Are you feeling overwhelmed by unexpected charges on your latest bill? You're not alone! Many people face the frustration of overbilling and the confusion it brings. In this article, we'll guide you through the process of crafting a formal complaint letter to address the issue and seek a resolutionâso stick with us to learn how to reclaim your hard-earned money!

Clear Subject Line

Overbilling on Invoice #12345 from Utility Company X has led to discrepancies in my account balance, which should reflect accurate usage amounts. The invoice dated September 30, 2023, indicates charges of $250, significantly higher than the usual monthly average of $150 based on prior usage patterns during the same billing cycle. Additionally, the statement lacks a breakdown of charges, leading to confusion about specific fees applied. A detailed account review, including usage history from previous months, will further clarify this situation. Immediate rectification of this discrepancy is required to restore trust and ensure accurate billing in future statements.

Recipient Information

Overbilling incidents can lead to significant frustration for customers. Instances of incorrect charges on invoices can undermine trust in service providers or companies. For example, a utility company may inadvertently charge a customer $150 instead of the expected $100 for the monthly bill. Such discrepancies can arise from system errors or miscalculations. Customers often notice these incorrect amounts when reviewing their statements. Addressing overbilling issues promptly is crucial for maintaining customer satisfaction and loyalty. Consumer protection agencies, such as the Federal Trade Commission (FTC) in the United States, encourage consumers to report such problems for resolution and possible restitution.

Detailed Explanation of Overbilling

Overbilling refers to the incorrect charging of an amount that exceeds the actual services rendered, often leading to financial discrepancies in bills issued by service providers, such as telecommunications companies or utility services. An example of this could involve a monthly phone bill for a residential plan that shows charges of $150 instead of the agreement of $100, potentially resulting from a clerical error or a faulty billing system. Such discrepancies may arise from factors like improper adjustments for previous payments, fees for services not used, or erroneous late payment charges applied without justification. Resolution may necessitate a detailed review of account statements and contractual agreements, along with timely communication with the customer service department, which is required to identify and rectify any unfair billing practices. This scenario is particularly relevant in consumer rights discussions, highlighting the importance of transparency in billing statements.

Supporting Documentation

The process of filing a formal complaint regarding overbilling should include clear and accurate supporting documentation. Essential documents may consist of original invoices (with amounts billed), comparison statements (showing discrepancies), correspondence (emails or letters exchanged with the billing department), and any relevant contract copies (detailing agreed pricing). These records provide evidence of the incorrect charges and establish the context of the complaint. It is crucial to highlight specific billing dates (noting when the overcharges occurred), customer account numbers, and reference any applicable service agreements (e.g., subscription terms, price quotes). Ensuring all documentation is organized and accessible strengthens the case and facilitates resolution from the billing department or service provider.

Desired Resolution and Next Steps

Formal complaints regarding overbilling often involve discrepancies in billing statements from service providers, such as utilities or telecommunication companies. In these situations, essential details include the specific amount overbilled, the billing period (for example, from January 1 to March 31, 2023), and the original contract terms outlining service costs. Customers typically seek resolution, which could involve a corrected bill reflecting the proper charges, potential refunds for overpaid amounts, and adjustments to future billing practices to prevent recurrence. In terms of next steps, consumers might request a timeline for resolution within a week and specify preferred communication methods, such as email or phone, for updates. This structured approach ensures clarity in addressing the issue and achieving satisfaction.

