Losing a loved one is never easy, and navigating the complexities of notifying an insurer can feel overwhelming during such a difficult time. Understanding the steps involved in formally informing the insurance company can help ease the burden and ensure that necessary arrangements are made promptly. In this article, we'll guide you through the process of drafting a notification letter to your insurer regarding the death of the insured. So, let's dive in and simplify this important task togetherâread on to learn more!

Policyholder Information

Upon the unfortunate event of the death of an insured individual, it is essential to provide accurate policyholder information to the insurance company. The policyholder, typically the individual or entity that owns the insurance policy, must complete necessary documentation detailing vital statistics such as full name, date of birth (often listed as MM/DD/YYYY), and policy number (like those assigned by major insurers). Additionally, the contact information, including address and phone number, is crucial for follow-up. Accurate details about the date of death and, if applicable, the cause of death are necessary for swift processing of claims. Providing these details ensures the timely resolution of claims, often critical for beneficiaries relying on insurance payouts.

Insured Person's Details

In the unfortunate event of an insured person's passing, it is essential to provide critical information to the insurance company for claims processing. Important details include the Full Name of the insured individual, Date of Birth (indicating their age at the time of death), Policy Number (which connects the policy to the claimant), and the Date of Death (noting when the event occurred). Additional context may involve the Place of Death (hospital name or residence, city, state), the Cause of Death (medical conditions, accidents), and any pertinent documents such as the Death Certificate (official document proving the death) or police reports, if applicable. Such thorough details ensure the insurance company handles the claim efficiently and compassionately.

Date and Cause of Death

The recent passing of the insured individual, John Smith, on October 15, 2023, was due to complications related to heart disease, a prevalent condition affecting millions worldwide. Heart disease, encompassing various cardiovascular ailments, often leads to unexpected mortality, with over 697,000 fatalities recorded annually in the United States alone. This unfortunate event has prompted the need to notify the insurance provider, Prime Life Insurance Company, promptly to initiate claims processing. Relevant policy details and documents will accompany the notification to facilitate the claims review. In addition, the address of the deceased's estate, located at 123 Elm Street, Springfield, will be included for any further correspondence required by the insurer.

Policy Number and Coverage Details

Notification of the death of an insured individual is crucial for initiating claims with insurance providers. The policy number (unique identifier for the insurance agreement) outlines the terms of coverage, specifying the benefits payable upon the policyholder's demise. Coverage details encompass the types of insurance, such as life insurance or accidental death benefits, ensuring proper financial provisions are activated. Dates of passing and any necessary documentation, such as a death certificate, play pivotal roles in expediting the claims process, thereby alleviating financial burdens on beneficiaries during their period of mourning.

Contact Information for Next of Kin

Notifying an insurance company of the death of an insured individual is a crucial step for claims processing. This notification typically includes essential details such as the contact information for the next of kin, ensuring prompt communication regarding the claim. Specifics required may include the full name, relationship to the deceased, phone number, and mailing address of the next of kin, usually a spouse, child, or sibling. Additionally, it is important to reference the policy number associated with the deceased, as well as the date of death, providing clarity for the insurer regarding which policy is affected. Timeliness in submitting this information is vital, as it can influence the processing time for any benefits that may be due.

