In the world of insurance claims, understanding the timeline can often feel daunting and overwhelming. Navigating the intricacies of paperwork and processes requires clarity and insight, which is why we've put together a helpful letter template specifically for estimating claim timelines. This guide aims to simplify your experience, ensuring you're well-informed every step of the way. So, grab a cup of coffee and join us as we break down the essentials to make your insurance journey smoother!

Claim reference number

Estimating a claim timeline involves understanding various phases of the claims process, including submission, review, and resolution. The claim reference number serves as a unique identifier for tracking your insurance claim throughout this timeline. Upon submission, insurance companies typically acknowledge receipt within 24 to 48 hours. The review period can vary, taking anywhere from a few days to several weeks, depending on the complexity of the claim and the need for additional documentation or investigation. The resolution phase, which includes either approval or denial of the claim, may take another few days to weeks. Keeping communication lines open with your claims adjuster and providing timely updates can help expedite the process.

Detailed description of the incident

A severe storm occurred on September 15, 2023, in Fort Lauderdale, Florida, resulting in extensive damage to residential properties. High winds, recorded at 85 miles per hour, uprooted trees and caused roofing materials to displace. My property at 1234 Ocean Drive experienced significant roof damage, with shingles torn off and rainwater intrusion affecting the interior walls. Emergency repairs began on September 16, with a local roofing contractor providing temporary tarping to prevent further water damage. By September 20, a comprehensive assessment was conducted, estimating repair costs at $12,000. All relevant documentation, including photographs of the damage and contractor estimates, is included with this claim for review. The urgency for repairs is critical due to potential mold growth and further structural issues if not addressed promptly.

Supporting documentation list

Insurance claims require thorough documentation to facilitate a smooth and efficient processing timeline. Essential supporting documents include a completed claim form outlining the incident details, proof of loss statements detailing the extent of the damage, photographs of the affected property, and repair estimates from licensed contractors. Additionally, medical records and bills are vital for health-related claims, while police reports are necessary for incidents involving theft or accidents. Policy documents, including coverage details and premium payments, provide context for the claim. Finally, any communication with the insurance company related to the claim serves as an important record of interactions and decisions. Proper organization of these documents expedites the review process, potentially minimizing delays in receiving compensation.

