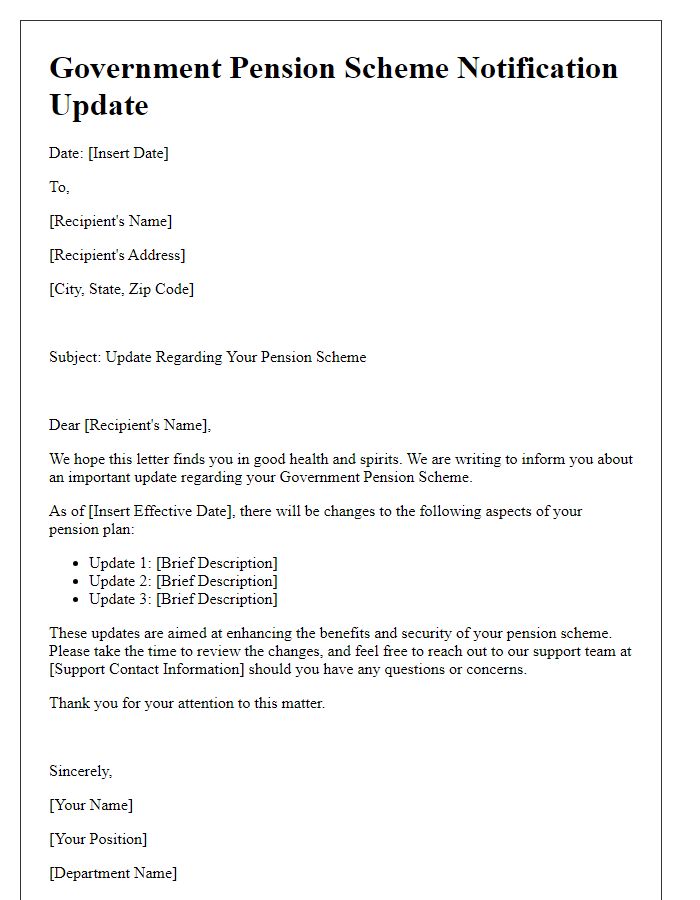

Are you looking to stay informed about the latest changes to the government pension scheme? In this article, we'll break down the essential updates and what they mean for you as a plan member. With so many developments, it's crucial to understand how these adjustments could affect your retirement savings and benefits. Let's dive in and explore these important updates together!

