Are you looking to navigate the often confusing world of tax exemptions? It can feel overwhelming, but with the right guidance, you'll be well-equipped to make your case. In this article, we'll break down an effective letter template you can use to request tax exemption, highlighting essential details to include. So, let's dive in and empower you to take the next step towards financial relief!

Proper Salutation

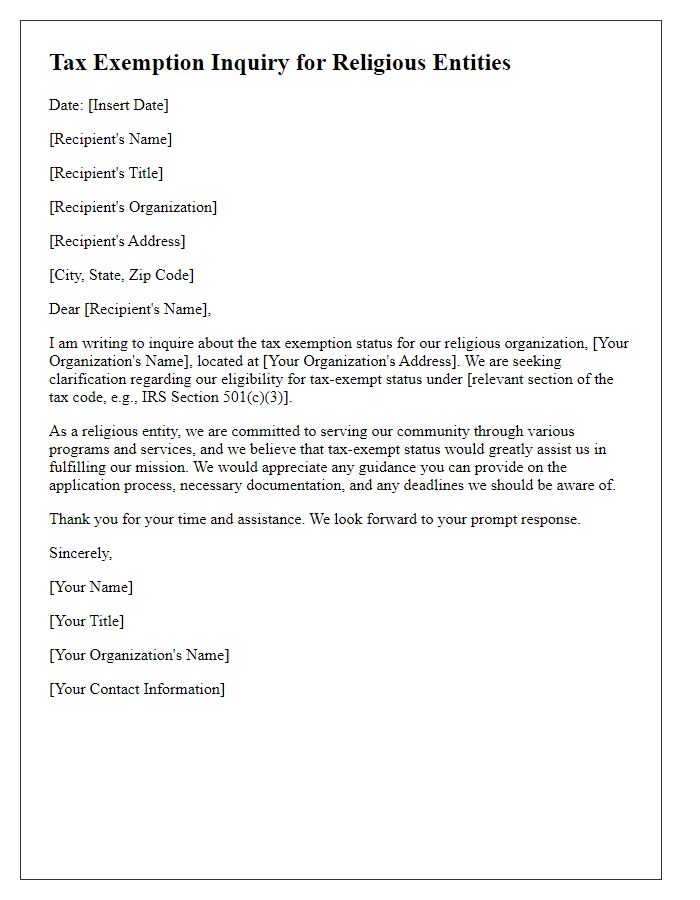

In a tax exemption request, a proper salutation sets a respectful tone for the correspondence. Begin with "Dear" followed by the title and last name of the recipient. For example, if addressing a government official, use "Dear Mr. Smith" or "Dear Ms. Johnson." Adding specific titles such as "Director" or "Commissioner" can provide more context and demonstrate the importance of your request. Ensure to use formal language to convey professionalism. Consider the context and organizational hierarchy to choose the appropriate salutation. Ending the salutation with a colon (:) is standard in formal letters.

