Are you navigating the intricacies of submitting a loss statement and feeling a bit overwhelmed? You're not alone! Many individuals and businesses face challenges in articulating their financial losses accurately and effectively. In this article, we'll walk you through a simple and clear letter template for submitting a loss statement, ensuring you provide all the necessary details with confidenceâso read on to get started!

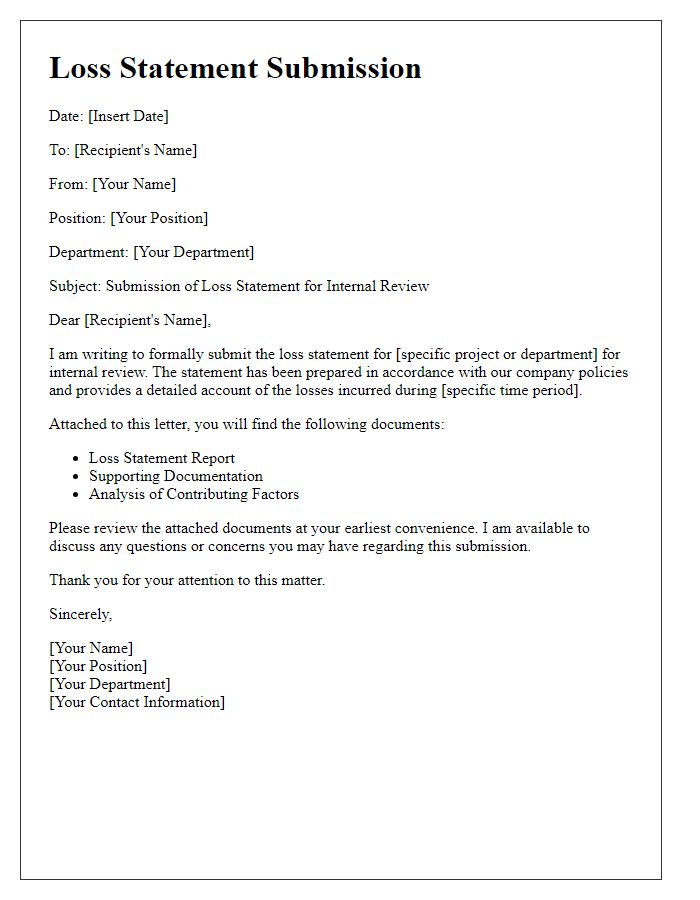