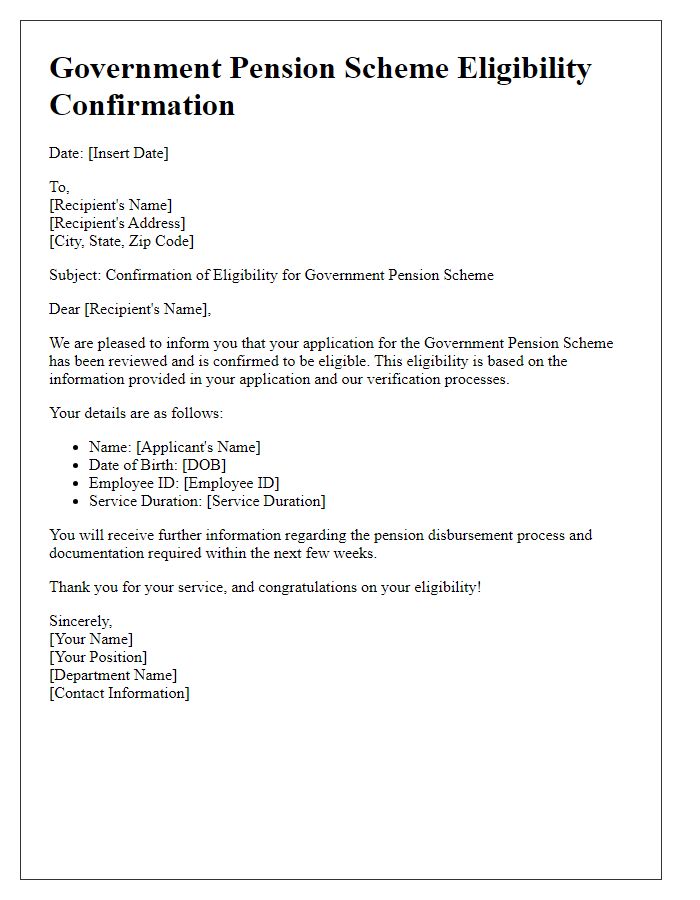

Personal identification details

The government pension scheme update requires personal identification details such as full name, date of birth, social security number, and residential address. Accurate name spelling ensures proper identification within government databases. The date of birth helps verify eligibility and calculate benefits accurately, while the social security number uniquely identifies individuals in the pension system. Residential address aids in communication and ensures individuals receive important updates regarding their pension status, changes in policies, or benefit adjustments. Keeping this information up to date is essential for seamless participation in the pension scheme.

Current pension scheme information

The current government pension scheme, known as the National Pension System (NPS), serves millions of employees across India. Established in 2004, this scheme promotes long-term savings for retirement, allowing contributors to invest in a mix of equity, corporate bonds, and government securities. As of 2023, the minimum contribution is set at Rs500 per month, with various tax benefits available under Section 80C of the Income Tax Act, providing a deduction up to Rs1.5 lakh. Additionally, the NPS offers a unique facility called the Partial Withdrawal feature, permitting subscribers to withdraw up to 25% of their contributions after three years for specific purposes such as education or health expenses. The government continues to enhance this scheme, aiming for greater financial security for retirees. Regular updates on contributions and performance are essential for participants to make informed decisions regarding their retirement portfolios.

Proposed changes or updates

The government pension scheme undergoes periodic adjustments to enhance benefits for retirees, aiming for improved financial security. Recent discussions reflect proposed changes, including increased contribution rates for employees, which may elevate pension payouts significantly over time. Additionally, the age of retirement may shift from 60 to 65, ensuring sustainability of the fund, especially as life expectancy increases. Furthermore, adjustments to the calculation formula for pension benefits could lead to more favorable outcomes for long-term contributors, particularly those with over 30 years of service in public sectors. Stakeholders are encouraged to review these proposals and provide feedback by the end of the next quarter to facilitate an inclusive decision-making process.

