Are you feeling overwhelmed by the vehicle insurance claim process? You're not alone! Navigating the ins and outs of an insurance claim can be tricky, especially when you're trying to gather all the necessary documentation and information. In this article, we'll simplify the steps for you and provide tips on how to effectively inquire about your vehicle insurance claimâso keep reading to find out more!

Policy Holder's Information

Vehicle insurance claims often require comprehensive documentation and clear communication. Policy holders need to furnish details such as their full name, address, and contact number, which should correspond with the information provided when purchasing the insurance policy. Additionally, the vehicle identification number (VIN) and policy number are crucial for identifying the specific insurance agreement and the covered vehicle, ensuring that all claims are processed efficiently. Documentation of the incident, including the date, time, and location, as well as any police reports or photographs, is essential in facilitating a thorough investigation by the insurance company.

Policy and Claim Details

A vehicle insurance claim inquiry requires specific attention to policy and claim information for proper processing. Policy details typically include the policy number, which uniquely identifies the coverage and can be vital in understanding the scope of protection offered. Claim details encompass the claim number, assigned after the incident is reported, ensuring that the claim is tracked through the insurance company's claims processing system. Additional context includes the date of the accident, location (such as city and state), and a brief description of the incident. Accurate information regarding vehicle details, like make, model, and year, is also critical for claims assessment. Furthermore, any supporting documents, including photos of the accident, repair estimates, or police reports, can significantly impact the resolution of the inquiry.

Description of Incident

In a recent incident involving my vehicle, a 2020 Honda Accord, I experienced a collision on Main Street in Springfield on October 15, 2023. The accident occurred at approximately 3:30 PM when another driver failed to yield at a stop sign, resulting in a side-impact collision. The impact caused significant damage to the driver's side door and rear quarter panel. Local authorities responded, filing a police report documenting the details of the incident, including the other driver's insurance information. Fortunately, no injuries were reported, but the vehicle's structural integrity may be compromised, necessitating a thorough assessment. I am seeking guidance on the next steps for processing my insurance claim for the repairs and any potential medical expenses incurred due to the stress caused by the incident.

Supporting Documentation

When filing a vehicle insurance claim, it's essential to gather comprehensive supporting documentation to facilitate the process. The claim should include detailed photographs of the damaged vehicle, ideally taken at the scene of the incident, showing different angles to highlight the extent of the damage. A formal police report (if applicable) detailing the incident's circumstances is crucial for validation. Additionally, any medical reports related to injuries sustained during the accident should be included for thoroughness. Estimates from certified auto repair shops indicating the cost of repairs provide necessary financial context. Furthermore, documentation proving ownership of the vehicle, like the vehicle registration and proof of insurance coverage, strengthens the claim. Collecting these documents ensures that the insurance company has adequate information to review and process the claim efficiently.

Contact Information for Follow-up

Inquiring about a vehicle insurance claim involves reaching out to the insurance provider with detailed contact information to streamline communication during the claims process. Including specific details such as claim number (e.g., CL123456), policy number (e.g., PN7891011), and date of incident (e.g., August 15, 2023) can enhance the efficiency of the inquiry. Additionally, providing a reliable phone number (such as +1-800-555-0199) and email address (e.g., customer.service@example.com) ensures that the claims adjuster can promptly follow up with necessary information or requests for further documentation. This structured communication is integral to resolving claims effectively.