Letter Template For Formal Complaint Regarding Overbilling Samples

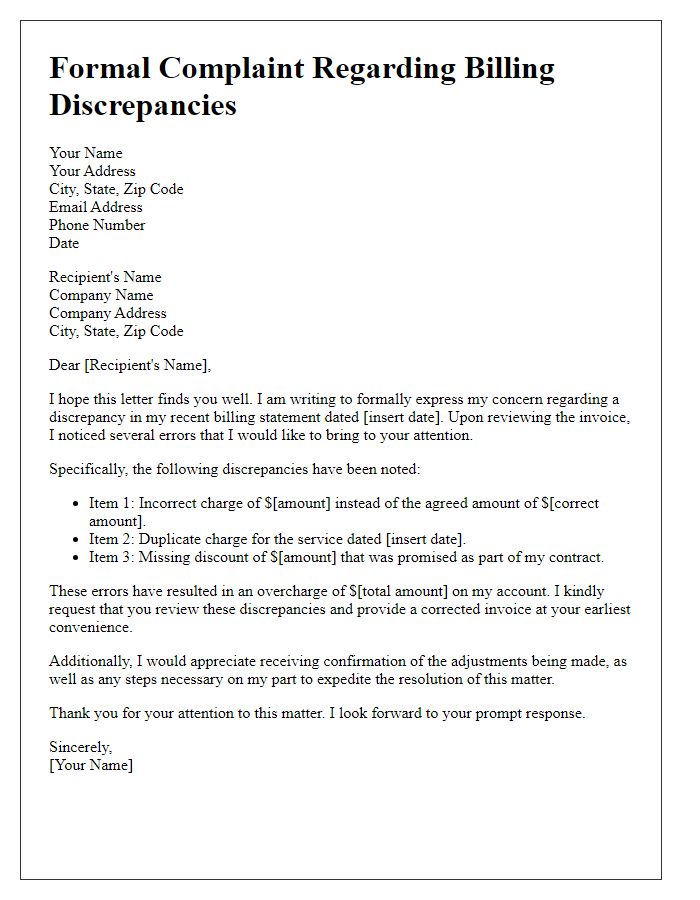

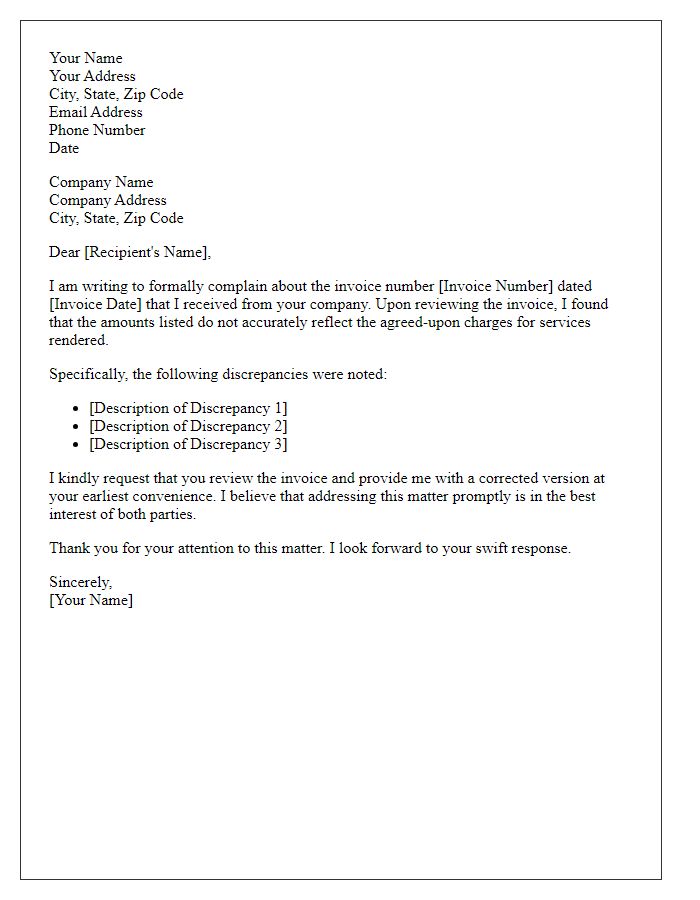

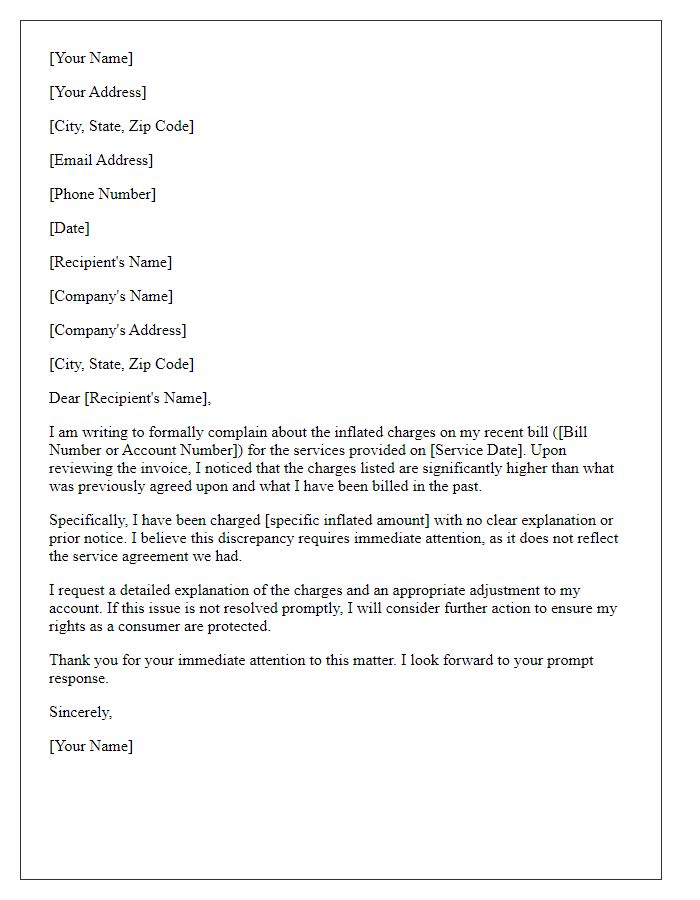

Letter template of formal complaint about erroneous billing discrepancies.