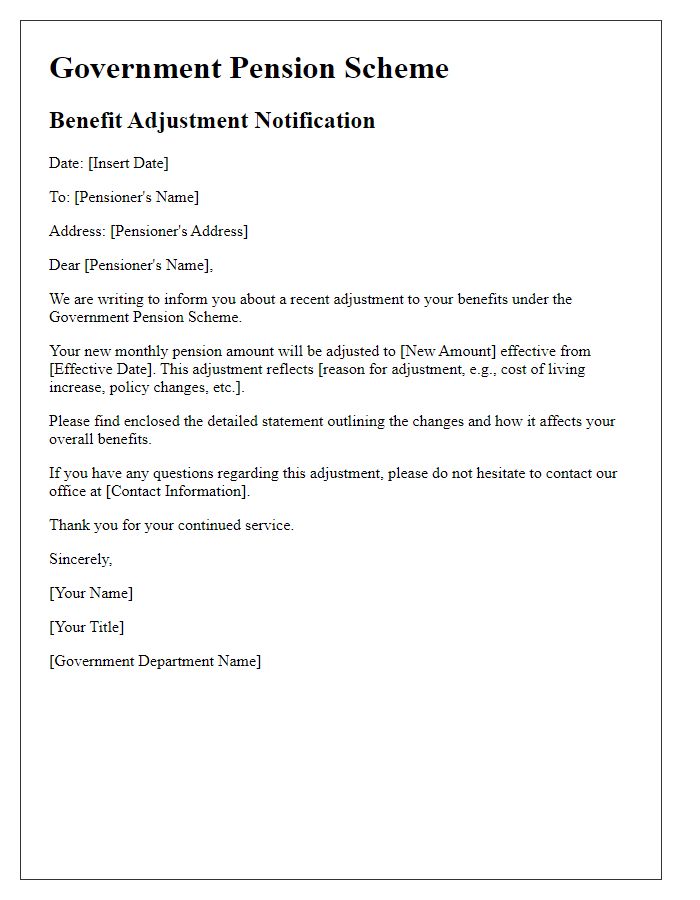

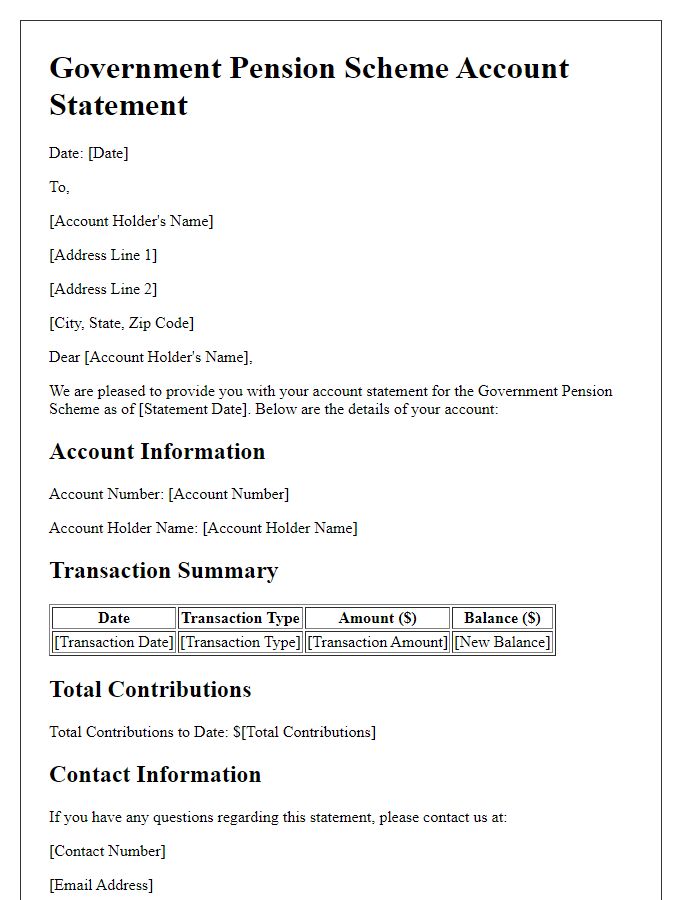

Impact analysis on benefits and contributions

Government pension schemes, like the National Pension System (NPS) in India, face significant impact from regulatory changes, influencing both benefits and contributions. Recent adjustments, scheduled for implementation in April 2024, could modify the contribution rates (increased from 10% to 14% for both employees and employers) while also altering the retirement benefit calculations based on updated mortality rates published by the Life Insurance Corporation. These changes aim to ensure long-term sustainability and higher pension payouts, yet may lead to reduced disposable income for employees due to the increased contribution percentage. Additionally, the revised scheme will enhance benefits, potentially translating to a higher average monthly pension of approximately INR 25,000, compared to the previous estimate of INR 18,000, thus reflecting the growing life expectancy in India. Stakeholders need to assess their financial planning in light of these impending changes to ensure compliance and optimize retirement outcomes.

Contact information for queries and support

Government pension scheme updates require clear and concise communication, particularly regarding contact information for queries and support. The designated hotline, available at 1-800-123-4567, operates from Monday to Friday, 9 AM to 5 PM, allowing beneficiaries to seek assistance regarding their pensions. Additionally, an email support option is provided at support@govpension.gov, enabling inquiries to be addressed electronically. For in-person support, local government offices, including the Department of Social Services located at 456 Civic Center, Suite 101, Springfield, are open from 8 AM to 4 PM. This combination of resources ensures that beneficiaries can receive timely and accurate information pertaining to their pension plans.

Comments