Are you feeling overwhelmed by the complexities of your current insurance policy? It's not uncommon to find that your coverage needs have changed, prompting the desire to adjust the terms of your insurance. Whether it's enhancing your coverage, adjusting premiums, or adding new protection features, modifying your insurance can provide peace of mind. If you're curious about how to effectively draft a letter for these changes, keep reading for a detailed template to guide you!

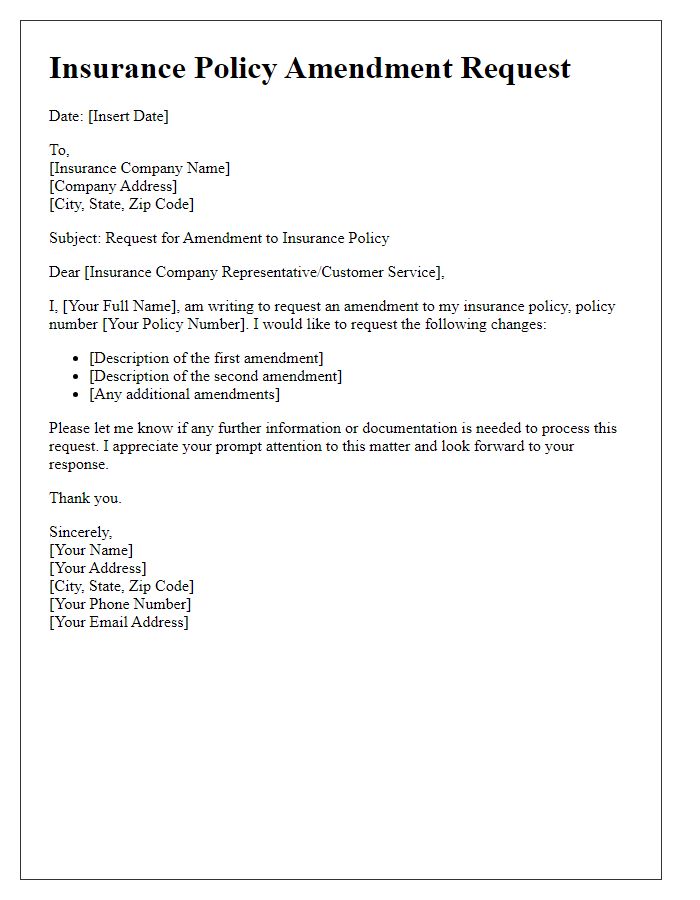

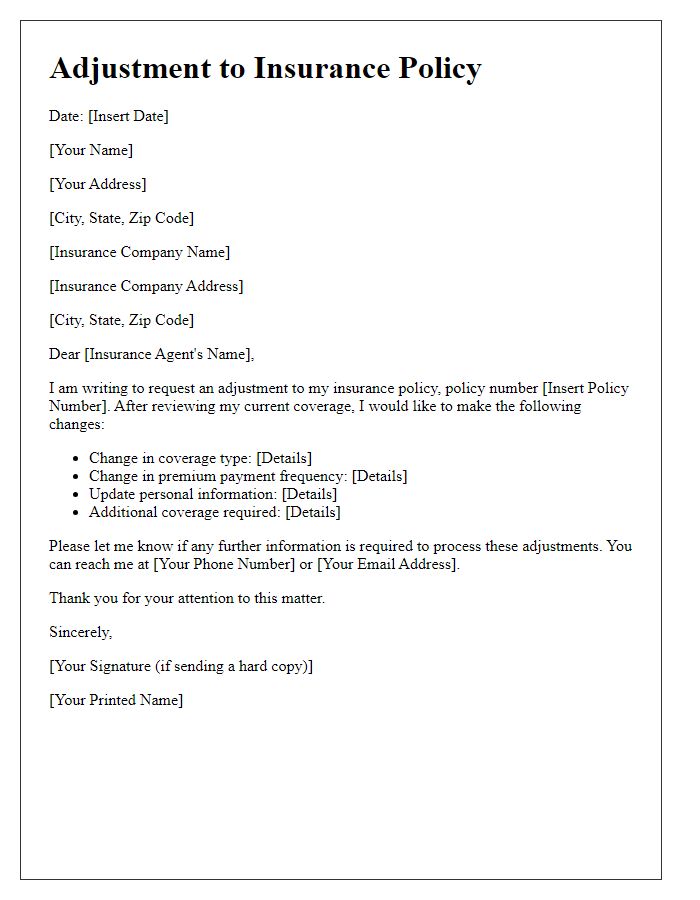

Clear identification of policyholder and policy number.

A modification request for insurance terms requires the clear identification of the policyholder (the individual or business who holds the insurance policy) and the specific policy number (the unique identifier assigned to the insurance agreement). Detailed information about the policyholder, including full name, address, and contact information, is essential to ensure accurate processing of the modification request. The policy number serves as a reference to locate the specific terms of the insurance agreement under consideration for modification, enabling insurance companies to quickly identify and evaluate the requested changes.

