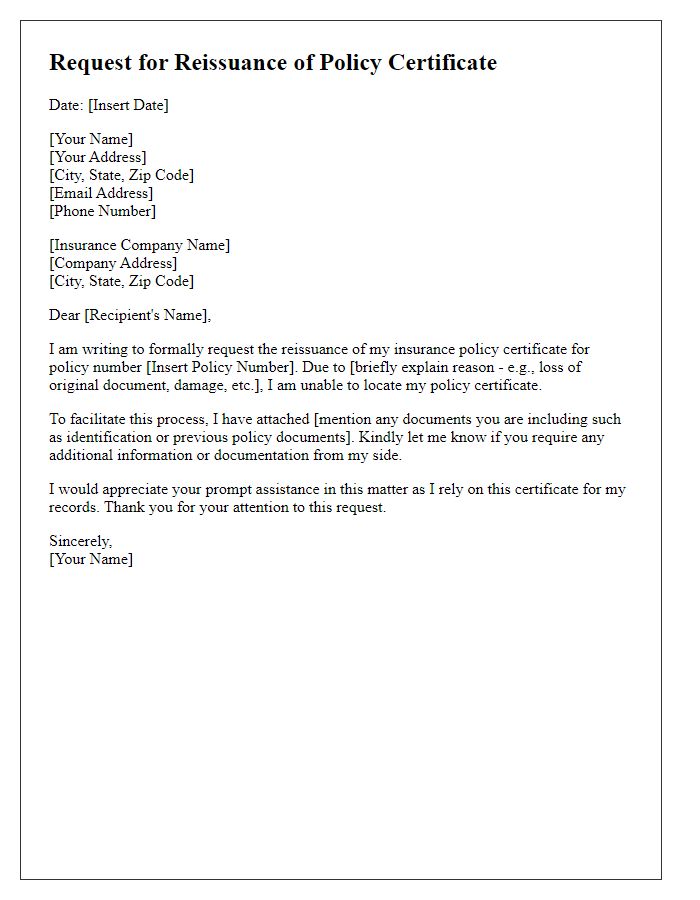

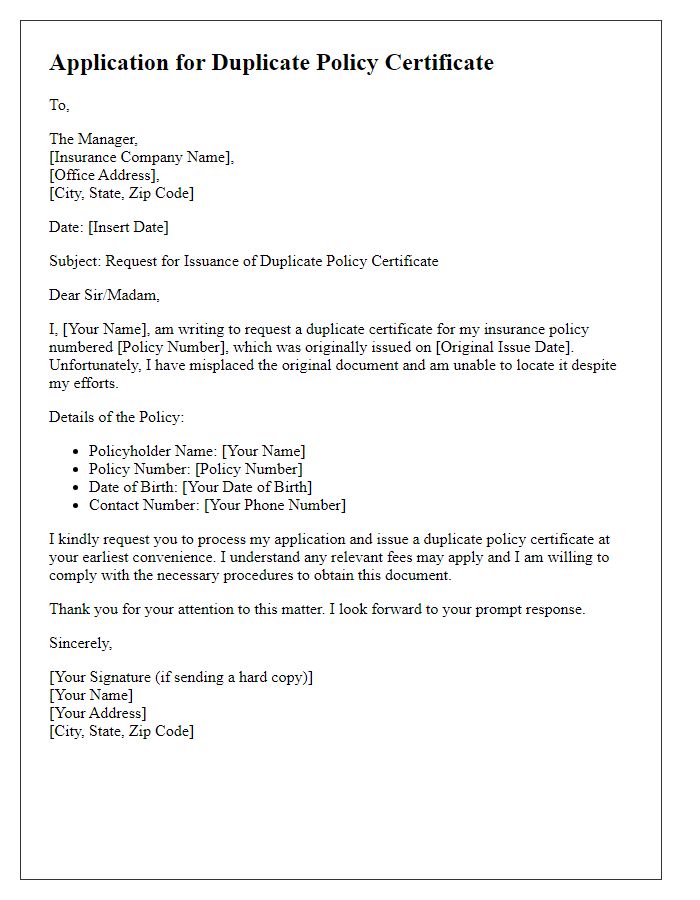

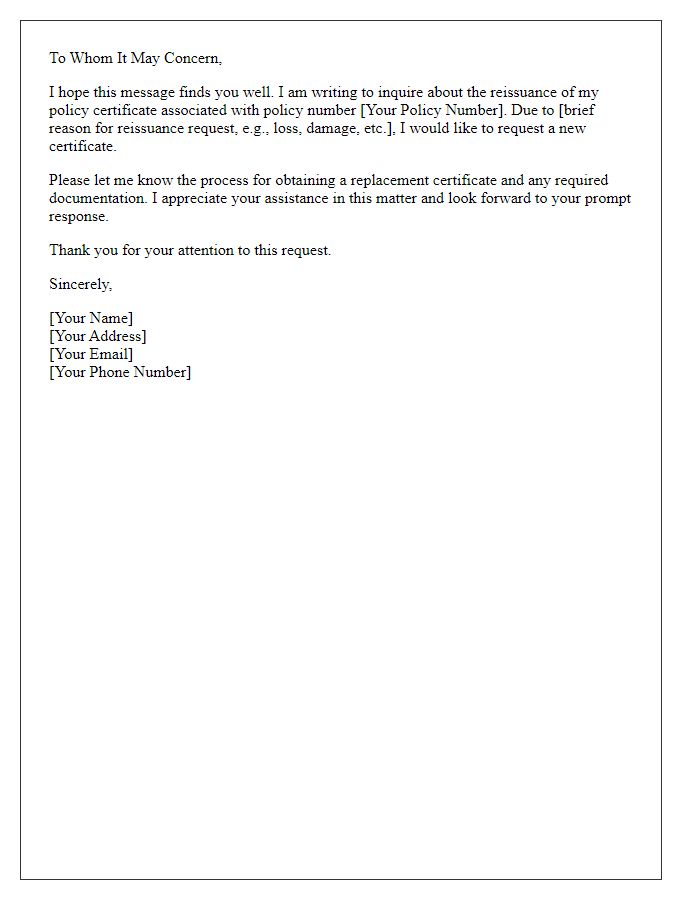

Are you in need of a reissuance of your policy certificate but unsure where to start? Writing a letter for this purpose doesn't have to be complicated; it's all about being clear and concise. By providing essential details like your policy number and the reason for the reissuance, you can ensure a smooth process. If you're ready to streamline your request and get that certificate in hand, read on for a helpful template!

