Are you feeling overwhelmed by the insurance claim process? You're not alone; many people find themselves frustrated with the time it takes to resolve their claims. But fear not, there are ways to speed things up and ensure you get the support you need. Let's dive into some effective strategies that can help accelerate your claim processâread on to discover how you can make your experience smoother!

Policy Details and Claim Reference

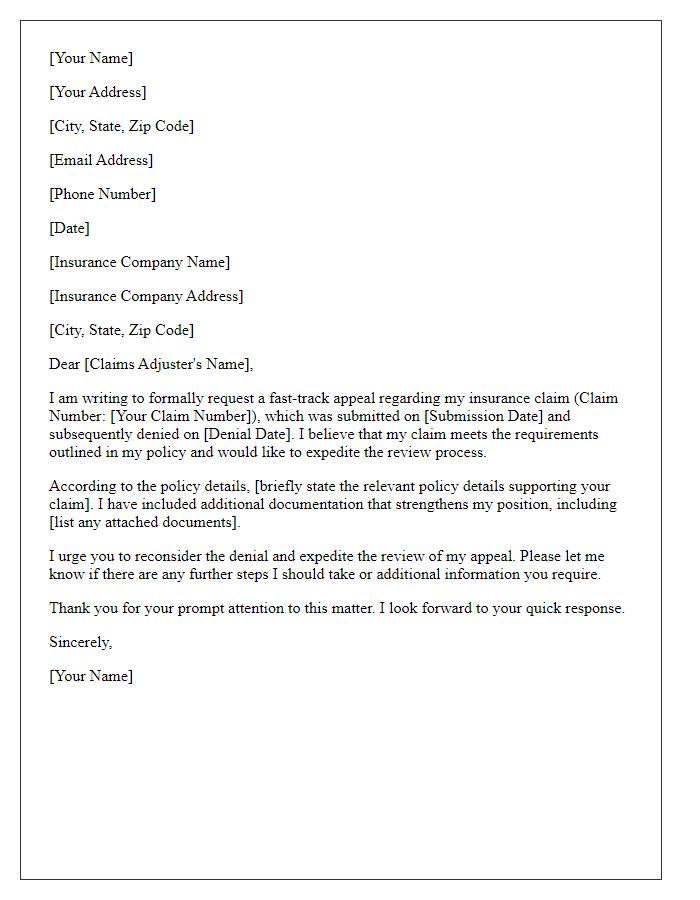

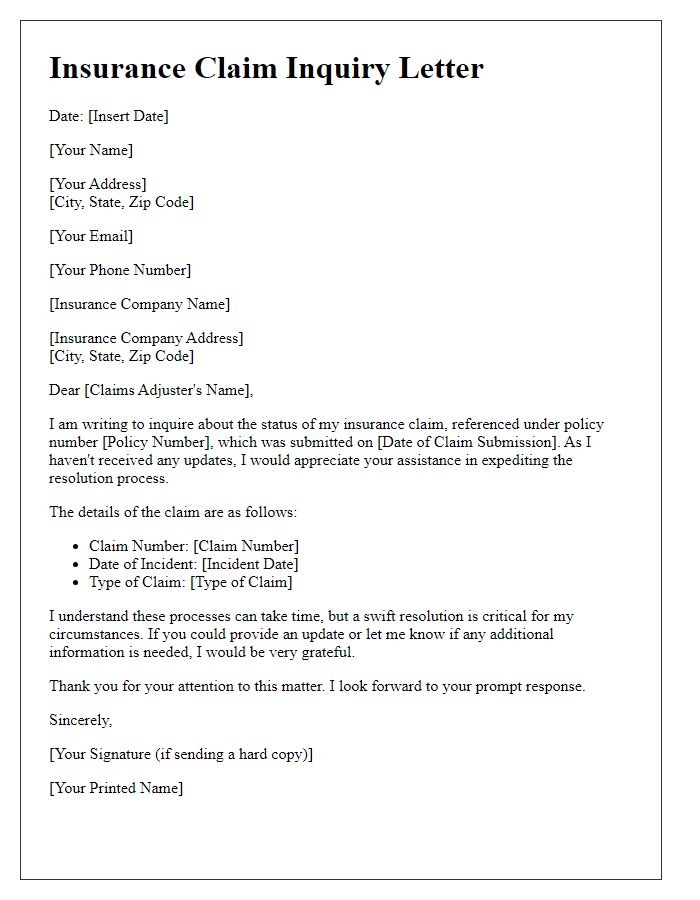

Insurance claims can often be delayed without proper documentation and tracking. Clear policy details include the policyholder's name, policy number (typically a unique identifier like 123456789), and type of coverage (e.g., comprehensive, liability). Claim references, such as the unique claim number (e.g., CLAIM2023-001), assist in tracking the claim status efficiently. Providing specific incident details, including the date (e.g., October 15, 2023), location (like Main Street, New York City), and nature of the claim, is crucial. Timely submission of documents, including photographs of damage, police reports, and receipts, can significantly expedite the approval process, enabling quicker reimbursements. Regular follow-ups with the claims adjuster maintain momentum in processing and resolution.

Clear Description of Claim

To file an insurance claim effectively, a clear and concise description is vital. Outline the incident, such as a vehicle collision on October 15, 2023, with location specifics (e.g., Main Street, Springfield). Identify involved parties, including names and contact details of other drivers, police report number (if applicable), and insurance policy number. Detail damages, such as estimated repair costs of $5,000 for vehicle bodywork and additional expenses like rental car fees of $100 per day. Include timelines of events and any medical treatments, such as visits to local clinics for injuries documented with invoices. Lastly, mention any relevant photographic evidence or witness statements that support the claim, providing comprehensive context for quicker processing.