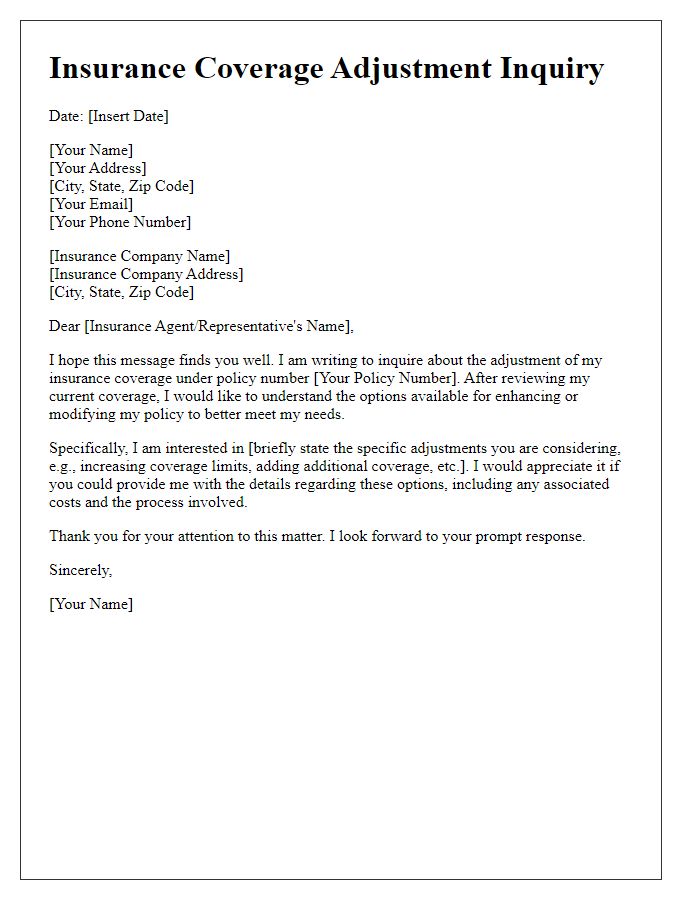

Specific details of requested modifications.

Insurance policy modifications can significantly impact coverage and premium costs. Policyholders often request adjustments, such as increasing coverage limits for personal property, which can be critical in areas prone to natural disasters like hurricanes (e.g., Florida). Reducing deductibles, particularly for health insurance plans, is another common modification; this could alleviate sudden medical expenses. Additionally, some may wish to add riders for specific events, such as accidental death or disability, enhancing protection against unforeseen circumstances. Furthermore, adjusting policy terms to align with major life events--like marriage, new home purchase in suburbia, or the birth of a child--can lead to better-tailored coverage that meets evolving needs. Each request can influence policy premiums, reflecting changes in risk assessment by insurance providers.