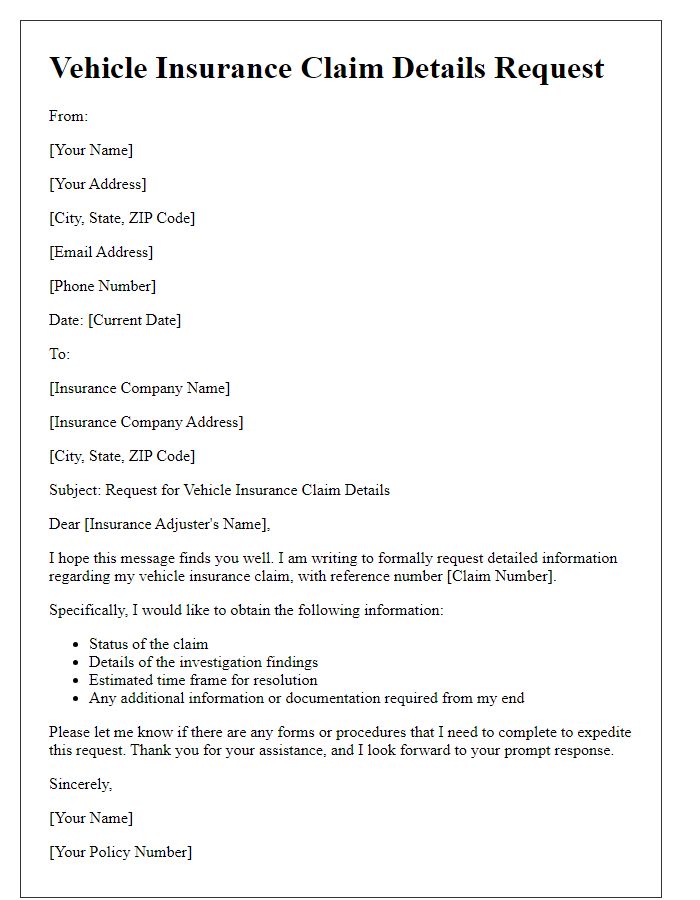

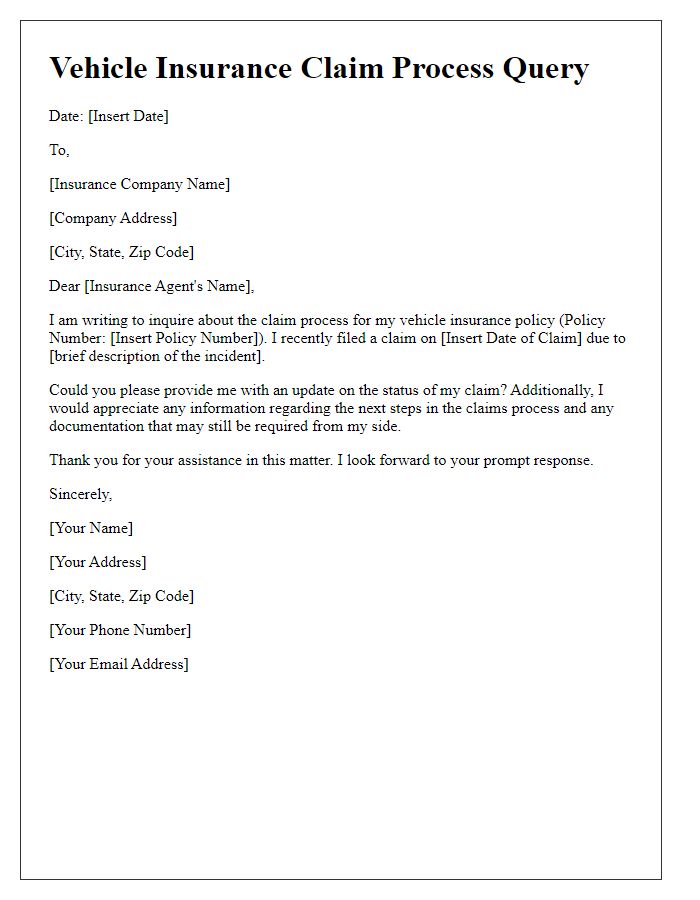

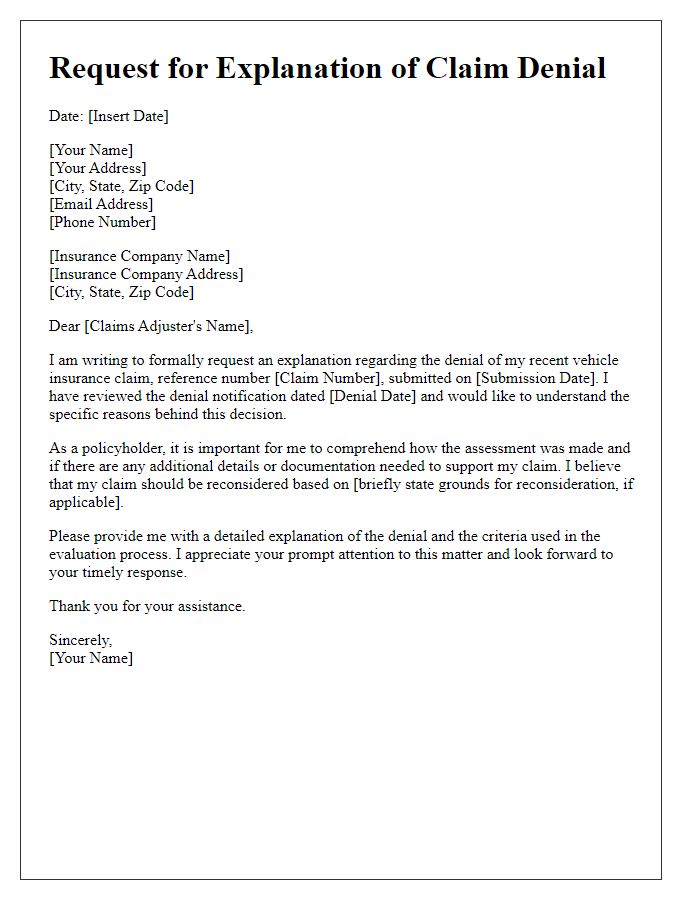

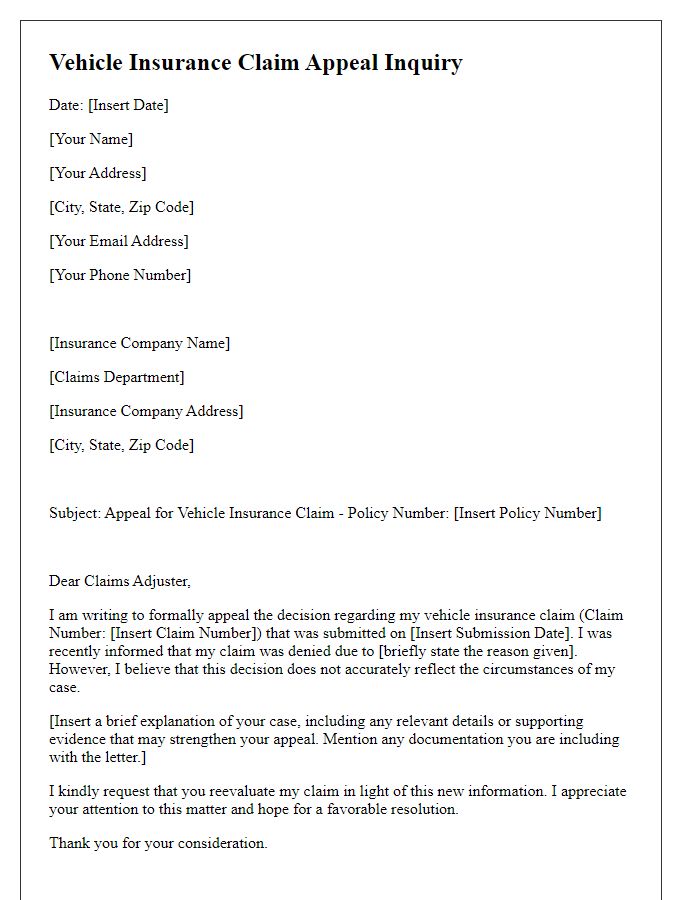

