When life throws unexpected challenges our way, it's easy for important things, like insurance policies, to slip through the cracks. We all want to protect ourselves and our families, but sometimes a lapse can happen due to oversight or unforeseen circumstances. If you find yourself in this situation, don't worryâthere's a straightforward process to request reinstatement of your insurance policy. Join me as we explore the steps you can take to get back on track and secure the coverage you needâread on for more details!

Clear Identification Information

Clear identification information is crucial in an insurance lapse reinstatement request. Full name (John Doe), policy number (123456789), and date of birth (January 1, 1985) should be prominently displayed. Address (123 Main Street, Springfield, IL 62701) provides the necessary location context for the insurer. Contact information, including phone number (555-123-4567) and email address (johndoe@email.com), ensures effective communication. Additionally, specifying the lapse date (July 1, 2023) and requested reinstatement date (October 1, 2023) clarifies urgency and intent. This detailed identification framework enhances the clarity and professionalism of the reinstatement request.

Policy Number and Details

Insurance policy lapse can lead to significant coverage gaps, affecting financial security during unexpected events. For example, a life insurance policy may have a specific grace period, often 30 days, beyond which it becomes inactive and requires a reinstatement request. Policy number (e.g., 12345ABC) identifies the coverage and associated terms, including premium payment dates and coverage amounts. It's essential to include personal details such as names, addresses, and contact information to facilitate processing. Documentation may include previous payment records and any relevant communication with the insurance provider, ensuring clarity in the reinstatement process.

Reason for Lapse

A lapse in health insurance coverage can occur due to various reasons, such as failure to pay premiums by the due date. Specific factors like financial difficulties, unexpected medical expenses, or changes in employment can contribute to this situation. When premiums are not received for a consecutive period, typically 30 days, policies may automatically terminate, impacting an individual's access to essential healthcare services. Reinstatement requests must often include a detailed explanation of the circumstances leading to the lapse, alongside any necessary documentation, such as bank statements or evidence of changed financial status, to facilitate review by the insurance provider. Additionally, reinstatement applications might require payment of any overdue premiums as part of the reinstatement process, affecting budget planning.

Request for Reinstatement

A lapse in insurance coverage can lead to significant risks for policyholders, typically occurring when premium payments are missed. This situation commonly affects various types of insurance, including health, auto, and homeowners insurance, often governed by specific grace periods of 30 to 60 days. Reinstatement requests for an insurance policy often require detailed information, including policy numbers, the reason for the lapse, and any applicable documentation to prove the ability to continue premium payments. Insurance companies such as State Farm, Allstate, or Geico may have distinct procedures for reinstatement, usually stipulating immediate payment of past due premiums and potential penalties. Responding promptly can mitigate potential coverage gaps and enhance peace of mind for insured individuals.

Contact Information and Signature

Contact information is crucial for effective communication regarding insurance policy reinstatement, typically including the policyholder's full name, residential address, phone number, and email. A signature at the end signifies the policyholder's consent and acknowledgment of the reinstatement request, reinforcing authenticity. In a formal context, details such as the insurance policy number and the date of the request are vital for identifying the specific account and processing the request efficiently. This information ensures that the insurance provider can locate the account quickly, streamlining the reinstatement process.

