Are you often left scratching your head about overdue payments? We understand how frustrating it can be to manage outstanding invoices and navigate reminders. In this article, we'll explore effective letter templates that can help you inquire about payments due while maintaining professionalism and clarity. So, if you're ready to streamline your communication and get those payments flowing, keep reading!

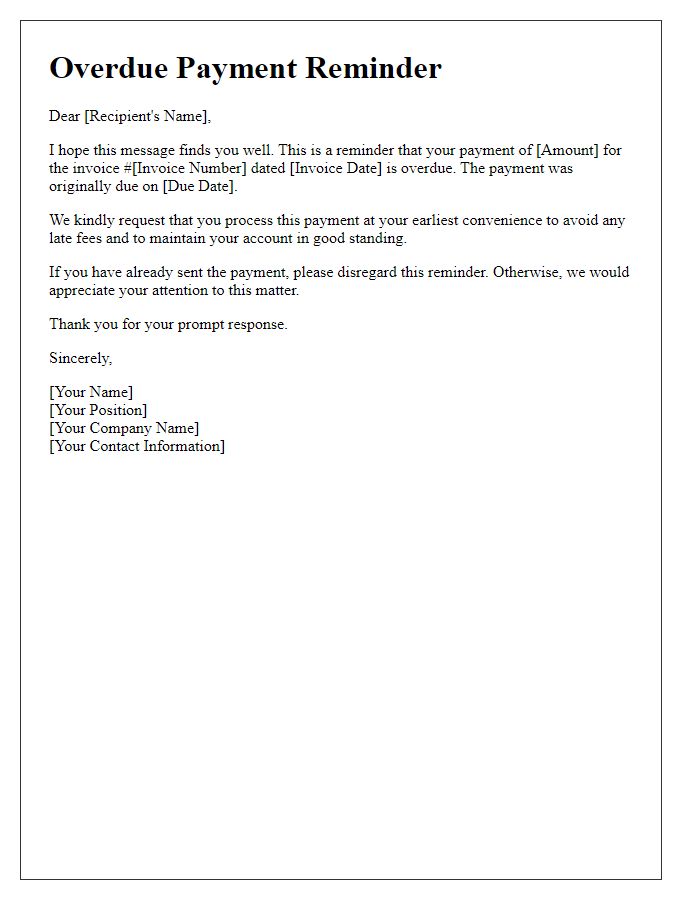

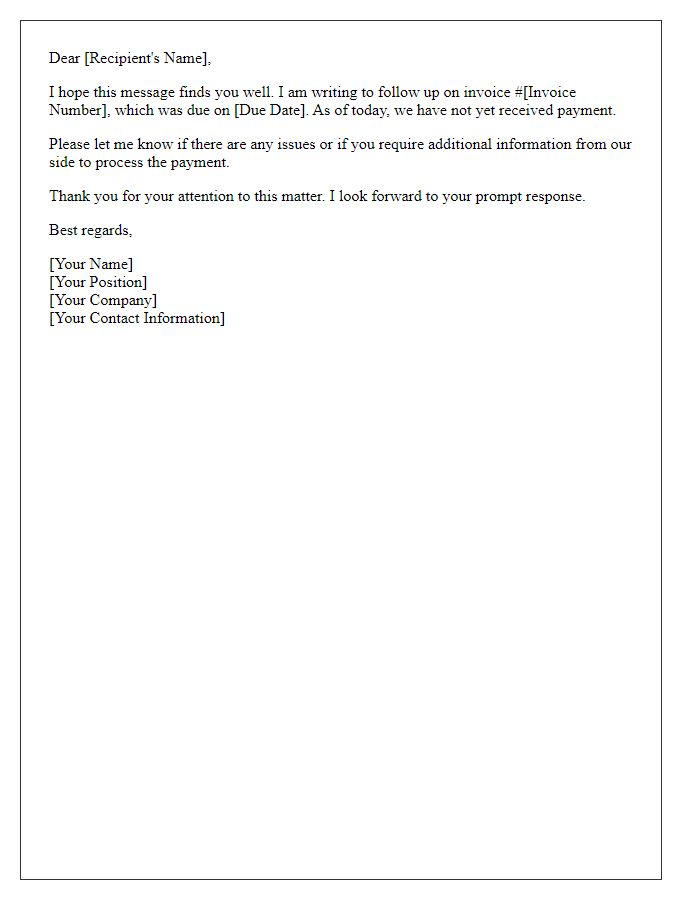

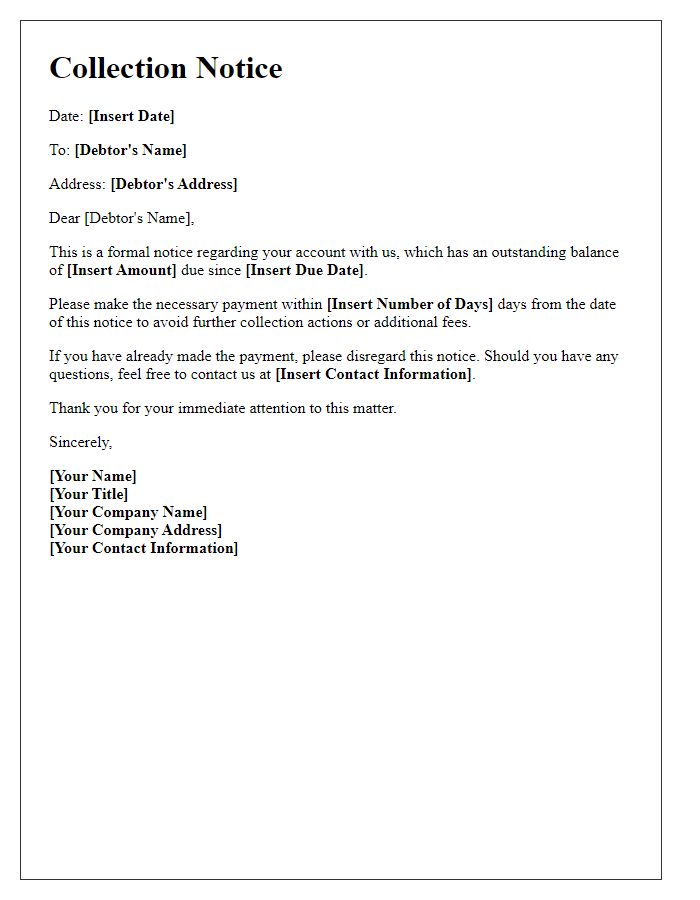

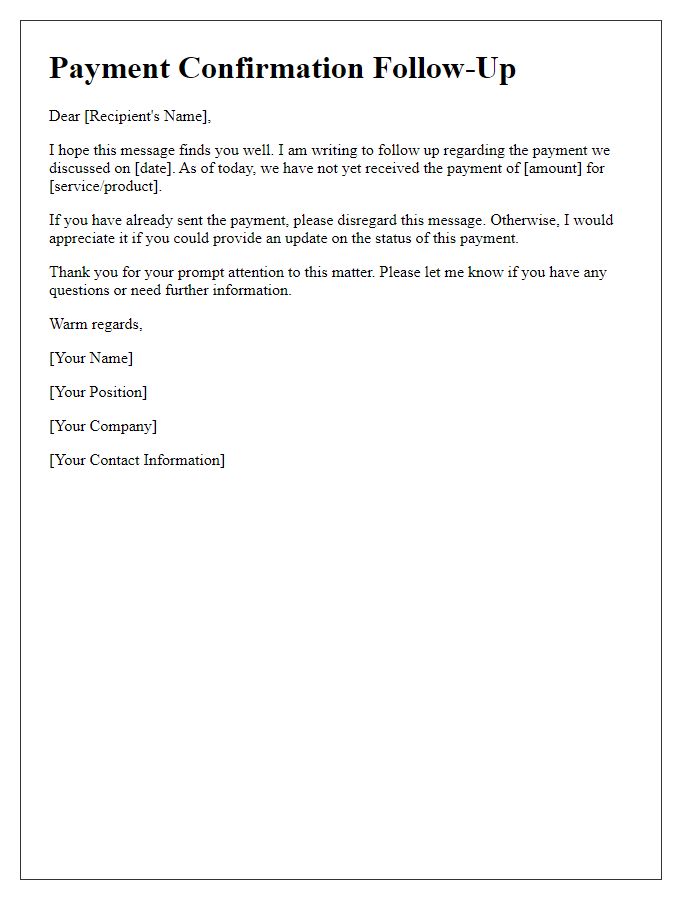

Professional and courteous tone

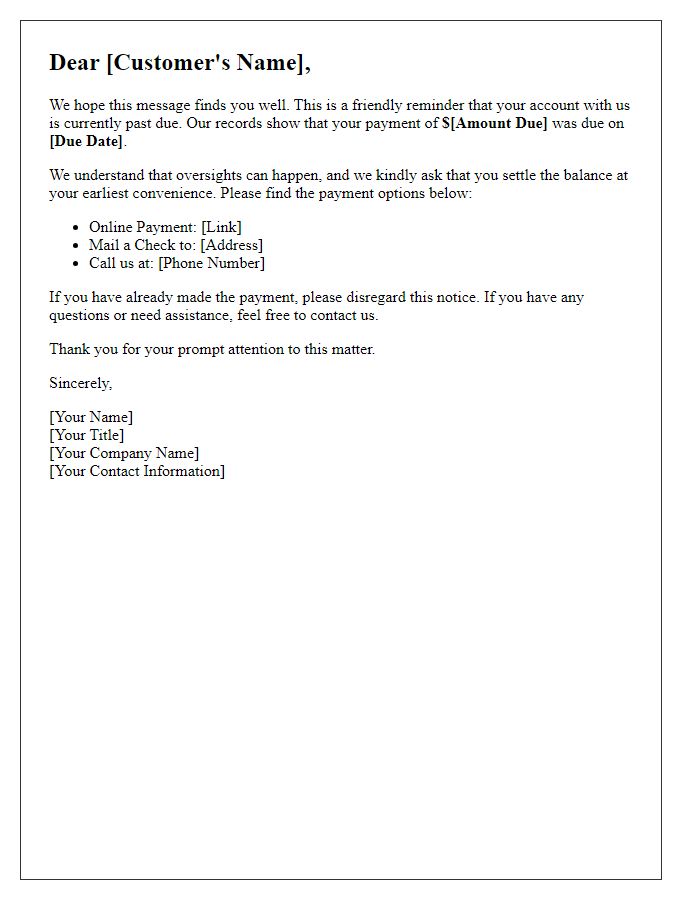

The outstanding invoice from Company X, totaling $2,500, originally due on September 15, 2023, has yet to be settled. This delayed payment has exceeded the standard net 30 days payment terms typical in our industry. Prompt resolution of this matter will help maintain our ongoing professional relationship. Please inform us of any issues regarding this payment, or provide an expected payment date at your earliest convenience. Thank you for your attention to this important financial matter.

