Navigating the world of insurance can often feel overwhelming, especially when it comes to understanding preventive measures. In today's ever-evolving landscape, taking proactive steps can significantly shield you against unforeseen risks while also ensuring peace of mind. Whether you're considering adjustments to your current policy or implementing new strategies to safeguard your assets, it's crucial to stay informed. Let's dive deeper into how preventive measure insurance can benefit you, and invite you to explore the details further in the article ahead!

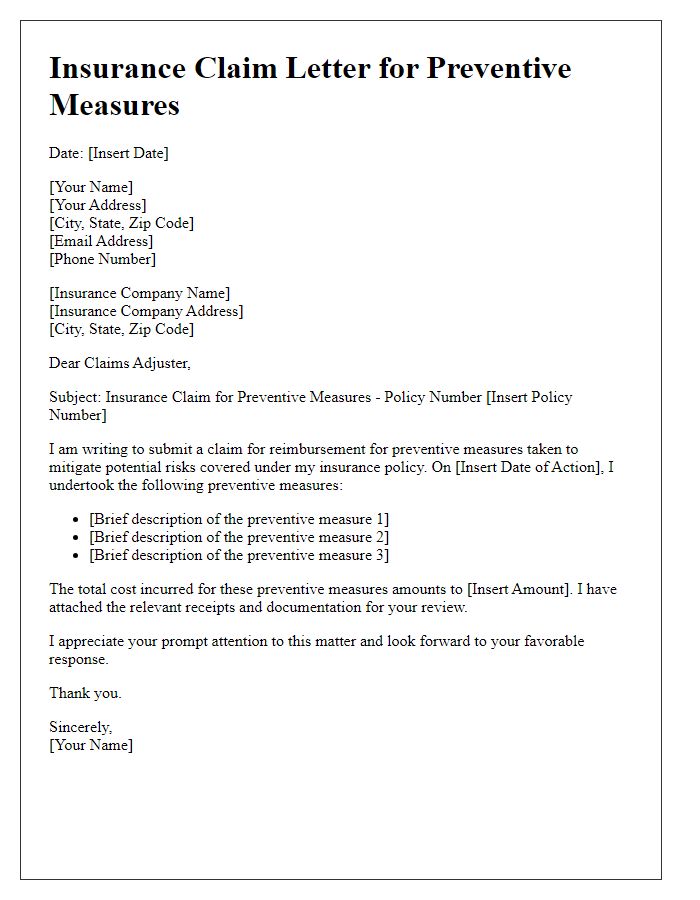

Policy Number and Holder Information

Preventive measures in home insurance policies typically focus on reducing risks associated with property damage. For example, installing smoke detectors can lower the likelihood of fire-related claims, with statistics indicating a 50% reduction in fatalities in homes equipped with them. Moreover, securing homes with advanced locks and alarm systems can deter burglaries, improving safety and reducing potential financial losses. Regular maintenance of roofs and gutters, particularly in areas prone to heavy rainfall, such as the Pacific Northwest (noted for its annual precipitation rates exceeding 100 inches), minimizes water damage risks. Insurance providers often incentivize these preventive measures, possibly offering premium discounts that can range from 5% to 20% depending on the improvements made. Policyholders are encouraged to document these measures for future claims or policy adjustments.

Detailed Explanation of Preventive Measures

In the realm of risk management, preventive measures play a critical role in minimizing potential financial losses associated with unforeseen events. These measures encompass a variety of strategies, such as thorough risk assessments conducted annually in organizational settings, implementation of fire alarms and suppression systems in commercial buildings, and employee training programs designed to enhance safety awareness. Data indicates that proactive measures, like regular maintenance of equipment and infrastructure, significantly reduce the likelihood of insurance claims, which may help decrease premiums over time. For example, businesses that invest in cybersecurity protocols, including firewalls and employee training against phishing attacks, can mitigate risks associated with data breaches, thus safeguarding sensitive information and maintaining customer trust. Moreover, research illustrates that properties maintained according to local building codes, particularly in regions prone to natural disasters like Florida's hurricane season, experience fewer claims related to damages.

