Have you ever found yourself wrestling with the complexities of requesting a premium overpayment refund? Navigating the ins and outs of insurance policies can be daunting, but it's actually simpler than you might think! This guide will walk you through crafting the perfect letter to secure your refund with ease. So, grab a pen and let's dive into the details together!

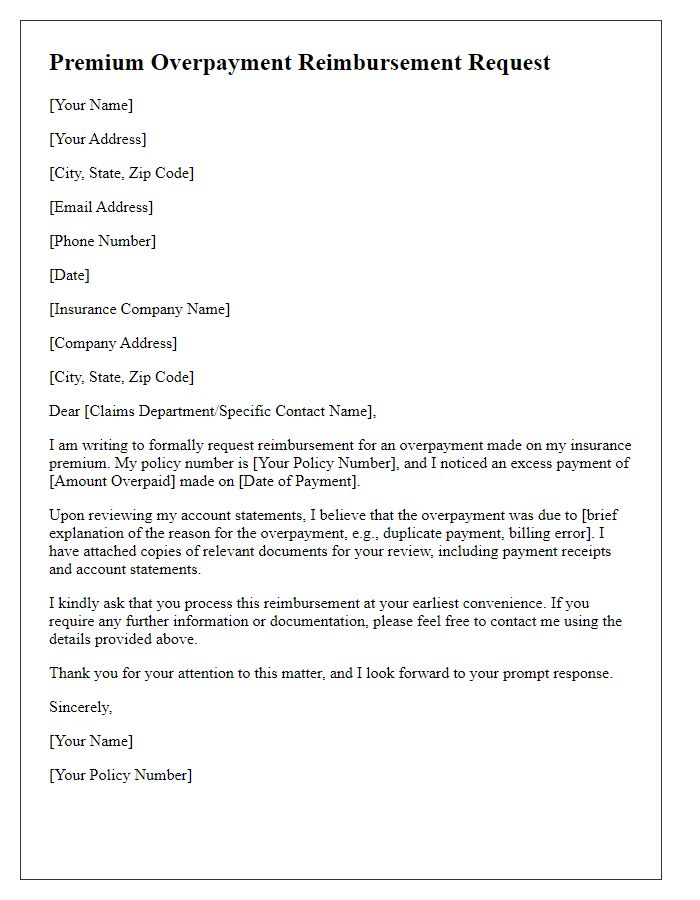

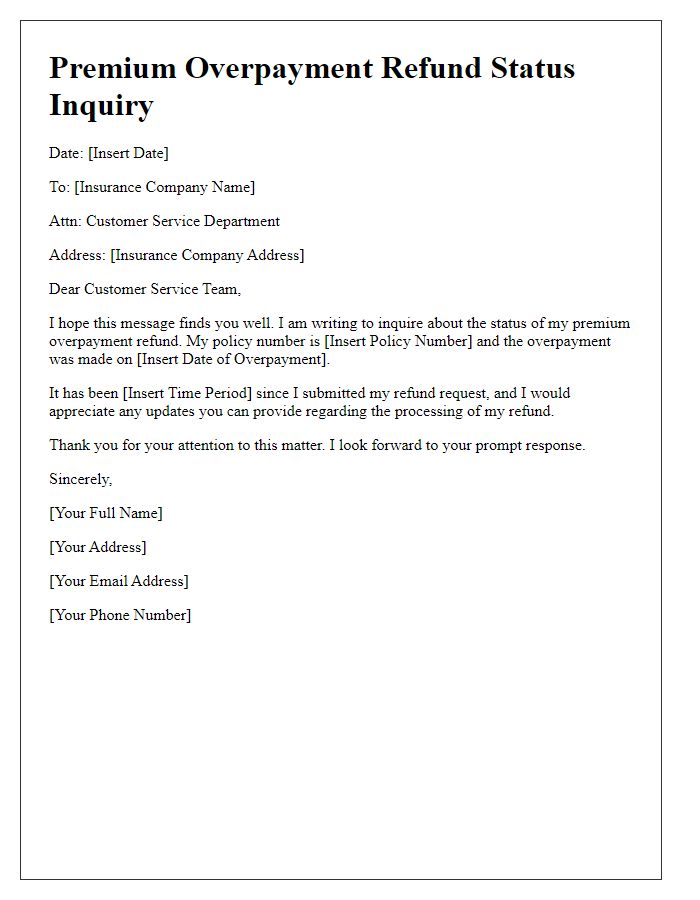

Clear identification of parties involved

A premium overpayment refund involves a financial transaction where a customer has paid more than the required amount for an insurance policy or subscription. The parties involved include the policyholder (the customer who made the overpayment) and the insurance company (the entity responsible for managing the policy). Proper identification of these parties is crucial. The policyholder's name, address, and policy number help establish their identity and clarify the specific account associated with the overpayment. The insurance company's name, contact details, and specific department handling refunds serve to direct the communication accurately. Additional information, such as the transaction date and overpayment amount, provides essential context for processing the refund efficiently.