Clear Subject Line

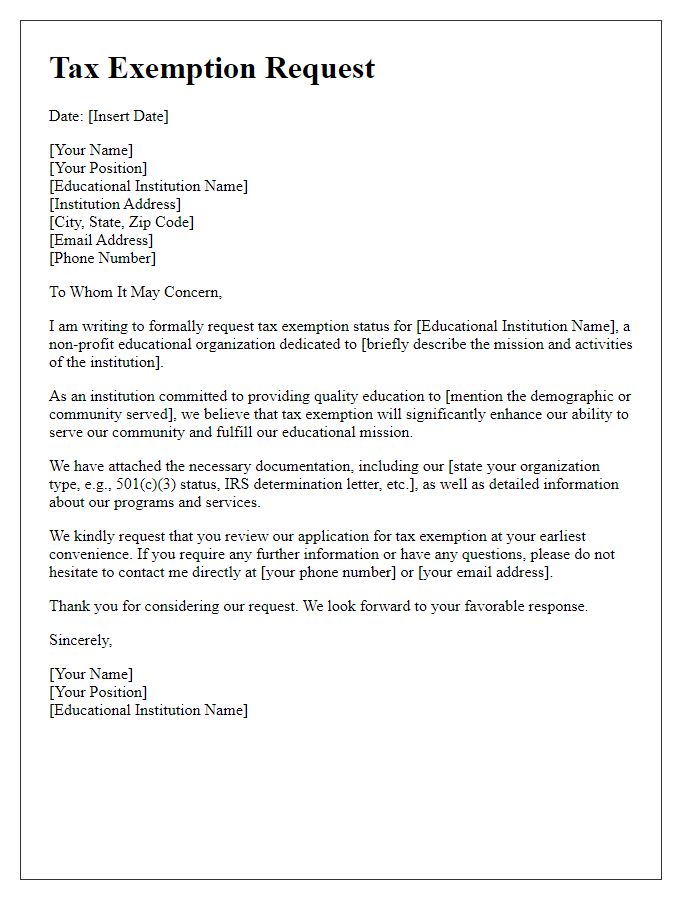

Tax exemption requests require precise and detailed documentation. The request letter should clearly state the taxpayer's name, identification number, and the specific tax years involved. Essential supporting documents include proof of income, employment status, and any relevant tax exemption certificates from local authorities. The jurisdiction, such as state (e.g., California) or federal, needs to be explicitly mentioned alongside tax codes applicable to the exemption. Details about the organization's purpose, like charitable work conducted by non-profits, strengthen the case. Additionally, it's crucial to include a contact number for follow-up communications and an understanding of deadlines to ensure compliance and timely processing.

Detailed Explanation

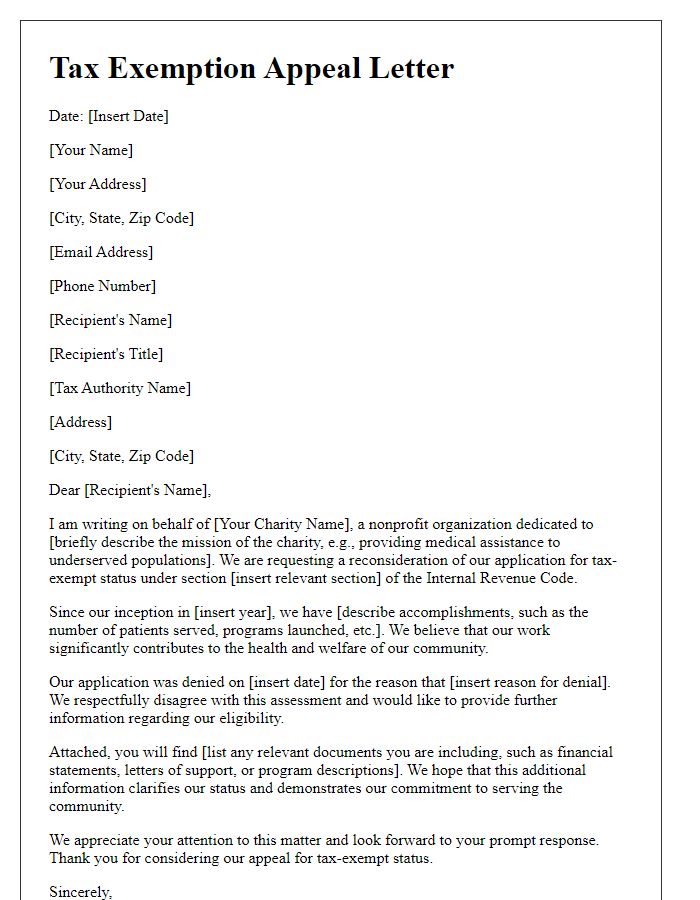

Tax exemption requests often require a comprehensive explanation of the eligibility criteria and relevant circumstances. A detailed explanation should highlight the organization's nonprofit status, such as registered 501(c)(3) in the United States, illustrating the mission to serve the community. For instance, if the organization provides educational services, it may cite specific programs benefiting underprivileged groups, like free tutoring sessions for over 200 students annually. Moreover, it can reference donations received, such as $50,000 from local businesses, demonstrating community support. Relevant documentation, including previous tax exemption letters or state certifications, should be included to substantiate claims. Financial records detailing operational expenses, such as salaries, supplies, and outreach costs, can illustrate the necessity for exemption. Including community impact statistics, such as increased literacy rates or successful job placements, bolsters the argument for continued or expanded support from tax exemptions.

Supporting Documentation

Tax exemption requests often require supporting documentation to verify eligibility and substantiate claims. Common documents include proof of non-profit status, such as a 501(c)(3) designation from the Internal Revenue Service (IRS) in the United States. Financial statements or budget reports can illustrate the organization's income and expenditures, demonstrating reliance on funding for charitable activities. Additional evidence might encompass letters of support from community leaders or beneficiaries, illustrating the organization's impact and outreach efforts. Documentation should be organized chronologically, with clear labels and explanations for each submitted item, ensuring transparency and clarity to facilitate the review process by tax authorities.

