Are you considering a structured settlement but unsure about its benefits? Understanding the ins and outs of structured settlements can empower you to make informed financial decisions. In this article, we'll break down key aspects of structured settlements, including their advantages and potential drawbacks. Keep reading to discover how you can maximize your financial future!

Recipient Information

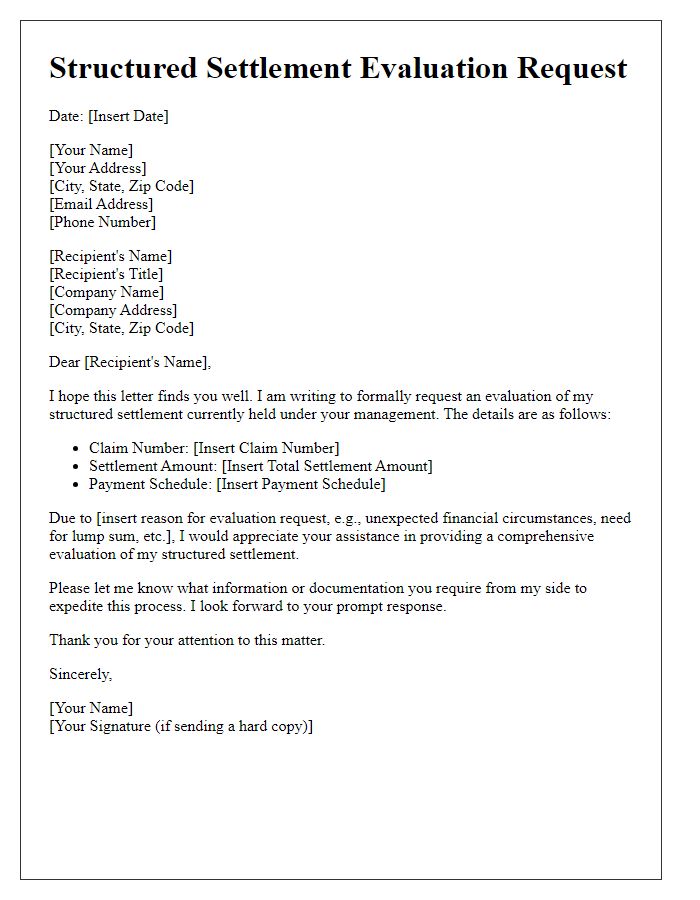

Recipient information, crucial in structured settlement analysis, encompasses the recipient's full name, such as John Doe, and complete address, including city, state, and zip code, for accurate identification and communication. Furthermore, the recipient's Social Security number is vital for financial assessments. It's essential to document the date of the settlement agreement, specifying terms and conditions agreed upon by the parties involved, along with the amount of the settlement, typically in total dollars, such as $100,000. The recipient's contact information, including phone number and email address, enables ongoing correspondence for any inquiries regarding payment schedules or changes. Understanding the recipient's background, including age and financial needs, provides context for evaluating the suitability of the structured settlement disbursement plan. Analytical tools like present value calculations offer insights into the long-term financial implications of the settlement, ensuring the recipient maximizes their financial outcome over time.

