Are you feeling overwhelmed by your business insurance premiums? You're not aloneâmany business owners face the challenge of rising costs each year. In this article, we'll explore effective strategies for negotiating your insurance premiums, helping you save money while ensuring your business remains well-protected. So, if you're ready to take control of your insurance expenses, keep reading to discover valuable tips and insights!

Clear identification of the policyholder and insurance details.

The business insurance premium negotiation involves a clear identification of the policyholder, including company name, address, and tax identification number, to ensure accuracy in the records. The policy details should specify the type of coverage, such as general liability or property insurance, along with the policy number and effective dates, which may impact the negotiation process. Additionally, highlighting claims history, current market trends, and competitive premium rates from similar businesses can provide leverage in discussions. Exploring coverage adjustments, such as increasing deductibles or bundling policies, may also influence premium adjustments. Ultimately, these factors contribute to achieving a more favorable insurance premium for the business.

Highlight of current business conditions and circumstances.

Current business conditions reveal significant challenges impacting operational costs and revenue generation within numerous industries. The ongoing economic fluctuations, characterized by inflation rates hovering around 6% in developed markets, have led to increased expenses for services and materials. In addition, recent supply chain disruptions, particularly due to global events like the COVID-19 pandemic, continue to create uncertainty. For instance, sectors such as retail are facing inventory shortages, while manufacturing is grappling with delayed shipments. Furthermore, rising labor costs, with average wages increasing by approximately 4% compared to last year, add pressure to maintaining profitability. Given these circumstances, a reassessment of business insurance premiums could truly reflect the current risk environment and financial realities, ensuring coverage is both fair and appropriate for today's evolving conditions.

Evidence of risk mitigation measures and safety protocols.

Implementing comprehensive risk mitigation measures and robust safety protocols can significantly enhance the overall safety profile of a business. Regular training sessions, such as the annual safety compliance workshops for all employees, ensure that everyone understands emergency procedures and minimizes workplace accidents. Installation of modern safety equipment, such as fire suppression systems with a 24/7 monitoring capability, protects assets and personnel effectively. Conducting quarterly risk assessments identifies potential hazards and facilitates the implementation of targeted interventions. Furthermore, maintaining an up-to-date safety manual aligns with industry standards set by organizations like the Occupational Safety and Health Administration (OSHA), which boosts confidence among stakeholders and may lead to favorable terms during insurance premium negotiations.

Comparative analysis of competitor offerings and market rates.

In the competitive landscape of business insurance, companies are often presented with a variety of premium offerings that can significantly impact their financial stability. Analyzing competitor offerings reveals variances in policy coverage, deductibles, and premium costs, with rates that can range from 20% lower to 30% higher than the average market rate of approximately $1,200 annually for small to medium-sized enterprises in major urban areas like New York City. Events such as natural disasters and cyber incidents have influenced underwriting practices, leading to increased premiums in specific sectors. Insurers such as AIG and Travelers have introduced tailored packages that appeal to industry-specific needs, highlighting the importance of comprehensive risk assessment. A detailed comparison of these factors is essential for negotiating favorable terms with insurance providers.

Proposal of new premium terms and conditions with justification.

The negotiation of business insurance premiums often focuses on factors such as risk assessment, claims history, and industry benchmarks. Recent analysis indicates that companies in the same sector, specifically within the technology industry, are experiencing an average premium reduction of 15% due to improved safety protocols and lower claim frequencies. For our organization, a reassessment of our risk profile reveals a significant decrease in claims over the past three years from an average of three claims per year to just one claim in the last fiscal period. Furthermore, the implementation of enhanced cybersecurity measures, including regular penetration testing and employee training programs, mitigates risk exposure significantly. This proposal advocates for a revised premium structure that incorporates these favorable metrics, aiming for a 20% reduction in our current premium, enabling more competitive budgeting for essential business operations. The adjustment aligns with broader market trends while rewarding our commitment to loss prevention strategies and overall operational safety.