Letter Template For Vehicle Insurance Claim Inquiry Samples

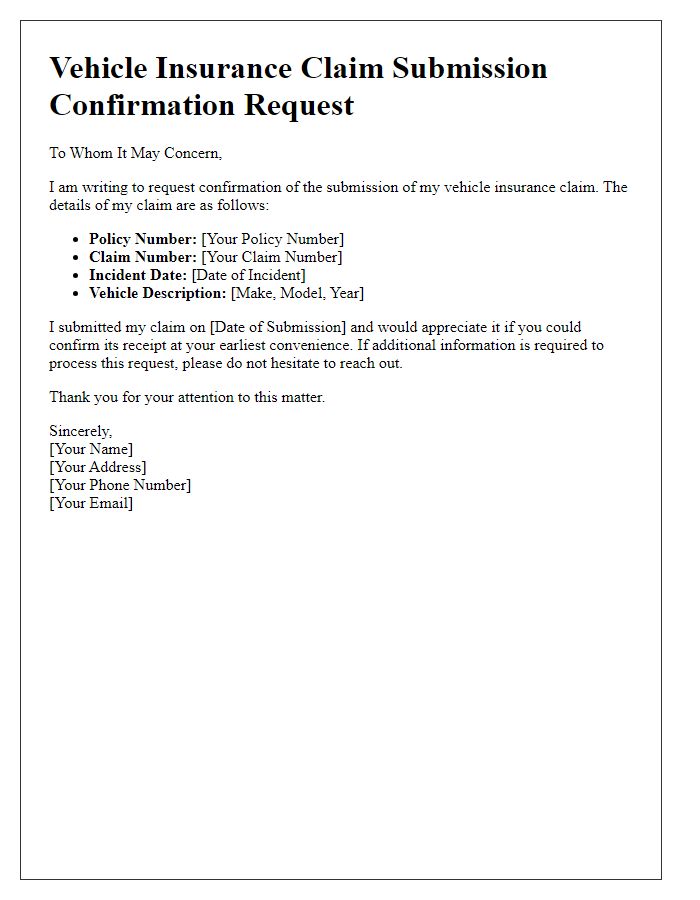

Letter template of vehicle insurance claim submission confirmation request

Comments