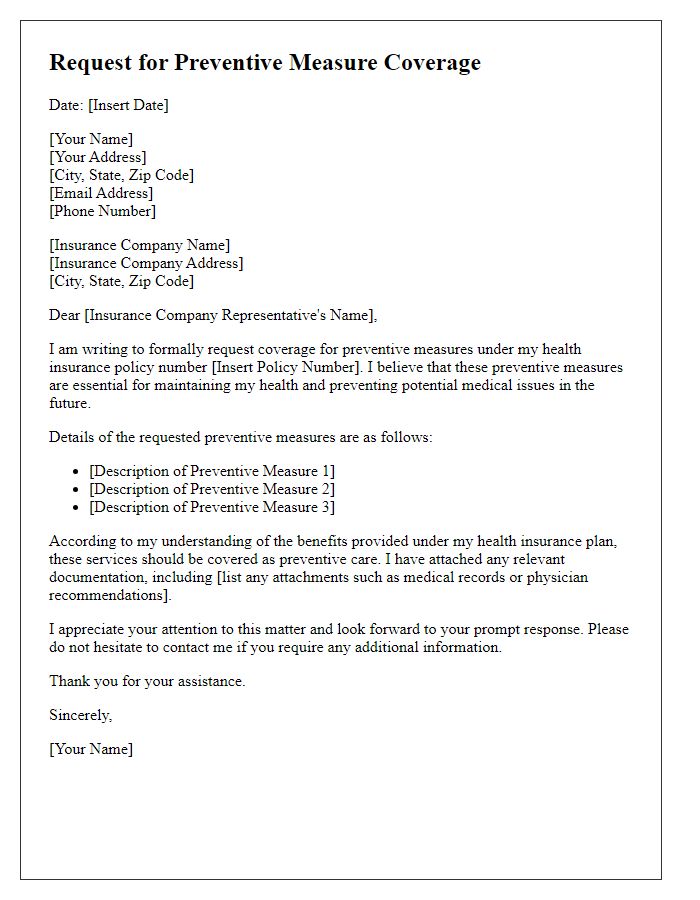

Coverage Terms and Conditions

The coverage terms and conditions for preventive measure insurance policies typically outline the specifics of protection against unexpected events, such as natural disasters or accidents. Coverage limits are defined in monetary amounts, commonly ranging from $10,000 to $500,000, depending on policy options. Events covered may include but are not limited to fire, flooding, and theft, providing varying levels of compensation based on deductibles, which can range from $500 to $5,000. Specific exclusions, such as damage from acts of war or neglect, will be detailed. Additionally, routine preventive measures like regular maintenance inspections and installation of security systems may qualify for premium discounts, promoting proactive risk management among policyholders. Regular updates to policy terms can occur to reflect changes in local regulations or market conditions.

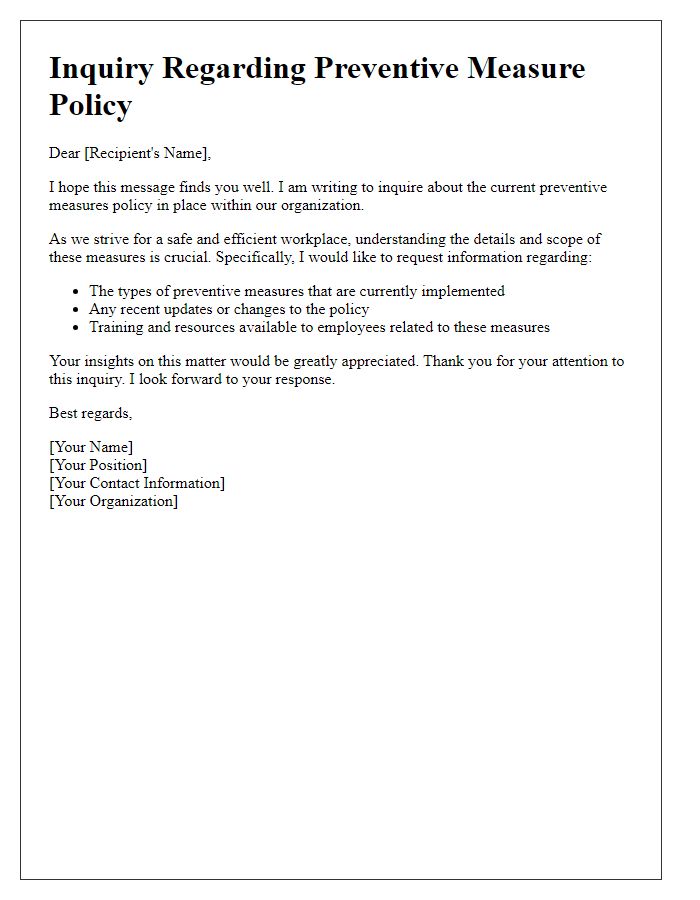

Contact Information for Questions

Preventive measure insurance response scenarios often require clear communication regarding coverage details. Ensuring policyholders have easy access to contact information for inquiries is vital. Customers can reach the insurance provider's customer service team via the toll-free number displayed on policy documents. Email correspondence can be directed to the designated claims department, allowing for secure handling of questions. For urgent matters, chat support is available on the company website during business hours, providing real-time assistance. Physical addresses for regional offices can be found on corporate communications, facilitating face-to-face meetings when necessary.

Formal Closing and Signatures

Preventive measures implemented by insurance companies often include comprehensive risk assessments and tailored policy designs. These measures aim to mitigate potential claims and promote safety for clients. For instance, insurers may conduct regular inspections of properties, often annually, to ensure compliance with safety standards. Discounts on premiums may apply for policyholders who adopt risk-reducing measures, such as installing advanced security systems or fire alarms. Effective communication through educational resources about risk management can enhance customer awareness, contributing to safer practices and a lower incidence of claims.

Comments