Are you feeling overwhelmed by a credit card charge that just doesn't seem right? Disputing a transaction can be daunting, but writing a clear and concise letter is your first step towards resolving the issue. In your dispute letter, you'll want to include essential details like the transaction date, amount, and a brief explanation of why you believe the charge is incorrect. Ready to tackle this head-on? Let's dive deeper into the step-by-step process of crafting the perfect dispute letter!

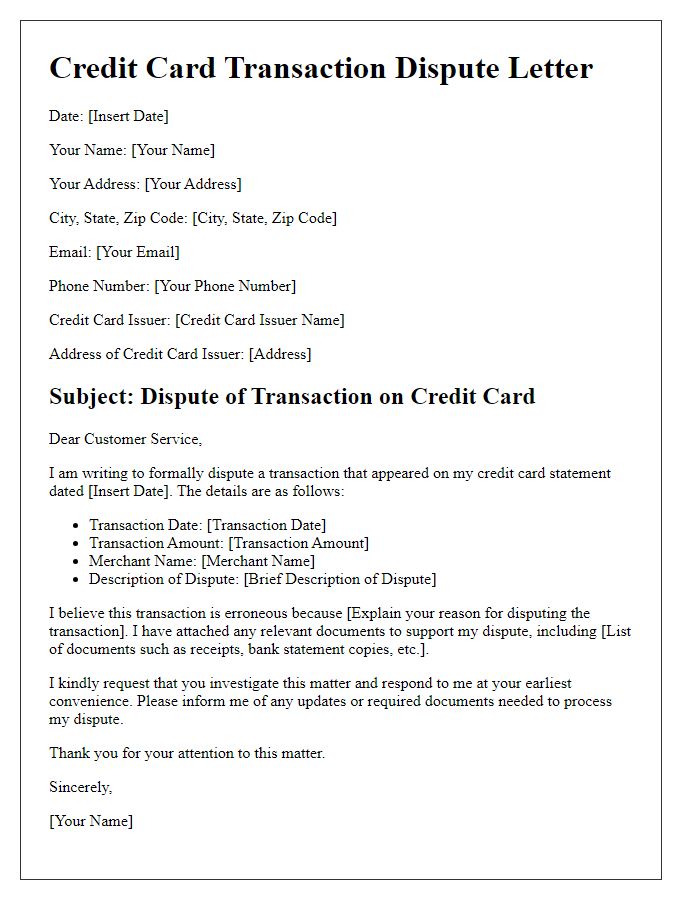

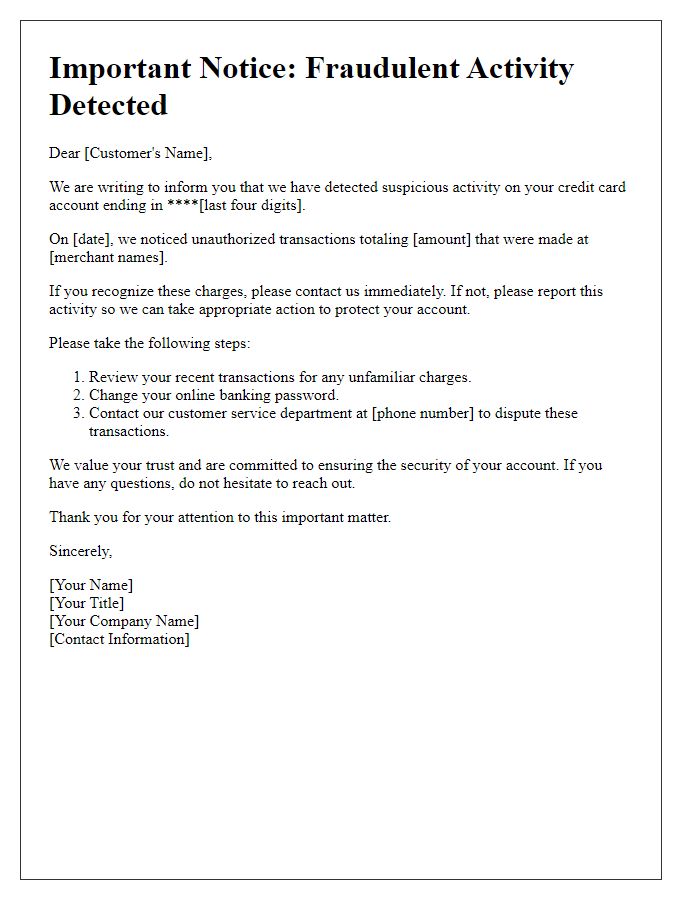

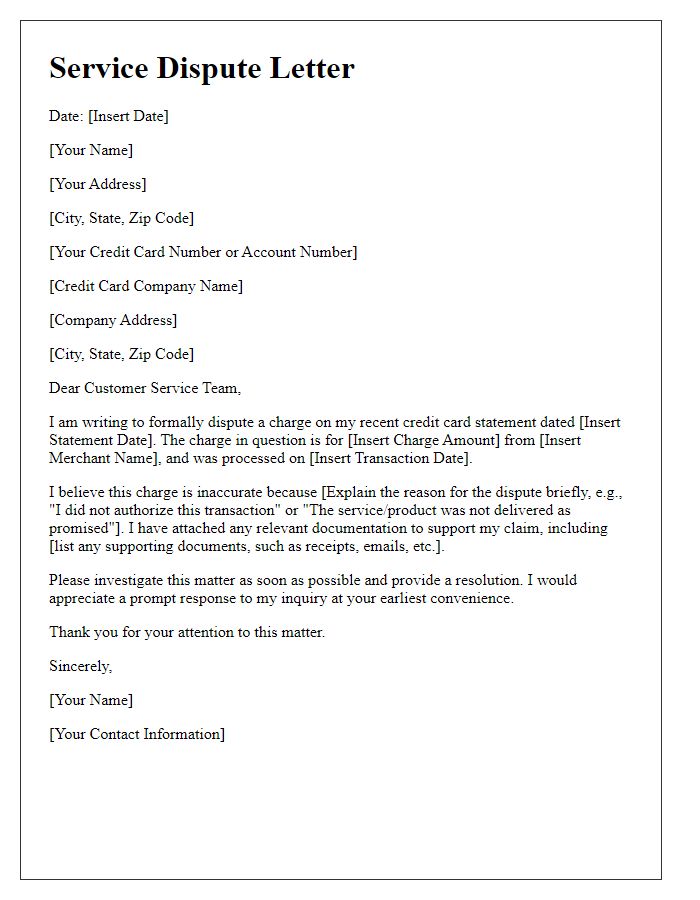

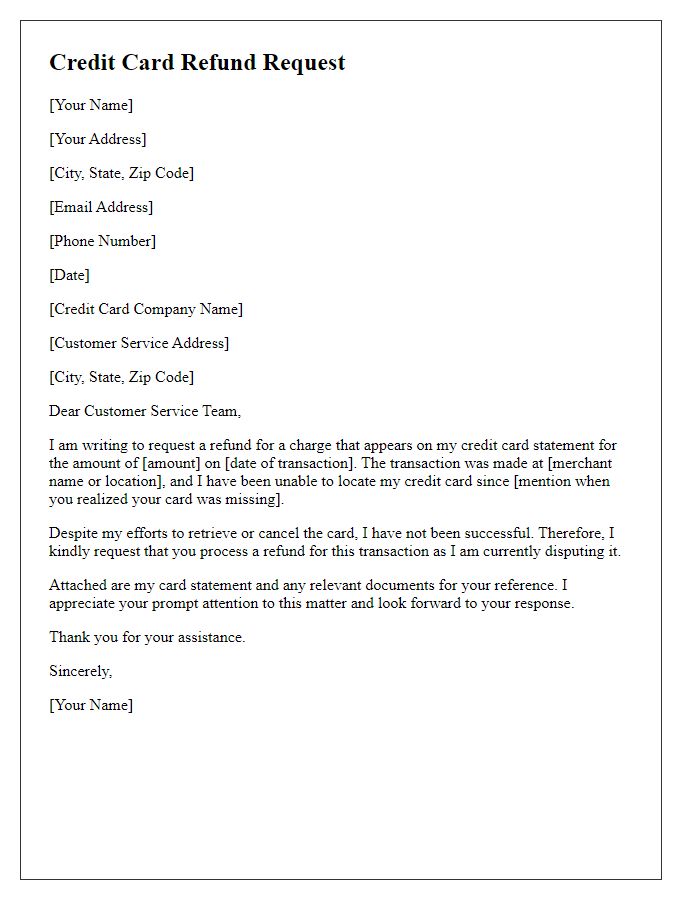

Clear subject line

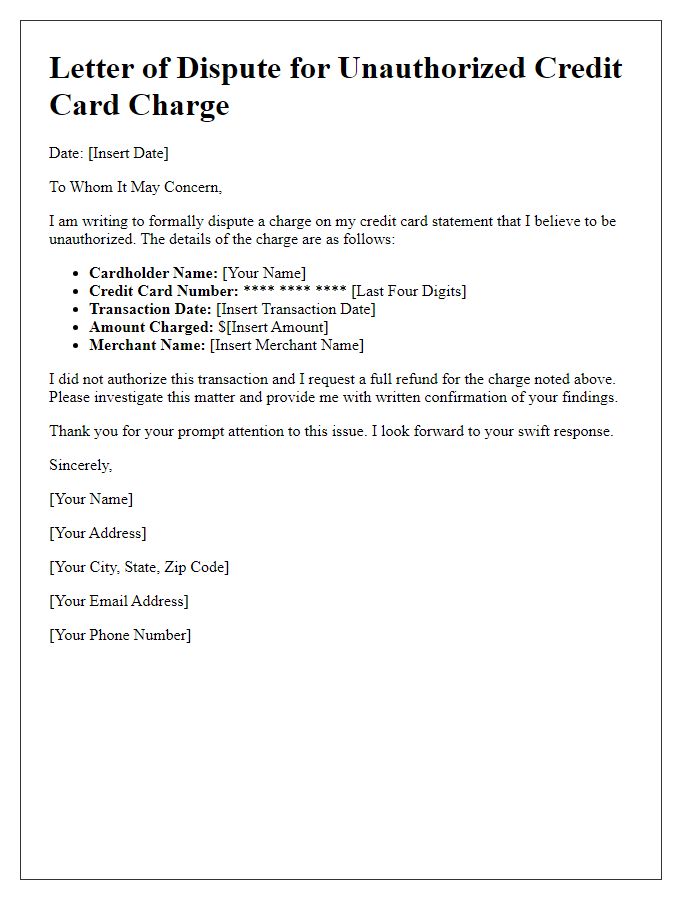