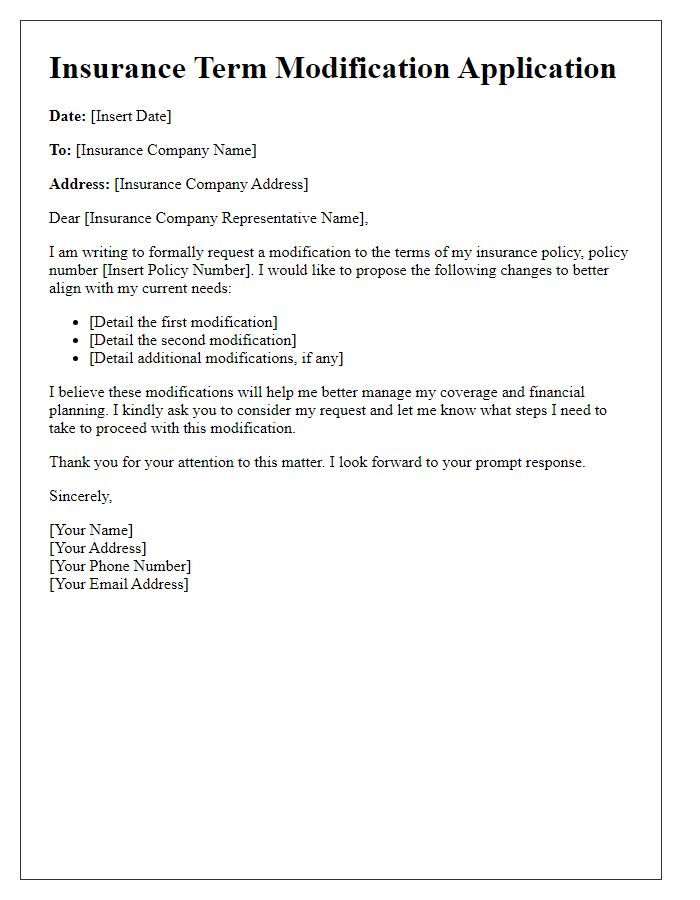

Reasoning or justification for modification request.

Insurance terms modification may be necessary due to changing personal circumstances, such as recent life events like marriage or the birth of a child, which can affect coverage needs. Increased property values, like home renovations or acquisitions, might require higher coverage limits to protect against potential losses. Additionally, shifts in financial status, such as new employment or income changes, can lead to the necessity of adjusting premiums and deductibles. Health changes, particularly chronic conditions, could warrant revisiting health insurance options for better coverage. Market changes, such as fluctuations in policy rates, also influence the decision to seek modifications for more favorable terms.