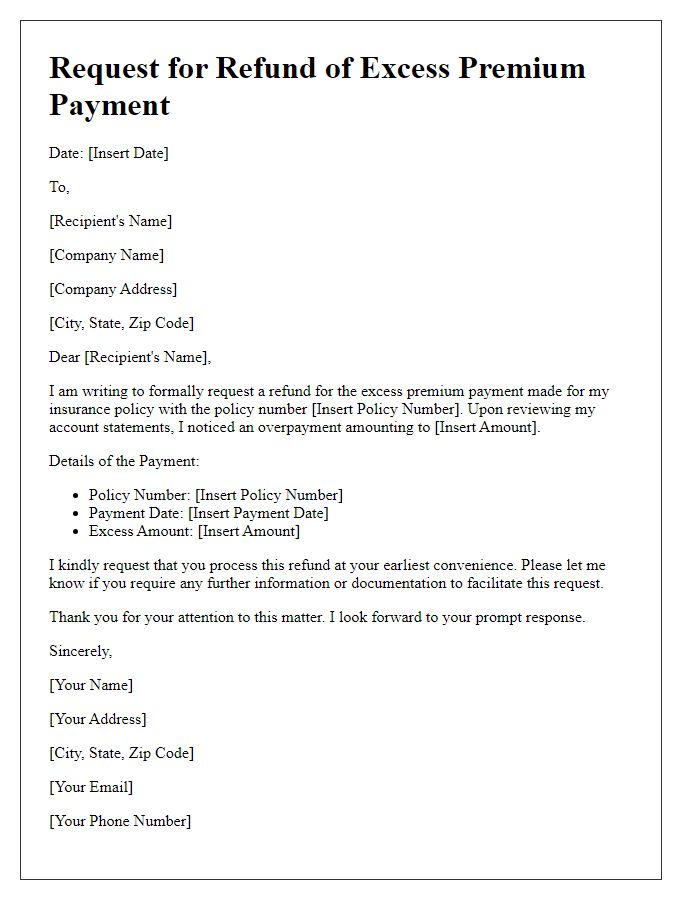

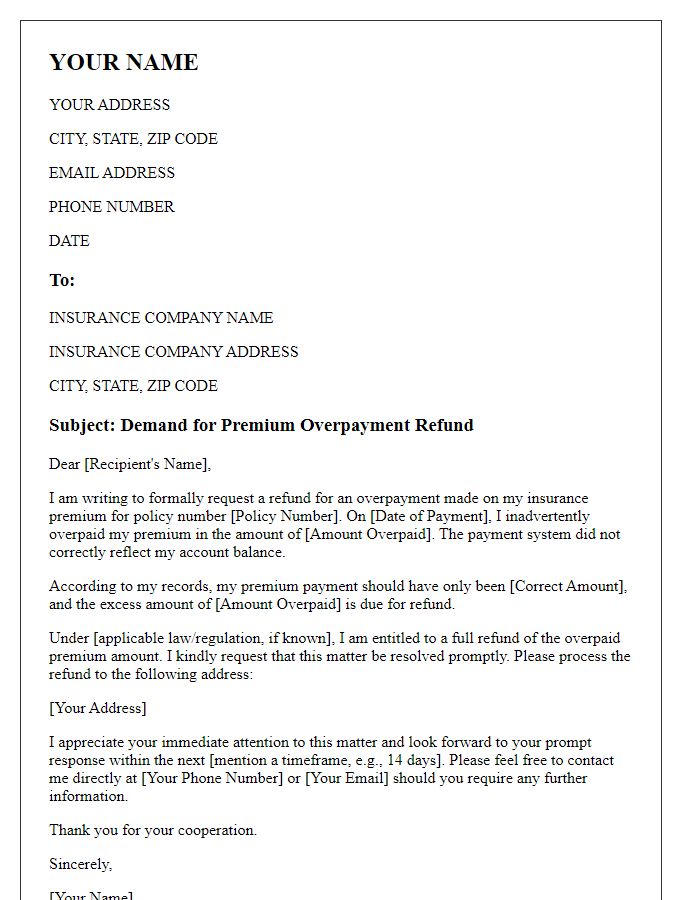

Precise refund amount and payment details

Customers may encounter overpayments on premium insurance policies, leading to the need for a refund process. For instance, a client who has overpaid $200 on a health insurance premium can initiate a refund request through their insurance provider. Payment details such as the original transaction reference number, payment method (credit card, bank transfer), and the date of the overpayment (e.g., January 15, 2024) should be included in the request. Ensuring accurate documentation of the error, along with a verification of the current account balance, can streamline the refund process and facilitate prompt reimbursement.

Explanation of overpayment circumstances

Overpayment of premiums often occurs due to billing errors, changes in coverage level, or policy adjustments. For instance, if an individual purchases a health insurance policy with a monthly premium of $300 but receives a bill for $350 due to a clerical error, this scenario would lead to an overpayment of $50. Similarly, if a policyholder decides to upgrade their coverage but the insurer incorrectly processes the downgrade instead, leading to an excess charge for a specific month, that overpayment might also require rectification. Such discrepancies can arise in various types of insurance including auto, home, or life insurance, impacting families and individuals financially. It's essential to document all communications and transactions related to the policy to streamline the refund process and facilitate proper resolution of any premium overpayment.