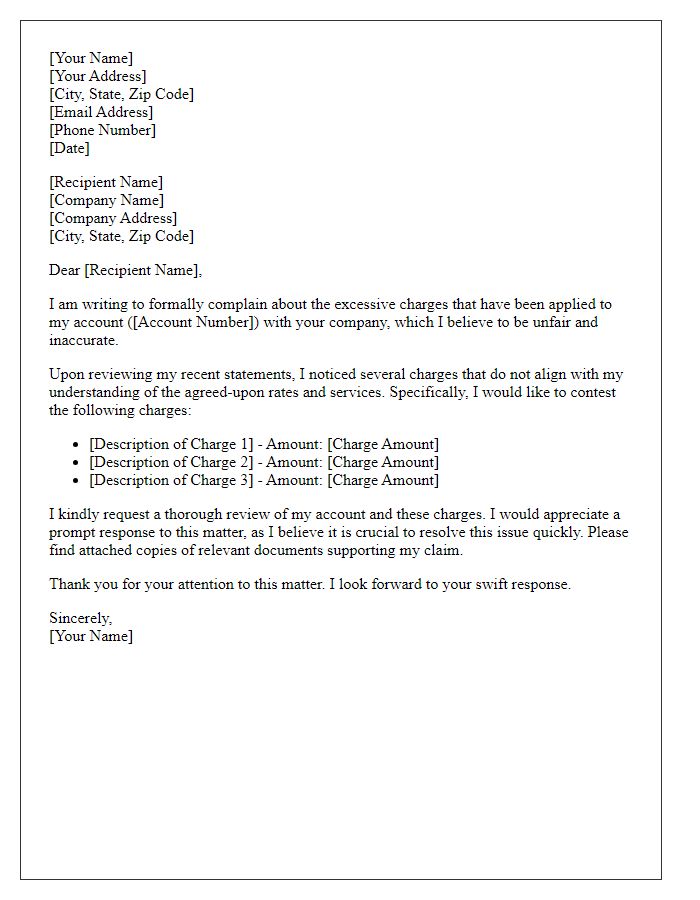

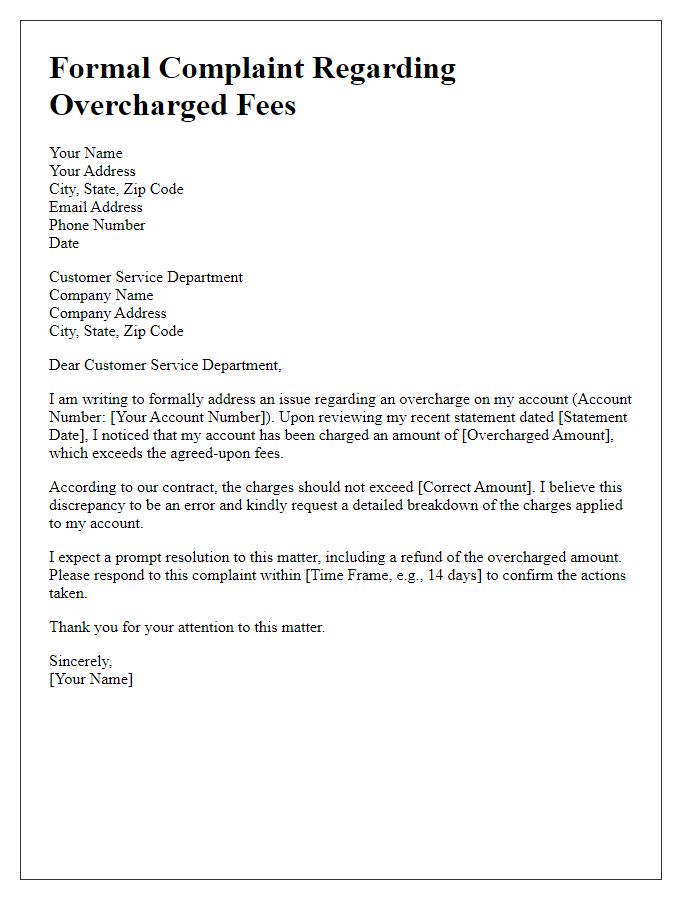

Letter template of formal complaint concerning excessive charges on account.