Letter Template For Notifying Insurer Of Death Of Insured Samples

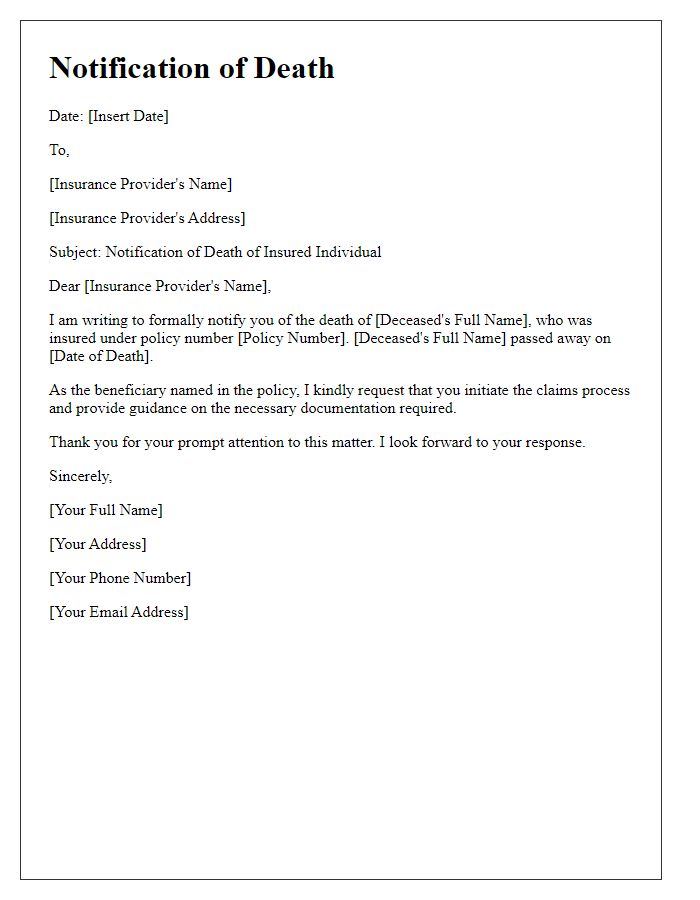

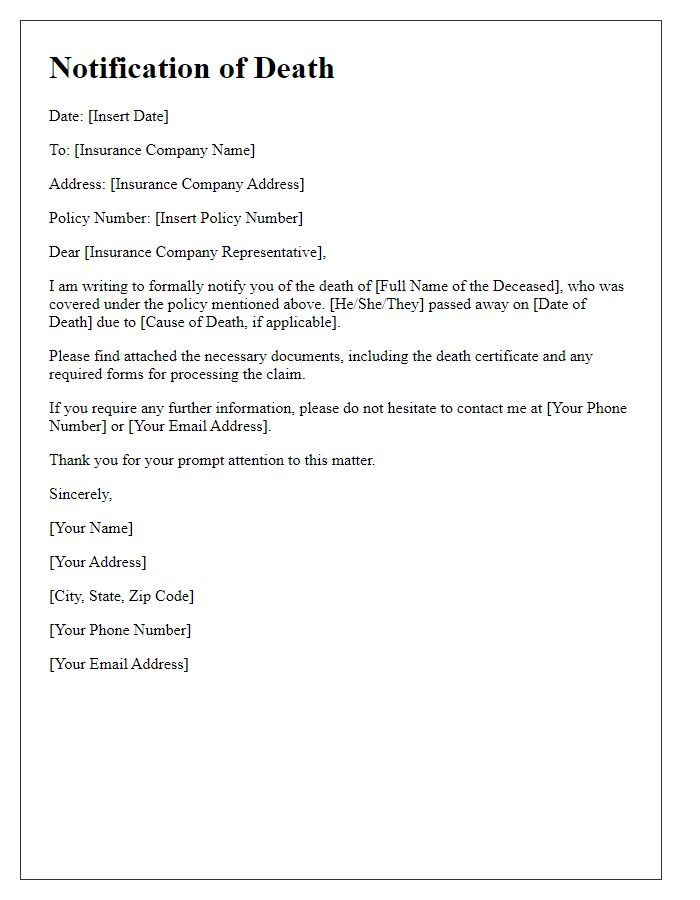

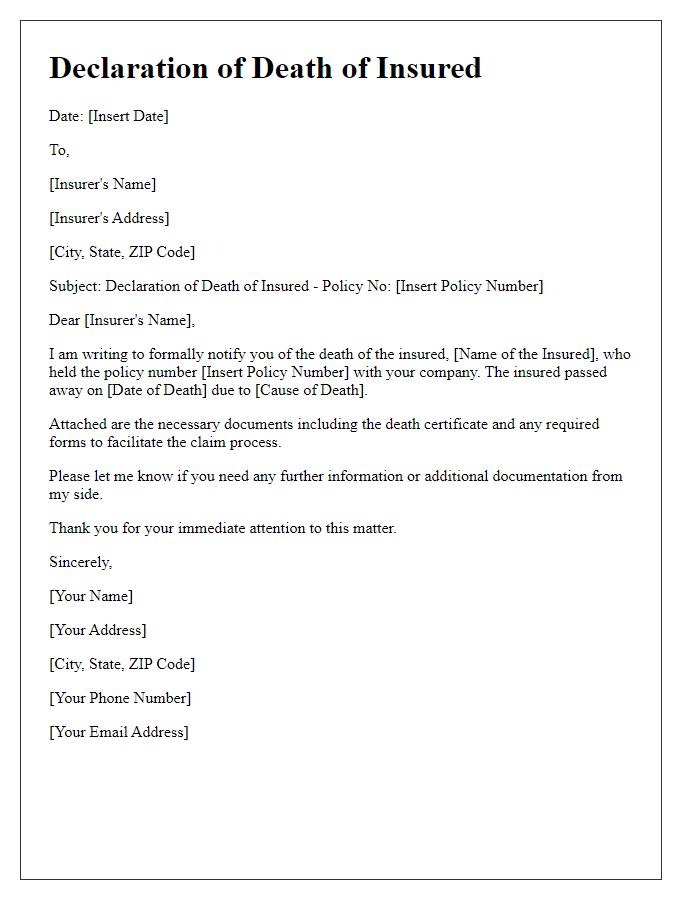

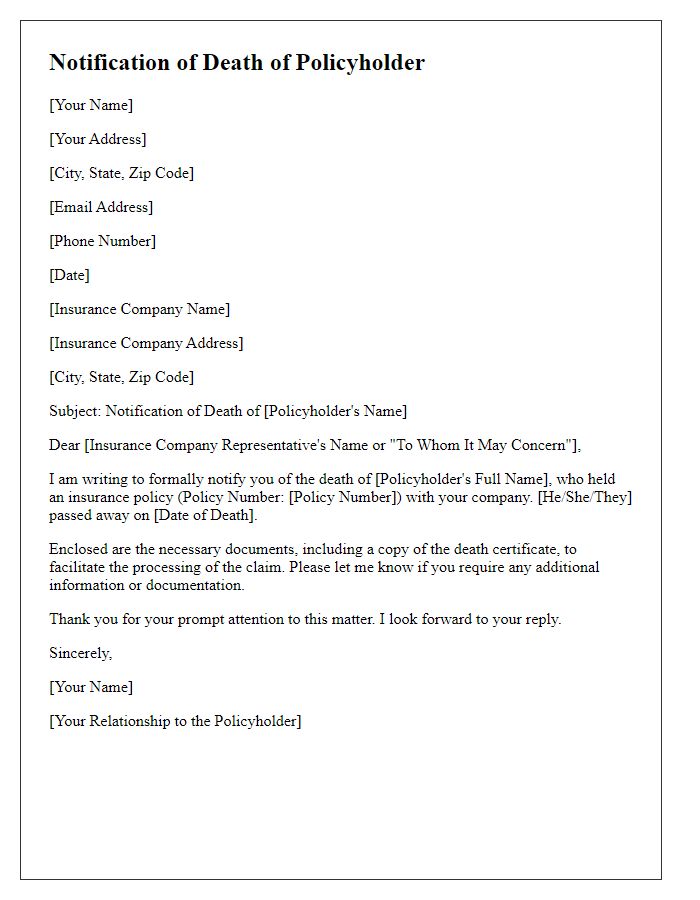

