Are you looking to expedite your claim approval process? If so, you're in the right place! This article will provide you with a practical letter template designed to speed things up and enhance your chances of getting a prompt response. Keep reading to discover tips and insights that can help you effectively communicate your needs!

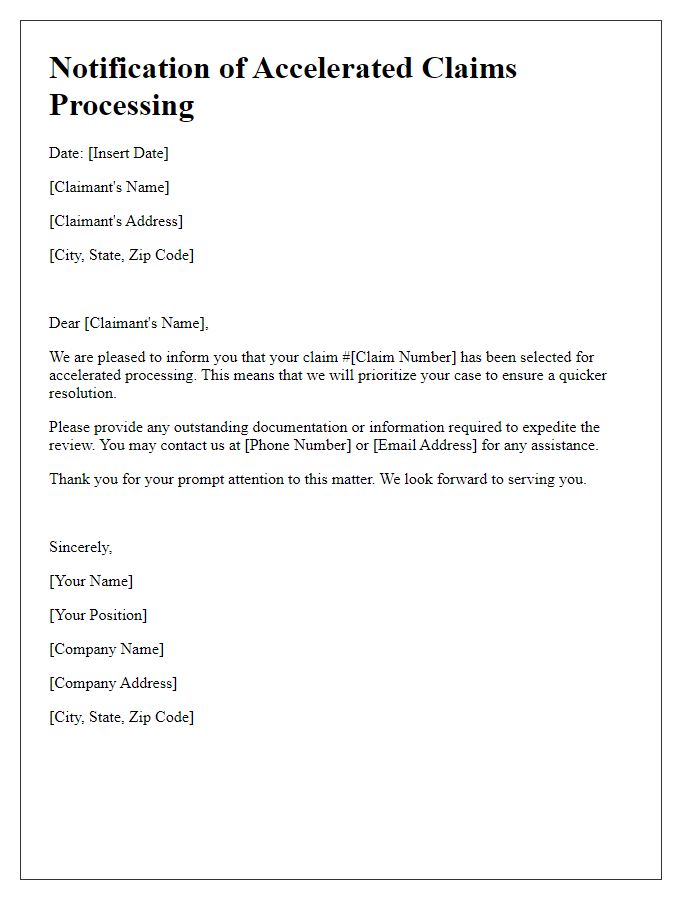

Claim Details Summary

The claim approval process for automobile insurance is often a critical component for policyholders seeking timely resolutions. An insurance claim (such as property damage following a vehicular accident) requires thorough documentation, including the estimated repair costs assessed by certified adjusters. The typical processing time for claims can vary, averaging between 14 to 30 days depending on the insurer's internal procedures and complexity of the case. Each claim must align with specific policy provisions; for instance, comprehensive coverage covers various incidents like theft or natural disasters. Effective communication with claims representatives is essential; providing clear summaries and additional documentation (like photographs, police reports from the accident scene, or witness statements) can expedite review processes and facilitate quicker approvals.

