Are you pondering the complexities of your home insurance policy? It's completely normal to have questions, especially when protecting your most valuable asset. Understanding the details can save you both time and money, ensuring that you're getting the best coverage for your needs. Join me as we delve deeper into the ins and outs of home insurance policies in the following sections!

Personal Information

Home insurance policies provide essential coverage for property owners, protecting against losses from events such as fire, theft, or natural disasters. Under the jurisdiction of state laws, terms and conditions may vary significantly, impacting coverage limits and deductibles. Specific types of coverage include dwelling protection (for the structure itself), personal property protection (covering belongings inside the home), liability coverage (protecting against lawsuits), and additional living expenses (for costs incurred if the home becomes uninhabitable). Homeowners should carefully review policy details, including premium rates (often influenced by factors like location, home age, and security features), in order to ensure comprehensive protection tailored to individual needs.

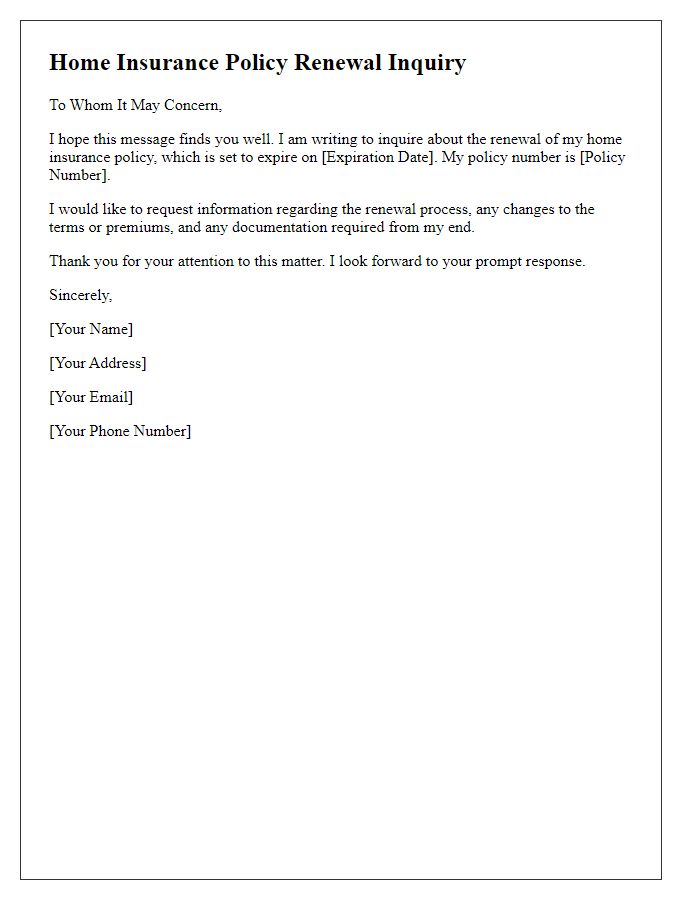

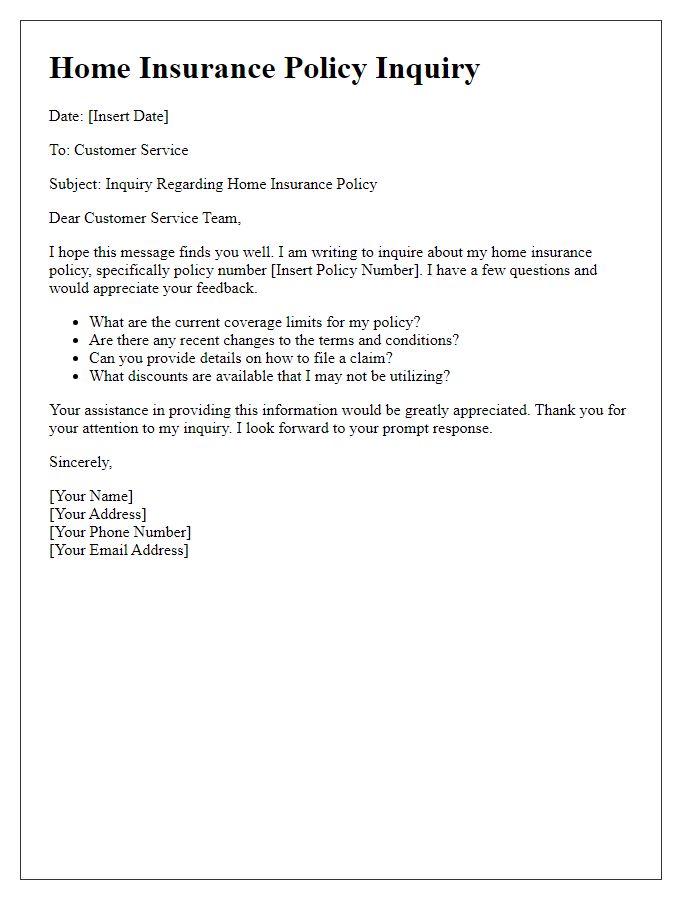

Policy Details Request

The inquiry regarding home insurance policies can provide vital information for homeowners seeking adequate coverage. Home insurance, which protects residential structures (typically single-family homes or condos) from damages and losses, often includes various forms of coverage, such as dwelling coverage, personal property protection, liability coverage, and additional living expenses provisions. Policy details, including effective dates, coverage limits, deductibles, and premium costs, can significantly influence a homeowner's financial security. Homeowners in regions prone to natural disasters, such as hurricanes in Florida or wildfires in California, must carefully assess their insurance options to ensure sufficient protection against unforeseen events. Understanding specific policy exclusions is crucial, as certain circumstances, like flooding or earthquakes, may require additional endorsements or separate policies. Therefore, gathering comprehensive and detailed information on policy specifics and coverage options is essential for making informed decisions regarding home insurance.

Coverage Requirements