Letter Template For Insurance Lapse Reinstatement Request Samples

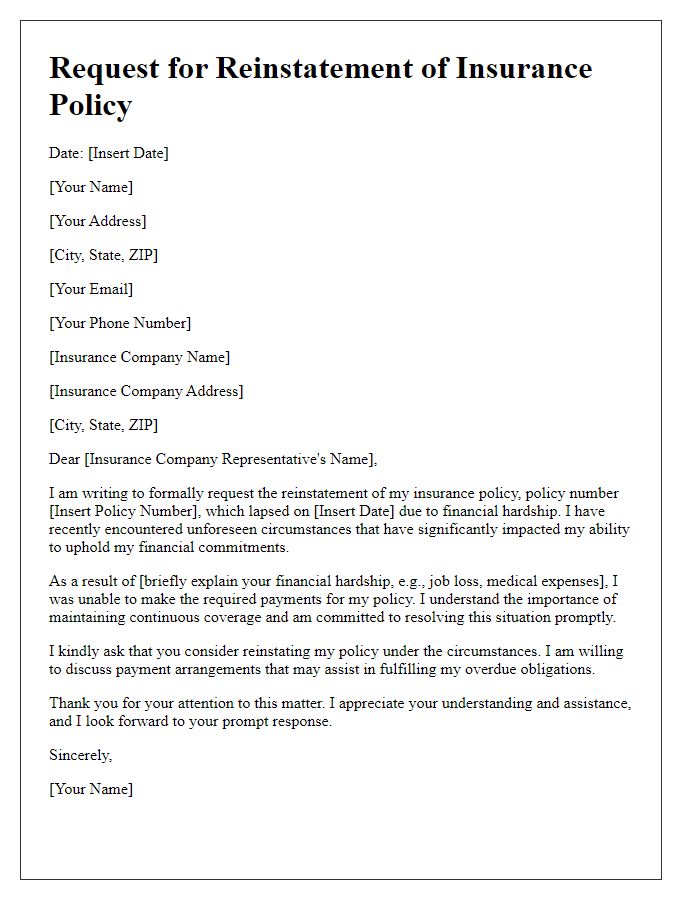

Letter template of insurance lapse reinstatement due to financial hardship.

