Are you looking for an exciting way to grow your savings? Discover the benefits of opening a promotional CD account with our unbeatable rates that can help you maximize your earnings. With our user-friendly approach and attractive terms, you can watch your money thrive while enjoying peace of mind. Dive into this article to learn more about how you can make the most of your savings today!

Engaging Introduction

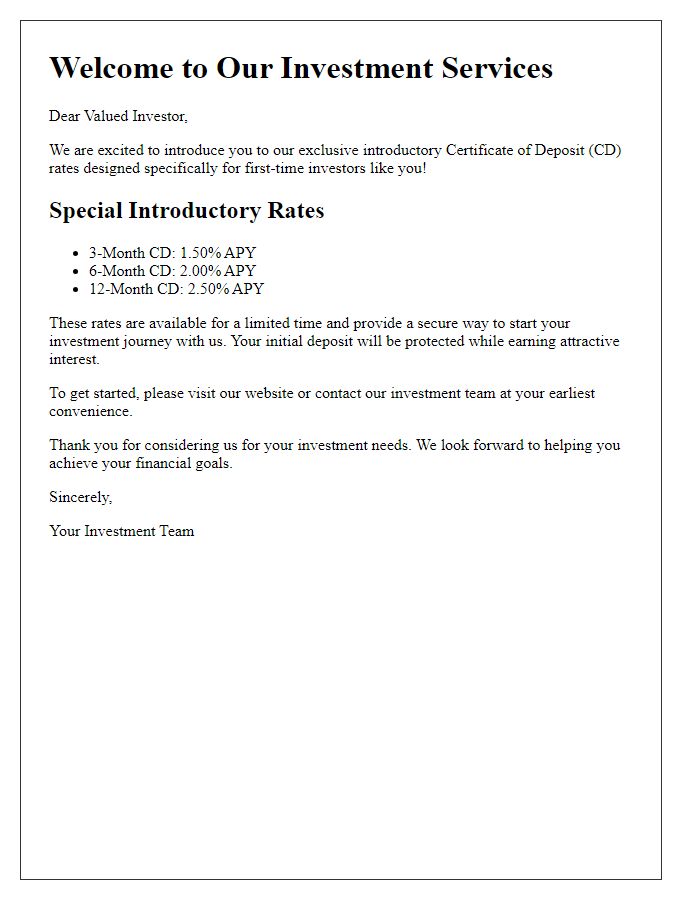

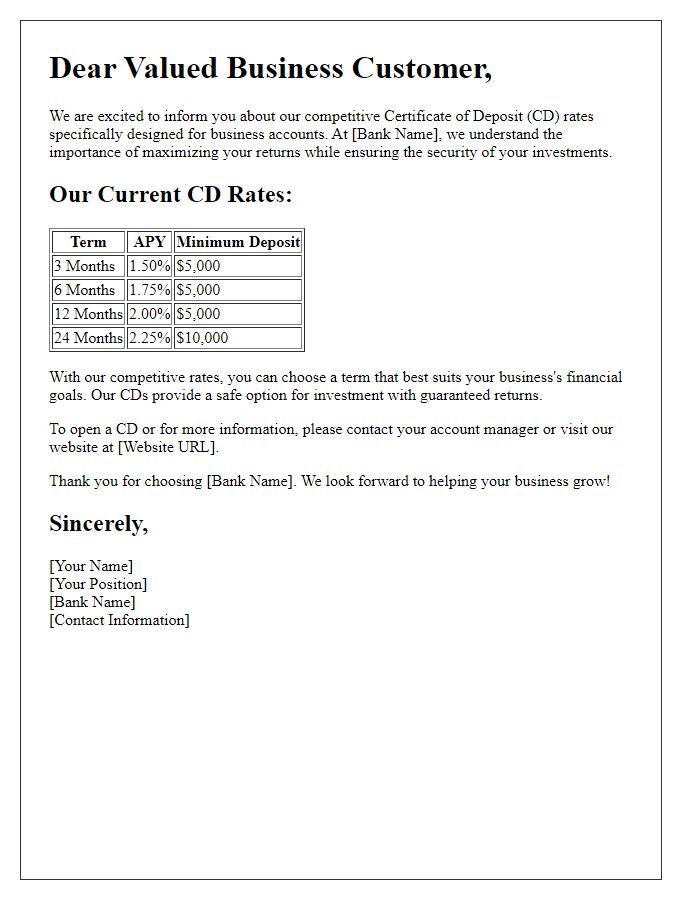

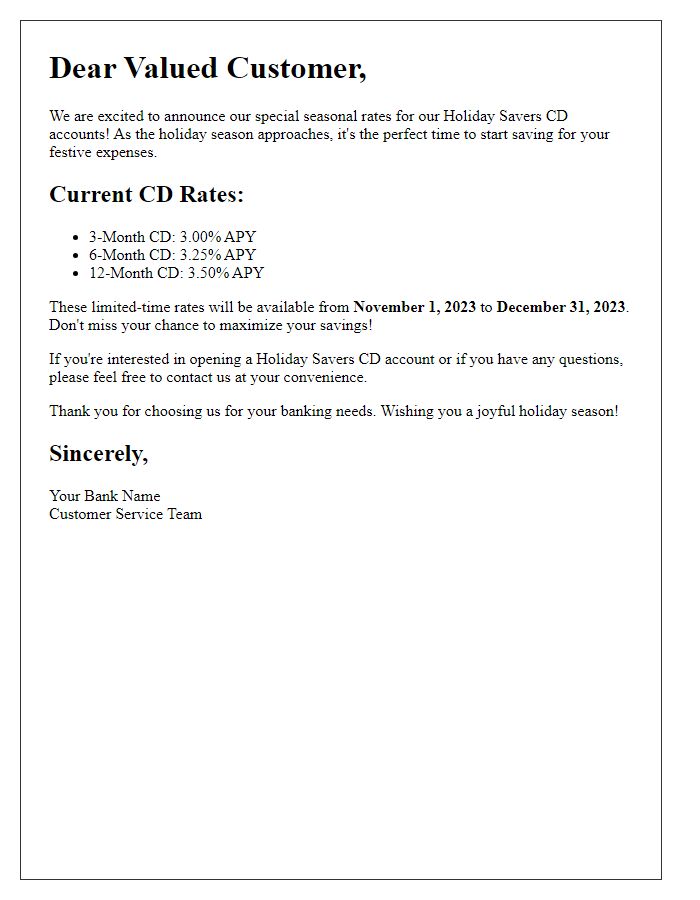

Promotional Certificate of Deposit (CD) account rates attract investors seeking secure savings options. Current rates for 12-month CDs can reach up to 3.50% Annual Percentage Yield (APY), appealing to individuals looking for stable returns in a fluctuating market. Financial institutions like banks and credit unions often introduce limited-time promotions to enhance deposit growth, especially in regions experiencing increased economic activity, such as the Midwest. Comparatively, these rates offer a substantial advantage over traditional savings accounts, typically yielding below 1% APY, thus encouraging customers to make informed, strategic financial decisions today.

Clear Rate Explanation

Promotional Certificate of Deposit (CD) accounts offer attractive interest rates, typically ranging from 1.5% to 3.2% depending on the term length and bank policies. Available terms can span from 6 months to 5 years, providing flexible options for investors. For instance, a 12-month promotional CD may yield a fixed interest rate of 2.5%, allowing depositors to enjoy guaranteed returns on investments. Interest is generally compounded quarterly, enhancing overall earnings. Minimum deposit requirements often start at $500, although some banks may offer higher rates for larger deposits. Be mindful of early withdrawal penalties, which can range from 3 months to 1 year of interest, impacting overall returns if funds are accessed prematurely.

Unique Selling Proposition

Promotional Certificate of Deposit (CD) accounts offer competitive interest rates that exceed traditional savings accounts, catering to those seeking secure investment opportunities. These rates can reach as high as 5% APY for terms ranging from 6 months to 5 years, appealing to both short-term and long-term savers. With FDIC insurance covering deposits up to $250,000, customers gain peace of mind when investing their money. Additionally, flexible options such as laddering strategies allow savers to access funds while maximizing interest earnings. Some financial institutions also provide promotional bonuses for opening new accounts, creating an attractive incentive for potential clients.