Clear subject line

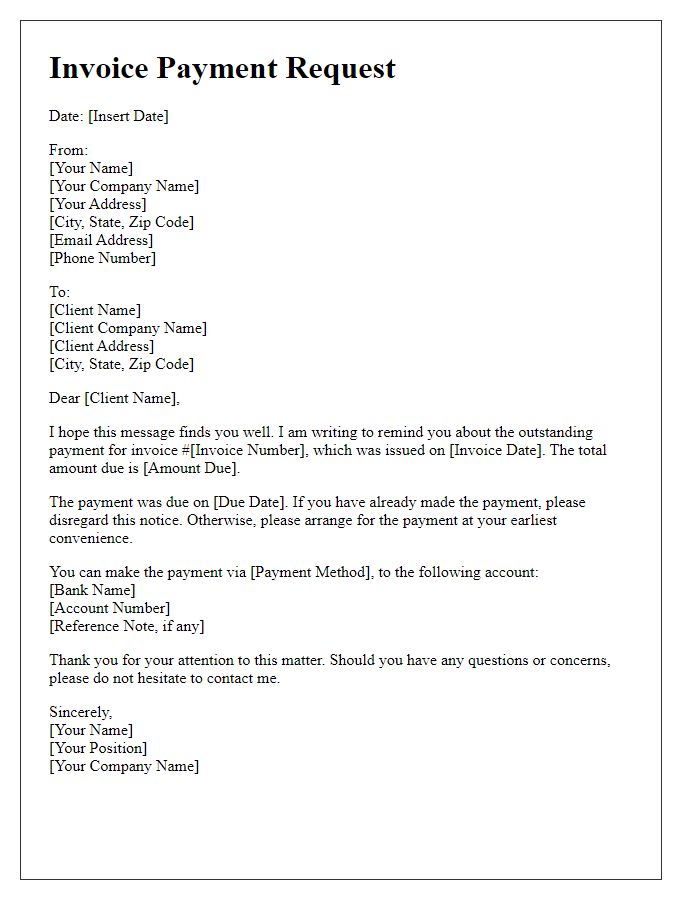

Late payments can severely impact a business's cash flow, inhibiting operations and growth. For example, invoices that exceed a 30-day payment term can significantly disrupt budgeting efforts for small to medium-sized enterprises. In the United States, over 70% of small businesses report cash flow issues, often stemming from unpaid invoices. Timely follow-up on outstanding payments, through clear communication and concise subject lines such as "Payment Due Inquiry for Invoice #12345," can improve collections efficiency. Engaging with clients and emphasizing the importance of prompt payment reinforces the business relationship and encourages future compliance.