Contact information for further communication

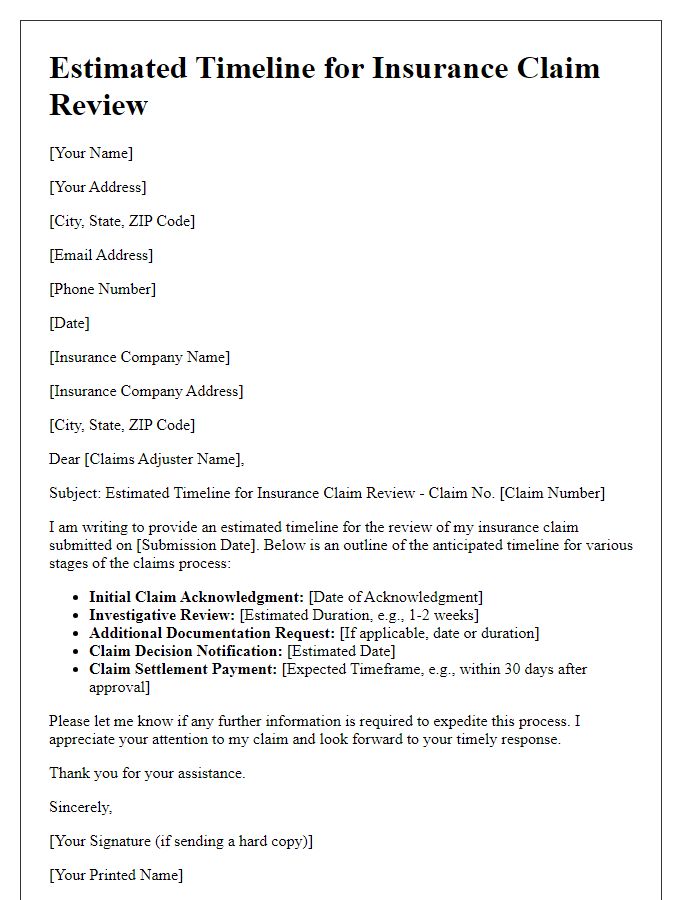

Estimating an insurance claim timeline involves several key factors that influence how quickly a claim is processed. The initial step often requires submitting a comprehensive claim form, including necessary documents such as police reports, medical records, or repair estimates, depending on the nature of the claim, for example, auto accidents or property damage. After submission, the claims adjuster conducts an investigation, which may include gathering statements and examining relevant evidence, affecting the timeline, typically taking anywhere from two weeks to several months. Following the investigation, the review phase assesses the findings against the policy terms, which may last an additional week. Communication with the insurance company plays a crucial role, where the provided contact information ensures timely updates, such as email addresses or phone numbers, for further inquiries. Factors like complexity of the claim, missing documentation, and cooperation from involved parties also contribute to possible delays.

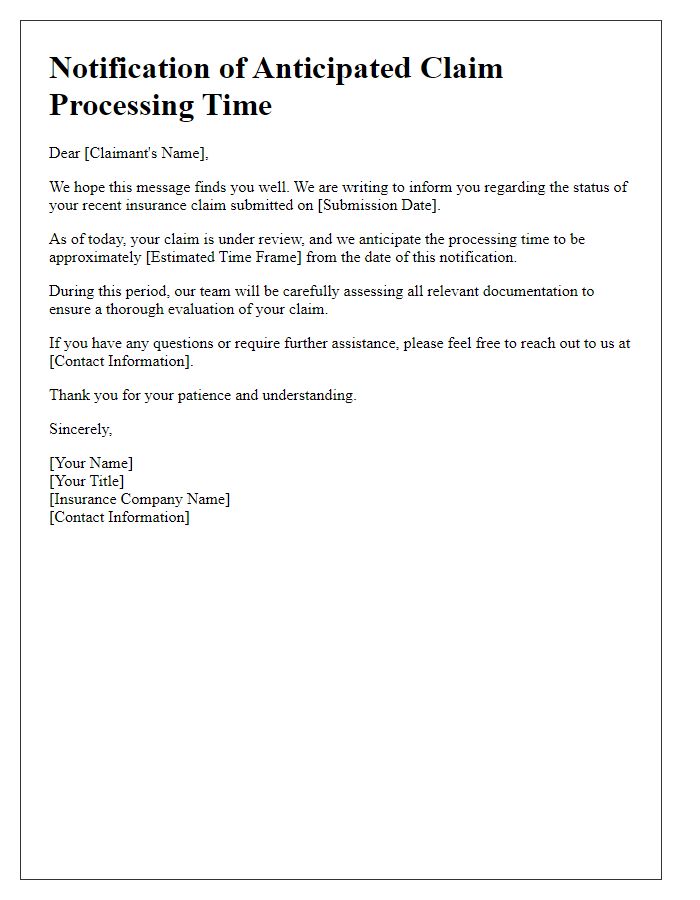

Expected timeline for resolution

The insurance claims process typically follows a structured timeline that varies depending on the complexity of the claim, the necessary documentation, and the involvement of third parties. Upon submission of the claim, an initial acknowledgment is usually provided within 1 to 3 business days, referencing the claim number for tracking. Following this, an adjuster from the insurance company will likely be assigned, often within 5 to 10 business days, to assess the claim in person or through documentation. The investigation phase may last from 10 to 30 days, contingent upon the nature of the claim and the availability of required information. Once evaluated, the insurance company typically communicates its decision within 5 to 15 business days. If further documentation is requested or disputes arise, this may extend the timeline significantly. Overall, claim resolution can range from 30 days for straightforward cases to potentially several months for more complex claims involving multiple stakeholders or legal considerations.