Urgency Explanation and Justification

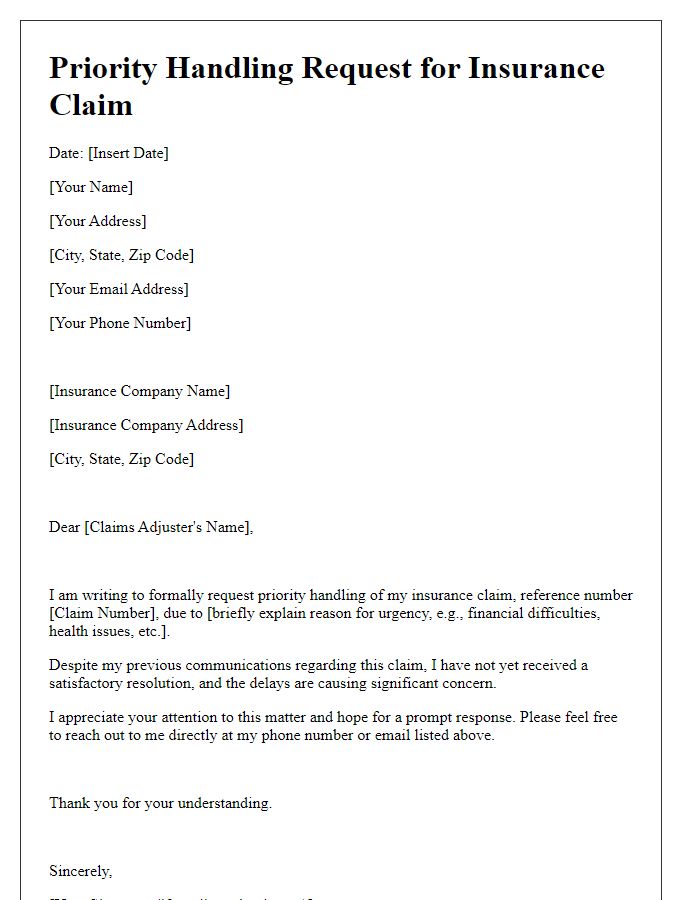

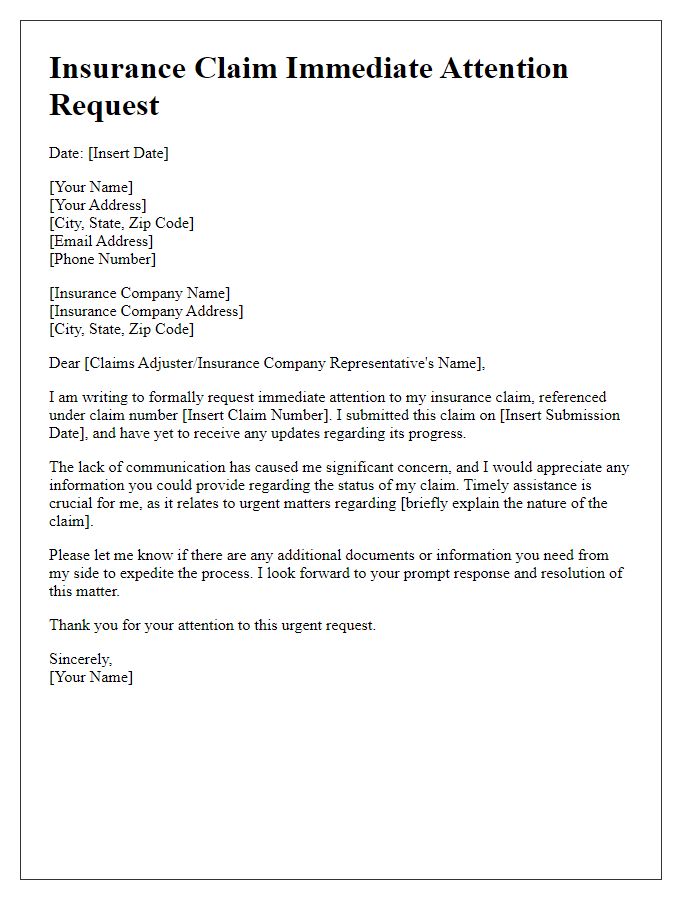

An urgent insurance claim request can significantly impact financial stability during unforeseen circumstances, like accidents or natural disasters. Delay in processing can lead to increased stress and uncertainty for the affected individuals. For instance, in the aftermath of Hurricane Ida in 2021, many homeowners faced extended waiting periods for claims approval, exacerbating financial strain as they sought repairs for damaged properties. Claimants often encounter mounting bills and insufficient temporary living arrangements, highlighting the necessity for prompt attention to their cases. Financial institutions can also experience repercussions due to delayed claim settlements, affecting overall economic stability in the community. Timely processing not only alleviates hardship for policyholders but ensures that insurers uphold their commitments, fostering trust and security within the insurance sector.