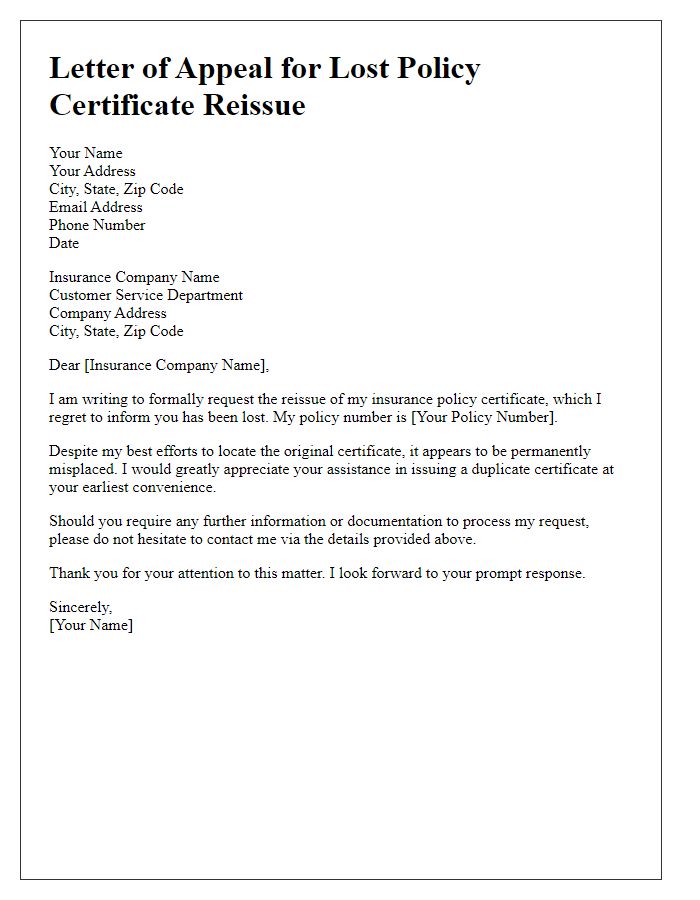

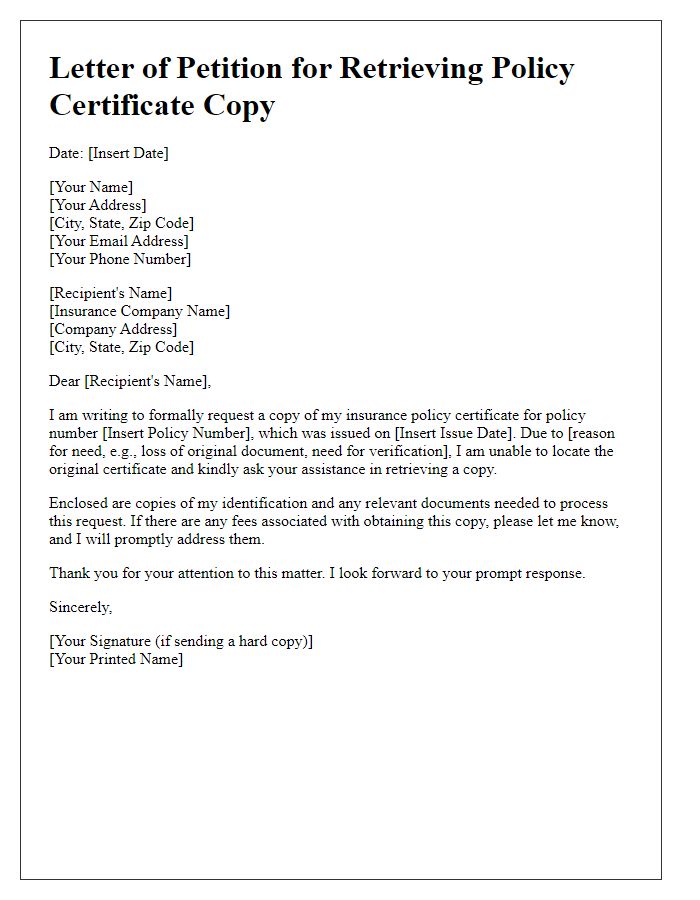

Policyholder's Name and Contact Information

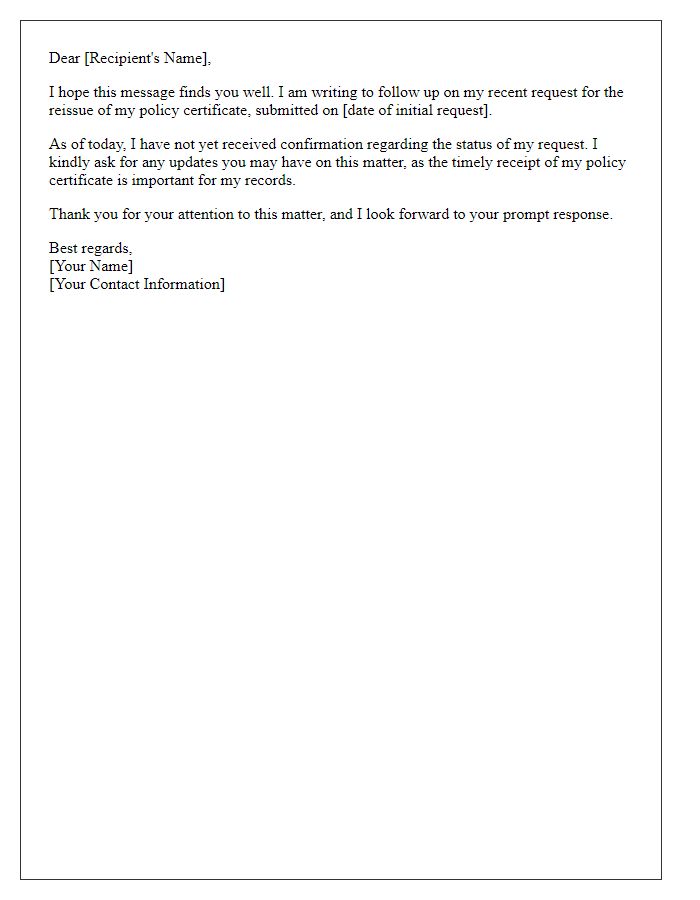

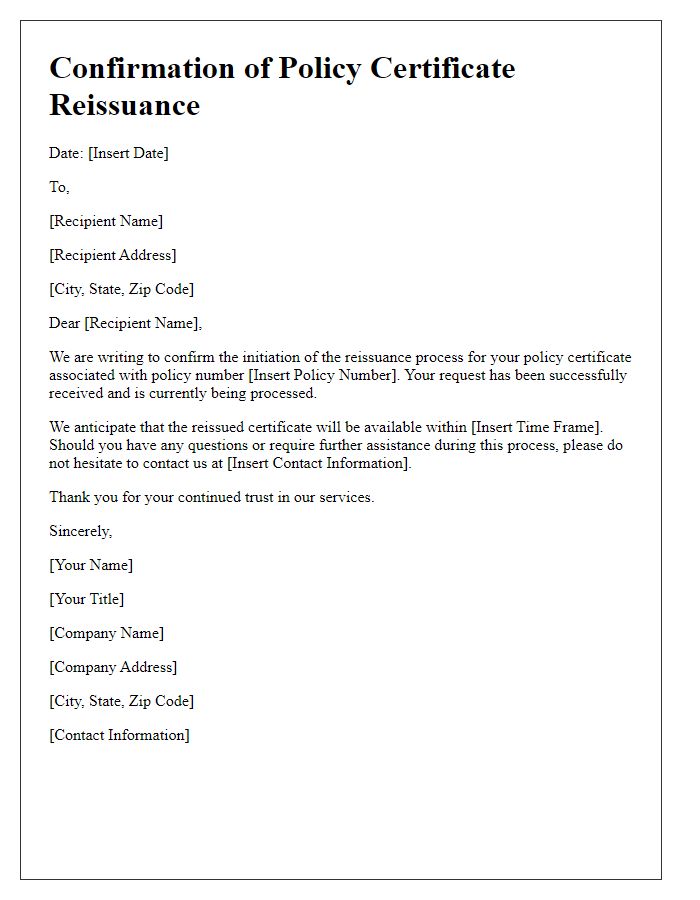

Policyholders may require the reissuance of a policy certificate, which serves as a crucial document providing proof of insurance coverage. The policyholder's name, along with detailed contact information, must be accurately stated to ensure the reissued document reflects the correct beneficiary information. Including the policy number is vital for efficient identification and retrieval within the insurance company's database. Additionally, specifying the reason for the request, such as a lost certificate or a change in personal information (like an address or contact number), can expedite processing. Timely response from the insurer is essential, as delays can affect the policyholder's assurance of coverage during unforeseen events.