Formal Closing and Contact Information

Tax exemption requests require clear communication and proper formatting. The closing section typically includes a simple and professional farewell, followed by your name, position, organization (if applicable), phone number, and email address. This segment ensures the recipient knows how to reach you for further inquiries or clarifications. Including your complete contact details provides an easy pathway for follow-up actions regarding the tax exemption status. Additionally, utilizing a formal closing statement establishes a respectful tone, reinforcing the gravity of the request.

Letter Template For Tax Exemption Request Samples

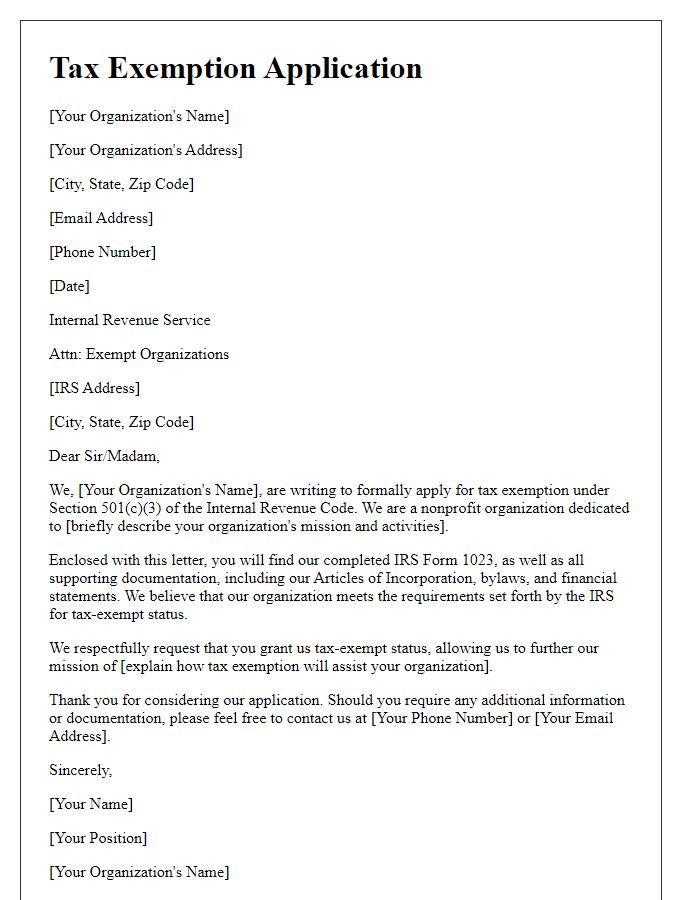

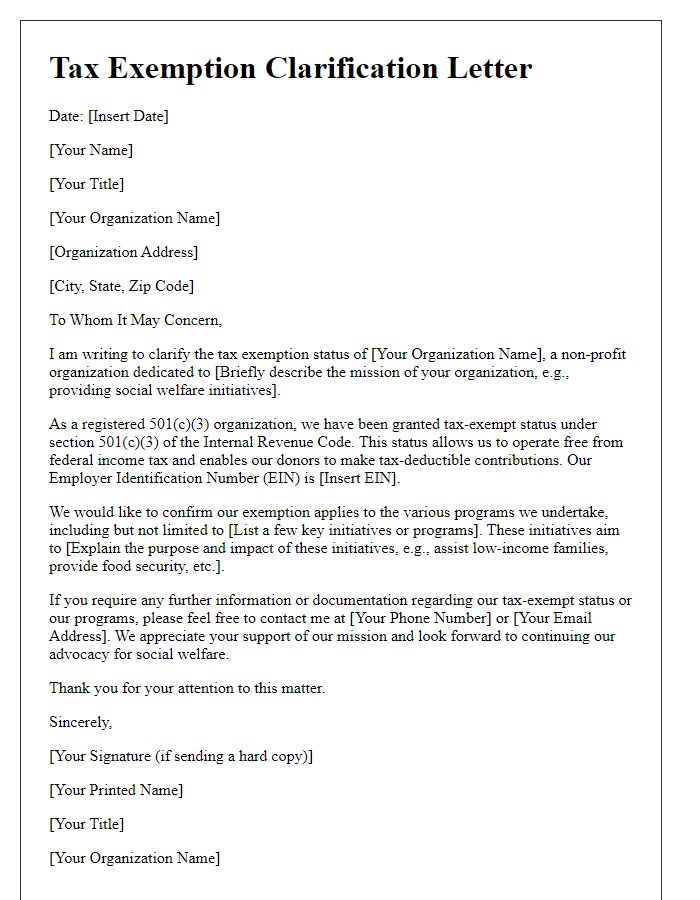

Letter template of tax exemption application for nonprofit organizations.