Home insurance policies provide essential coverage for residential properties, safeguarding against various risks such as fire, theft, and natural disasters. Policyholders, especially homeowners in areas prone to flooding (like New Orleans) or wildfires (such as California), should understand their specific coverage requirements, including dwelling coverage (the amount needed to rebuild), personal property coverage (value of belongings), and liability coverage (protection against legal claims). Additionally, factors like deductible amounts, premium rates, and additional endorsements (such as coverage for home-based businesses) play crucial roles in customizing a policy to fit individual needs. Understanding these elements enables homeowners to effectively assess their insurance requirements and ensure adequate protection for their investments.

Claim History Query

Home insurance policies often require policyholders to understand their claim history thoroughly. Insurance providers usually store records of previous claims, including details such as dates, amounts, and reasons for each claim. Transparency about claim history can significantly impact policy renewals and premium rates. For instance, a home in Florida, experiencing frequent hurricanes, may have numerous claims related to storm damage, whereas a residence in California, prone to wildfires, may show entirely different trends. Insurers consider this history to assess risk, adjust coverage limits, or modify premiums accordingly. Understanding this context is essential for homeowners seeking to optimize their insurance protection and financial planning.

Contact Information for Follow-up

Home insurance policies protect property owners from damages or losses due to unforeseen events, such as natural disasters, theft, or fire. A comprehensive policy typically includes coverage for personal belongings, liability, and dwelling protection, often with deductibles ranging from $500 to $5,000. Homeowners frequently inquire about policy terms, including premium rates based on location, home value, and claim history. Additionally, understanding exclusions, endorsements, and available discounts can greatly impact premium costs. A thorough examination of the coverage limits and terms of service is essential for ensuring adequate protection for all residential assets.

Letter Template For Home Insurance Policy Inquiry Samples

Letter template of home insurance policy inquiry for coverage adjustments

Letter template of home insurance policy inquiry for claims process clarification

Letter template of home insurance policy inquiry for premium rate changes

Letter template of home insurance policy inquiry for additional coverage options

Letter template of home insurance policy inquiry for multi-policy discounts

Letter template of home insurance policy inquiry for policy cancellation

Letter template of home insurance policy inquiry for emergency assistance services

Comments