Are you feeling the pressure of an upcoming insurance payment deadline? You're not aloneâmany people find themselves in need of a little extra time to gather funds or navigate unexpected circumstances. Luckily, the process for requesting an extension can be straightforward when you know what to say. Join us as we delve into essential tips and a helpful letter template that can simplify your request for an insurance payment extension!

Polite tone and clarity

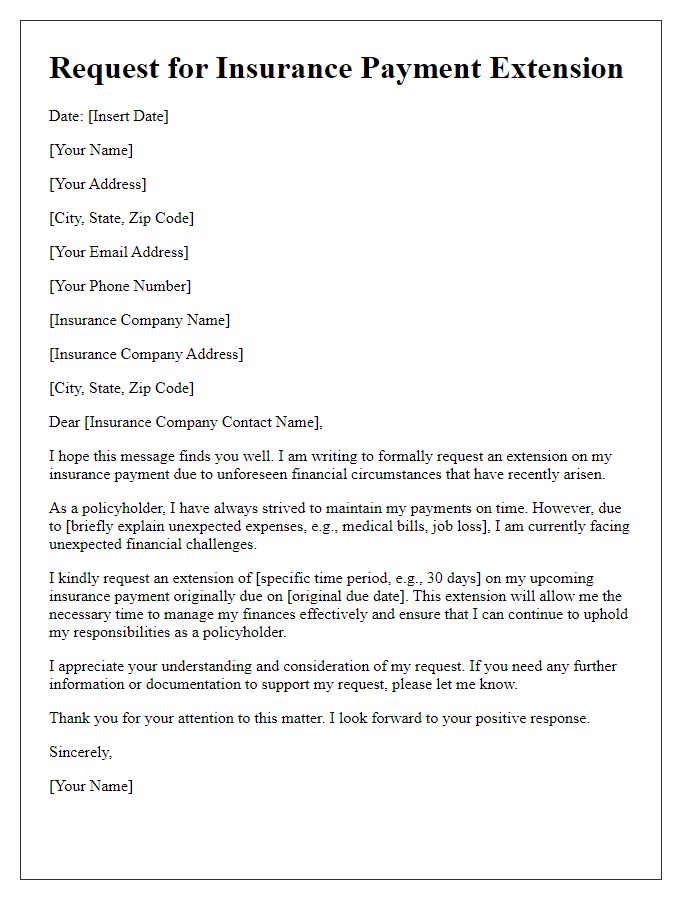

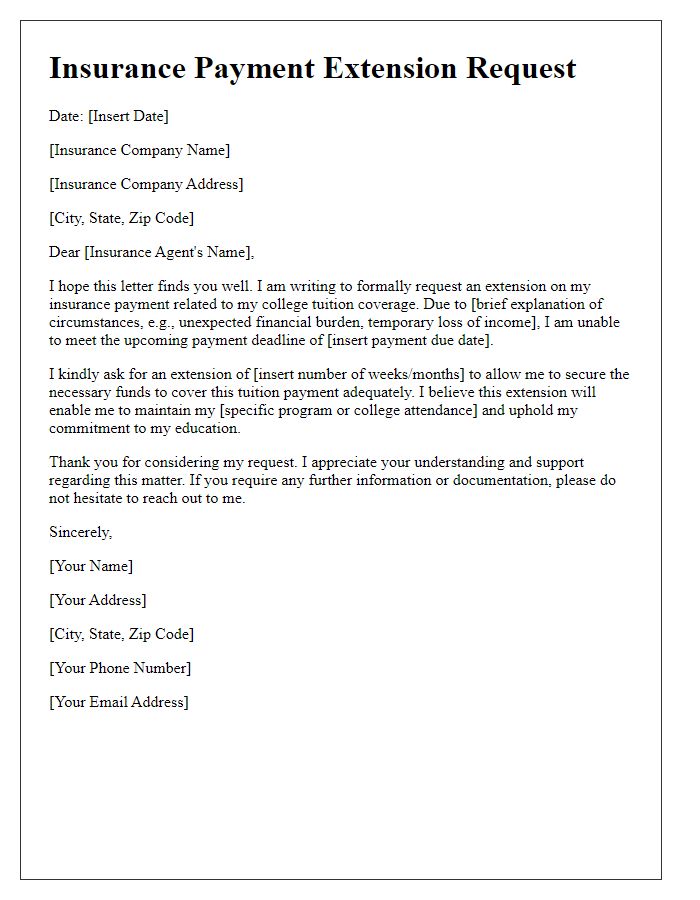

A request for an insurance payment extension may arise due to various financial circumstances. Policyholders facing unexpected expenses often seek assistance from their insurance provider. Crafting an effective letter can aid in communicating the need clearly and respectfully. A timely approach is essential, as most insurance companies expect communication at least 30 days before the due date. The letter should include pertinent details such as policy number, claim number, and specific reasons for the request. Highlighting commitment to payment and mentioning previous payment history may enhance the likelihood of approval. The tone should remain courteous, expressing appreciation for the support provided by the company. Additionally, offering a proposed timeline for the new payment date conveys responsibility and planning. This proactive communication can foster a positive relationship with the insurer, ensuring mutual understanding.

Specific reason for extension

When businesses face unforeseen financial challenges, such as extended disruptions due to natural disasters, insurance companies may grant extensions on payment deadlines. Often, these extensions are documented with precise details, including the date of the event (e.g., Hurricane Ian struck Florida on September 28, 2022), and the specific financial implications (e.g., 30% drop in revenue). Insurers typically request a formal written explanation outlining the reasons for the request, the desired extension period (for example, an additional 30 days), and supporting evidence, such as financial statements. This information helps the insurance provider assess the circumstances of the situation and determine the appropriateness of granting an extension.

Proposed new payment date