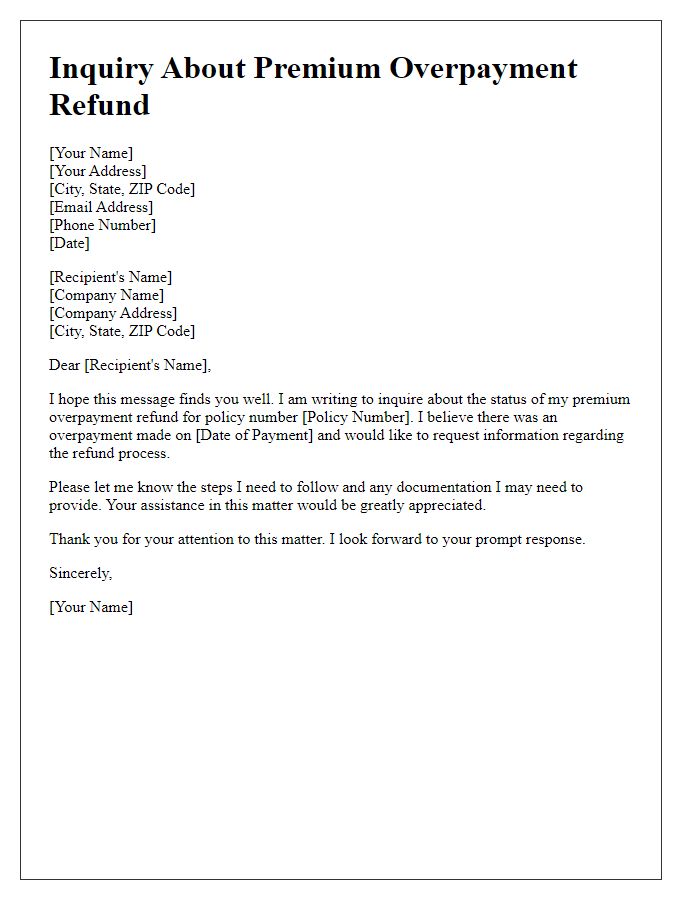

Desired refund timeline and method

Premium overpayments can significantly impact personal finances, especially when dealing with insurance premiums, such as health, auto, or home insurance. Policyholders often seek refunds for overpaid amounts due to various reasons, including billing errors or changes in coverage. Typically, desired refund timelines, usually ranging from 30 to 60 days, reflect industry standards set forth by regulatory agencies. Refund methods include direct bank transfers to streamline the process, checks mailed to the policyholder's address, or credits applied to future premium payments, enhancing customer satisfaction and retention. Tracking refund requests helps ensure timely reimbursement, fostering trust between consumers and insurance providers.