Call-to-Action

Promotional CD accounts offer attractive interest rates, enticing investors looking to maximize their savings in a secure manner. Current rates, often exceeding 5 percent annual percentage yield (APY), provide a competitive edge over traditional savings accounts. Fixed terms typically range from 6 months to 5 years, allowing for flexibility based on financial goals. Institutions such as major banks and credit unions often provide these accounts, ensuring the Federal Deposit Insurance Corporation (FDIC) coverage up to $250,000 per depositor. Investors benefit from predictable returns without market risk, making this an ideal option for conservative savers seeking to enhance their financial portfolio. Take action now to secure these limited-time rates and elevate your savings strategy.

Contact Information

Promotional Certificate of Deposit (CD) account rates can vary significantly across financial institutions, often promising attractive interest rates to encourage savings. For example, a 12-month CD may offer rates as high as 4.50% APY (Annual Percentage Yield) at local banks or credit unions, including Bank of America and JPMorgan Chase. Customers should review terms associated with the accounts, such as minimum deposit requirements, penalties for early withdrawal, and compound interest frequency, as these factors can heavily impact earnings. Engaging directly with a bank's customer service (often available via phone at 1-800-555-0199) or through online platforms can facilitate inquiries about current promotional offers, ensuring informed decisions are made regarding savings strategies. In an era of fluctuating interest rates influenced by Federal Reserve policies, optimizing savings through high-yield CDs can be a strategically sound financial move.