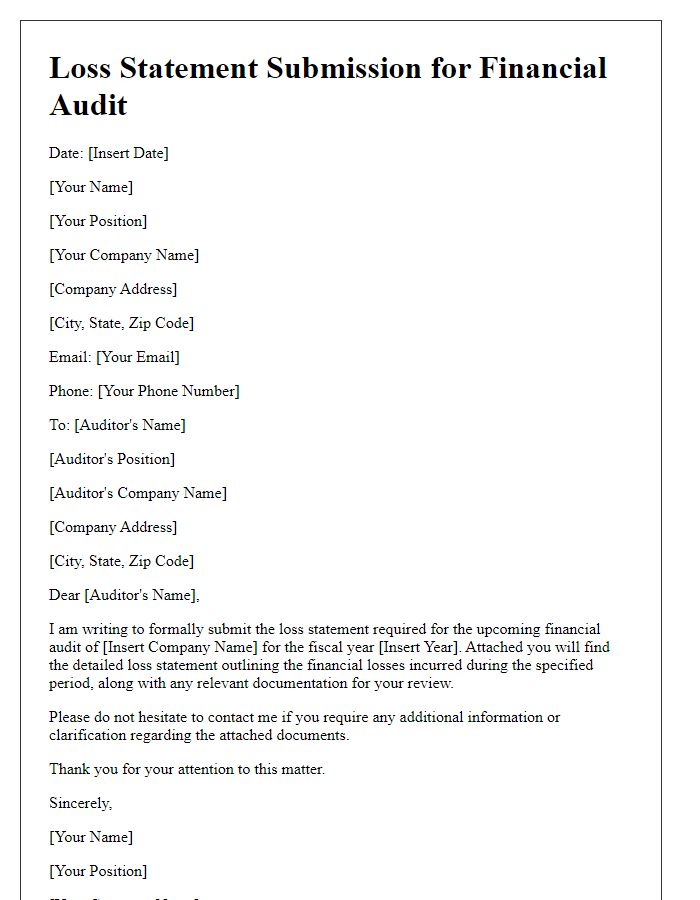

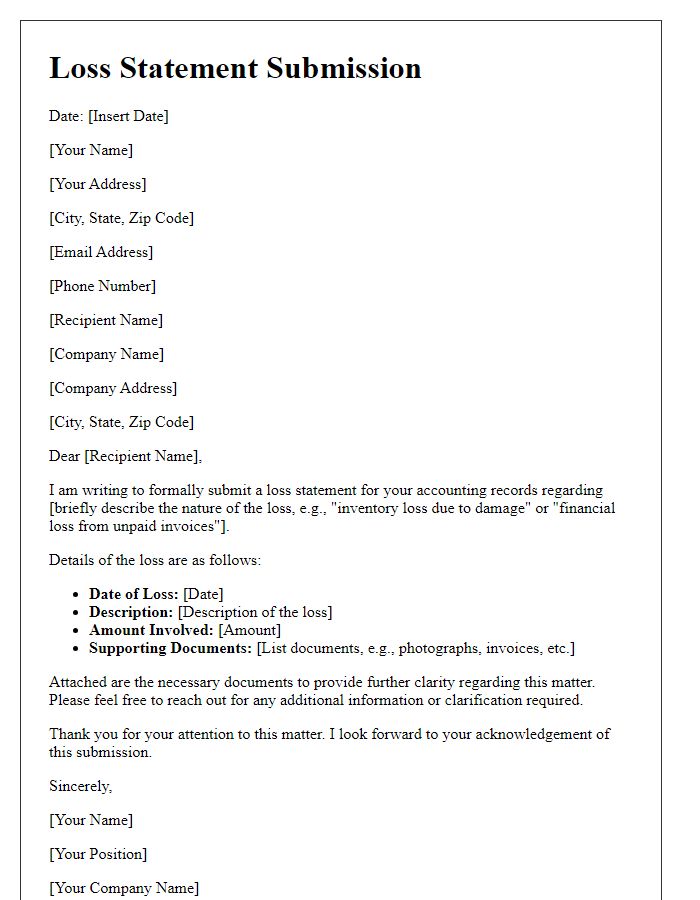

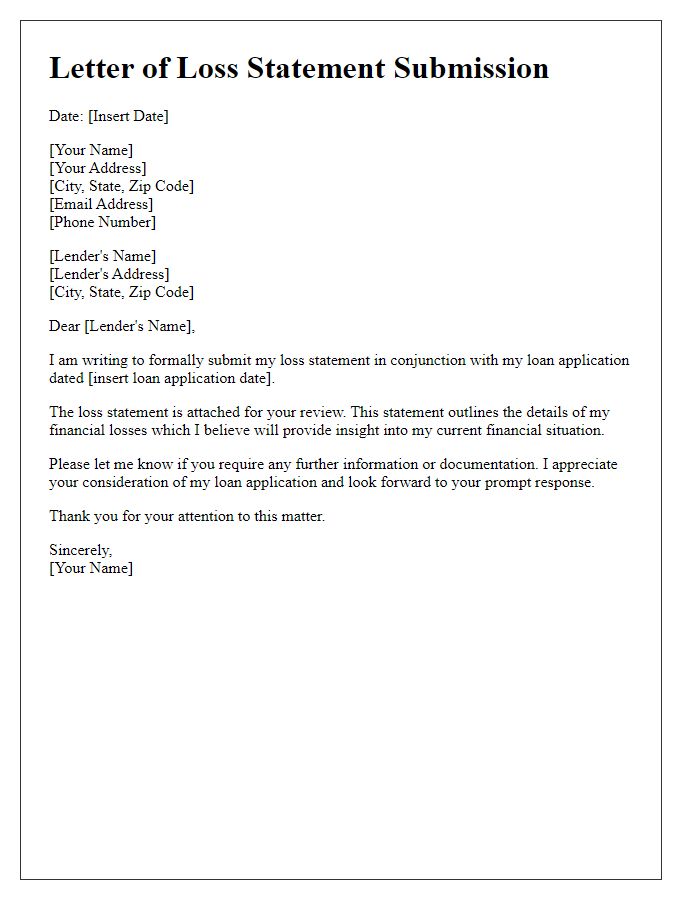

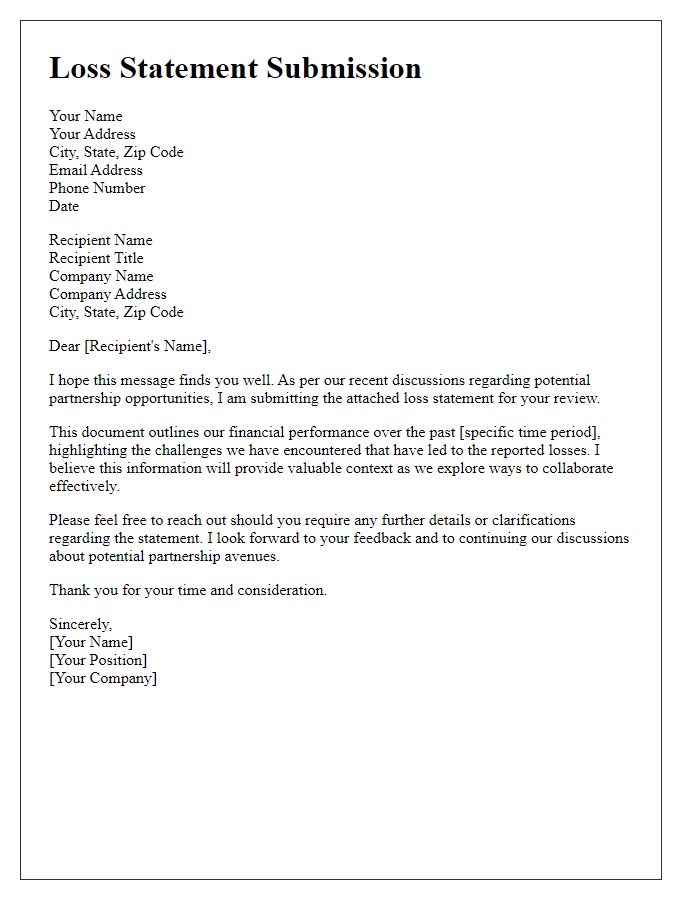

Header Information

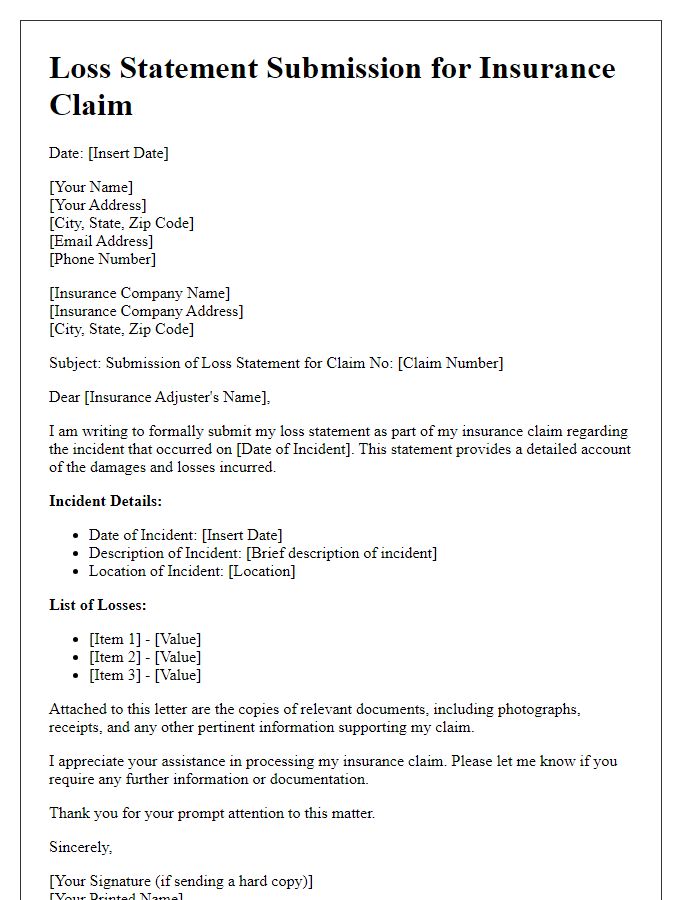

Submitting a loss statement, such as for insurance claims, requires precise header information for clear identification. The sender's name appears at the top, accompanied by their address, phone number, and email, providing contact clarity. Underneath, the recipient's name, typically an insurance adjuster or claims department representative, includes their organization's name, address, and any relevant department information, ensuring the document reaches the correct office. The date of submission follows to establish a timeline for the claim. Finally, a subject line specifies the nature of the correspondence, clearly indicating it as a "Loss Statement Submission" related to the specific claim number or incident date, facilitating easy reference for processing.