In the context of insurance payment extensions, a client may request a modification to the payment schedule due to financial constraints. For example, a homeowner whose insurance premium is due on September 15 might encounter unforeseen circumstances, such as a medical emergency or job loss, impacting their ability to pay on time. The homeowner proposes a new payment date of October 15, allowing an additional 30 days for financial recovery. This request details the homeowner's commitment to fulfilling payment obligations while seeking temporary relief to avoid potential policy lapses or penalties. Clear communication with the insurance company, such as XYZ Insurance Group, is critical to ensure transparency regarding the request and to maintain good standing.

Assurance of continued communication

In challenging financial circumstances, individuals may seek an insurance payment extension to alleviate immediate fiscal pressures. Affected parties often face unexpected events, such as medical emergencies or job loss, prompting a need for leniency from insurance providers. Effective communication becomes essential in this context, ensuring that the insurer understands the reasons for the request and the individual's commitment to fulfill payment obligations. Emphasizing cooperative dialogue facilitates a smooth process, fostering mutual understanding and potential solutions that accommodate both the policyholder's needs and the insurer's policies. Establishing a timeline for continued correspondence may also reassure the insurer of the policyholder's intent and ability to meet future commitments.

Contact information for follow-up

Insurance payment extensions may provide essential relief for policyholders facing financial difficulties. Clients might require additional time to manage their payments due to unforeseen circumstances, such as medical emergencies or pandemic-related job loss. Providing thorough contact information is crucial for effective follow-up. Including specific details, such as the policyholder's name, policy number, and the best contact number, enhances the claims process. Additionally, email addresses are beneficial for written correspondence. Accurate and accessible contact details enable insurance companies to respond promptly and facilitate a smoother communication flow regarding payment extensions.