Letter Template For Promotional Cd Account Rates Samples

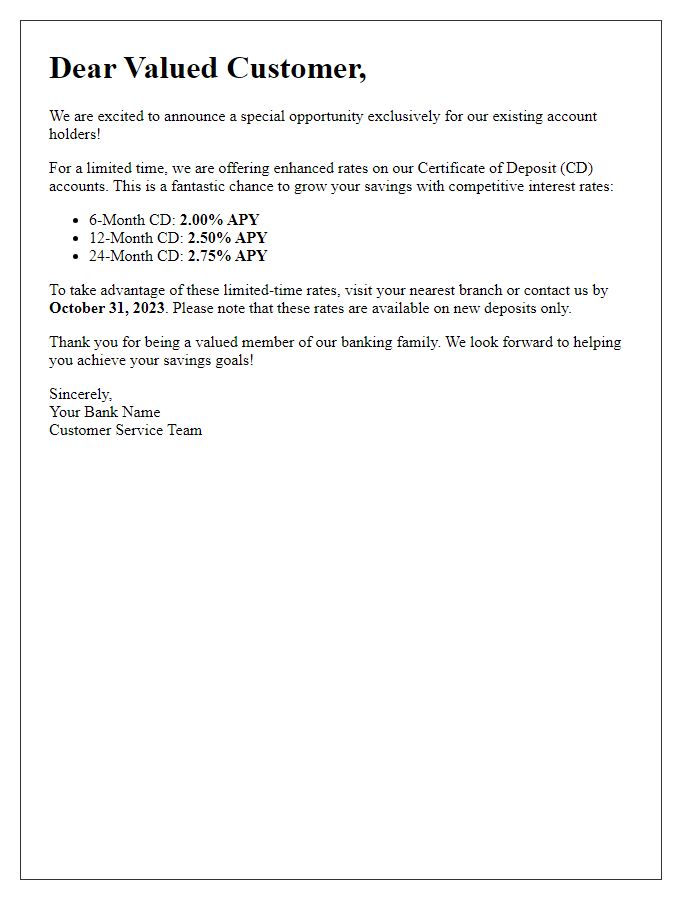

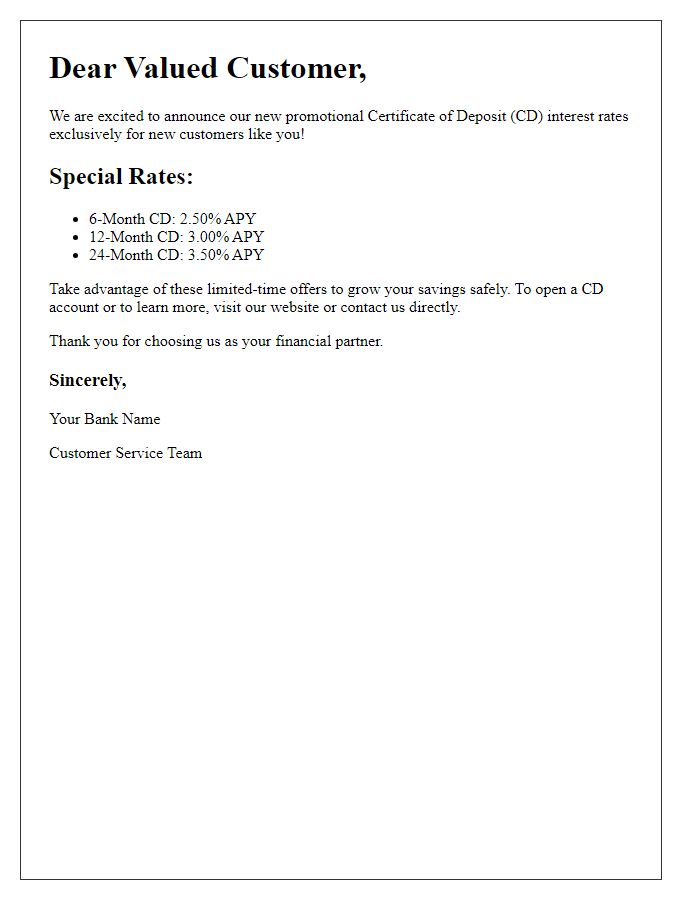

Letter template of limited-time CD account rates for existing account holders.