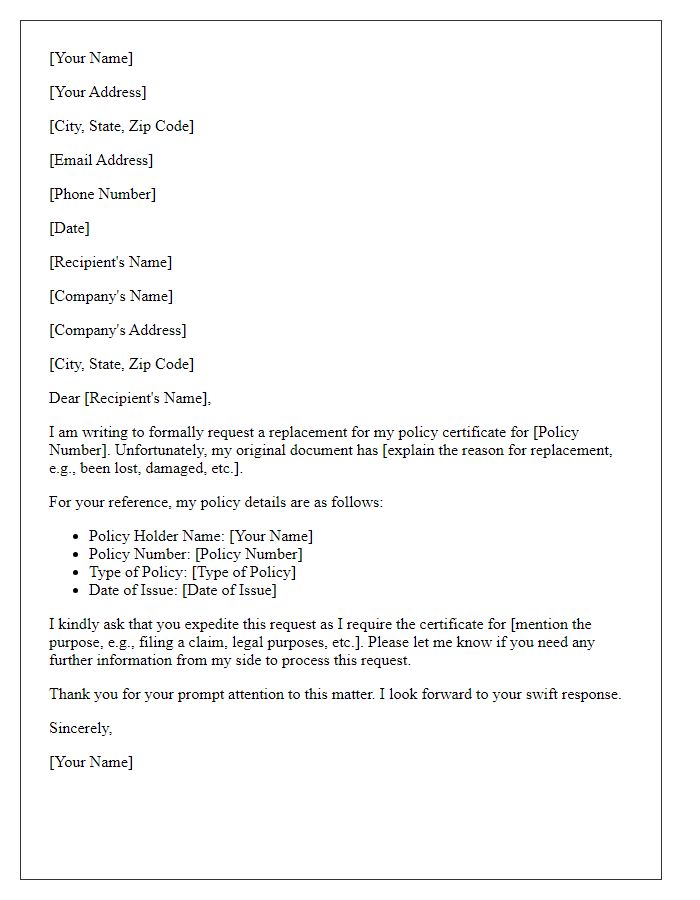

Policy Number and Details

The reissuance of policy certificates, particularly for insurance policies, often involves a specific request due to loss or damage of the original document. For instance, an individual may require a reissued certificate for a home insurance policy (Policy Number: H123456789) obtained from a reputable insurance provider. Essential details include the policyholder's name, the effective dates of coverage spanning from January 1, 2023, to December 31, 2023, and a thorough description of the insured property located at 123 Main Street, Springfield. Additionally, a unique identification number may be necessary for referencing the policy in the provider's system during the request process. This ensures accurate processing and expedites the issuance of the required document, serving as crucial validation of the coverage for potential claims.

