Are you excited about the potential of stock options and what they can mean for your financial future? You're not alone! Many individuals find themselves navigating the intricacies of stock option grants, eager to understand how these benefits work and how they can optimize their investment journey. Join us as we unpack the essentials of stock option grant notifications and help you unlock the full potential of your equity â read on to delve deeper!

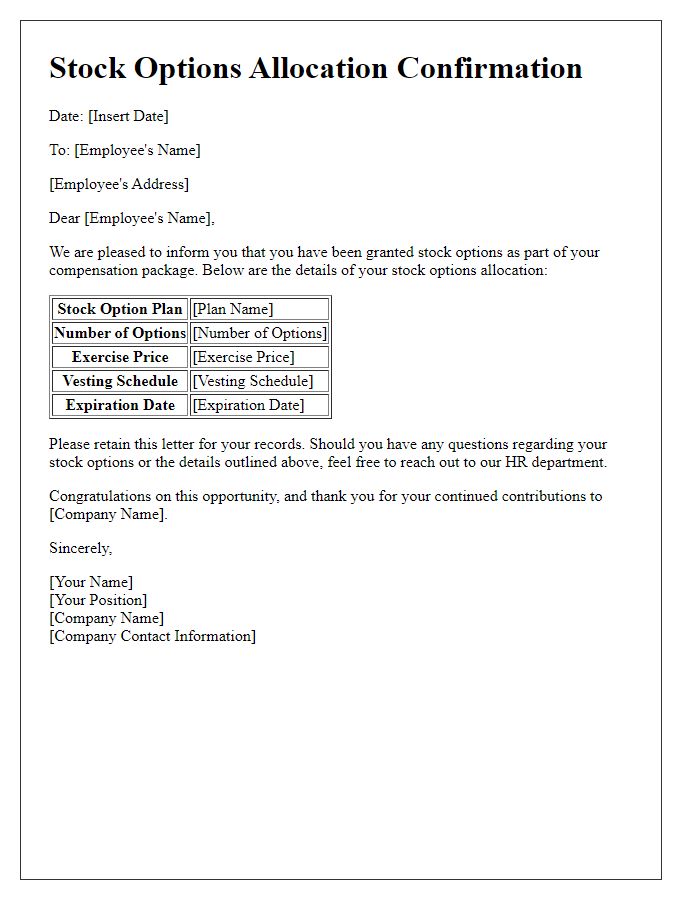

Grant Details

Stock option grants serve as a valuable incentive for employees, allowing them to acquire shares of the company's stock at a predetermined price. Key components of a stock option grant notification include specific details of the grant, such as the grant date (the date the options are awarded), exercise price (the price at which the employee can purchase shares), vesting schedule (the timeline over which the employee earns the right to exercise the options), and expiration date (the last date the options can be exercised). The grant may be contingent upon employment status within the company, often with requirements to continue active employment until certain milestones are reached. Tax implications may also be significant, as capital gains tax can apply when shares are sold after exercise. Overall, understanding these details is crucial for employees to maximize the benefits of their stock option grant.

Vesting Schedule

In a stock option grant notification, a typical vesting schedule outlines the timeline and conditions under which an employee acquires the right to exercise stock options. For example, a four-year vesting schedule with a one-year cliff indicates that the employee must remain with the company, such as Tech Innovations Inc., for at least one year before any options become available. After the initial year, 25% of the granted options, typically 1,000 shares for a total grant of 4,000 shares, vest, allowing the employee to exercise them. Following the cliff vesting period, the remaining 75% vest monthly over the next three years, signifying consistent commitment to the organization. This schedule serves as a crucial incentive aligning employee performance with company growth, particularly during significant events such as public offerings or mergers.

Exercise Price

Stock option grants come with specific terms related to the exercise price, which is the predetermined price at which an employee can purchase shares of stock. For example, if an employee receives a grant of 1,000 stock options with an exercise price of $20 per share (this amount often correlates with the market value at the time of the grant), they have the opportunity to purchase shares at that fixed price regardless of any future increases in market value. If the stock price rises to $30, the employee can still exercise their options at $20, thus potentially realizing a profit. The exercise period, typically ranging from 10 years, dictates the timeframe within which the options must be exercised. Important tax implications arise at the point of exercise, impacting the employee's overall financial profile significantly. Understanding these aspects is crucial for effective financial planning.

Expiration Date

Stock option grants allow employees the right to purchase company shares at a fixed price within a specified period. Each grant includes an expiration date, typically set at ten years from the grant date, influencing an employee's decision to exercise their options. Missing this expiration date can result in the total forfeiture of options, dictating careful planning. Notable considerations include the vesting schedule in relation to the grant's duration, any applicable tax implications, and the stock's market performance. Understanding these elements is crucial for maximizing the value derived from stock options within corporate structures.

Terms and Conditions

Stock option grants serve as a valuable incentive for employees, typically outlined in a formal notification letter. Clear communication of terms and conditions is crucial to ensure understanding. Key elements include the grant date, the exercise price (often tied to the fair market value of the company's shares), the vesting schedule (commonly staggered over four years), and the expiration period (typically ten years). Specific requirements for exercising options must also be noted, including tax implications and compliance with regulations from the Internal Revenue Service (IRS) and the Securities and Exchange Commission (SEC). In most cases, grants will be contingent upon continued employment, reinforcing employee commitment to long-term goals. Properly documenting these terms protects both the company and the employee while promoting transparency in the stock option process.

Comments