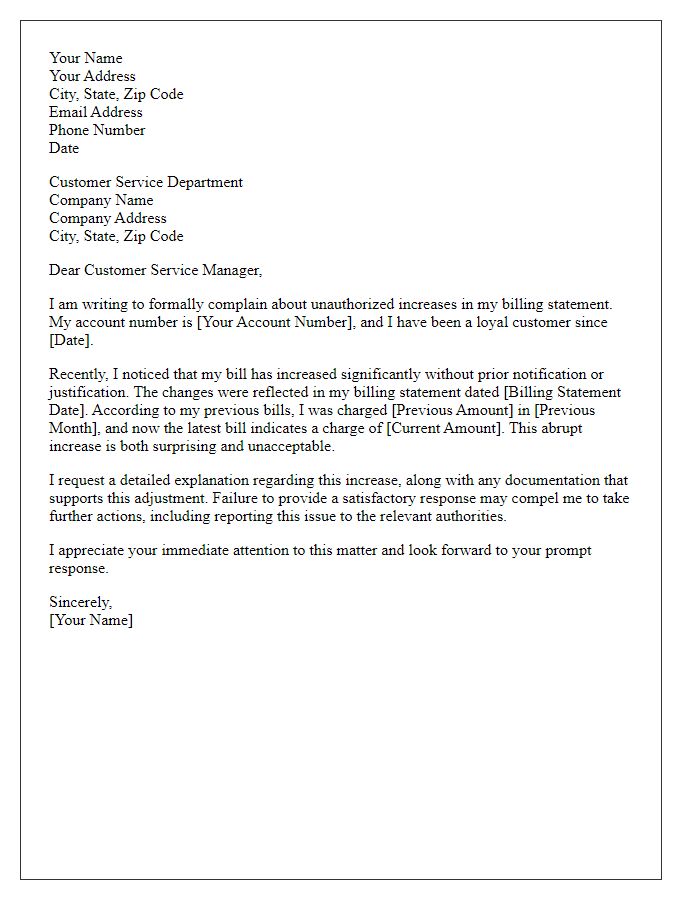

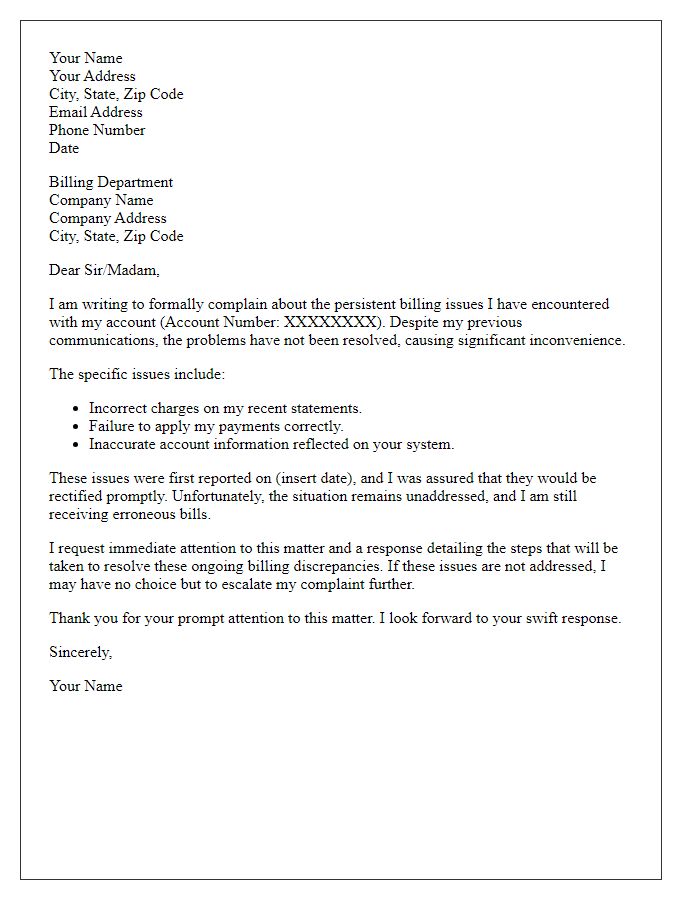

Letter template of formal complaint regarding unauthorized billing increases.

