Are you frustrated with your travel insurance provider? Writing a formal complaint letter can feel daunting, but it's an essential step in addressing your concerns effectively. In this article, we'll guide you through crafting a clear and concise complaint that outlines your issues and expectations. So, grab a pen and let's delve into the details of creating your compelling complaint letter!

Policy Details

Travel insurance policies, such as those offered by providers like Allianz or AXA, typically include essential details like policy number (often a combination of letters and numbers), coverage limits, and specific terms governing claims. Customers must be aware of conditions, such as exclusions for pre-existing medical conditions, or coverage restrictions during extreme weather events, like hurricanes or calamities. Policy validity periods, ranging from single trip coverage (up to 30 days) to annual multi-trip plans, also impact claims. Documentation requirements often include detailed incident reports, proof of expenses, and relevant medical records to support claims. Notably, understanding your policy's claims process, including submission deadlines and required forms, is crucial for ensuring a prompt and successful resolution.

Incident Description

A travel insurance claim can be initiated following an incident where a traveler experiences a significant disruption or loss during their trip. For example, a lost suitcase at an international airport like Heathrow, which contained valuable items, may lead to substantial financial stress. The insured traveler may require reimbursement for clothing and essential supplies purchased due to the delay. The claim process typically involves detailing the circumstances of the loss, providing receipts for replacement items, and including a police report if applicable. Timely submission of these documents, often required within 30 days, is crucial for a successful resolution. This process usually occurs through a formal claims form submitted to the insurance company along with all necessary documentation to support the claim.

Supporting Documentation

Travel insurance claims often require supporting documentation to validate the circumstances of the incident. Key documents include the original policy agreement, outlining coverage details and exclusions. Incident reports, such as police reports for theft or medical reports detailing treatment received in case of injury, provide essential evidence. Receipts for expenses incurred, such as accommodation costs or medical bills from healthcare providers, demonstrate the financial impact of the event. Additionally, correspondence with the insurance provider can serve as documentation of communication attempts and claims submission status, further supporting the complaint process. Proper organization and submission of these documents are crucial for a successful claims resolution.

Desired Resolution

A formal complaint to a travel insurance provider often necessitates clear articulation of the desired resolution. For instance, a traveler affected by a delayed claim might request a rapid review of their case for an expedited settlement, ensuring reimbursement of out-of-pocket medical expenses incurred, totaling $1,500, due to unexpected travel interruptions. Alternatively, in instances of denied claims, the individual could seek a reevaluation of the policy terms, particularly regarding trip cancellations related to Covid-19, aimed at acquiring full compensation of the travel costs, which amounted to $3,000. The resolution path should include a timeline for response and clarification of the appeals process.