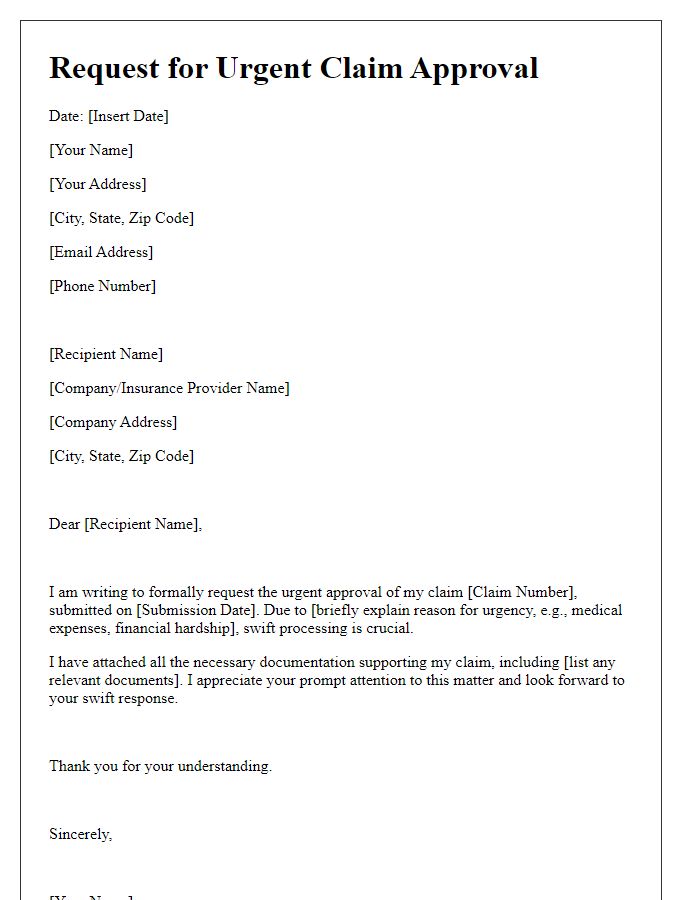

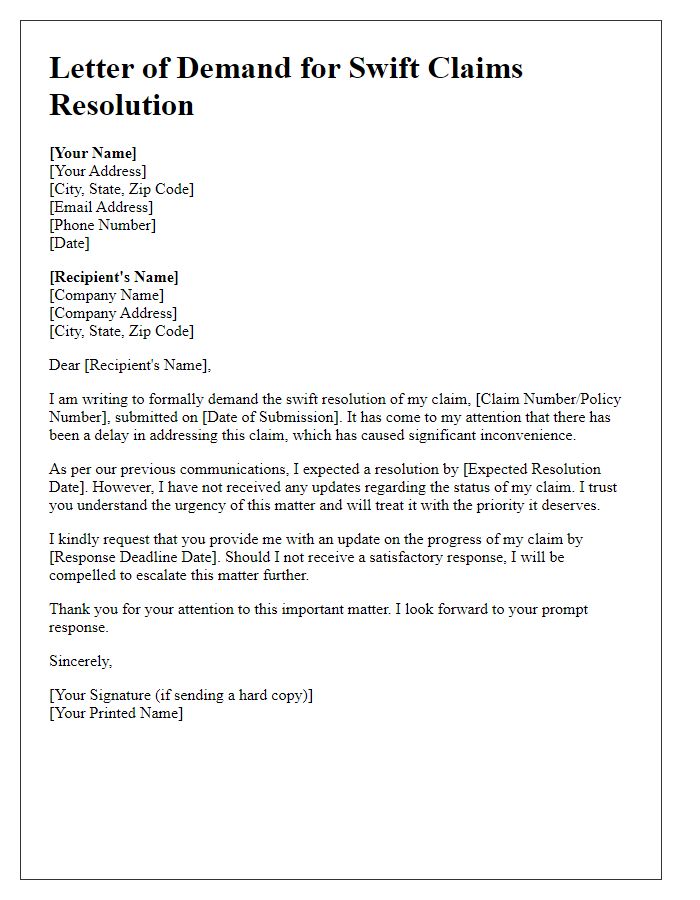

Urgency Justification

A claim approval acceleration request highlights the urgency of the situation, emphasizing critical factors that necessitate rapid processing. For instance, medical claims for life-saving treatments, such as cancer immunotherapy costing $150,000, demand swift attention due to the direct impact on a patient's health. Delays in approval may lead to worsened medical conditions or potential financial burdens, underscoring the need for prompt resolution by the insurance provider. Documentation, including doctor's notes and medical records, illustrates the immediate necessity for action. Addressing these claims within a week, rather than the standard 30-day period, can significantly improve outcomes for individuals relying on essential care.