Letter template of formal complaint related to inaccurate invoice amounts.

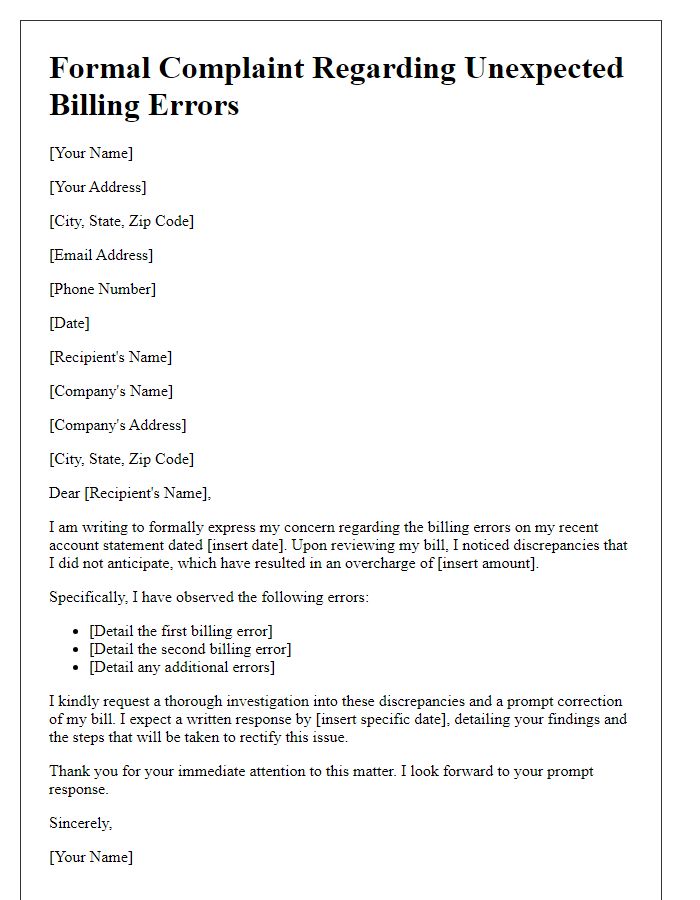

Letter template of formal complaint addressing unexpected billing errors.

