Hey there! If you've ever wondered how to effectively verify an insurance transaction, you've come to the right place. This quick guide will walk you through the essential elements to include in your verification letter to ensure clarity and professionalism. Whether you're a seasoned pro or just starting out, understanding the nuances can make all the difference. So, let's dive in and explore the details together!

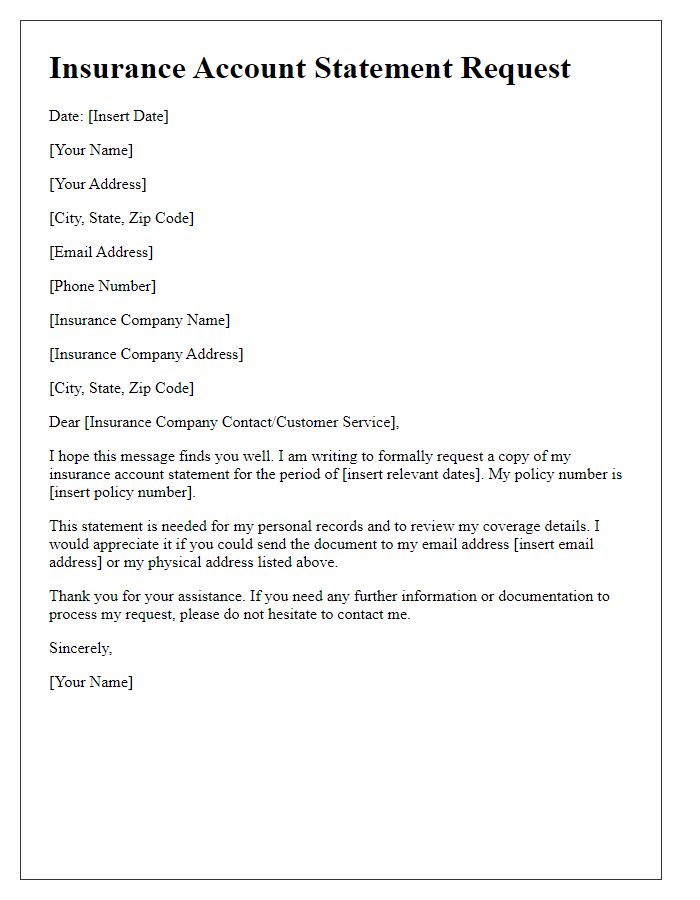

Customer Identification Details

Insurance transaction verification requires precise customer identification details to ensure accuracy and prevent fraud. Essential information includes the full name of the policyholder, such as John Doe, date of birth (e.g., March 15, 1980), and the policy number (e.g., 123456789). Additional identification details contain social security number (e.g., XXX-XX-XXXX), and residential address (e.g., 123 Elm Street, Springfield, IL, 62701). Contact information should comprise a functional phone number (e.g., (555) 123-4567) and email address (e.g., johndoe@example.com). Verification may also require supporting documents such as a government-issued ID (e.g., driver's license) and proof of residence (e.g., utility bill) for improved security and compliance with regulations.