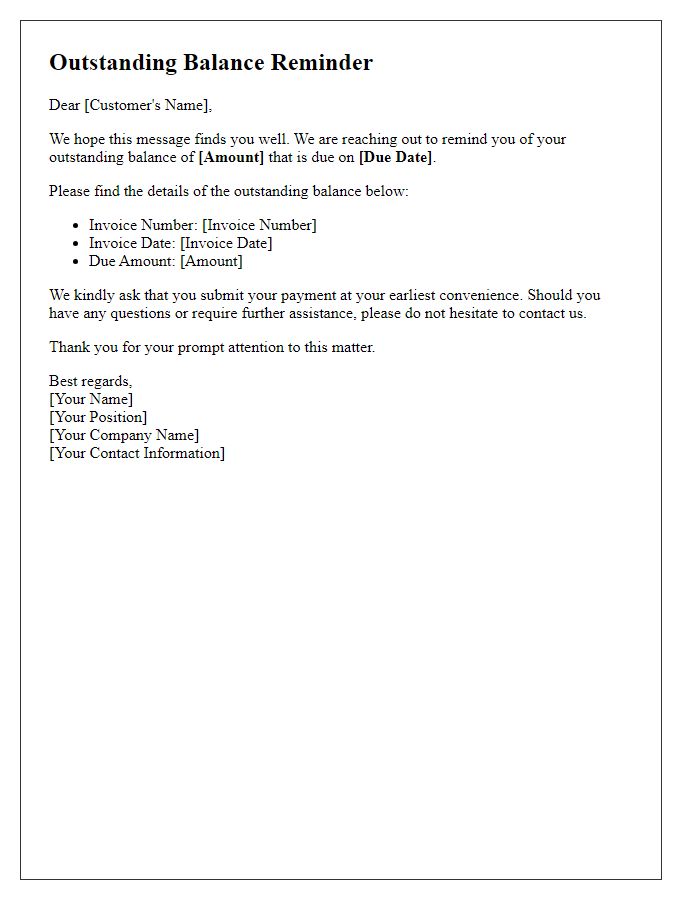

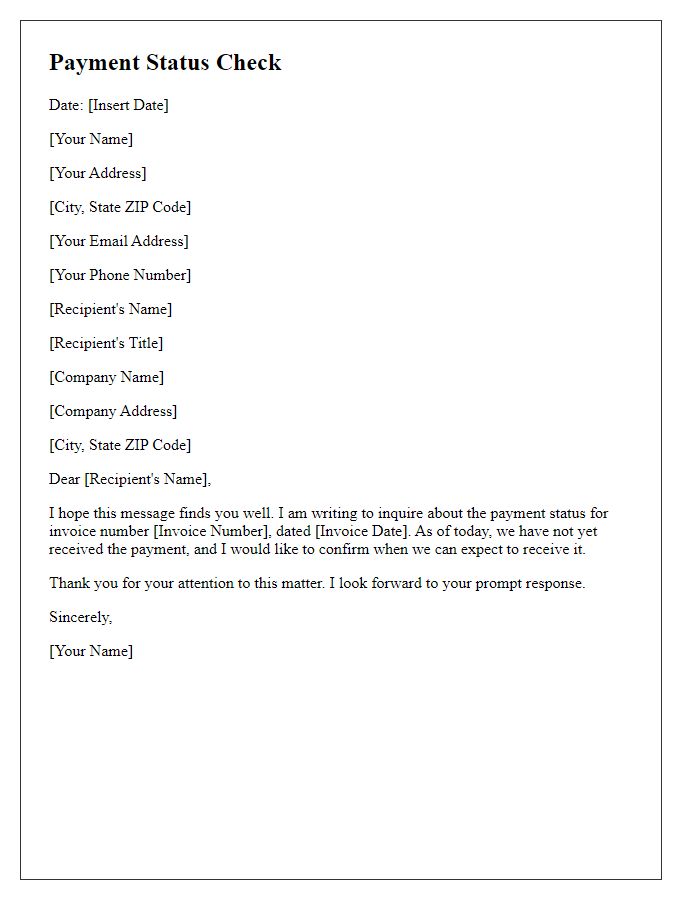

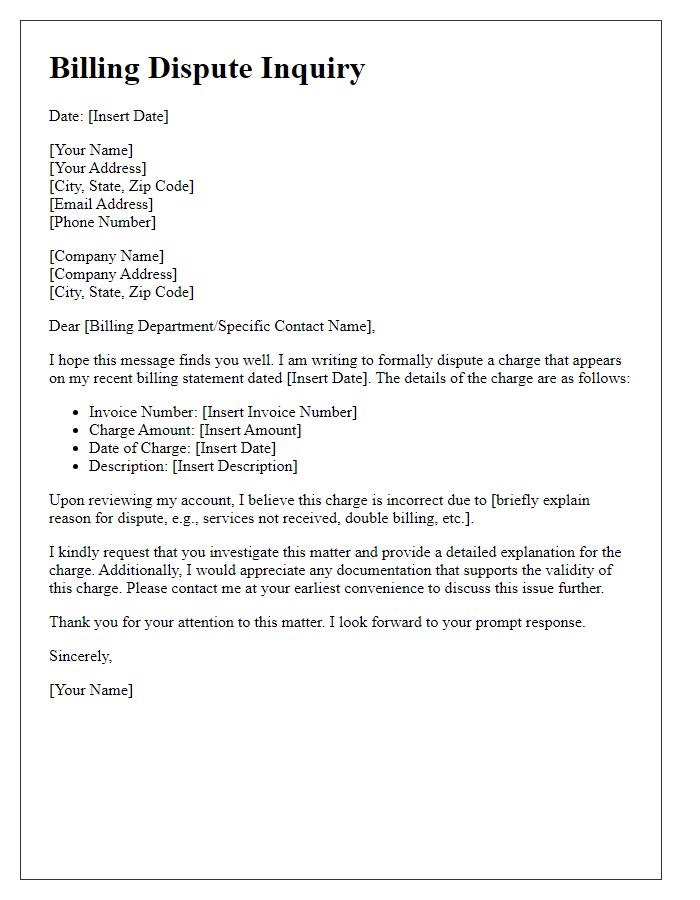

Specific invoice details

The outstanding payment on Invoice #4567, dated August 15, 2023, for the services rendered in New York has reached a total of $1,250. This invoice covers the graphic design services provided over a two-month period, from June 1, 2023, to July 31, 2023. The payment was due on September 15, 2023, and is now 30 days past due. To avoid any late fees, it is crucial to process this payment within the next week. Contact information for payment issues is listed on the invoice, which also specifies accepted payment methods, including bank transfer or credit card payments.

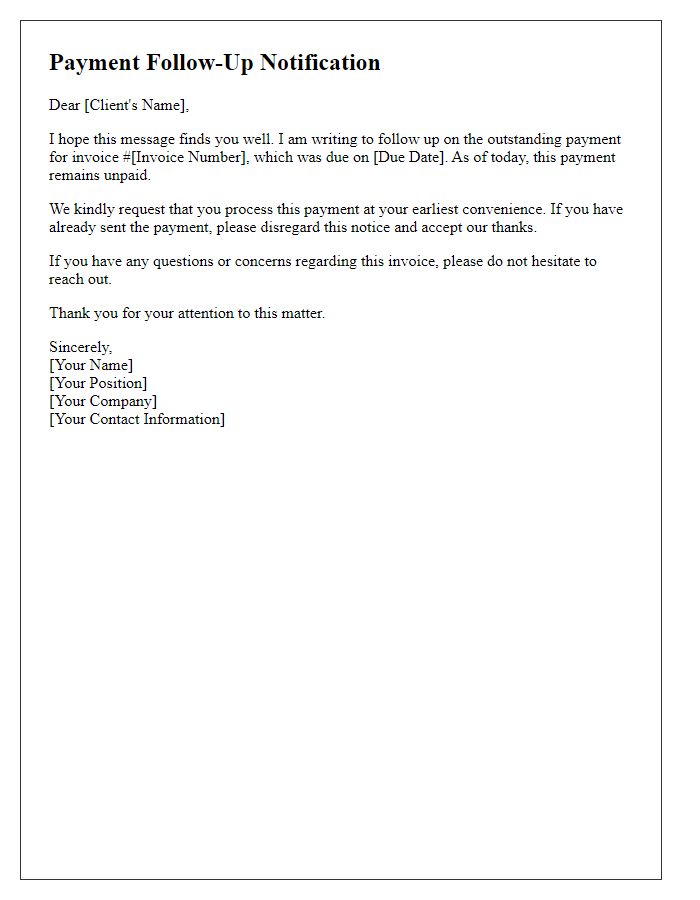

Due date reminder

A payment due inquiry is often triggered by a lack of received payment, highlighting the importance of timely financial transactions. For example, invoices sent to businesses can have due dates ranging from 30 to 90 days after issuance, influenced by industry standards and agreements. When payments become overdue, clients may face late fees, potentially increasing the initial amount due by 1.5% to 5% of the outstanding balance each month, depending on contract stipulations. Regular follow-ups via email or telephone help maintain cash flow and communication with clients, especially in service sectors like construction or retail where cash flow fluctuations are common. Understanding local regulations regarding payment terms is also essential, as they can vary significantly across regions and industries, ensuring compliance and fostering better business relationships.

Contact information for inquiries

Inquiries regarding payment dues often involve various entities, including financial institutions and customer service departments. Customers should contact their account representatives or dedicated payment processing teams for assistance. Important contact information includes phone numbers, email addresses, and physical mailing addresses relevant to the specific accounts. Typically, businesses provide this information on official invoices or websites, ensuring customers can reach out easily. Additionally, maintaining a record of previous communications might facilitate quicker resolutions for payment-related inquiries, fostering better customer relations.

Comments