Are you looking for the right insurance agent to guide you through the ever-changing landscape of insurance options? Finding someone knowledgeable and relatable can make all the difference in securing the best coverage for your needs. In this article, we'll explore how to identify an insurance agent who not only meets your requirements but also provides peace of mind. So, let's dive in and discover the qualities to look for in your next insurance partner!

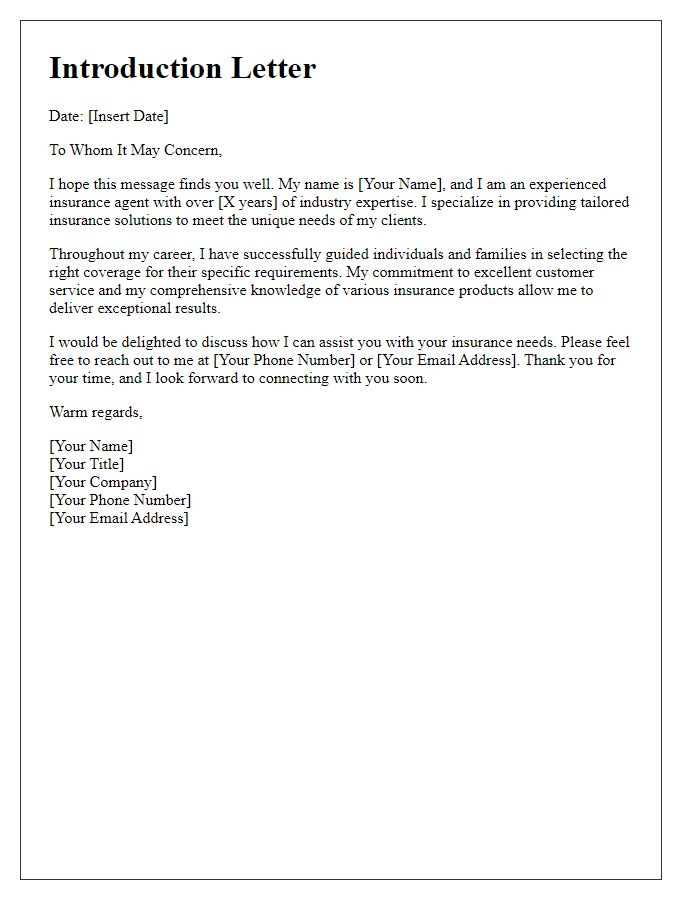

Personalization

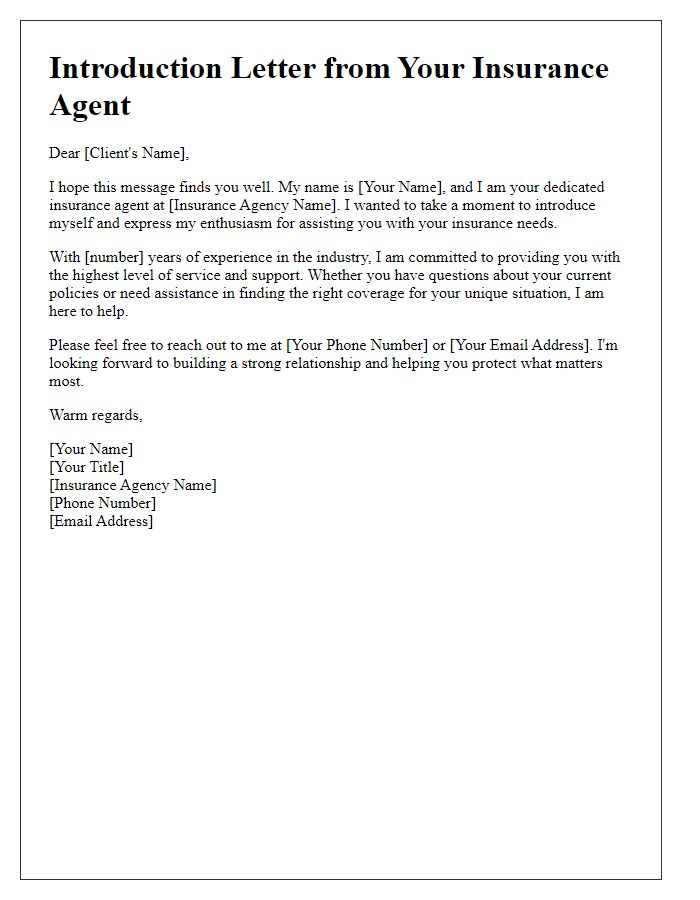

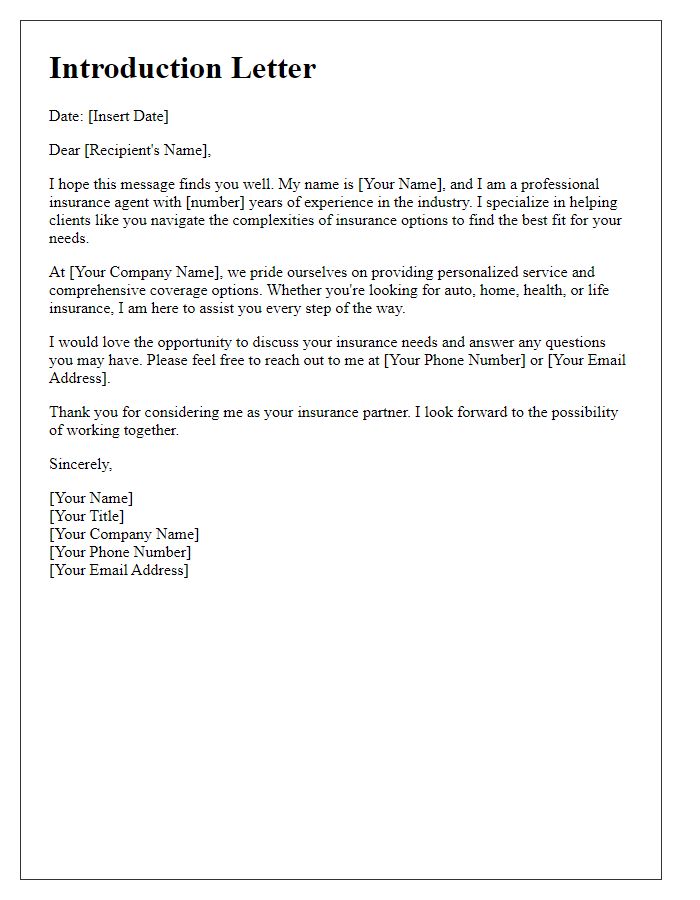

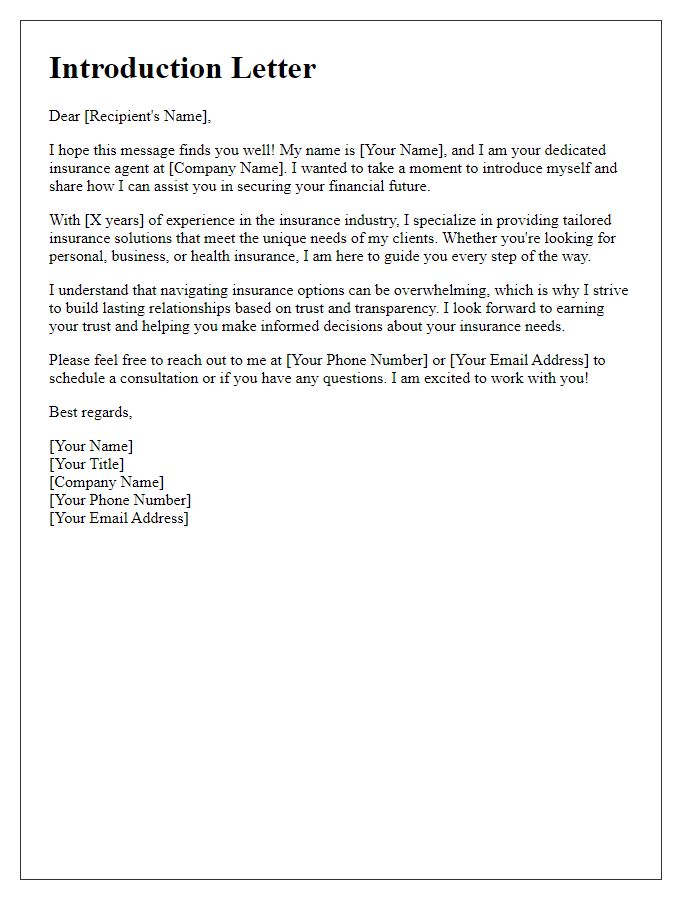

Insurance agents play a vital role in helping clients navigate the complexities of various insurance products, such as life, health, and auto insurance. A personalized introduction