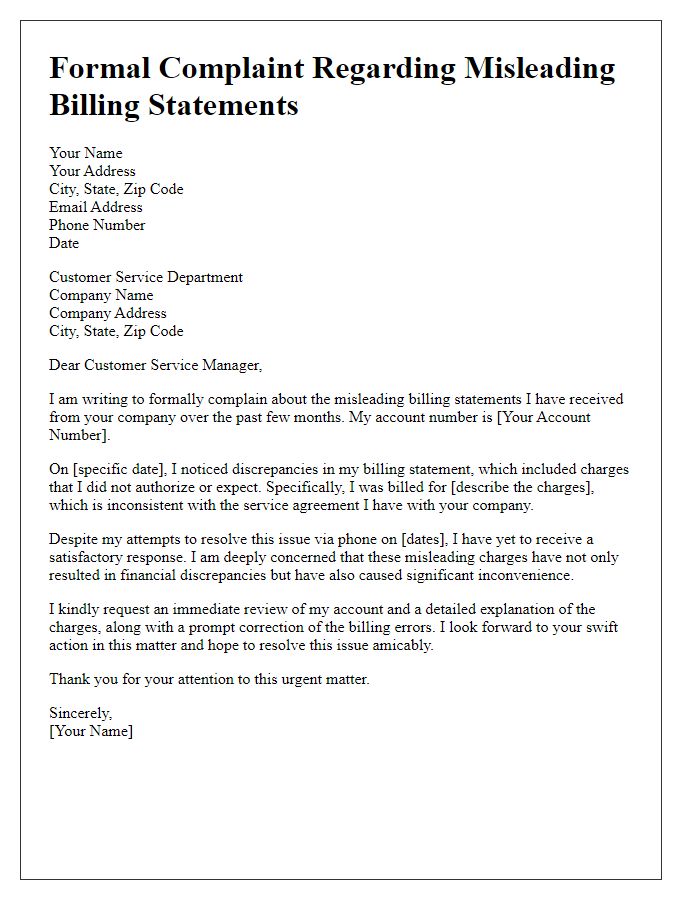

Letter template of formal complaint about misleading billing statements.

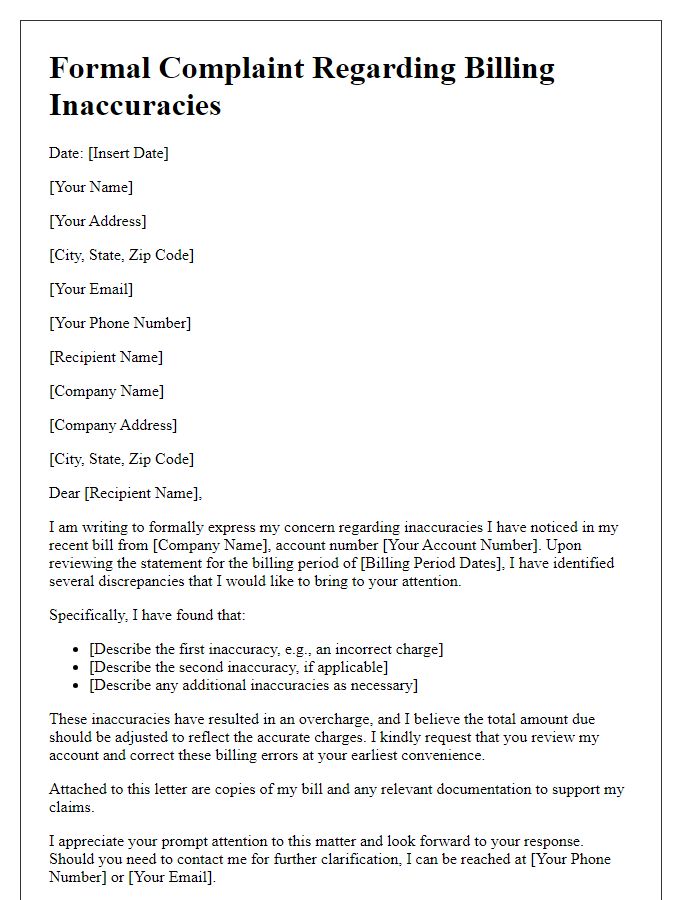

Letter template of formal complaint with respect to billing inaccuracies.

Comments