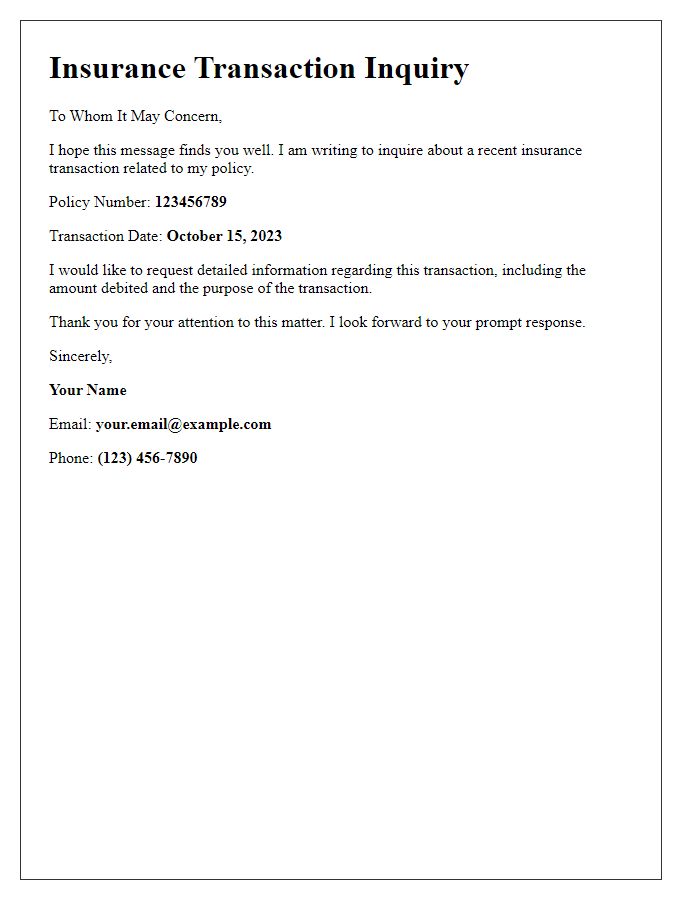

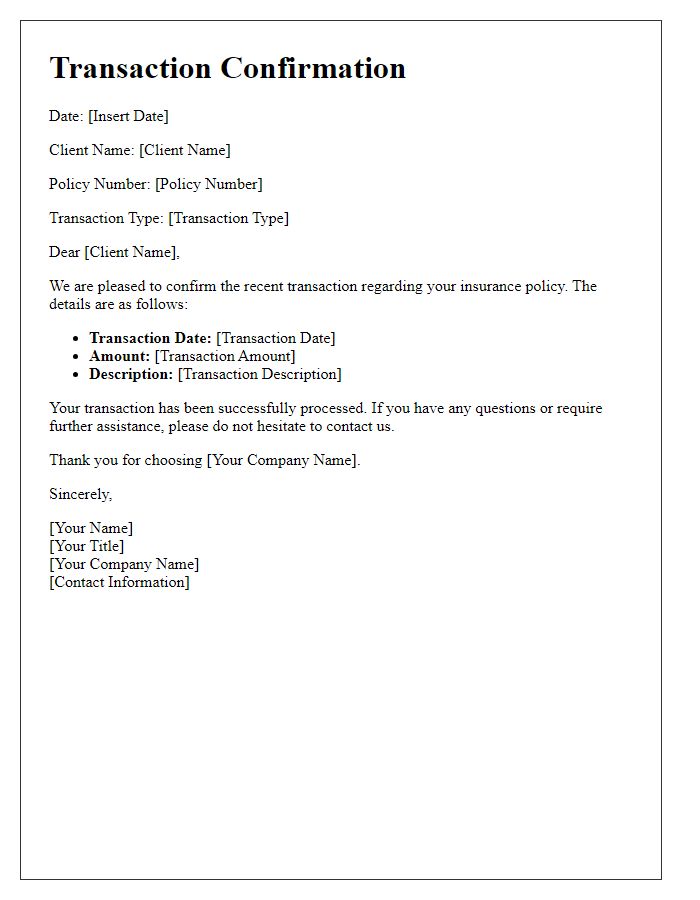

Transaction Details and Amount

Transaction verification plays a crucial role in insurance processes, ensuring accuracy and transparency of financial dealings. Policy numbers often serve as unique identifiers in confirming transactions, typically composed of alphanumeric codes assigned to each insured individual or entity. Transaction amounts can vary widely, ranging from small premiums to significant payouts, often necessitating detailed records for accountability. These transactions may occur within specific timeframes, adhering to renewal dates or claim submissions, often documented in both electronic and paper formats. Addressing the insurance provider's office, usually located in major cities, ensures that clients receive timely confirmations regarding their financial activities.