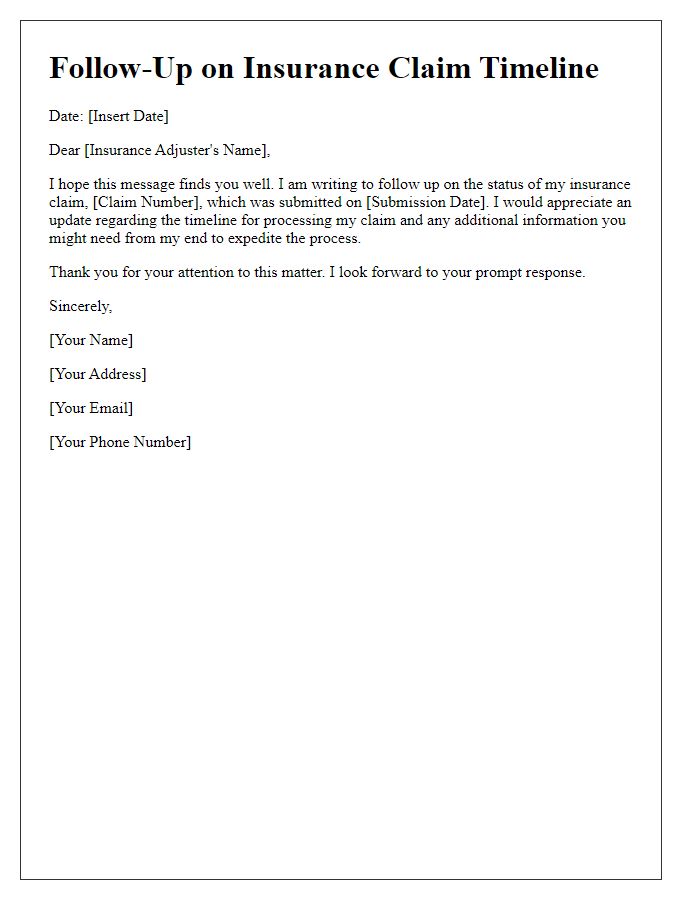

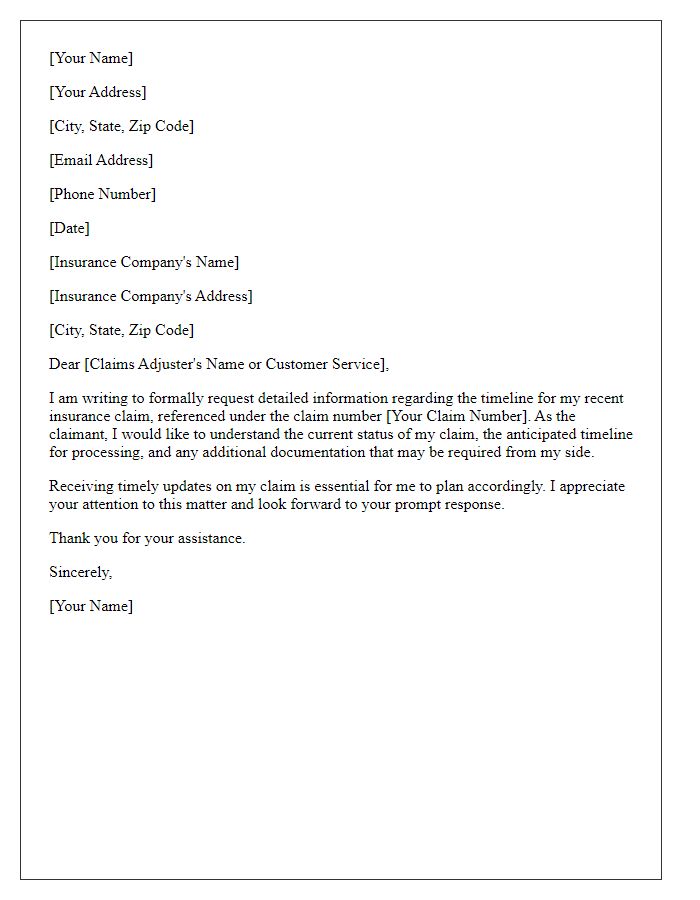

Letter Template For Insurance Claim Timeline Estimation Samples

Letter template of inquiry regarding insurance claim adjudication period

Comments