If you've been considering how to enhance your dental policy coverage, you're not alone! Many individuals are discovering the benefits of increased coverage to protect their smiles better and alleviate out-of-pocket expenses. Understanding the nuances of dental insurance can be a bit overwhelming, but fear notâthere's a simple way to navigate your options. Join us as we dive into the specifics of securing a dental policy coverage increase that suits your needs!

Personal Information Details

Dental insurance policy coverage increases can significantly impact overall oral health care. Enhanced coverage often includes routine cleanings, preventive check-ups, and major procedures, which can instill confidence in patients regarding their dental health. For instance, a policy that rises from $1,000 to $2,500 annually opens up access to higher-end treatments such as crowns, bridges, and orthodontics, which are essential for comprehensive care. Additionally, adding family members under the same policy can further maximize benefits, ensuring all individuals receive adequate dental support. Tracking changes in one's dental needs over time can illustrate the importance of having a robust coverage plan tailored for changing life circumstances.

Policy Number and Coverage Specifics

An increase in dental policy coverage can significantly enhance access to necessary oral health services. For instance, policy number 12345ABC allows for comprehensive care, including preventive, restorative, and orthodontic treatments. Current coverage specifics cap annual benefits at $1,500, limiting essential procedures. Upgrading to a higher limit of $2,500 would facilitate timely dental interventions such as crowns ($1,000), bridges ($800), and orthodontic aligners ($3,000) without financial strain. This adjustment promotes better oral health outcomes, ensuring patients receive prompt care, minimizing the risk of complex issues like periodontal disease and tooth loss. Ultimately, enhanced coverage aligns with practices aimed at improving overall public health through preventive care.

Reason for Coverage Increase Request

Many families are seeking comprehensive dental care that meets their evolving needs, particularly children's orthodontic treatments such as braces. With increasing costs of dental procedures, especially in major U.S. cities like New York or Los Angeles, families often find that their existing policies, covering only basic services like routine cleanings (typically priced at $150), do not suffice. Additional significant treatments, including root canals (averaging $1,500) or dental implants (costing around $3,000 each), necessitate a higher level of policy coverage. Furthermore, a growing emphasis on preventive care, which can reduce long-term costs, highlights the importance of updating coverage to include advanced preventive measures. In light of these factors, many individuals are requesting a review and increase in their dental policy coverage to ensure adequate protection against rising dental expenses.

Supporting Documentation or Evidence

Requesting an increase in dental policy coverage often necessitates comprehensive supporting documentation. Essential evidence may include current dental treatment records, detailing ongoing procedures or treatments undertaken at dental establishments (for example, State Dental Clinic or Harmony Dental Center) along with their respective costs. Itemized bills from dental professionals, such as oral surgeons or orthodontists, can clearly illustrate the financial burden incurred by necessary dental work, especially if restorative procedures (crown placements or root canals) exceed typical coverage limits. Insurance policy statements should also be attached, showing existing coverage levels, exclusions, and past claims history. Furthermore, recommendations or referrals from dental practitioners highlighting the necessity for increased coverage due to specific dental health conditions can provide substantial support for the request. Finally, statistical data regarding the rising costs of dental care and insurance trends from reliable sources like the American Dental Association can contextualize the need for enhanced coverage.

Contact Information for Communication

When considering a dental policy coverage increase, it is essential to provide accurate contact information for effective communication. This should include your full name, residential address, and preferred phone number (such as a mobile or home number) for immediate reach. Additionally, an email address (ensuring it's regularly checked) serves as a crucial point of contact for receiving confirmation and documentation related to the policy. Including alternative contact numbers, such as those for family members or trusted advisors, can facilitate the process if direct communication becomes challenging. Clear, updated information allows insurance providers to process requests efficiently, ensuring all inquiries regarding coverage adjustments are addressed promptly.