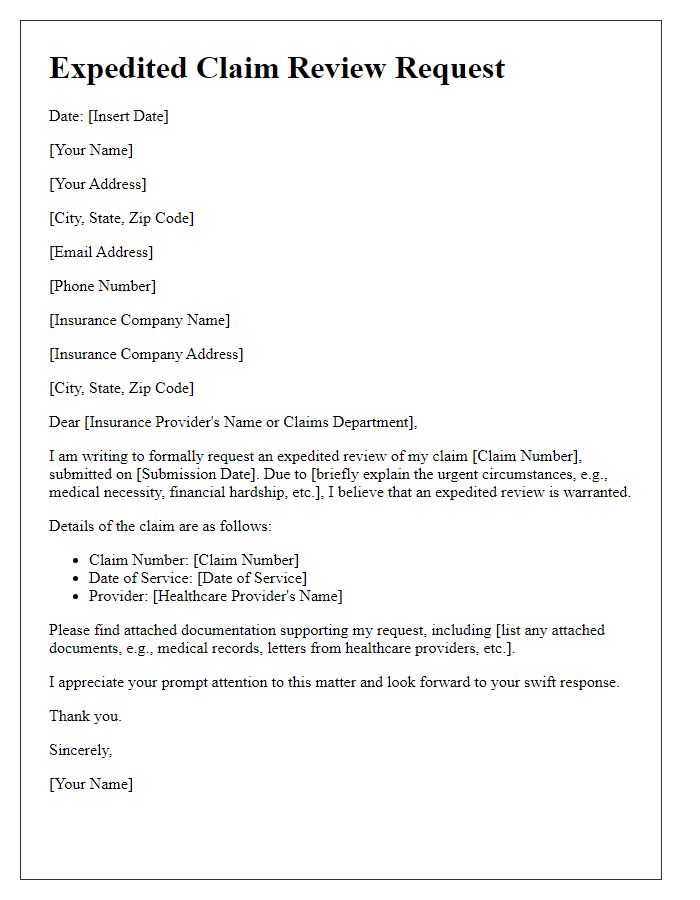

Supporting Documentation References

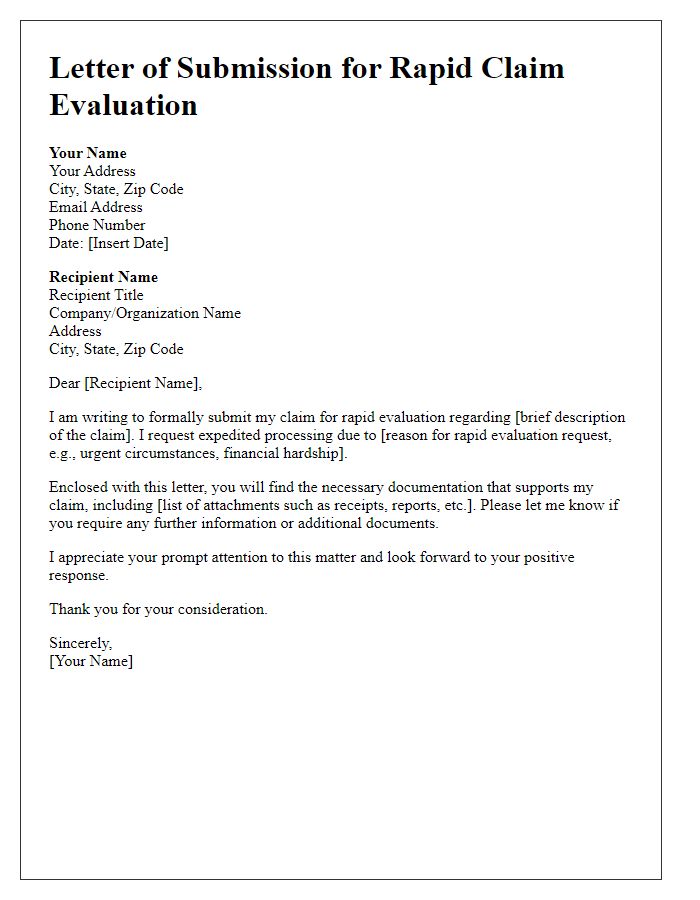

Supporting documentation plays a crucial role in accelerating claim approval processes, particularly in insurance scenarios. Key documents such as medical records (including diagnosis codes and treatment history), receipts (showing detailed expenses related to the claim), and proof of loss forms (detailing what was lost or damaged) can significantly expedite assessments. Additionally, claim forms should be accurately filled out, referencing specific policy numbers and relevant coverage details. Including communication logs with the insurance provider (dates, names of representatives) can enhance clarity. Properly organized supporting documentation can lead to quicker resolutions, potentially reducing the waiting period which may stretch from weeks to months. Furthermore, ensuring that all documents are submitted in accordance with the insurer's requirements is crucial for timely processing.