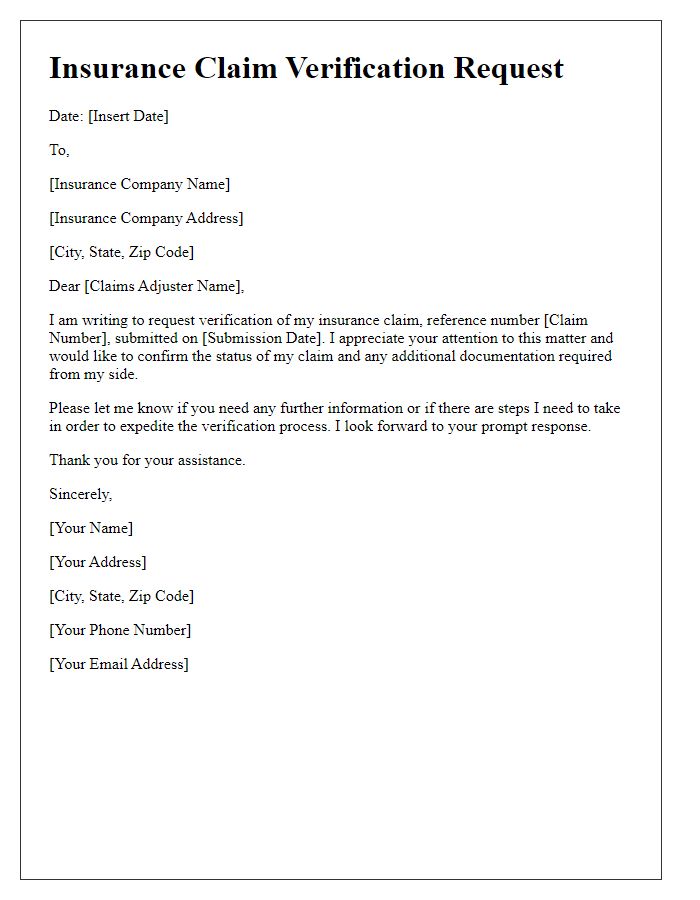

Verification Purpose and Request

Insurance transaction verification ensures accurate record-keeping and fraud prevention within the insurance industry. Policyholders often submit claims or requests related to their insurance coverage, requiring confirmation of the details provided. Insurance companies, employing robust systems (such as claims management software), meticulously review submitted documents (such as invoices and medical reports) against their internal databases. This process validates the authenticity of claims, safeguarding against potential scams and errors. An efficient verification process can enhance customer trust and streamline operations, facilitating timely payments and service delivery in locations like New York, where high transaction volumes necessitate quick resolutions.