can significantly enhance the client-agent relationship, fostering trust and understanding. Each agent should emphasize their unique qualifications, such as years of experience in the industry (often 5-10 years), areas of specialization (like homeowner's insurance or commercial policies), and commitment to customer service. Highlighting local knowledge of regulations in specific regions (e.g., California insurance laws or Florida hurricane coverage) can create a more relatable and confident environment. Additionally, sharing success stories or testimonials from previous clients can illustrate the agent's dedication and effectiveness in meeting distinct insurance needs. Understanding the local community's concerns, such as recent flooding events or health care changes, can further personalize interactions. Engaging on a personal level, perhaps by discussing shared interests or family values, can solidify rapport and foster long-term relationships.

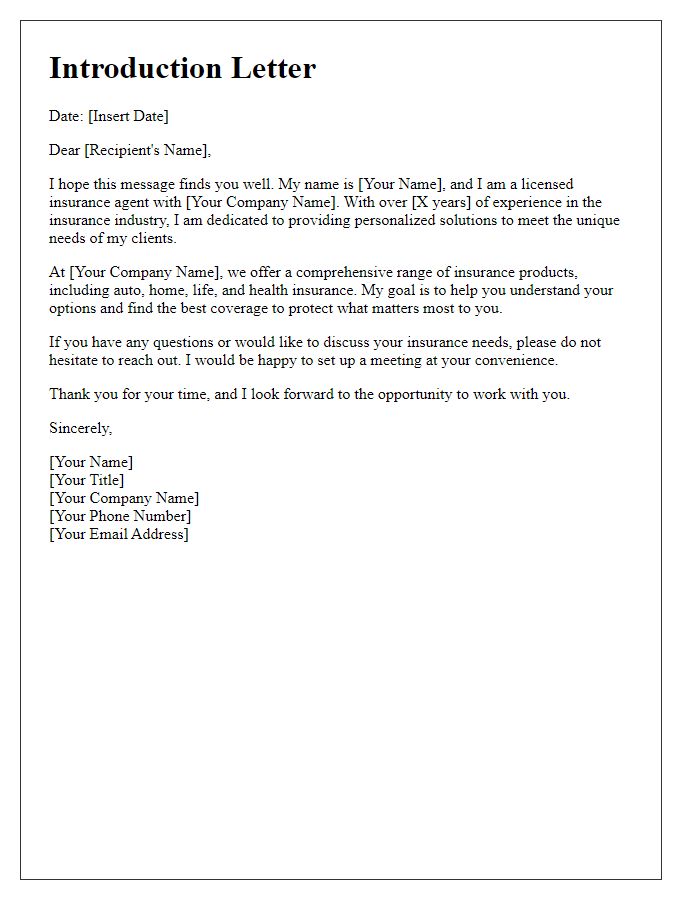

Clear subject line

Innovative insurance solutions for your peace of mind. Experienced insurance agent specializing in comprehensive coverage options, such as auto, home, and life insurance, available to assist clients in navigating complex policies. With extensive knowledge of the latest industry trends and regulations, tailored solutions can be provided to meet individual needs. Dedicated to exceptional client service and fostering long-term relationships, ensuring clients feel confident and secure in their coverage decisions. Contact for personalized advice and support in safeguarding assets and ensuring financial stability.