Letter template of notification for death of an insured individual to an insurance provider.

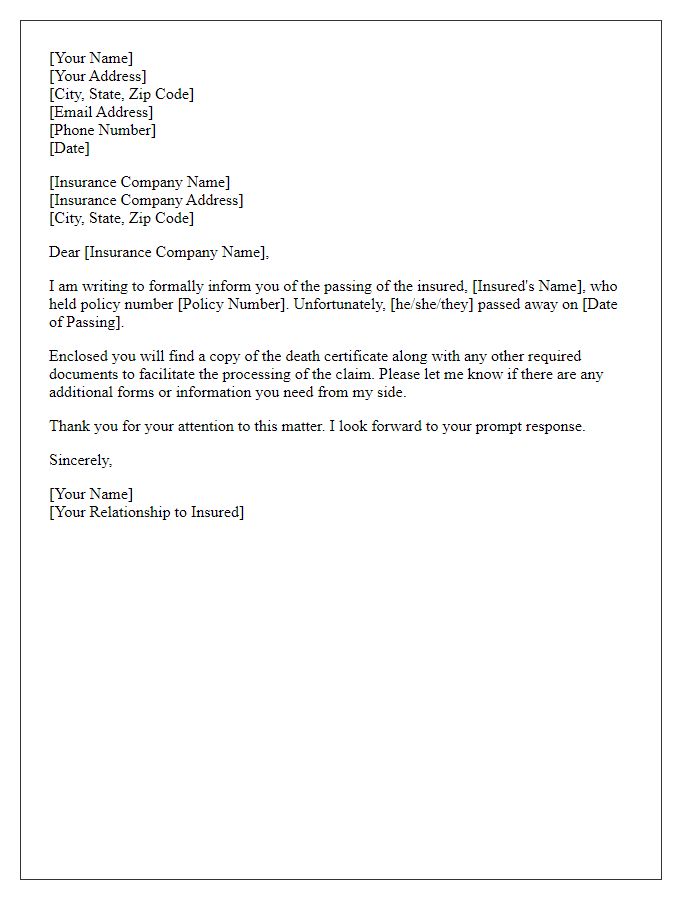

Letter template of informing the insurance company about the passing of the insured.