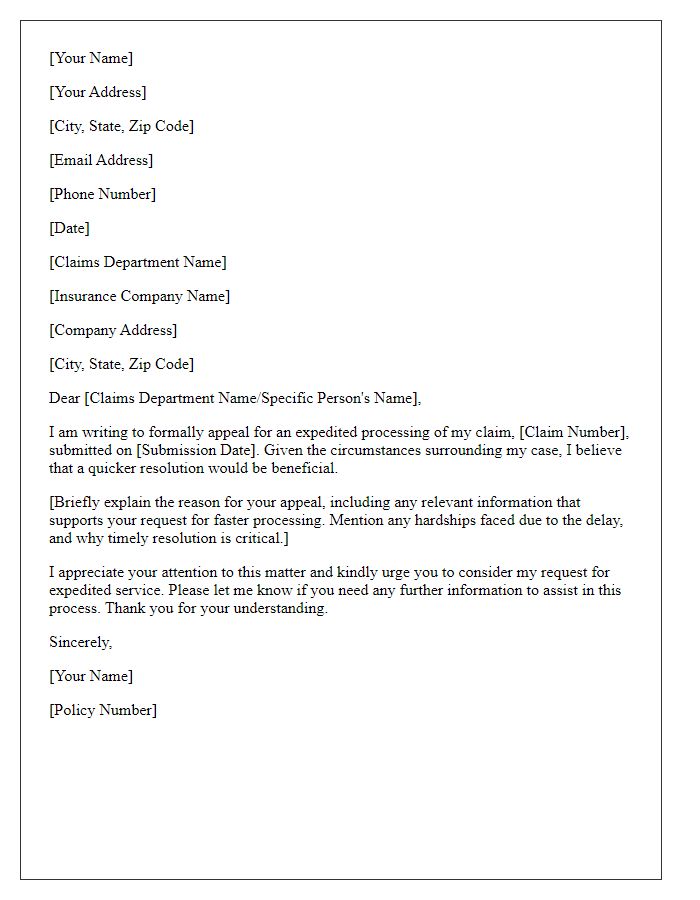

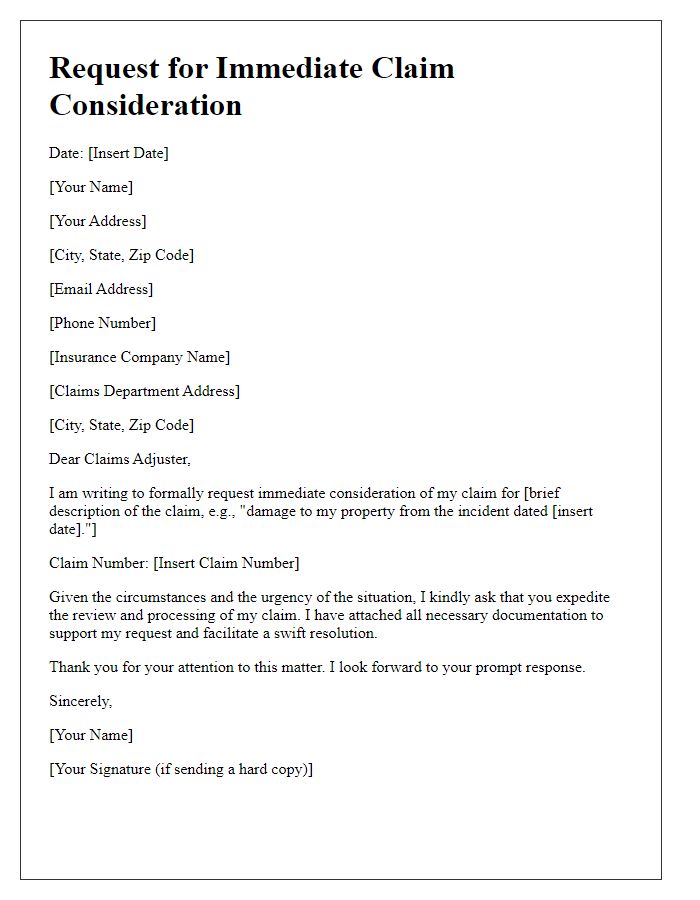

Clear Action Request

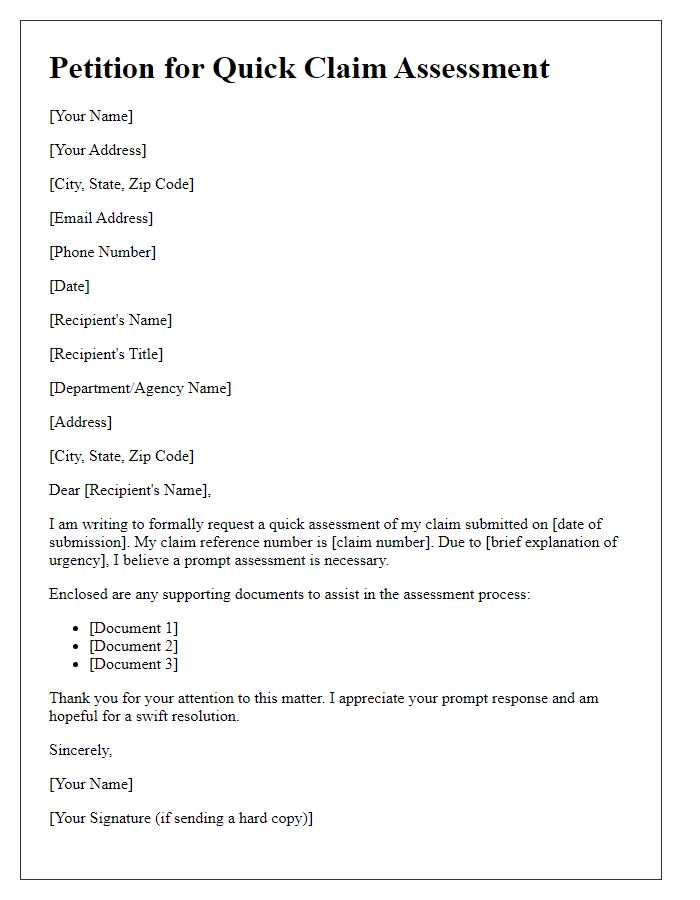

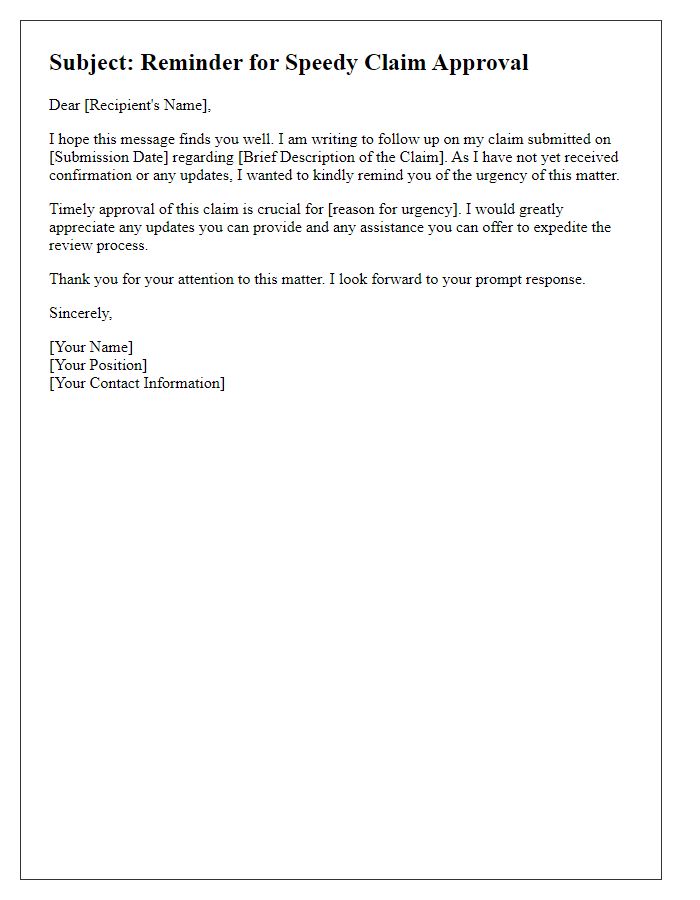

A clear action request for claim approval acceleration can significantly enhance the process for individuals or organizations awaiting essential reimbursements. Timely submissions of comprehensive documentation are vital, including claim forms, receipts (itemized proof of expenses), and any relevant supporting evidence (such as medical records if applicable). It is essential to indicate the claim number (unique identifier for processing) clearly and to