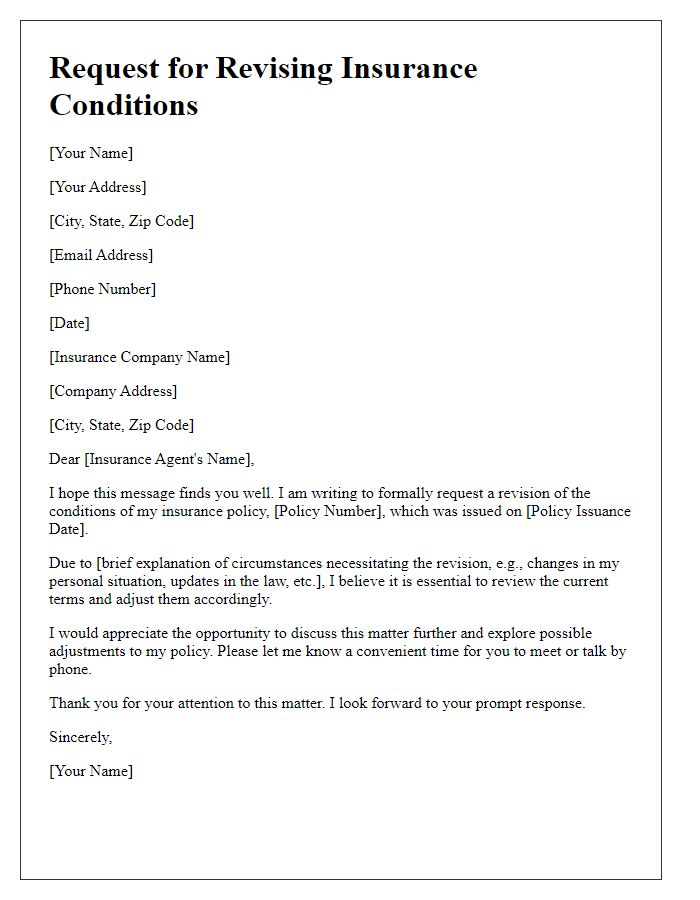

Contact information for follow-up or clarification.

Insurance policies often require modifications to terms to better fit individual needs. Policyholders can request changes regarding coverage limits, deductibles, or additional riders. Effective communication with the insurance provider is crucial for understanding the implications of such modifications. Policyholders should provide a concise description of requested changes, referencing specific sections of the insurance agreement. Contact information such as the insurance company's customer service number and email address facilitates follow-up or clarification requests, ensuring both parties remain informed throughout the process. Ensuring that all correspondence includes the policy number (usually a unique identifier) helps streamline the modification process.

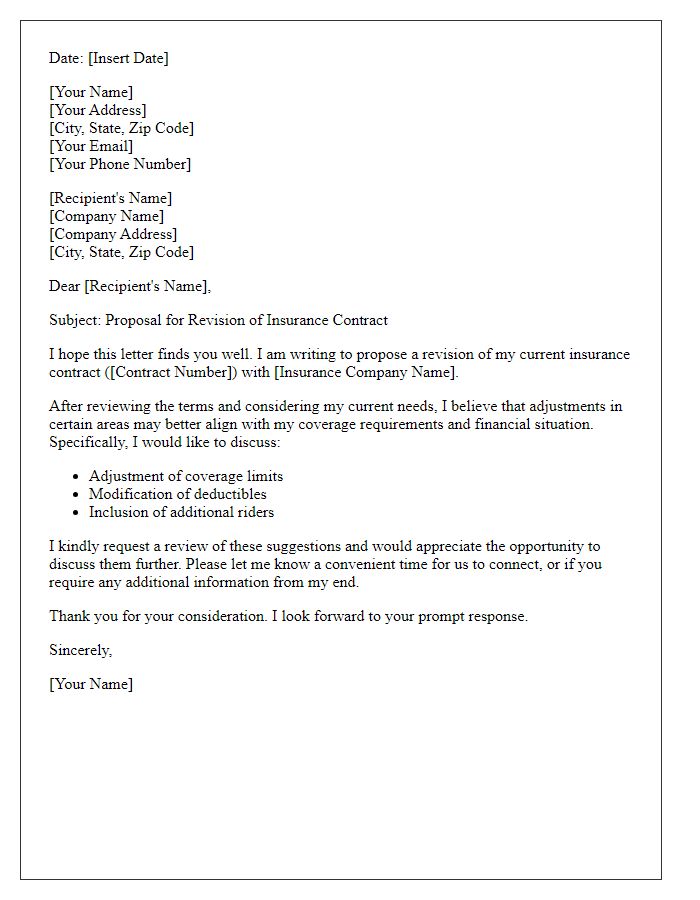

Deadline or urgency for requested changes.

Insurance policies often require modifications to meet clients' evolving needs. Effective communication regarding these amendments is crucial. Request for changes, such as adjusting coverage limits or updating beneficiaries, should be submitted promptly to ensure seamless policy management. Set clear deadlines, generally within 30 days of request, to facilitate efficient processing by insurance providers. Urgency may arise from significant life events, like marriage or property acquisitions, influencing the necessity for immediate attention. Timely modifications safeguard against potential gaps in coverage, ensuring financial protection is upheld according to the individual's current situation.

Comments