Letter Template For Insurance Payment Extension Request Samples

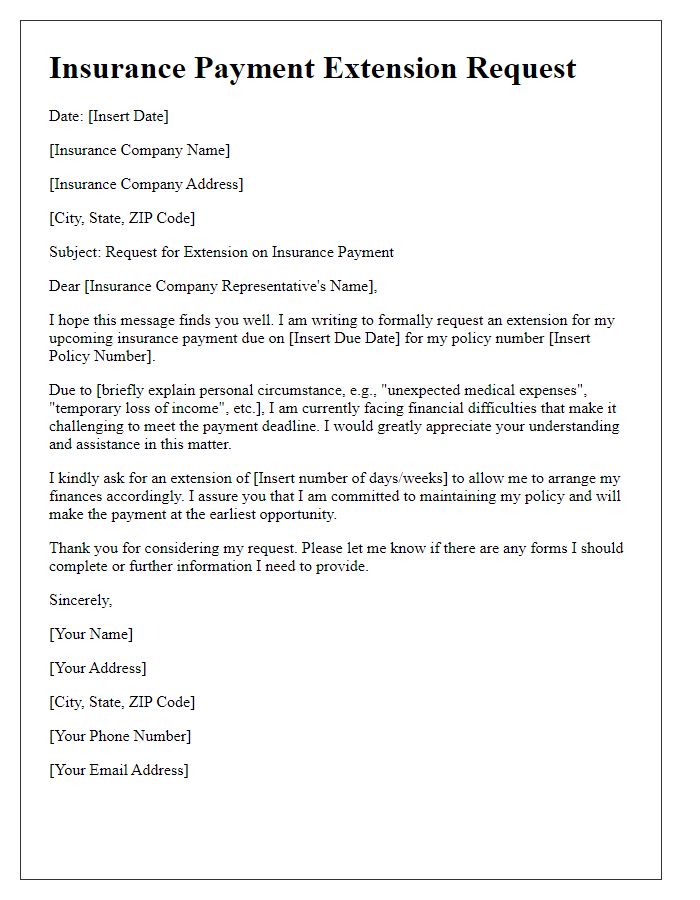

Letter template of insurance payment extension request for personal circumstances.

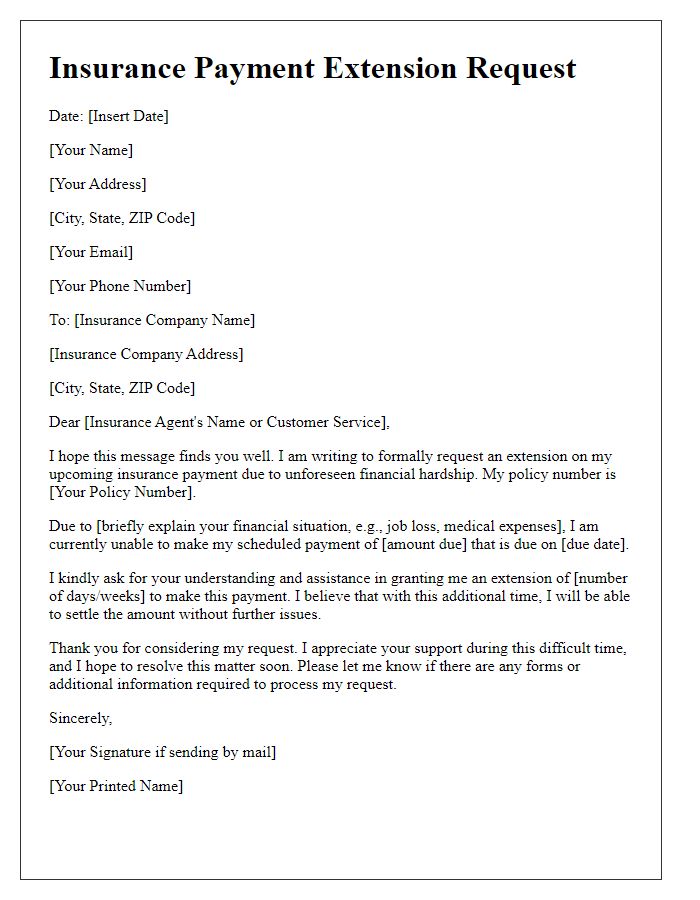

Letter template of insurance payment extension request due to financial hardship.