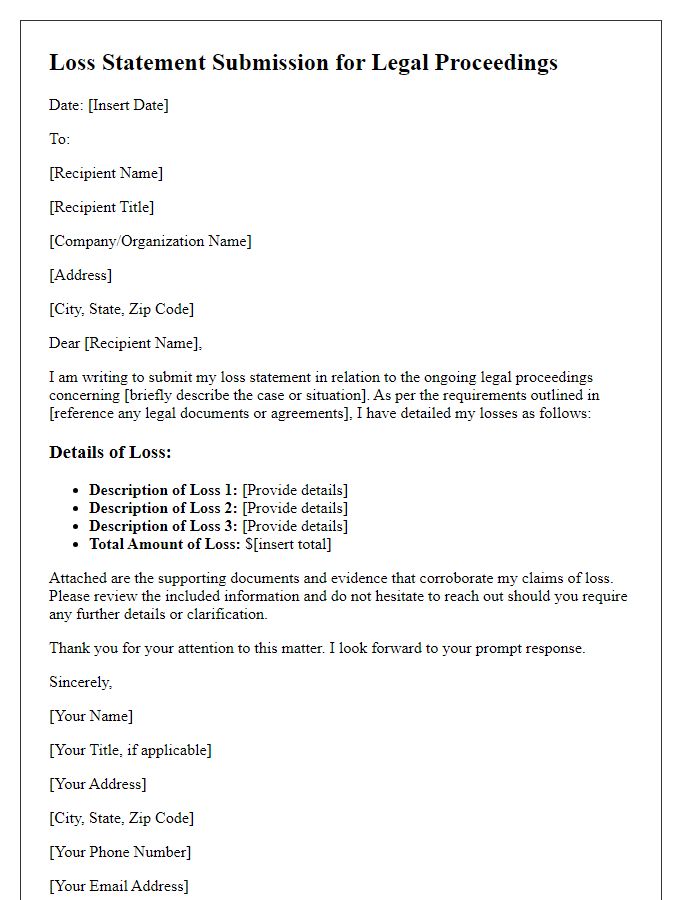

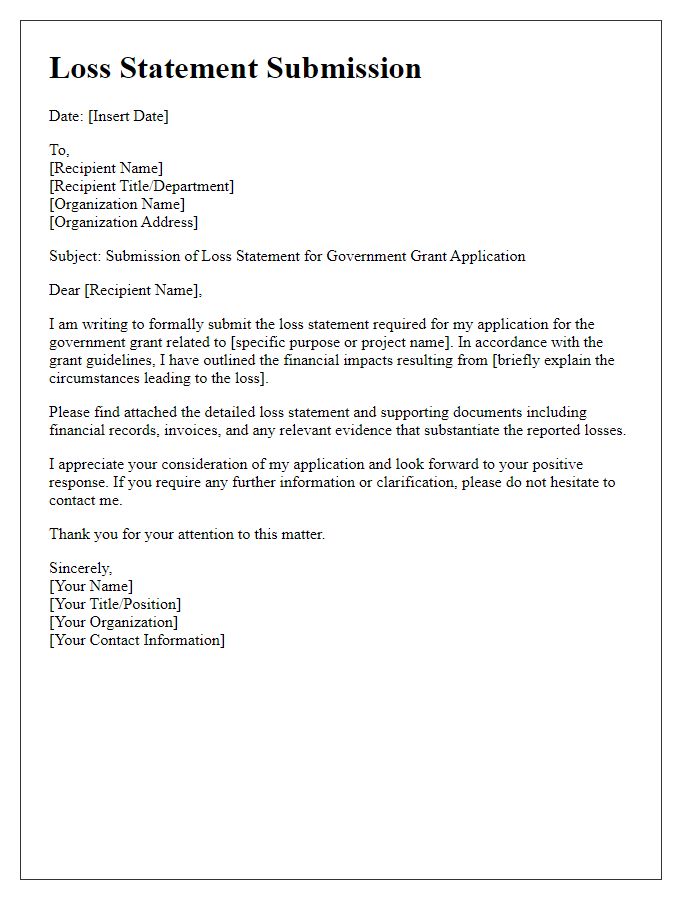

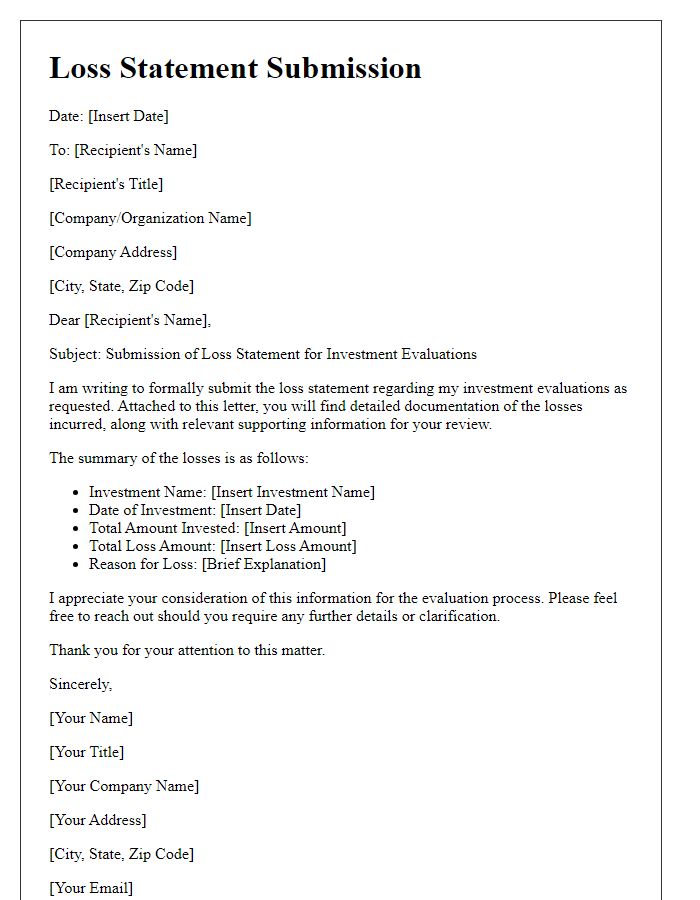

Recipient's Details

The submission of a loss statement often takes place in the context of insurance claims or financial reporting, detailing losses sustained by a business or an individual. Properly addressing recipients, such as insurance companies or financial institutions, is crucial for efficient processing. Include important details, like the recipient's name, title, organization, mailing address, and any reference numbers associated with the claim or account. Ensuring clarity in the recipient's details can expedite communication and prompt responses, ultimately assisting in the efficient resolution of any financial discrepancies or claims for compensation related to unexpected losses.