specify the reason for the request--such as financial hardship or urgent medical needs--affecting the request's priority. This streamlined approach may expedite decision-making and facilitate faster disbursement of funds, alleviating any potential financial strain on claimants. Regular follow-ups (at least once a week) with the claims department can also ensure that the request remains prioritized and on track for potential approval.

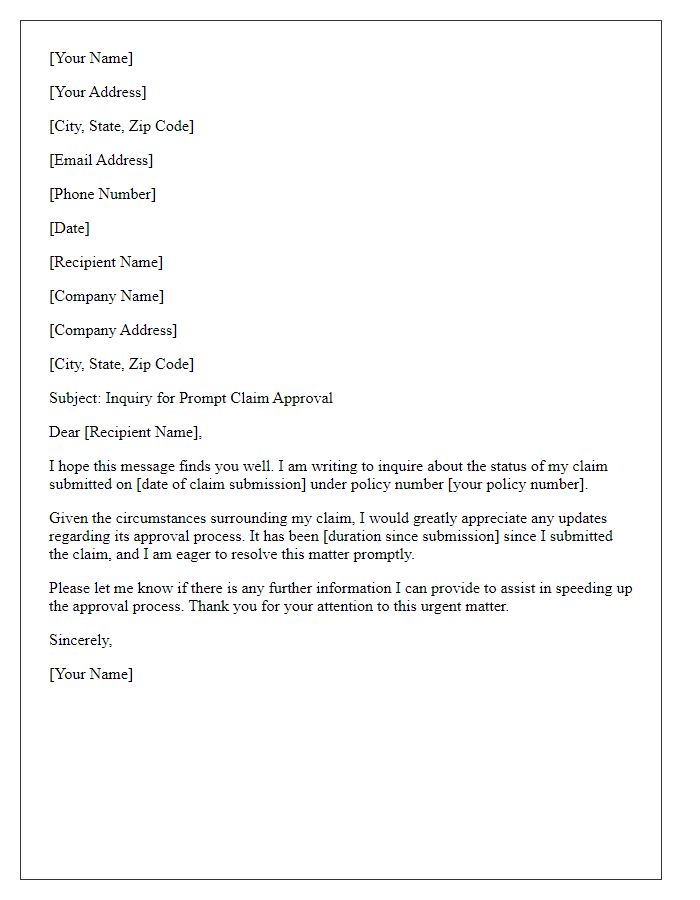

Contact Information

Claim approval acceleration often requires precise communication to ensure timely processing. Specific information such as claim number (e.g., 123456789), case handler (e.g., Susan Miller), and relevant policy details (e.g., policy number AB12345) facilitate quick reference. It is crucial to include a clear request for expedited review, contextualizing the urgency based on factors like pending medical treatment or financial hardships. Always provide accurate contact information, including phone number (e.g., (555) 123-4567) and email address (e.g., example@email.com), to enable instant communication for necessary clarifications or follow-up discussions. Providing supporting documentation (e.g., bills, medical records) enhances credibility and salvages processing delays.

Comments