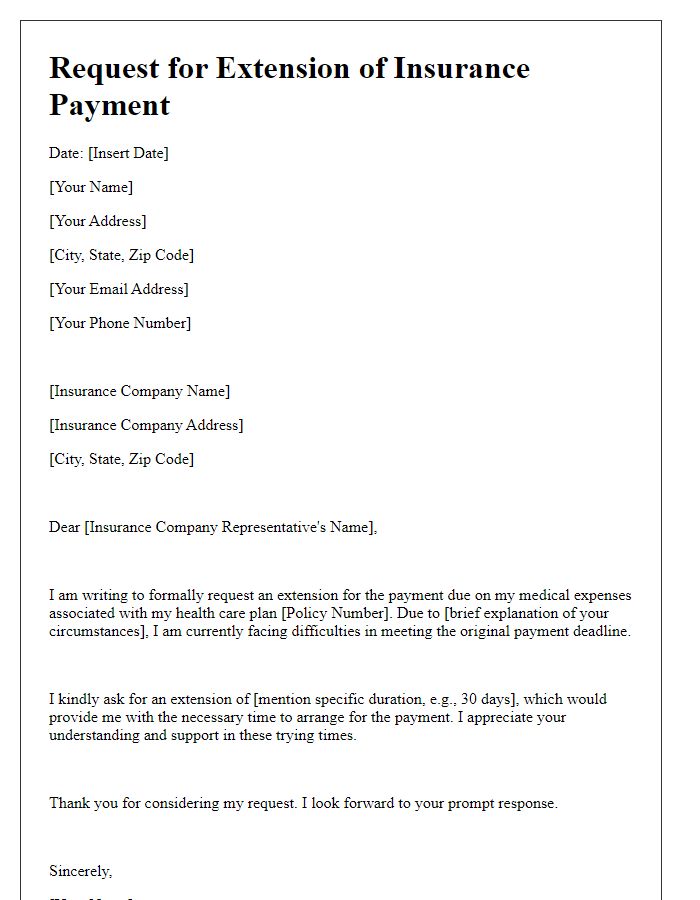

Letter template of insurance payment extension request for medical expenses.

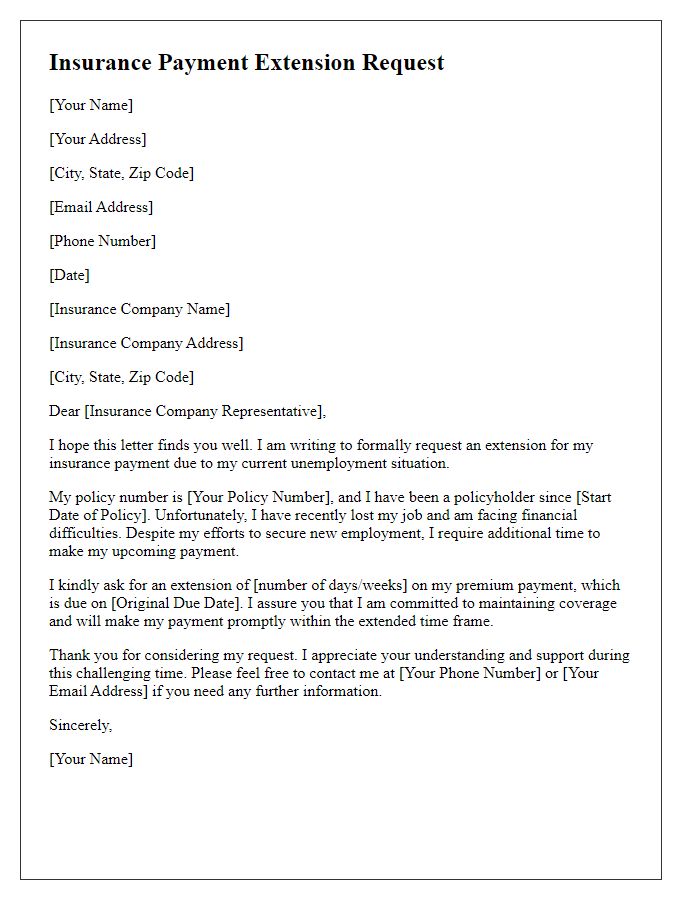

Letter template of insurance payment extension request for unemployment.