Contact Information

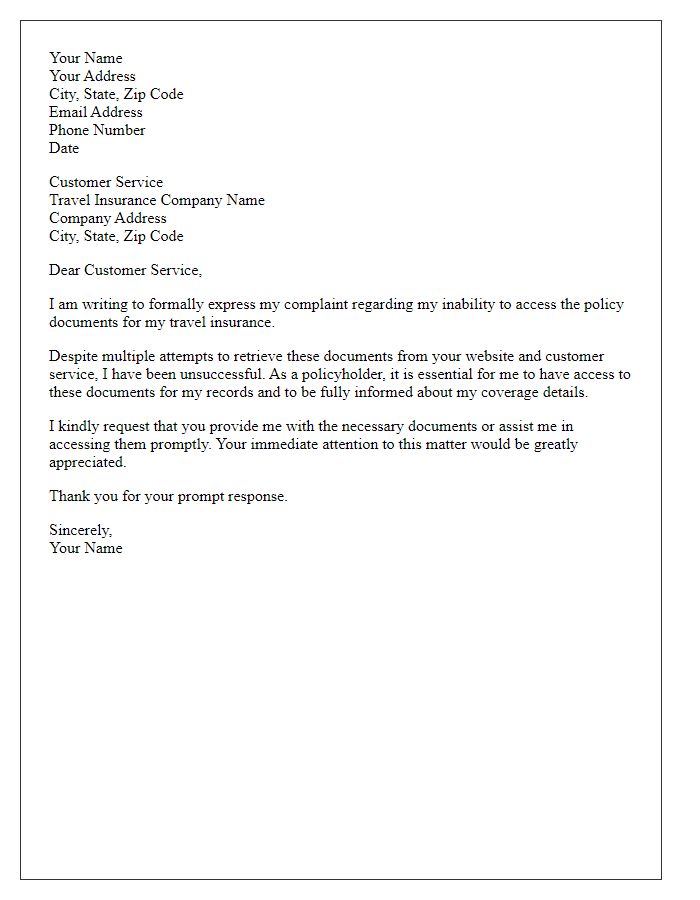

To initiate a formal complaint regarding travel insurance services, begin by providing essential contact information. This includes the name of the policyholder (individual holding the insurance), the policy number (unique identifier for the insurance policy), and the contact address (location where correspondence can be received, often a home or business address). Additionally, include a primary contact number (telephone number for direct communication) and an email address (digital means of communication for swift responses). Clarity and accuracy in this information ensure that the travel insurance provider can promptly address the complaint.

Letter Template For Formal Complaint To Travel Insurance Provider Samples

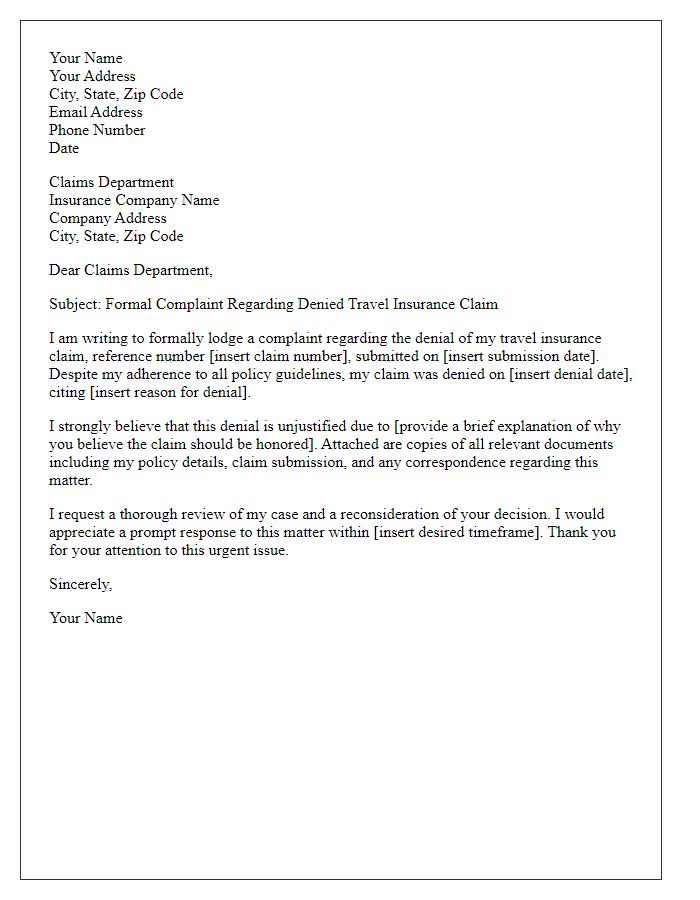

Letter template of formal complaint regarding denied travel insurance claim.