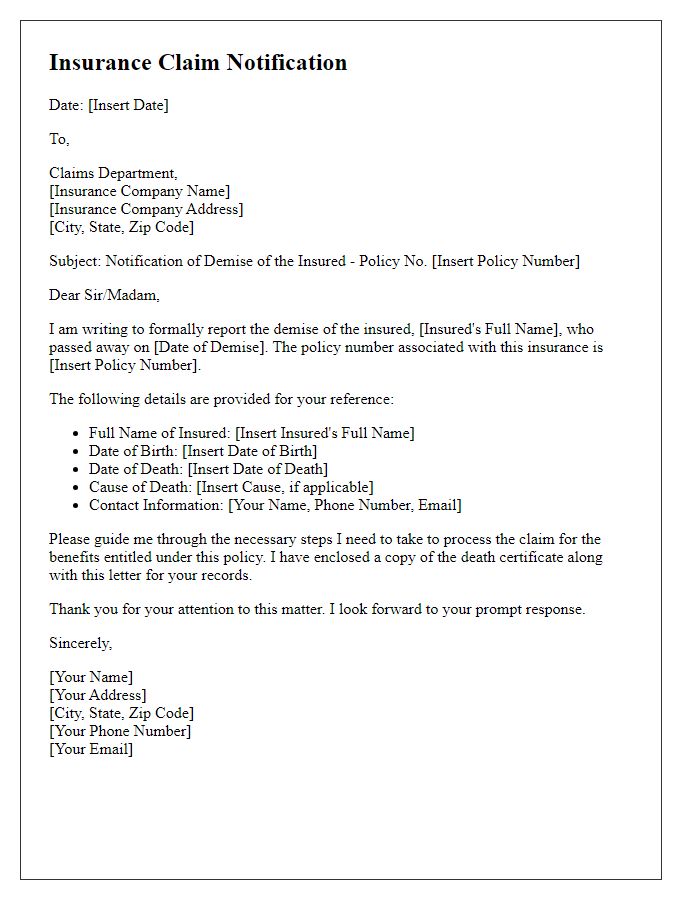

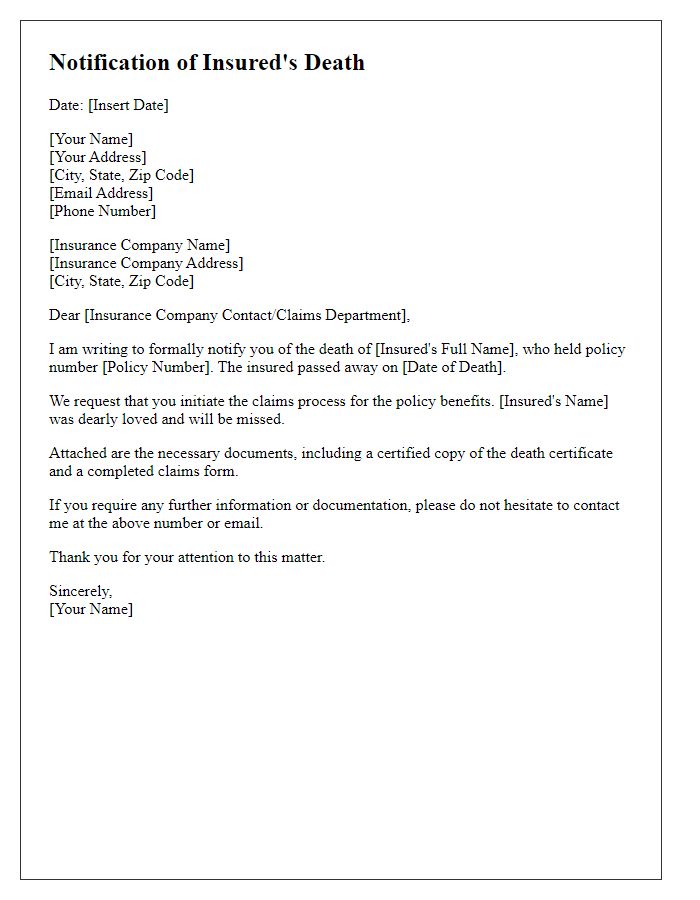

Letter template of reporting the demise of the insured to an insurance firm.