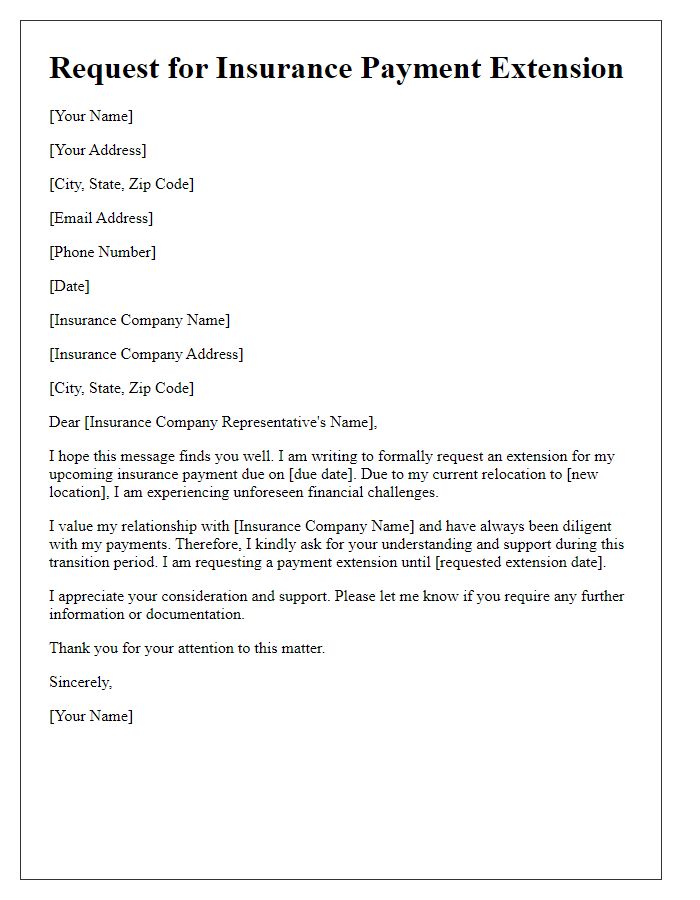

Letter template of insurance payment extension request during relocation.

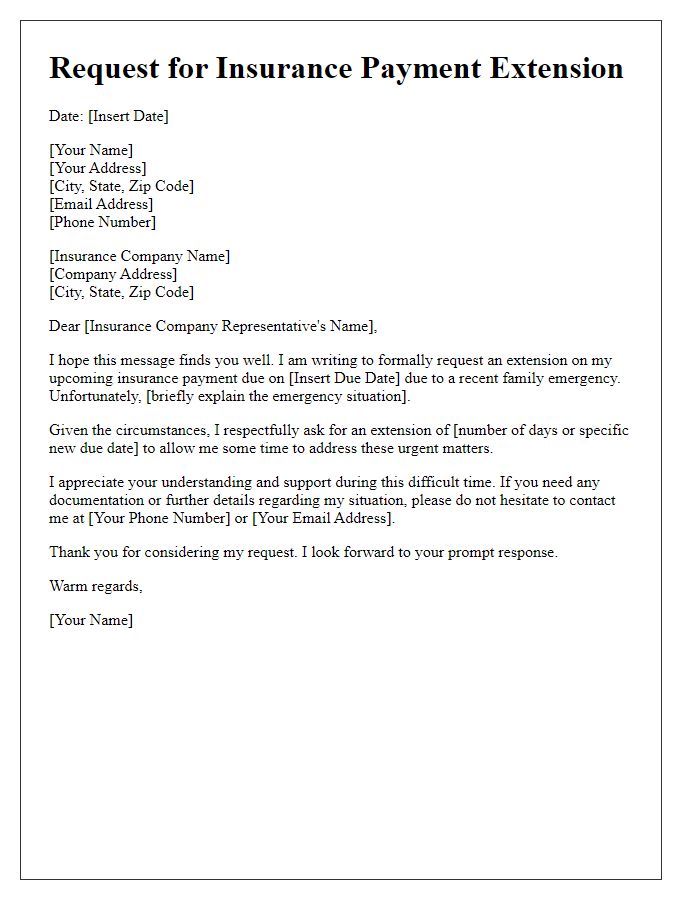

Letter template of insurance payment extension request for family emergencies.