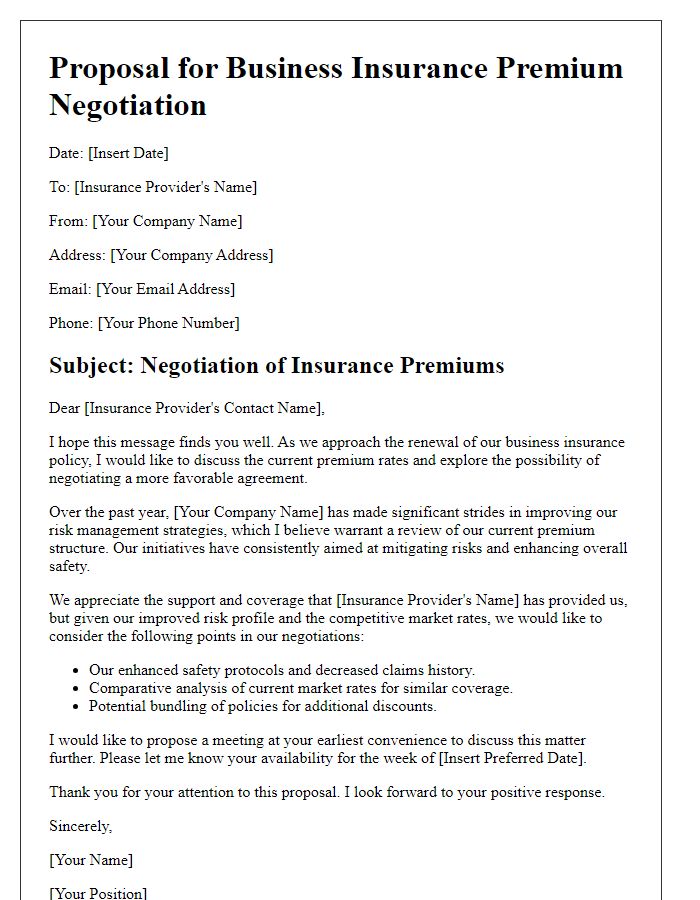

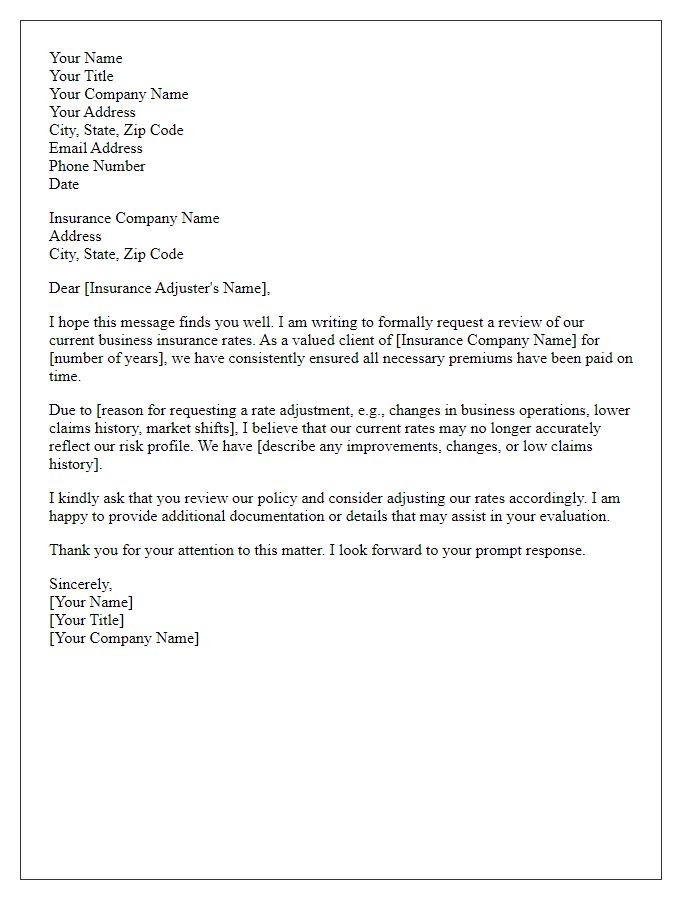

Letter Template For Business Insurance Premium Negotiation Samples

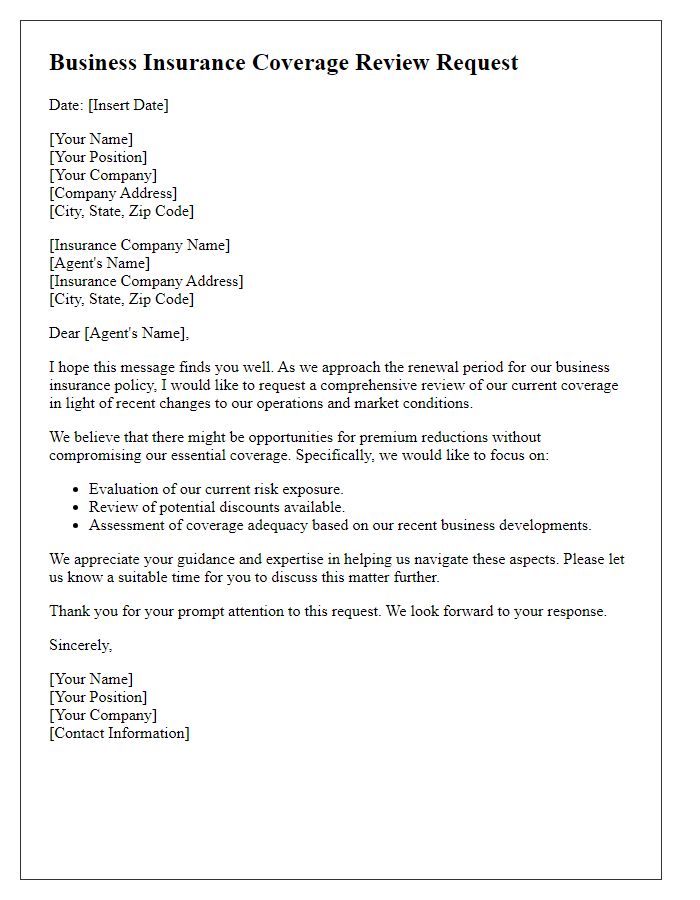

Letter template of business insurance coverage review for premium reduction

Comments