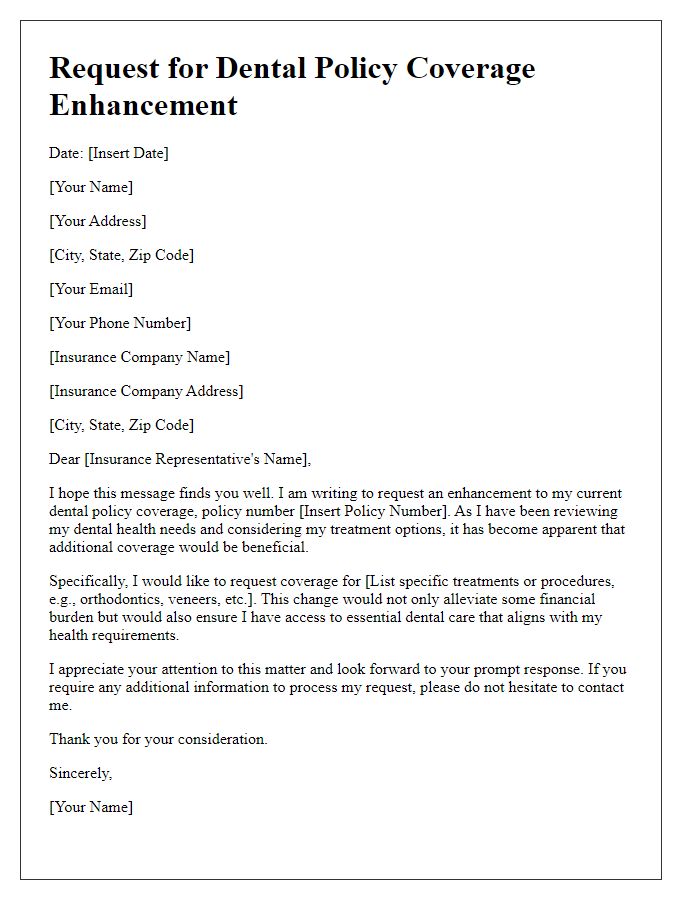

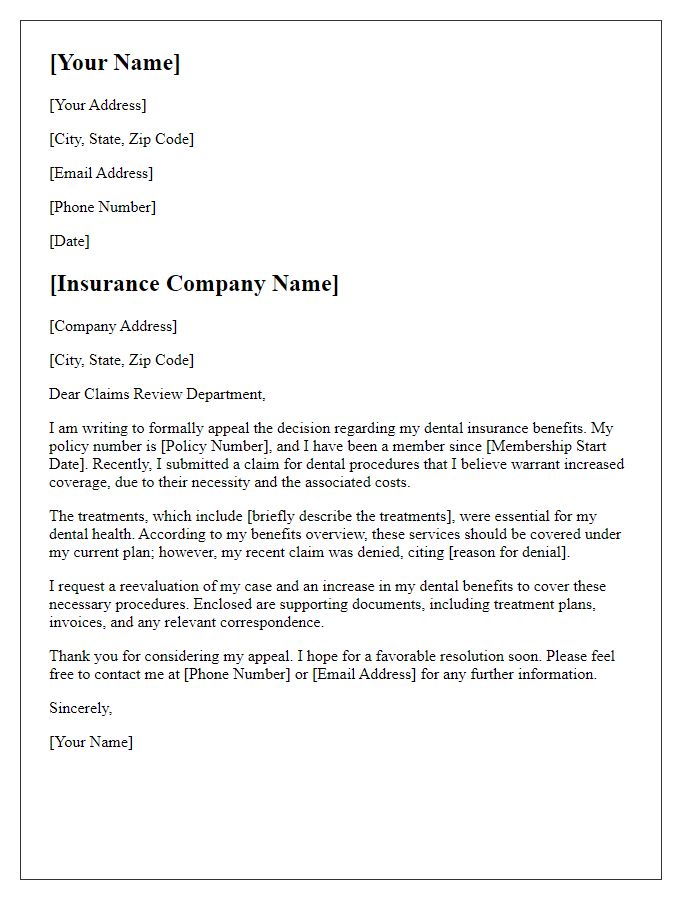

Letter Template For Dental Policy Coverage Increase Samples

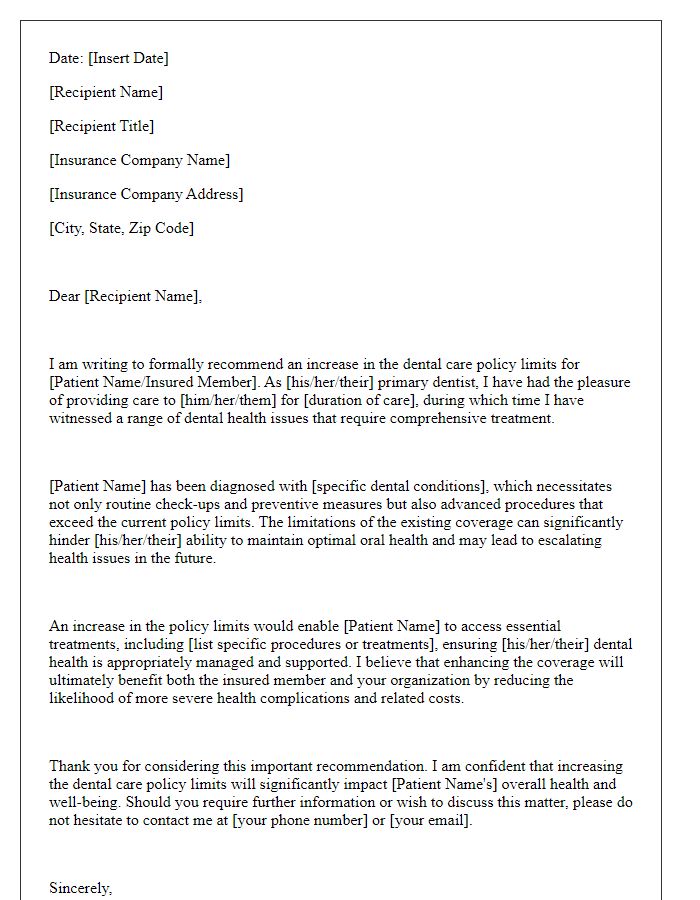

Letter template of recommendation for increased dental care policy limits

Comments