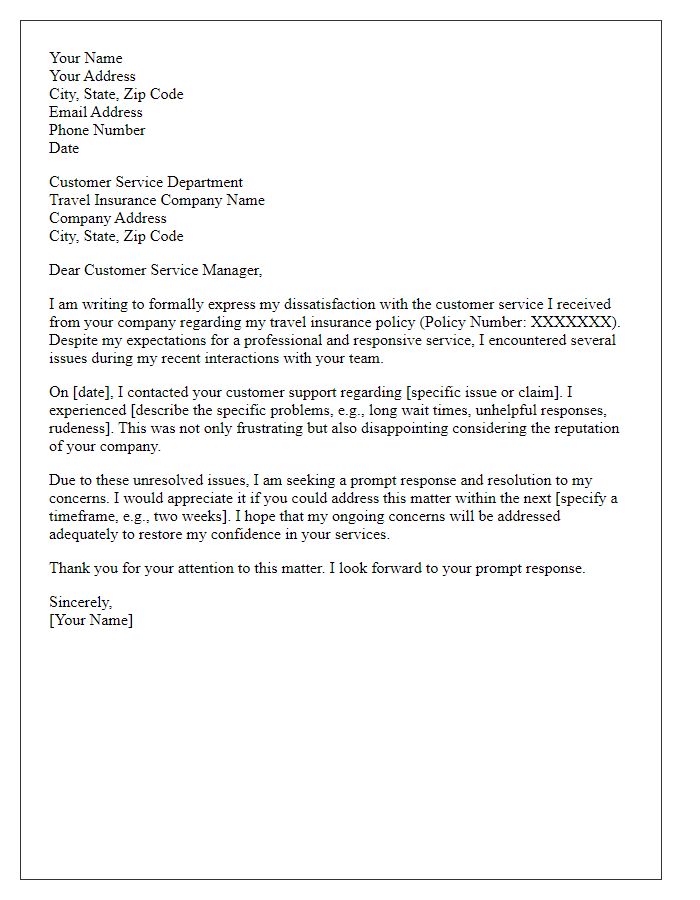

Letter template of formal complaint about unsatisfactory customer service from travel insurance provider.

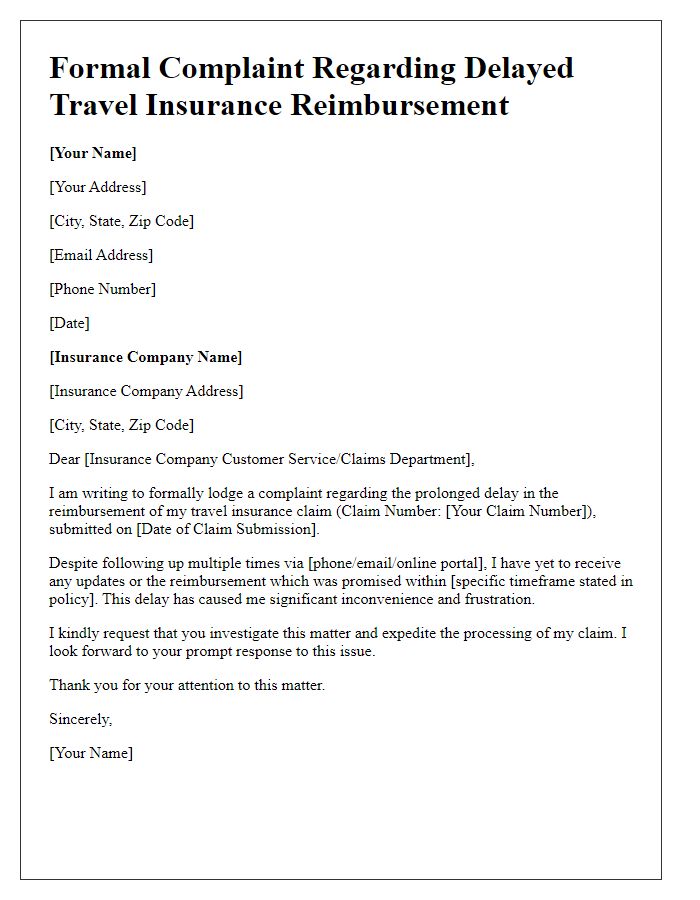

Letter template of formal complaint concerning delayed travel insurance reimbursement.

Letter template of formal complaint for coverage exclusion in travel insurance policy.

Letter template of formal complaint over misleading travel insurance policy details.

Letter template of formal complaint related to unresponsive travel insurance claims department.

Letter template of formal complaint regarding inadequate assistance during travel emergencies.