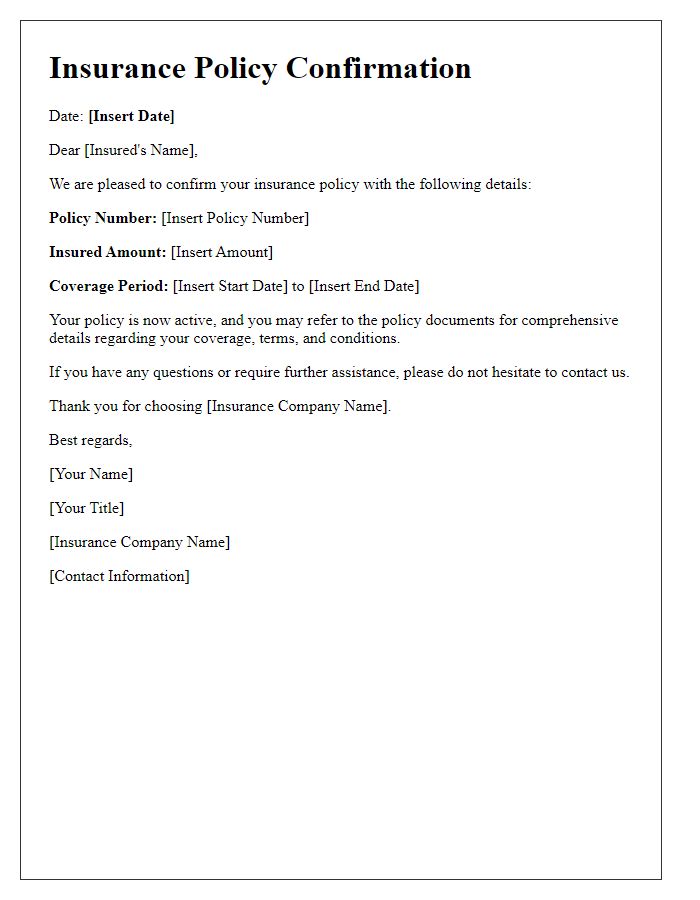

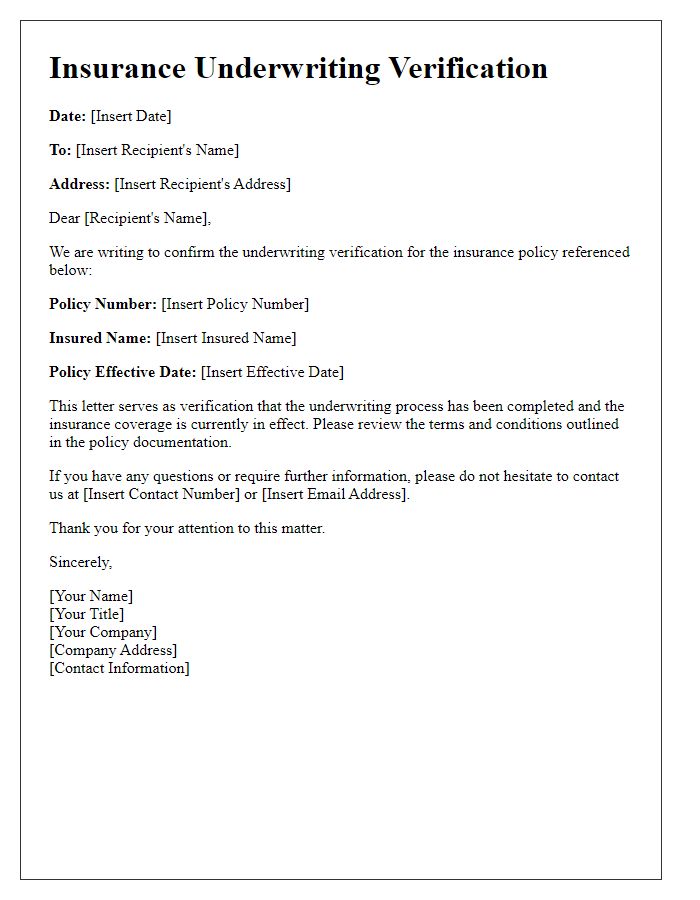

Insurance Policy Information

Insurance policy information is crucial for verifying transactions related to coverage, claims, and customer satisfaction. Each policy typically includes a unique identifier, such as a policy number, which aids in tracking. Essential details encompass the insured individual's name, the property or asset covered (like a house or vehicle), and the types of coverage provided (such as liability or collision). Moreover, relevant dates, including the policy's effective start and end dates, must be noted. Premium amounts and payment schedules also play a vital role in validating current coverage status. Understanding the insurer's name and contact information assists in facilitating communication during the verification process.

Contact Information for Verification

Contact information for insurance transaction verification includes essential details such as phone numbers, email addresses, and physical addresses used for achieving secure and accurate communication. Each insurance company typically provides a designated customer service hotline, often featuring a series of digits (10-12) that customers dial for inquiries. Verified email addresses often include the domain name of the insurance provider, ensuring authenticity. Physical addresses (such as 123 Insurance Ave, Cityville, State, ZIP Code, USA) serve as official points for documentation submission or in-person consultations, emphasizing the necessity of accurate identification during the verification process. Collectively, this information supports efficient resolution of claims, policy inquiries, and transaction confirmations.

Comments