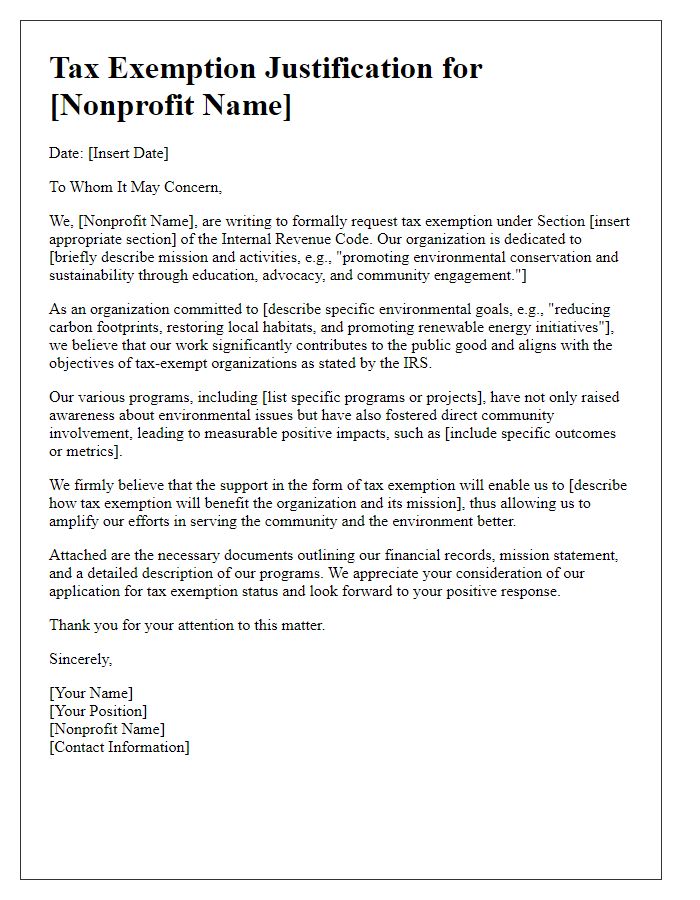

Letter template of tax exemption justification for environmental nonprofits.

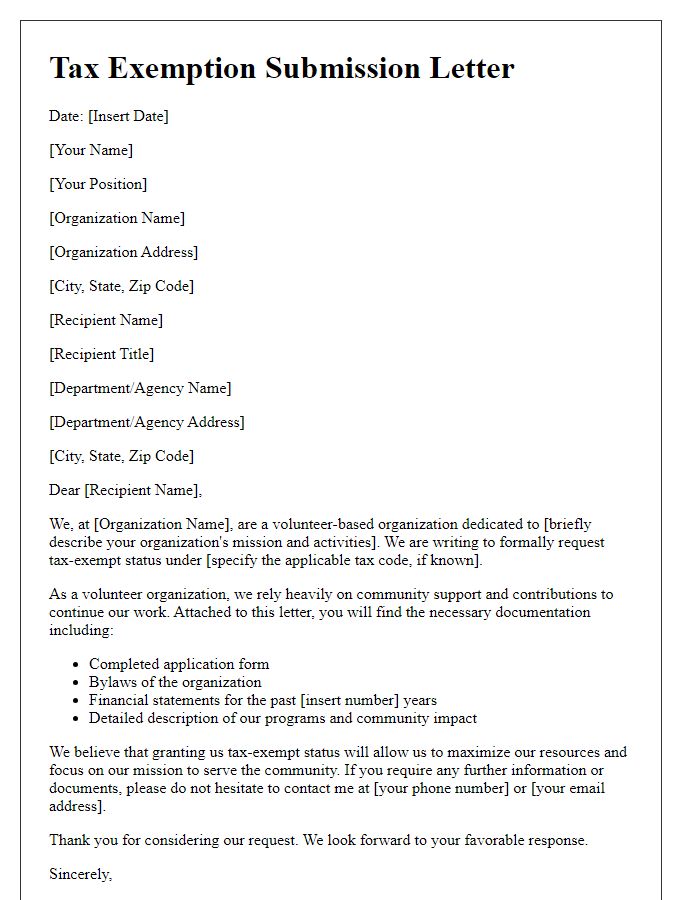

Letter template of tax exemption submission for volunteer-based organizations.

Letter template of tax exemption clarification for social welfare initiatives.

Comments