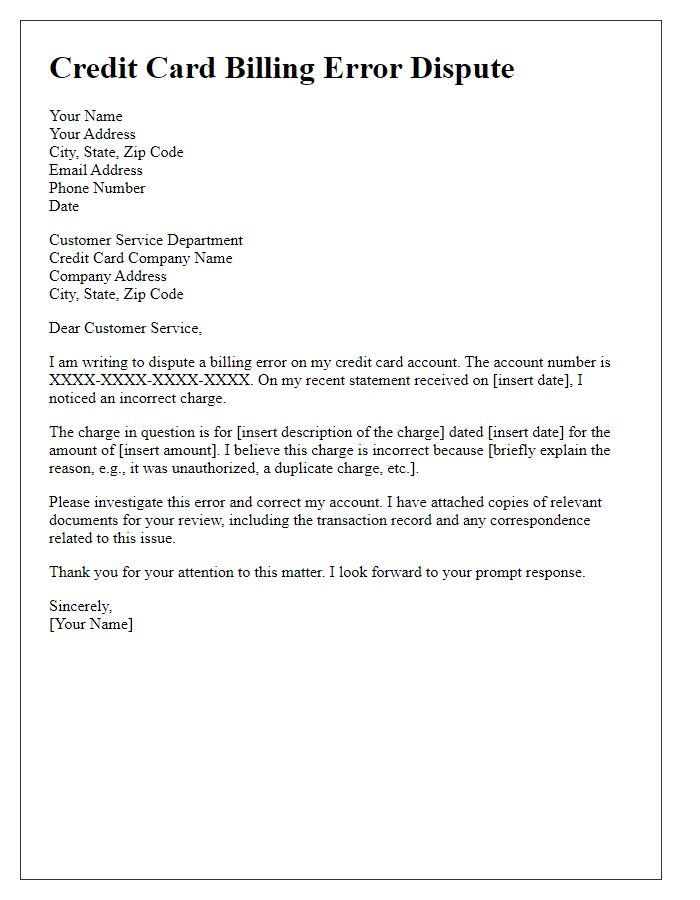

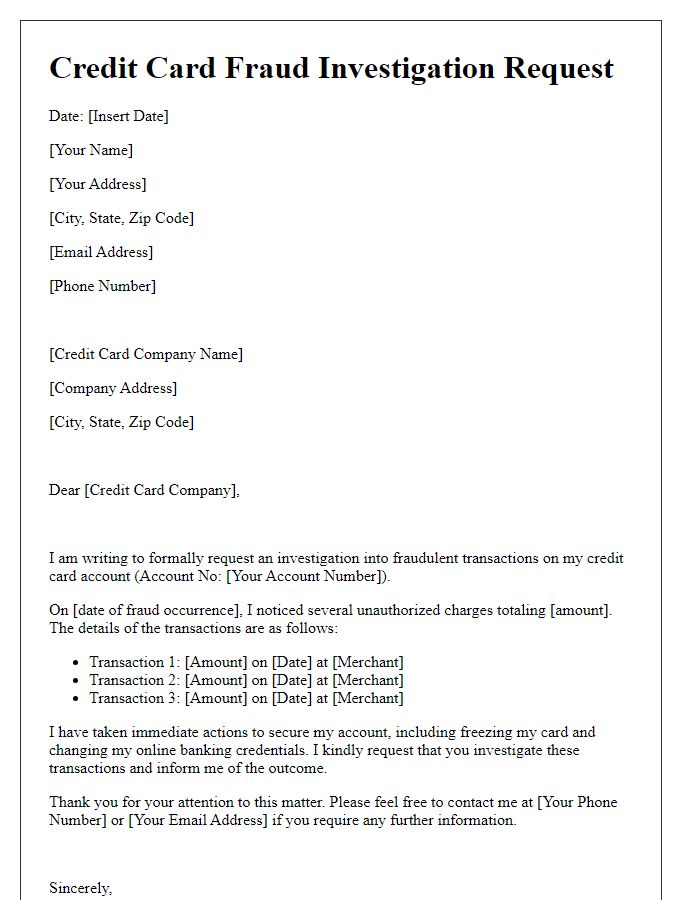

Credit card disputes often arise due to unauthorized transactions or billing errors. It is essential to address these issues promptly with your credit card issuer to protect your financial interests. Clear identification of disputed transactions, including transaction dates, amounts, and merchant names, is crucial. Include your account number and contact information for quick resolution. Providing supporting documents, such as receipts or communication records, strengthens your case. Ensure to request a specific response timeframe to expedite the investigation process. Follow up diligently if you do not receive a timely reply.