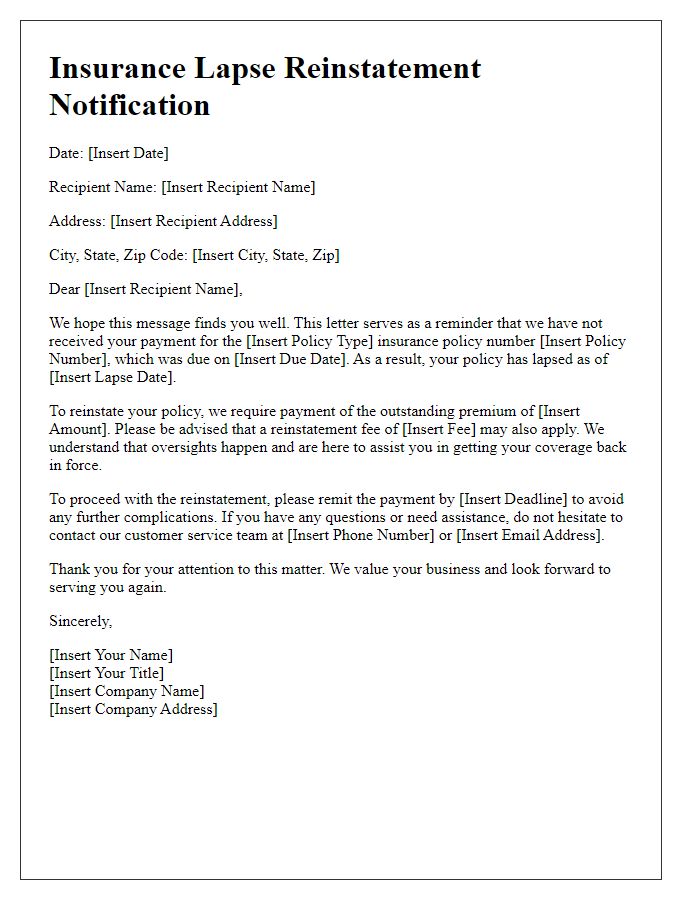

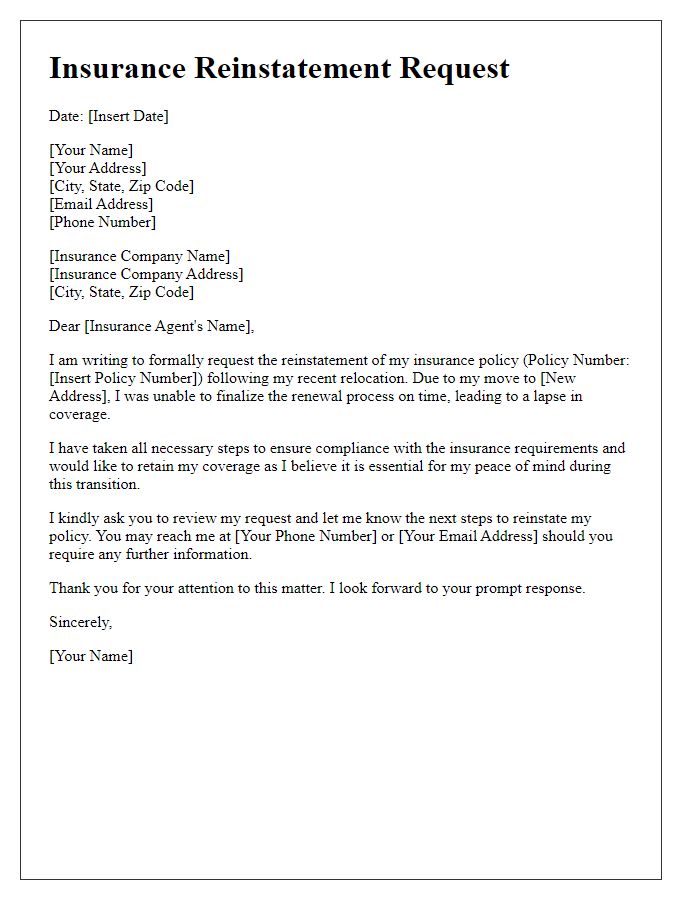

Letter template of insurance lapse reinstatement following missed payment reminder.

Letter template of insurance lapse reinstatement after medical emergency.

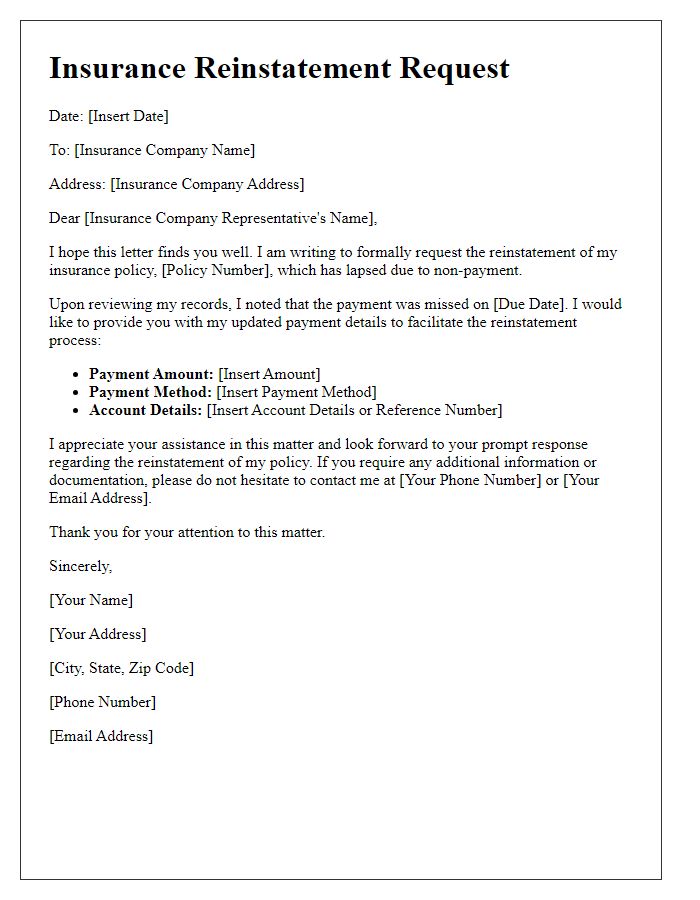

Letter template of insurance lapse reinstatement with updated payment details.

