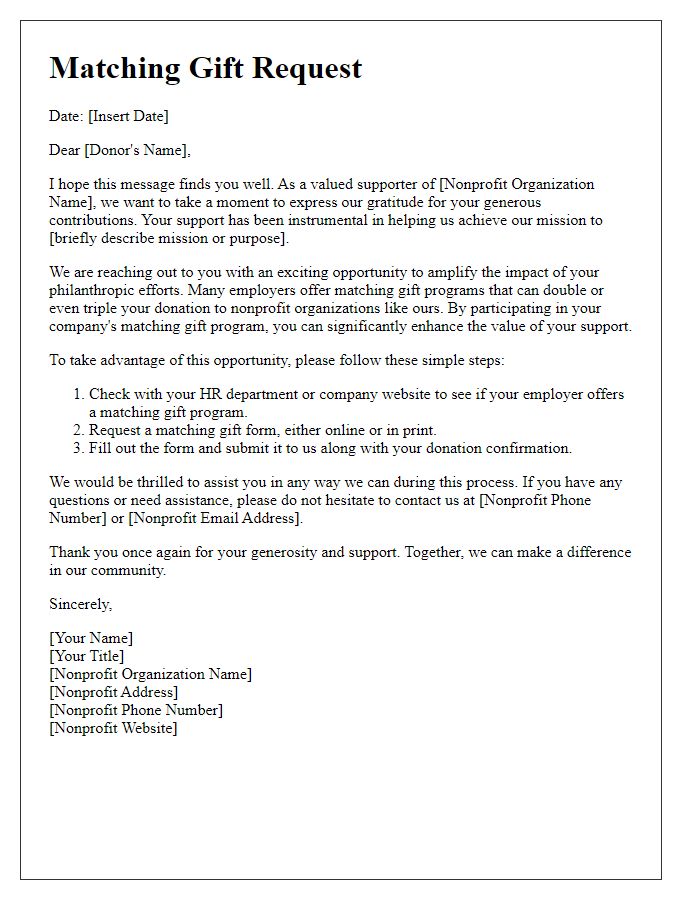

Are you looking to maximize the impact of your charitable giving? Matching gifts can double or even triple your contributions, making your generosity stretch even further. In this article, we'll explore how to create a compelling letter that invites organizations to match your donations. Ready to learn more about this effective strategy? Let's dive in!

Donor's Personal Information

Many corporations and organizations operate matching gift programs, which allow donors to amplify their charitable contributions. This process often requires specific donor information such as name, address, email, and employment details. For instance, a donor named Sarah Johnson, employed at Tech Innovations Inc., can submit a request to match her recent donation of $500 to a nonprofit organization focused on education. The match ratio varies, with some companies offering a dollar-for-dollar match, while others may provide a 2:1 match, effectively doubling the impact of Sarah's contribution. Accurate and detailed donor information is crucial to facilitate this process and ensure that the nonprofit receives the full benefit of the donor's generosity.

Gift Information (Amount, Date, Purpose)

Matching gift programs enable donors to increase their contributions through employer support. Donations can vary, with amounts ranging from $50 to $10,000 or more, depending on the company. A matching gift request often includes detailed information such as donation amount, which specifies the financial commitment, the date of donation indicating when the contribution was made, and the purpose, usually detailing how the funds will be utilized to support specific programs or initiatives, like community development or educational scholarships. Organizations often respond with appreciation letters acknowledging the generosity and confirming the matching process required by the employer to amplify the impact of the donor's contribution.

Receipient Organization's Details (Name, Address, Tax ID)

Matching gift requests can enhance fundraising efforts for nonprofit organizations, increasing their revenue through employer sponsorships. For effective communication, include the recipient organization's precise name, a complete address incorporating street, city, state, and zip code, and the Tax Identification Number (Tax ID) which is critical for tax-exempt status verification. Each detail fosters transparency, ensuring compliance with corporate matching gift policies and streamlining the donation process for employers like Corporate Giants, Inc., noted for its philanthropic initiatives. This structured approach provides clarity and increases the likelihood of securing additional funds to support meaningful community programs and initiatives.

Matching Gift Program Details (Company Name, Matching Ratio, Deadline)

The matching gift program initiated by Company Name significantly enhances charitable contributions made by employees. This program typically features a matching ratio of 1:1, meaning for every dollar donated by an employee, the company contributes an equal amount up to a specified limit. Employees must submit their requests for matching gifts by a deadline, often set for December 31st of the current year. Such initiatives encourage philanthropy while amplifying the impact of individual donations to non-profit organizations, ensuring that both the employee's generosity and the company's commitment to community engagement are recognized and rewarded.

Closing Statement (Contact Information, Gratitude, Next Steps)

In closing, we deeply appreciate your consideration of our matching gift program, which significantly enhances our mission to support community needs and drive positive change. Should you have any questions or require further information, please do not hesitate to contact us at (555) 123-4567 or via email at info@ourorganization.org. Your generosity is invaluable to us, and we look forward to keeping you updated on the impact of your contribution. Next steps involve completing the matching gift paperwork through your employer, ensuring that your gift's impact is doubled for our beneficiaries. Thank you once again for your support and commitment to our cause.

Comments