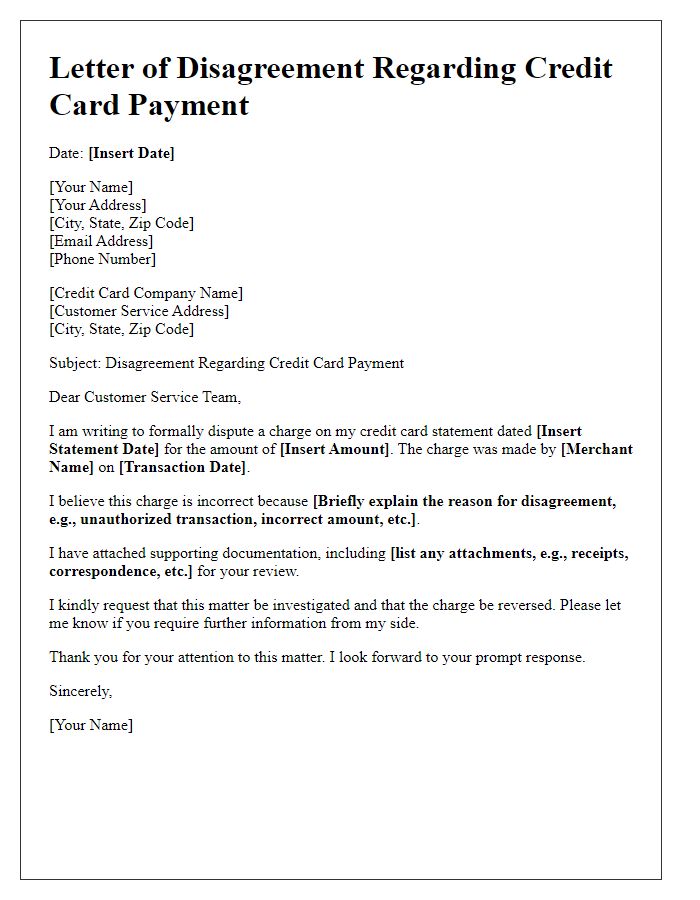

Account details and personal information

Credit card disputes often arise when unauthorized charges appear on an account. Details such as the account number (e.g., 1234 5678 9012 3456) and the cardholder's full name (e.g., John Doe) are crucial for identification and resolution. The transaction date (e.g., October 10, 2023) and the disputed amount (e.g., $125.00) must be highlighted for clarity. Including specific merchant information (e.g., XYZ Retail, Located in New York, NY) can provide context for the dispute. Documentation such as billing statements or receipts may enhance the case. Ensuring that contact information (e.g., email: johndoe@email.com, phone: (555) 123-4567) is up-to-date can facilitate communication between the cardholder and the credit card company.

