Are you feeling overwhelmed by your homeowners insurance premium? You're not aloneâmany homeowners are finding themselves in a similar situation as rates fluctuate. Fortunately, there are several strategies you can employ to negotiate your premium and potentially save a significant amount of money. Read on to discover tips and templates that can help you advocate for a better rate!

Policy Review and Analysis

Homeowners insurance premium negotiations require a thorough policy review and analysis to identify areas for potential savings. Homeowners should examine their existing coverage limits and deductibles, ensuring they align with the current market value of their property (which may have appreciated over time). Evaluating risk factors, such as the geographical location (notably areas prone to natural disasters like hurricanes or floods), can reveal opportunities to adjust coverage. Additionally, considering discounts for bundled policies (combining home and auto insurance with the same provider) may lead to reduced premium rates. It is also beneficial to research competitors' offers in the local insurance market, allowing homeowners to leverage alternative options during negotiations with their current insurer.

Comparable Market Rates

Homeowners insurance premiums can significantly vary based on market conditions and comparable property values. Recent data shows that premiums for similar properties in neighborhoods such as Westwood and Brookfield average around $1,200 annually, highlighting discrepancies with your current policy of $1,800. Factors influencing these variations include the age of the property (typically built post-2000), local crime rates, and regional weather-related risks (like hurricanes or floods). Additionally, discounts for bundling policies or maintaining a claims-free history can further decrease costs. Insurers may also consider the square footage of the home, which could influence replacement costs. Adjustments based on these prevailing market trends could lead to a more competitive premium fitting for your property in the current economic landscape.

Property Security Enhancements

Homeowners investing in property security enhancements, such as advanced alarm systems, reinforced entry points, and surveillance cameras, can significantly lower risk factors associated with potential theft or vandalism. Comprehensive systems, particularly those integrating smart technology, provide real-time monitoring and alerts, potentially reducing premiums by up to 20% on policies from major insurers like State Farm or Allstate. Insurance providers often favor homes in secured neighborhoods with low crime rates, highlighting the importance of local safety statistics. Added features, including motion detectors and smart locks, further demonstrate a homeowner's commitment to safety, which may persuade insurers to offer better rates, ultimately resulting in substantial savings for informed property owners.

Claims History and Record

Homeowners insurance premiums can significantly increase based on claims history, impacting financial planning. A record of multiple claims may signal higher risk to insurers, potentially resulting in elevated rates. For example, filing more than three claims within five years can lead insurers to categorize a homeowner as high-risk, raising the premium by up to 20%. On the other hand, a clean claims history, such as having no claims for over a decade, may position homeowners for premium discounts or better negotiations with insurers. Homeowners should review their claims history, provided by the insurance company, to understand their standing and leverage this information in premium negotiations. Regular home maintenance and proactive measures, like security systems or disaster preparedness (such as flood barriers), can also improve the risk assessment in negotiations.

Loyalty and Bundling Discounts

Homeowners insurance premiums can often be reduced through loyalty and bundling discounts, allowing homeowners to save significantly. Loyalty discounts reward long-term customers with premiums that decrease over time, sometimes reducing costs by 10% to 20%. Bundling discounts offer combined coverage for multiple policies, like auto and home insurance, leading to additional savings, typically between 5% and 25%. Homeowners should gather their policy details, available discounts from their insurance provider, and compare quotes from competitors to strengthen their negotiation position. Engaging directly with an insurance representative can also help clarify discount eligibility, ensuring that homeowner's unique situation is fully addressed during the discussion.

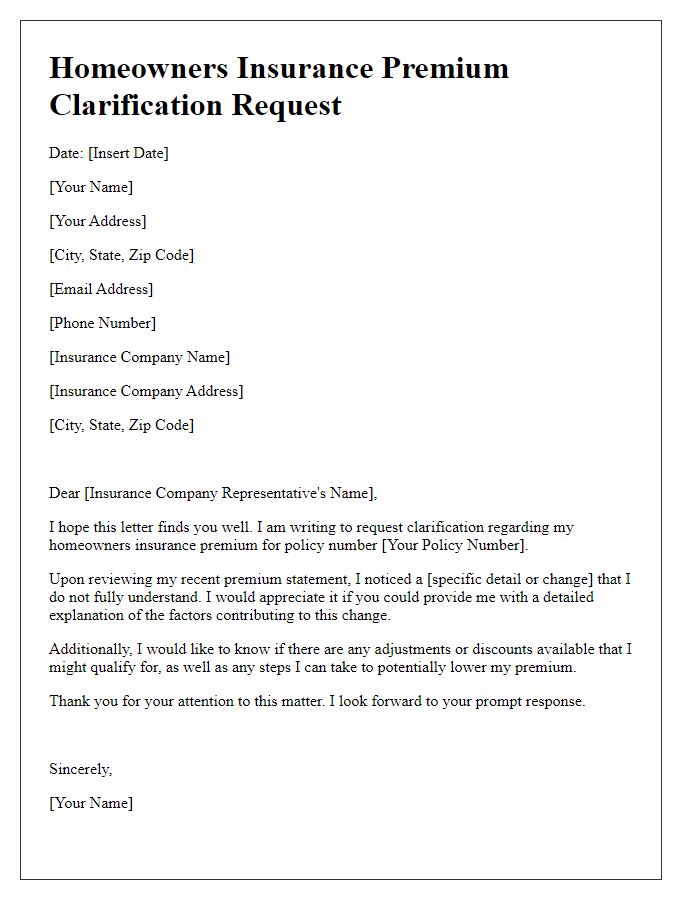

Letter Template For Homeowners Insurance Premium Negotiation Samples

Letter template of homeowners insurance policy review for premium decrease

Comments