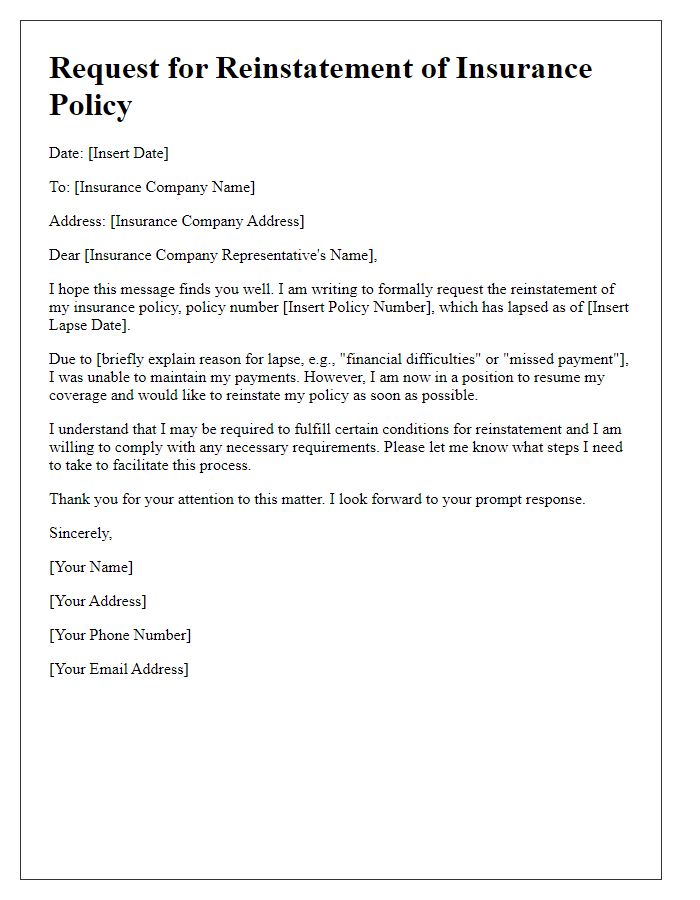

Letter template of insurance lapse reinstatement for policyholder request.

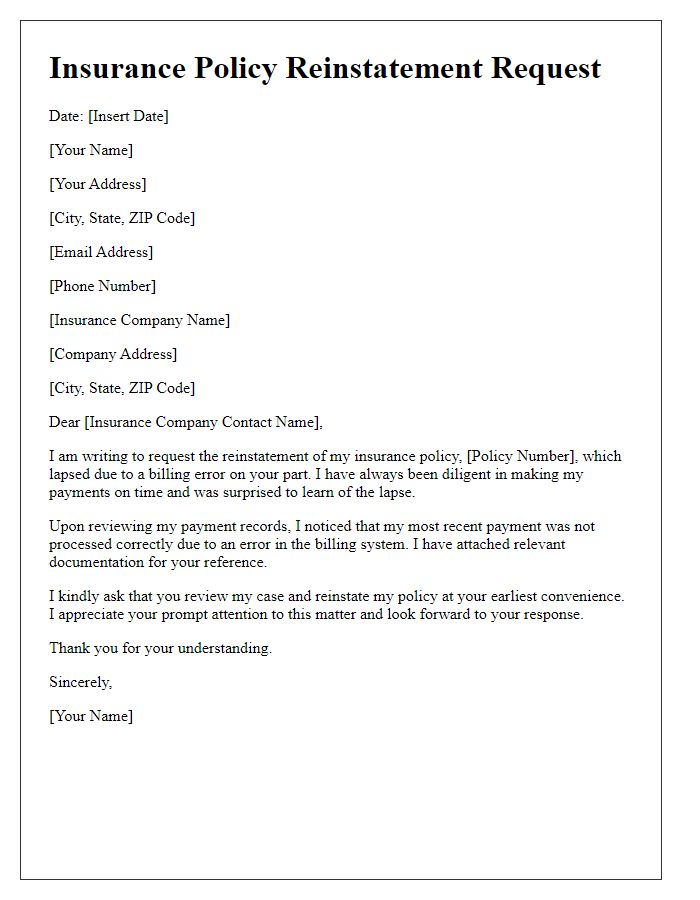

Letter template of insurance lapse reinstatement because of billing error.

Comments