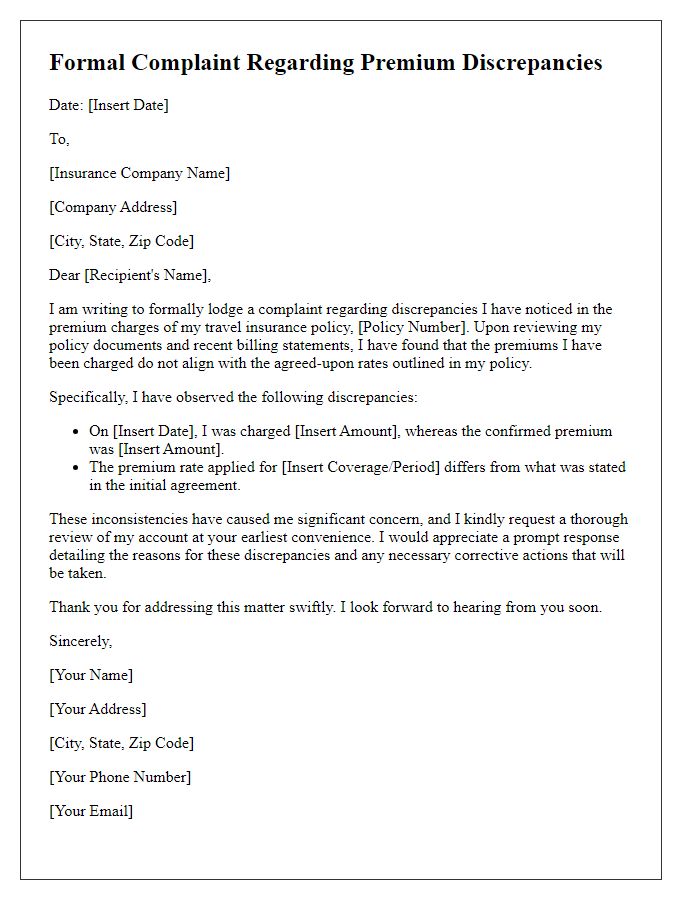

Letter template of formal complaint about premium discrepancies in travel insurance plan.

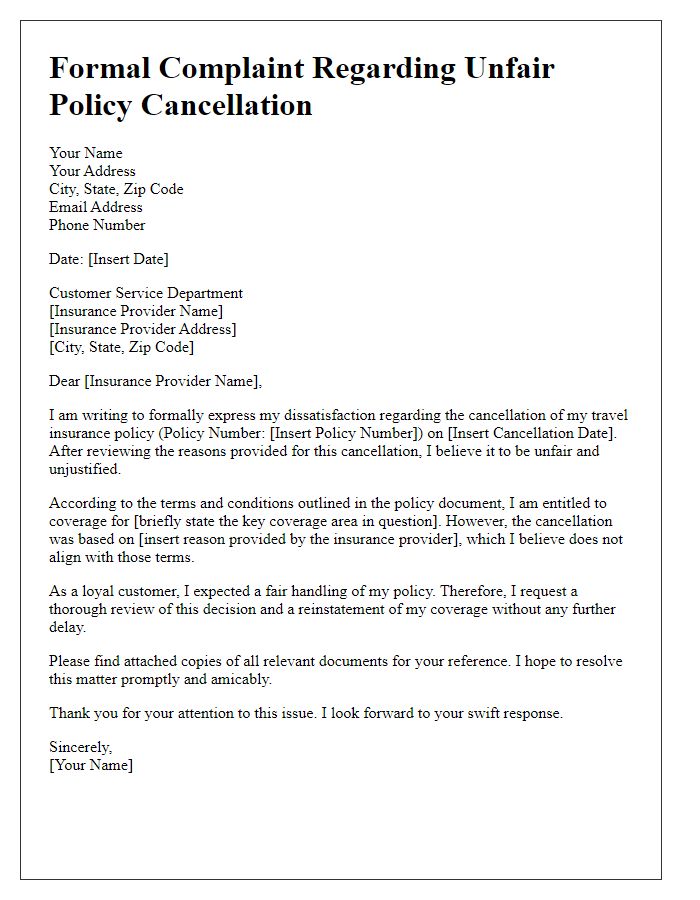

Letter template of formal complaint for unfair policy cancellation by travel insurance provider.

Comments