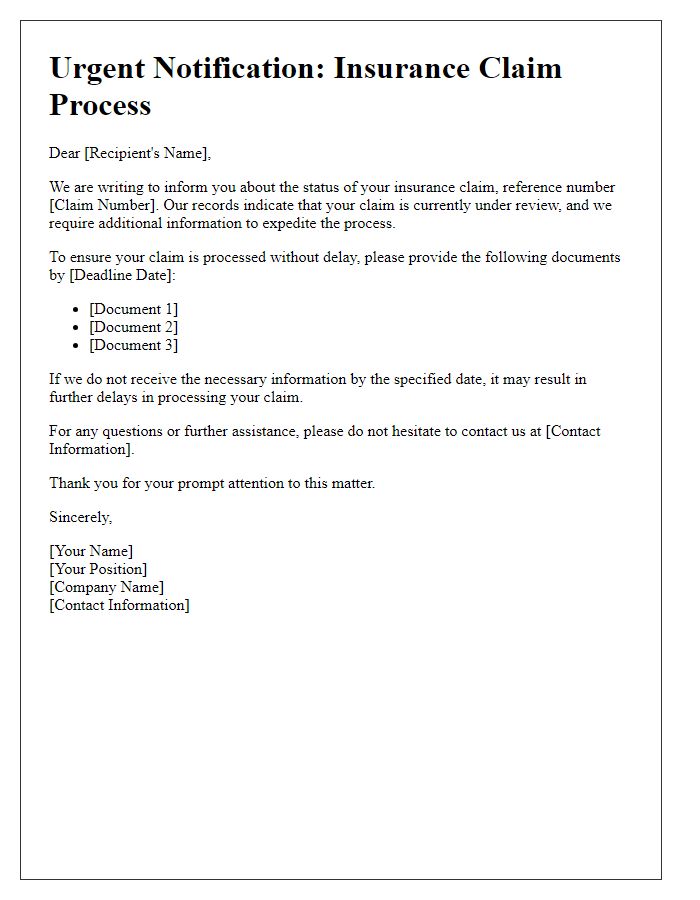

Required Documentation and Attachments

Documentation for insurance claims often includes essential papers such as incident reports, photographs of damages, witness statements, and medical records. Specifics such as claim forms need to be filled accurately, outlining policy numbers (e.g., auto, home, health) and details regarding the incident (date, time, location). Additional items may include repair estimates from licensed professionals and bills related to the claim. For health-related claims, hospital discharge papers and prescriptions may be necessary. Always ensure that correspondence, like emails or letters sent to the insurance company, are dated and recorded, as timely submission can accelerate the claims process.

Contact Information and Preferred Communication Channel

To ensure the swift processing of your insurance claim, it is vital to provide accurate contact information. Your main contact number should receive immediate attention, enabling timely responses from claim adjusters. Preferred communication channels include email for written correspondence and phone calls for urgent inquiries. Including an alternative contact ensures backup communication in case of any unforeseen issues, such as unavailability. Always specify your preferred time for contact to facilitate a smoother interaction, ensuring your concerns are addressed promptly. Accurate information minimizes delays in processing and enhances the overall efficiency of your claim.

Letter Template For Insurance Claim Process Acceleration Samples

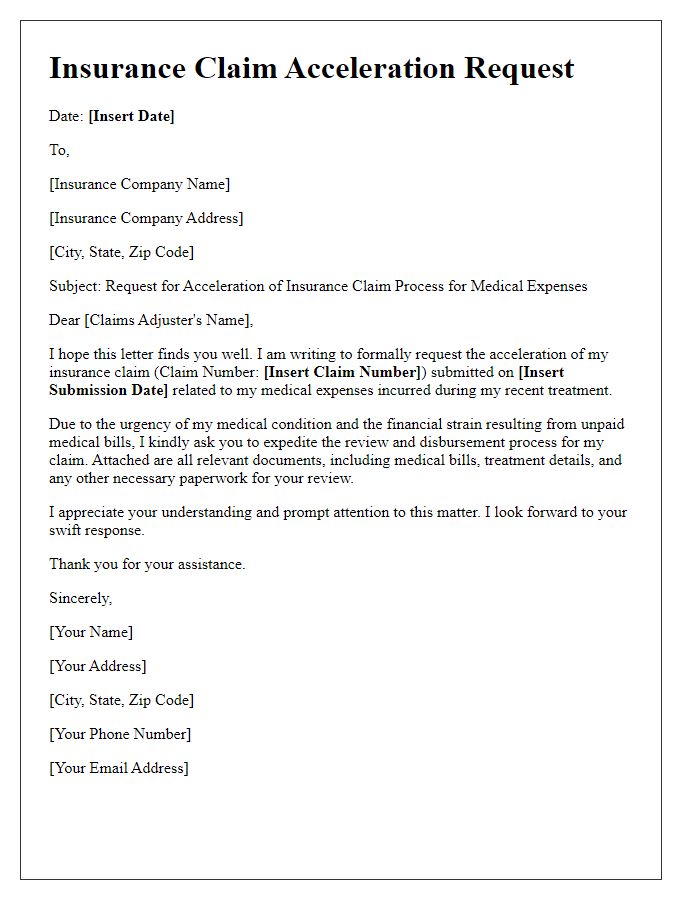

Letter template of insurance claim process acceleration for medical expenses

Comments