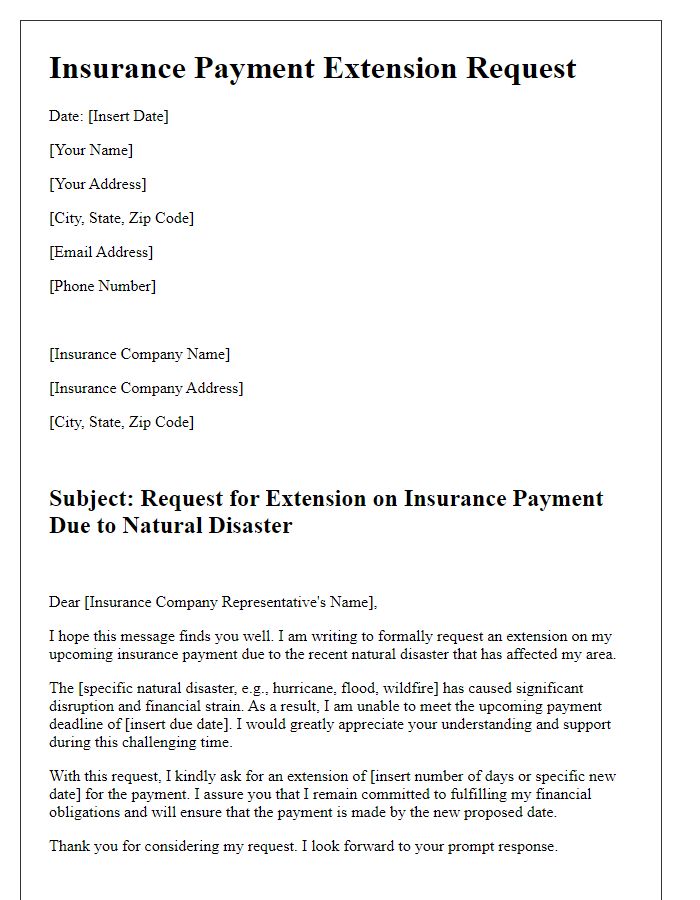

Letter template of insurance payment extension request due to natural disasters.

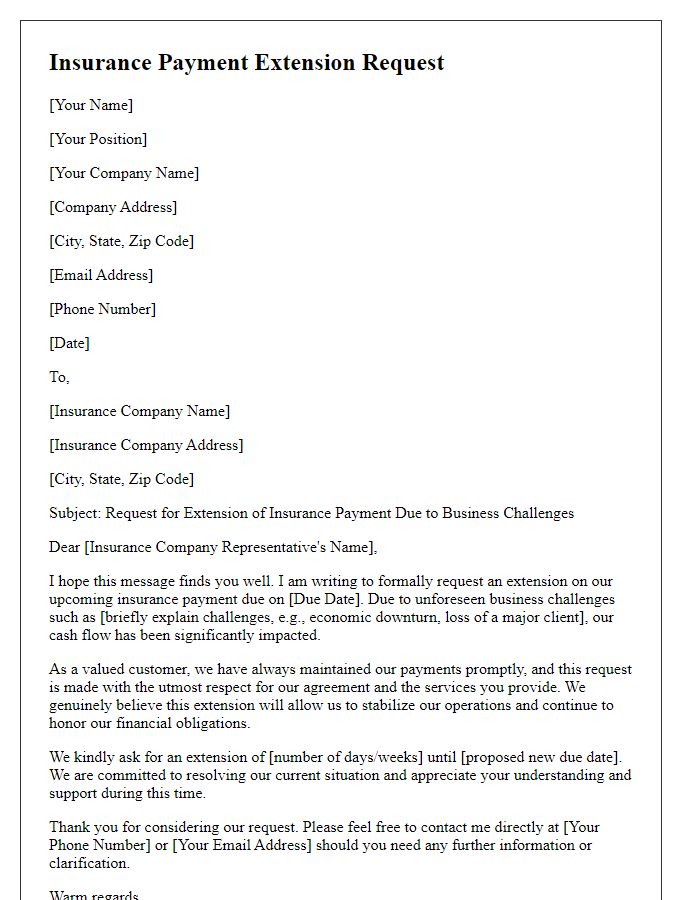

Letter template of insurance payment extension request for business challenges.

Letter template of insurance payment extension request for unexpected expenses.

Comments