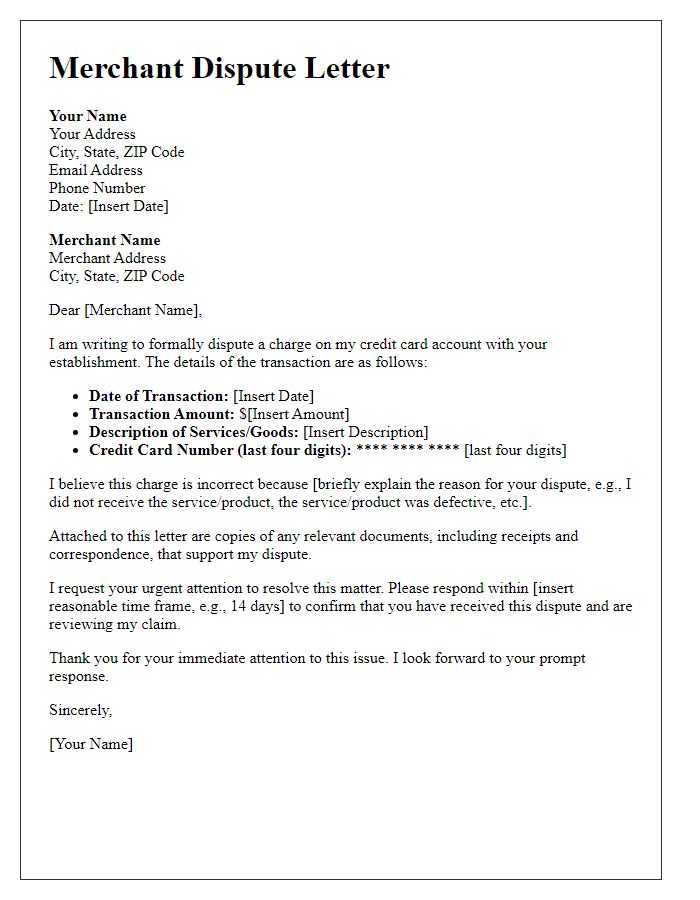

Detailed description of dispute

Credit card disputes often arise from unauthorized transactions or billing errors. For instance, a consumer may notice a charge of $250 for a monthly subscription service on a statement for a service never subscribed to. The recipient may want to emphasize the transaction date (April 15, 2023) and the merchant name (XYZ Streaming Services) to provide accurate details. Additionally, providing supporting evidence like bank statements or emails from the merchant can strengthen the case. Highlighting communication attempts with customer service (approximately three calls made and two emails sent) can also demonstrate the effort taken to resolve the issue prior to initiating a formal dispute. This comprehensive approach aids financial institutions in understanding the context and urgency of the dispute.

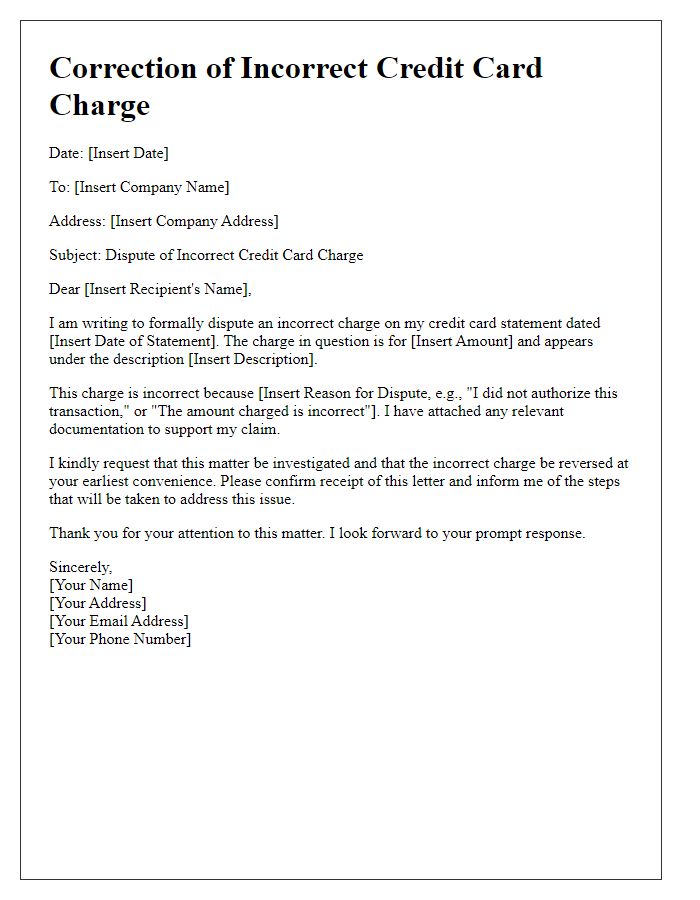

Supporting documents and evidence

Credit card disputes often arise from unauthorized charges, billing errors, or service dissatisfaction. Supporting documents such as transaction receipts (detailed proof of purchase), bank statements (listing account activity for verification), and correspondence with the merchant (emails or messages detailing the issue) are crucial in establishing a case. Evidence may also include photos of the goods or services received (showing discrepancies), warranty policies (indicating breach of agreement), and any relevant personal identification (to confirm account ownership). This documentation strengthens the dispute, enabling financial institutions to investigate thoroughly and resolve the matter effectively.

Contact information and request for confirmation

A credit card dispute letter should include essential contact information, such as the cardholder's name, address, and phone number. It should clearly state the request for confirmation regarding the transaction in question, detailing the date of the transaction, the amount, and the merchant's name. Attach any supporting documentation, such as receipts or statements, to bolster the claim. Clear and concise language will help communicate the issue effectively while requesting a prompt response from the credit card issuer. Specific transaction codes and familiar terminology will assist in expediting the dispute process.

Comments