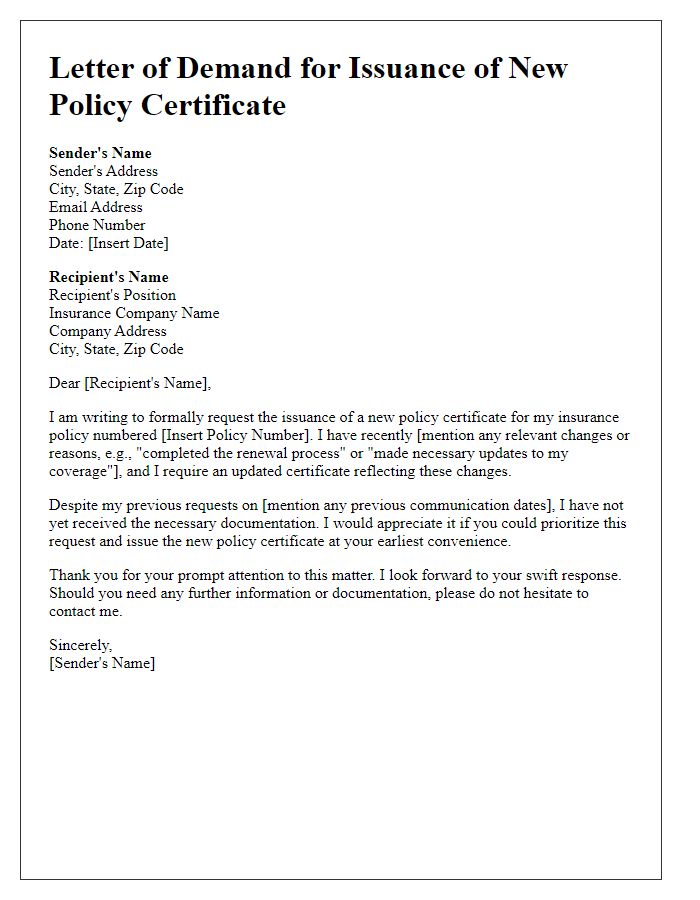

Reason for Reissuance Request

Reissuance of policy certificates may be necessary due to various reasons. Common scenarios include loss of the original document, which may occur through misplacement or accidental damage, requiring a formal request to replace the certificate. Changes in personal information, such as an update in the policyholder's address, name, or marital status, necessitate a reissuance to ensure accurate records with the insurance provider. Additionally, policy upgrades or modifications, including increased coverage limits or added riders, may also demand a new certificate to reflect the updated terms. Each of these reasons underscores the importance of maintaining accurate and accessible insurance documentation for both policyholders and insurers, safeguarding against potential disputes and misunderstandings.

Date of Original Issuance

The reissuance of a policy certificate is essential in maintaining accurate records for policyholders, especially in cases of loss or damage. Original issuance dates, such as March 15, 2020, play a crucial role in calculating policy duration, potential claims, and renewal periods. Insurers, including Aetna or Progressive (as examples), require a formal request along with relevant identification and existing policy details to process this request efficiently. Policyholders must provide their unique policy number, which helps streamline the reissuance process, ensuring that the new certificate contains all pertinent information, including coverage specifics and terms. Furthermore, timely reissuance prevents gaps in coverage and maintains compliance with regulatory requirements, safeguarding the interests of both the insurer and the policyholder.

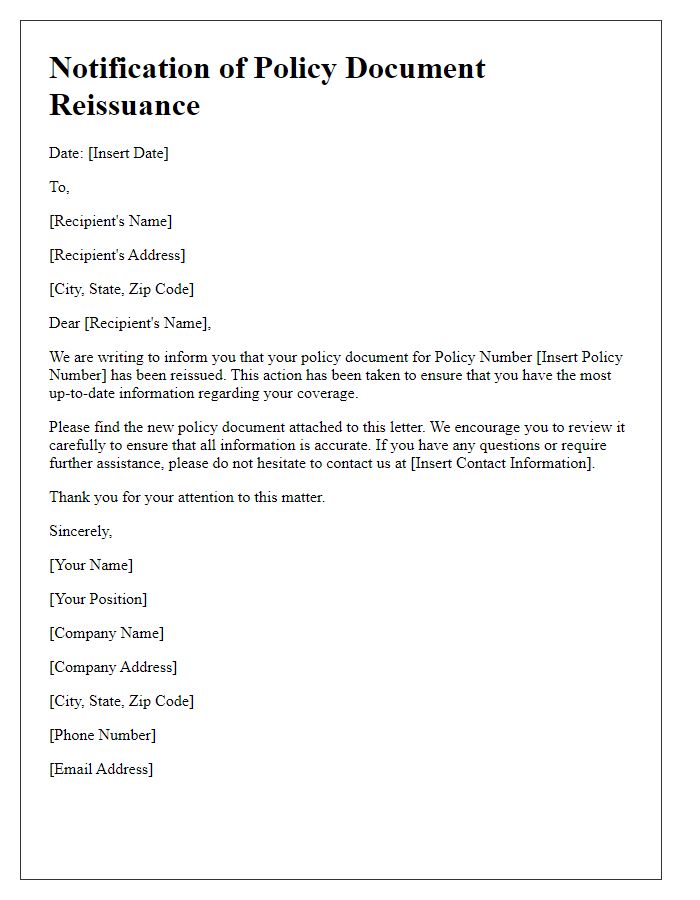

Signature and Authorization Statement

Reissuance of policy certificates often requires a detailed Signature and Authorization Statement to ensure the legitimacy of the request. A properly structured statement should include the policy number, the insured individual's full name, and specifications regarding the type of policy - for instance, a life insurance policy or an automobile insurance policy. In detailing the request, it is essential to affirm the identity of the requester through methods such as providing a government-issued identification number or Social Security number. Furthermore, clarity in the statement should indicate consent for the insurance company to process the reissuance, with promptly stated dates for processing, reflecting urgency when necessary, particularly when impending renewals or deadlines for coverage are imminent.

Comments