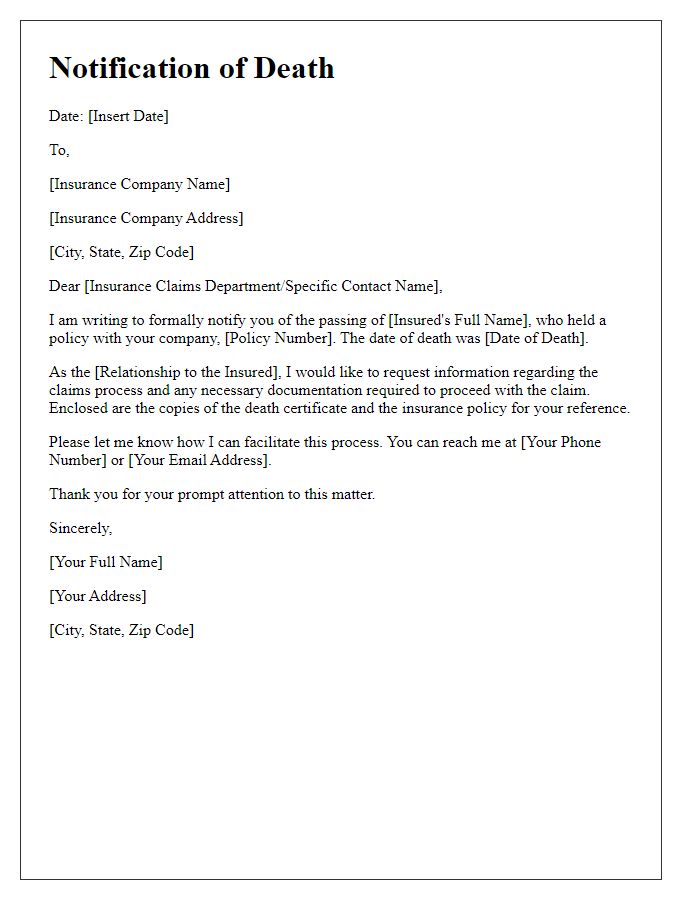

Letter template of communicating the death of the insurance policyholder to the provider.

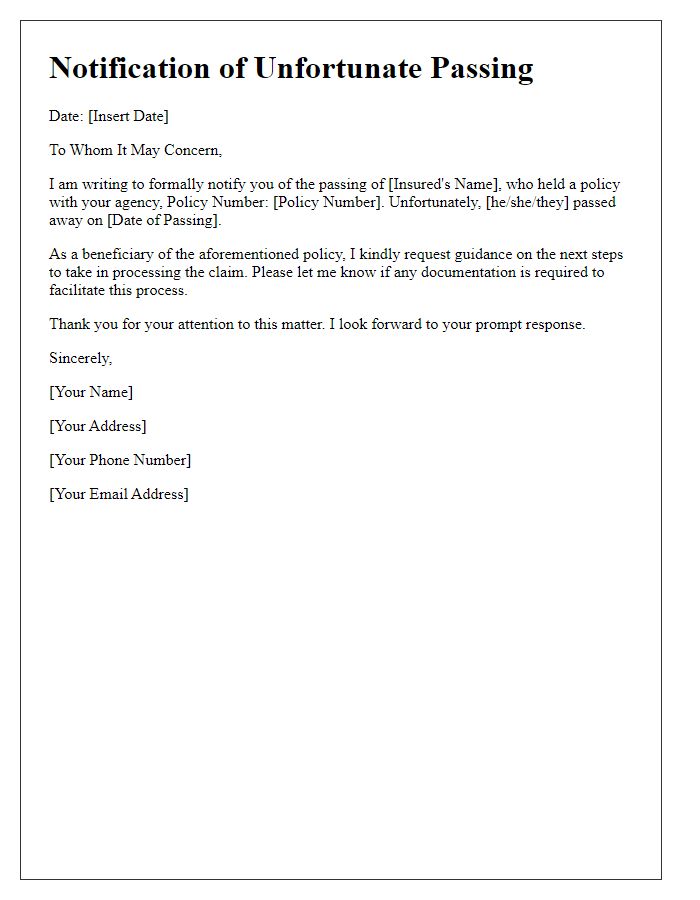

Letter template of stating the unfortunate passing of the insured to the insurance agency.

Letter template of advising the insurer regarding the death of the covered individual.

Letter template of delivering the news of the insured's death to the insurance company.

Letter template of reaching out to the insurer to report the death of the insured.

Comments