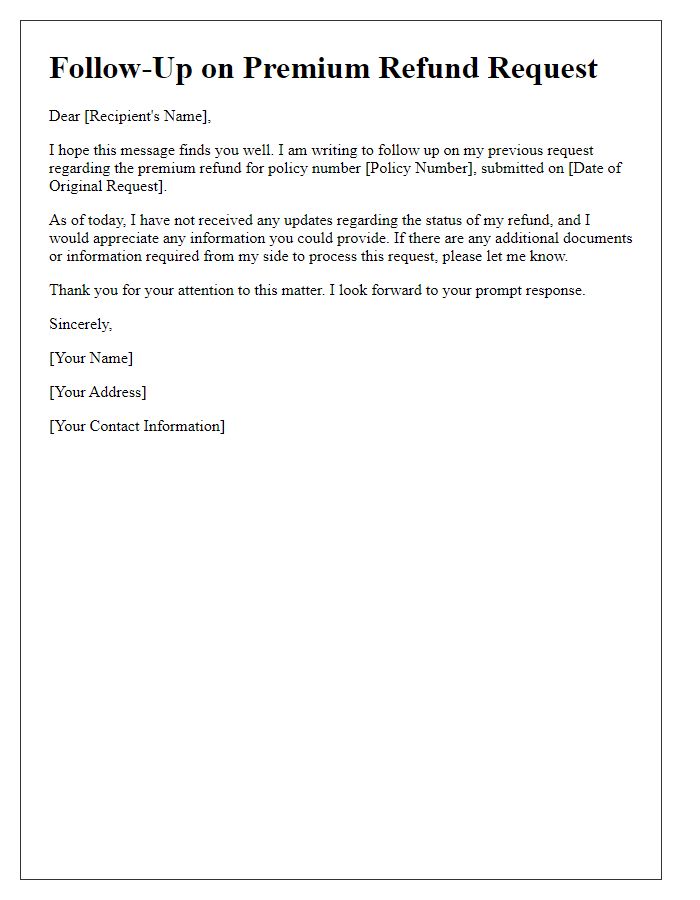

Contact information for queries or follow-up

Premium overpayments can create financial confusion for policyholders seeking refunds. Insurance companies often have specific protocols for addressing these refunds and usually provide dedicated contact information for inquiries. Customers may need to reach out via a customer service hotline or email address, commonly found on the company's official website, such as [XYZInsurance.com]. Contact representatives can assist with refund processes, gaining clarity on policy details, and checking the status of the refund application. Some insurers may have online claim submission forms available for convenience, streamlining the entire process. Follow-up communications may be required, and it is essential to reference claim or policy numbers for efficiency.

Comments