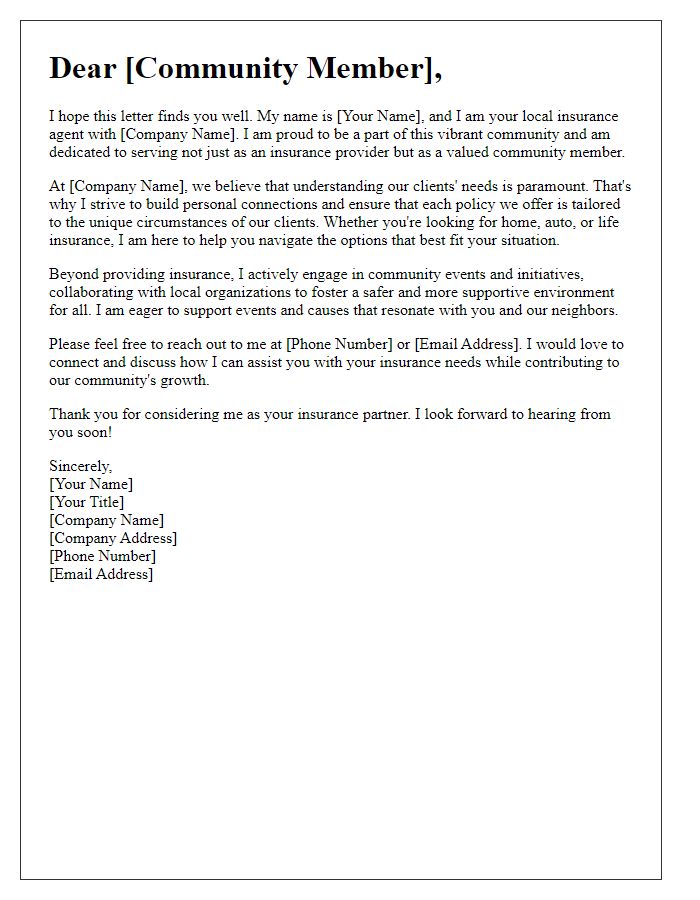

Company branding

Introducing insurance agents plays a crucial role in establishing trust and credibility within the insurance industry. Agents enhance company branding through consistent messaging and professional demeanor. An effective introduction highlights expertise in various insurance products, such as life, health, and auto insurance, along with knowledge of relevant policies and regulations. Engaging visuals, such as the company logo and color scheme, reinforce brand identity. Additionally, sharing success stories or testimonials from satisfied clients can enhance the agent's reputation, making a lasting impression on potential customers. Clear communication of unique selling propositions, such as competitive rates or personalized service, is critical for differentiating the agency in a crowded market.

Call to action

Introducing a new insurance agent can involve showcasing their expertise in risk management and customer service. An insurance agent, particularly one specializing in a sector such as life or property coverage, plays a crucial role in helping clients understand their options. With a wealth of knowledge about policies from leading companies like State Farm or Allstate, they can tailor recommendations to fit the unique needs of clients in diverse demographics. Engaging with this professional can provide peace of mind through comprehensive assessments of individual or family needs regarding safeguarding assets and ensuring adequate coverage. Taking the first step involves a brief consultation, which can illuminate opportunities to enhance one's financial security through informed decisions in risk management strategies.

Professional tone

An insurance agent serves as a vital resource in helping individuals and businesses protect their assets and manage risk. In a constantly evolving financial landscape, understanding policies for health, property, and life insurance is essential. With expertise in various insurance products, an agent can tailor solutions to meet distinct needs, such as home insurance for homeowners in Florida or commercial liability insurance for businesses in California. The agent's role includes analyzing risks, providing guidance on policy terms, and assisting with claims processes, ensuring peace of mind for clients. Establishing a strong, trust-based relationship is crucial, as it fosters effective communication and allows for personalized service, leading to more informed decision-making for clients throughout their insurance journey.

Comments