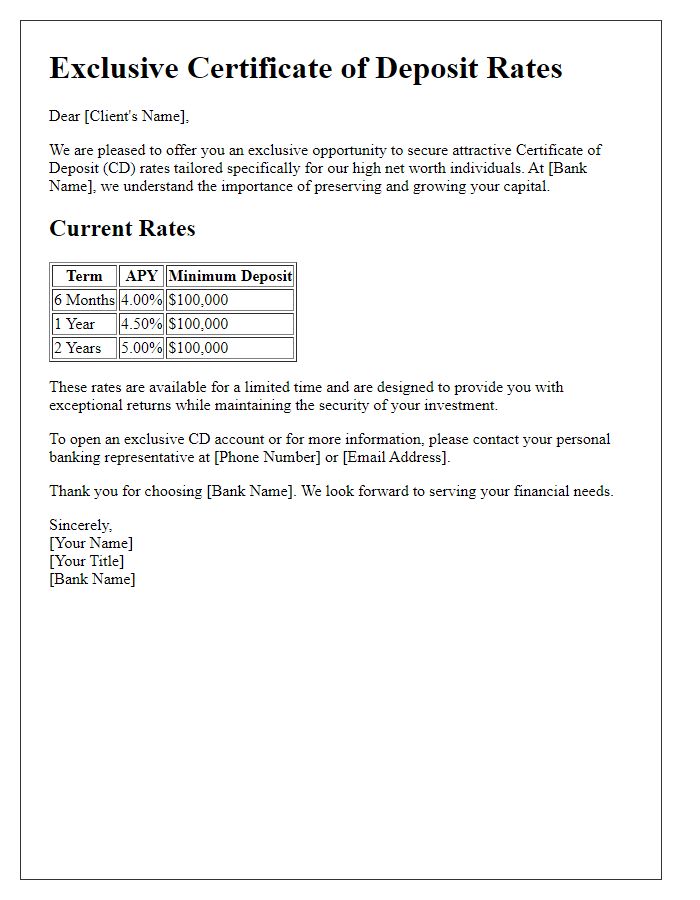

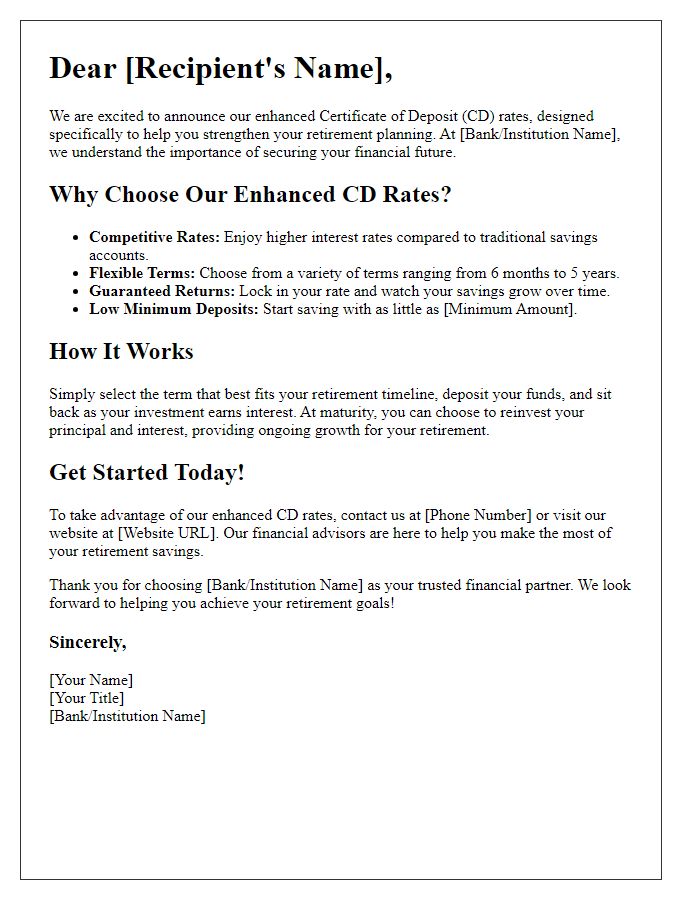

Letter template of exclusive CD account rates for high net worth individuals.