Subject Line

Submitting Loss Statement for Review and Processing

Introduction and Purpose

Submitting a loss statement serves a crucial purpose in documenting financial discrepancies that may arise due to various factors. The loss statement, often required by insurance companies or financial institutions, outlines the specifics of the financial deficit experienced, such as the amount incurred, type of loss (fire damage, theft, or market fluctuations), and associated documentation (receipts, photographs, or incident reports). Accurate and comprehensive details improve claim processing efficiency, ensuring that stakeholders can make informed decisions regarding compensation or financial relief. This formal submission not only helps in maintaining transparency but also assists in the accurate record-keeping of financial health and risks associated with the entity or individual involved.

Detailed Loss Statement Information

A detailed loss statement provides crucial insights into financial setbacks experienced by businesses or individuals. This document includes specific figures, such as total losses reported during the fiscal year, broken down by categories, including operational, property, and inventory losses. For instance, in 2023, a retail business based in New York experienced a total operational loss of $250,000 due to a decline in foot traffic (approximately 40% compared to pre-pandemic levels). Property losses, particularly from unforeseen events such as water damage, accounted for an additional $75,000. Inventory losses, resulting from theft and spoilage, added another $50,000, bringing the total to $375,000. The comprehensive summary includes details about relevant timestamps of incidents, purchasing records, and insurance claims filed. It aids in evaluating the overall financial health and planning recovery strategies for the affected entity.

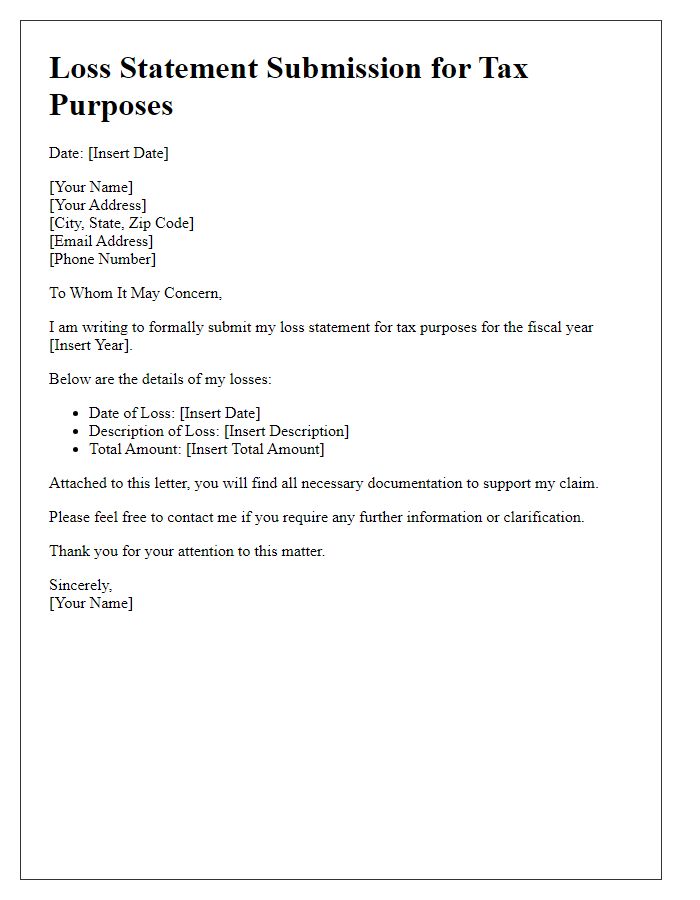

Letter Template For Submission Of Loss Statement Samples

Letter template of loss statement submission for internal company review

Comments