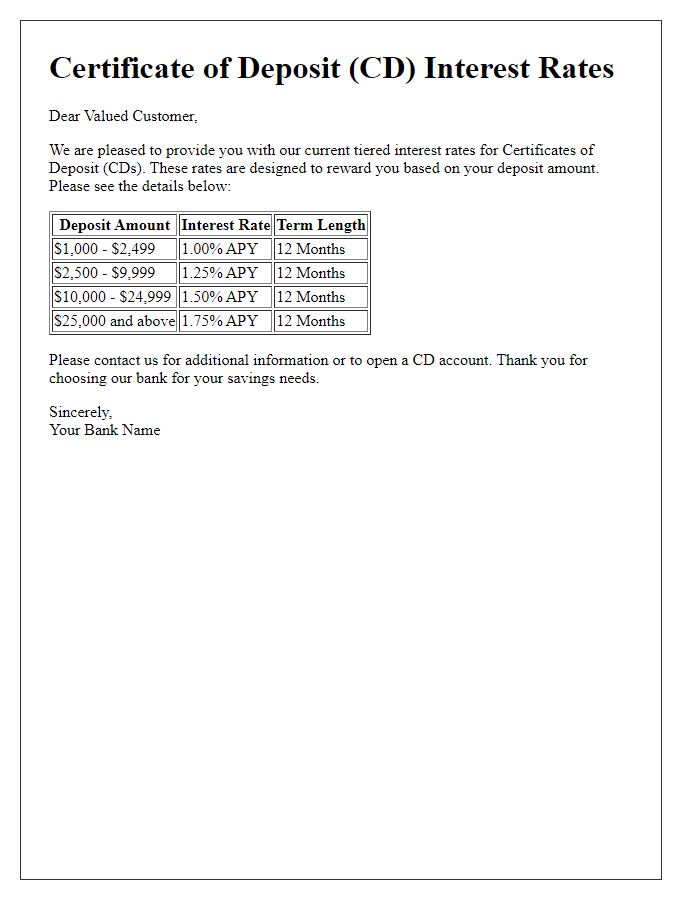

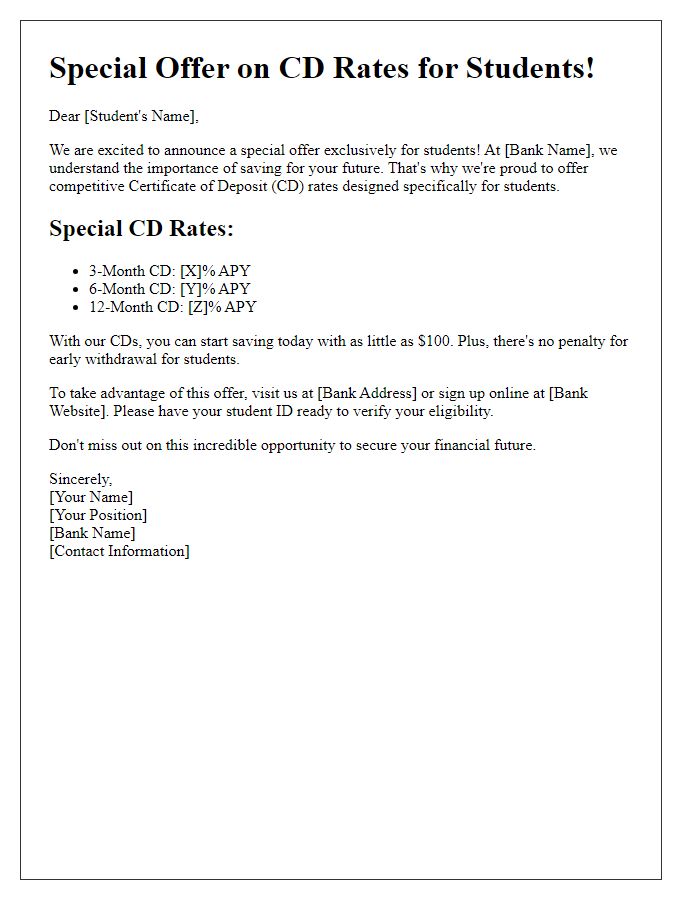

Letter template of tiered CD interest rates for various deposit amounts.

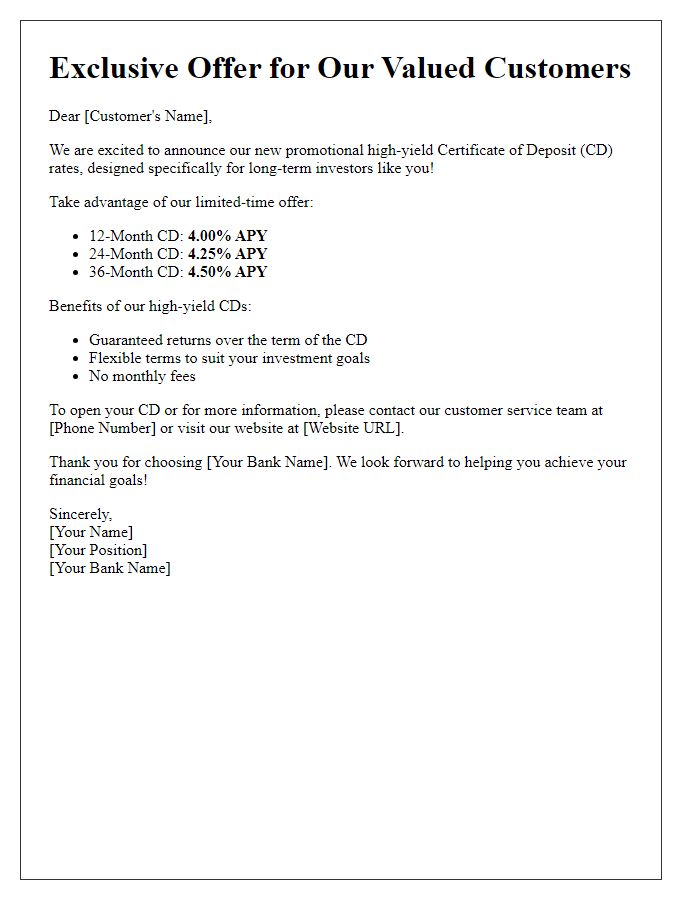

Letter template of promotional high-yield CD rates for long-term investors.

Comments