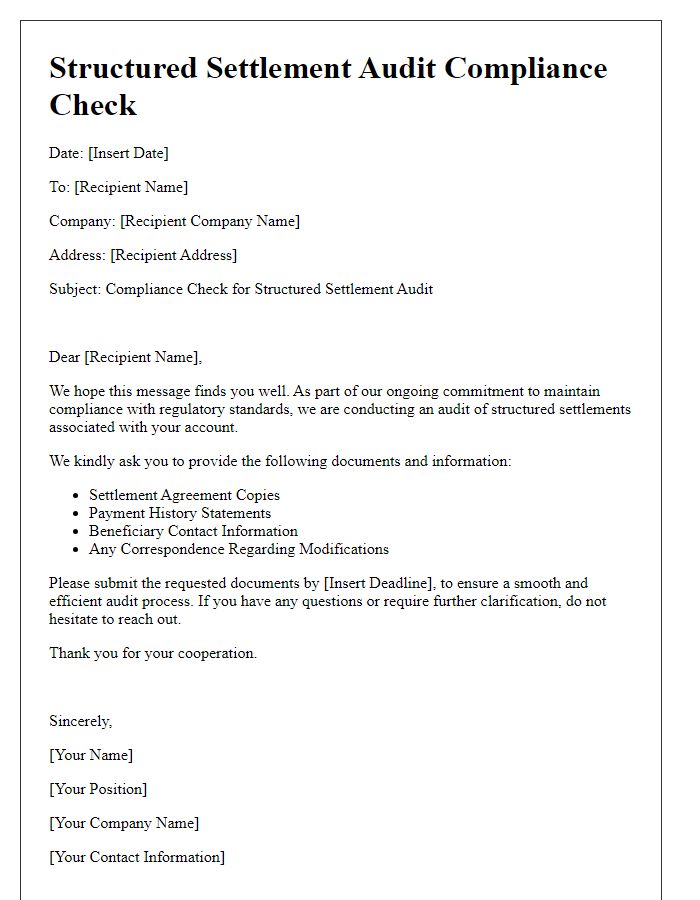

Settlement Details

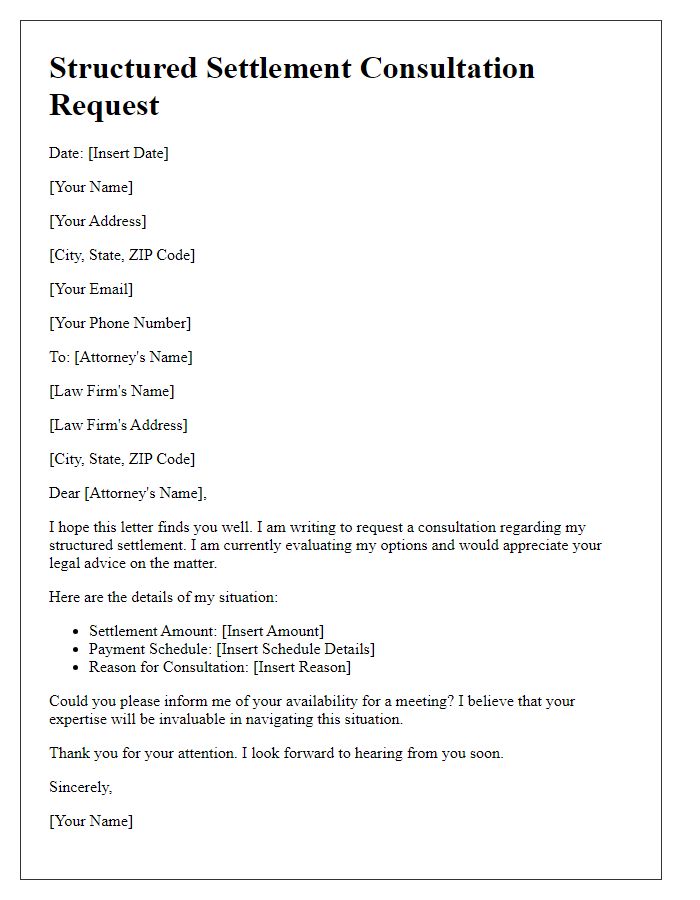

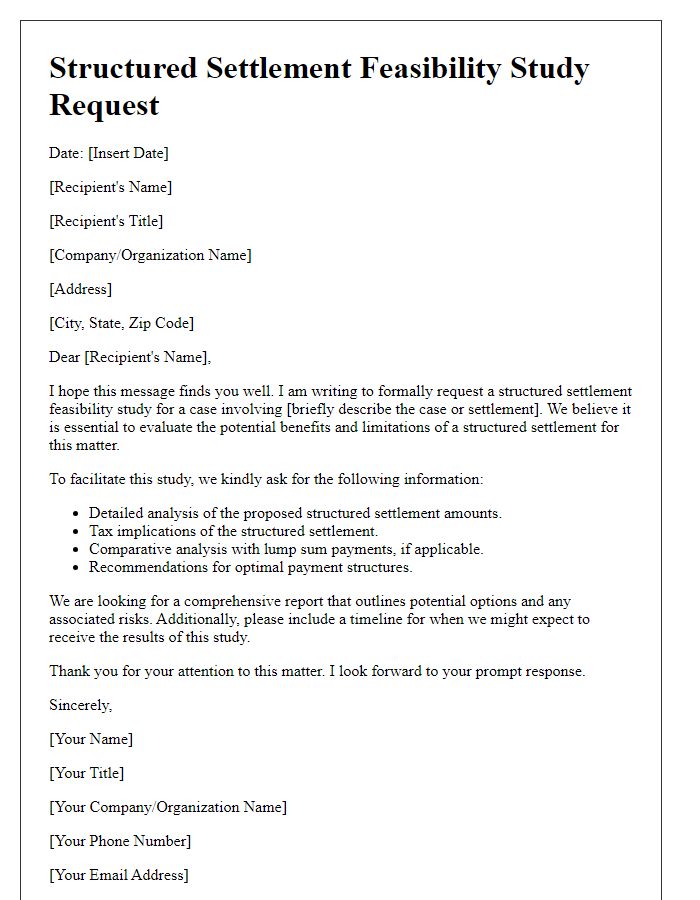

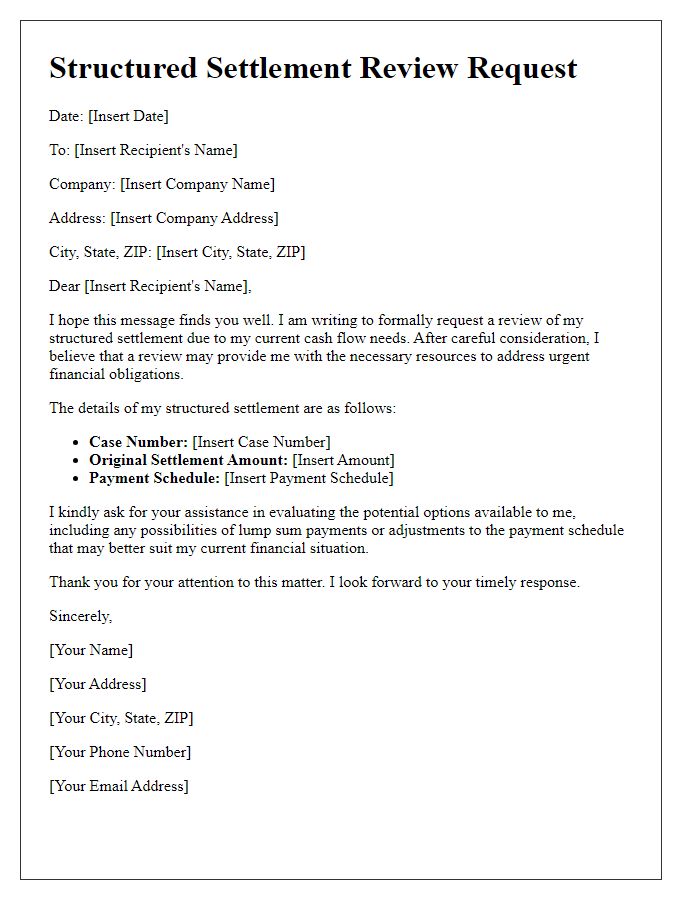

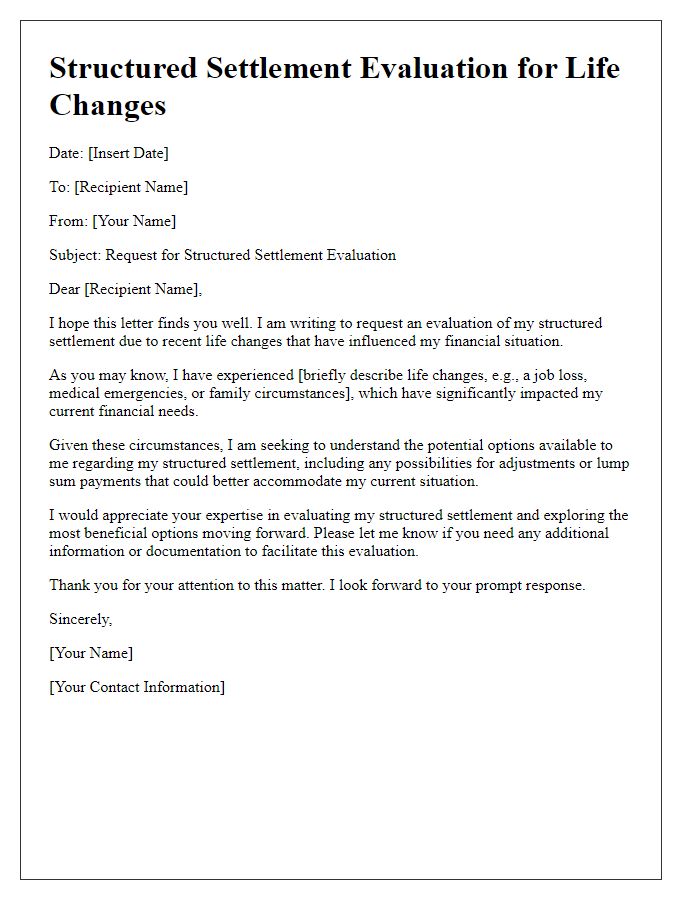

Structured settlements provide a way for individuals to receive compensation over time, particularly in cases related to personal injury or wrongful death claims. These settlements typically involve periodic payments, which can be customized to the recipient's needs. Key details include the total settlement amount, which may reach hundreds of thousands or even millions of dollars, and the schedule of payments, often spanning several years or decades. Important entities involved in structured settlements include the insurance company responsible for funding the payments, as well as the financial institution managing the annuity that guarantees future payouts. Factors such as interest rates and inflation can also significantly influence the real value of the payments over time, making careful analysis essential for recipients to understand the long-term benefits of their settlement.

Payment Structure

A structured settlement payment plan outlines the scheduled disbursements of compensation from legal cases, often related to personal injury or wrongful death claims. This financial arrangement typically includes an initial lump sum payment followed by periodic payments that can range from monthly to annual disbursements, sometimes lasting for decades, depending on the agreement's terms. Payment amounts can fluctuate based on specific events, such as reaching certain ages or experiencing life milestones like higher education attainment. Moreover, these settlements may include provisions for future medical expenses, ensuring long-term coverage for healthcare needs associated with the initial case. Such structured arrangements are often overseen by financial institutions that manage the settlement funds and ensure timely payments to the recipients.

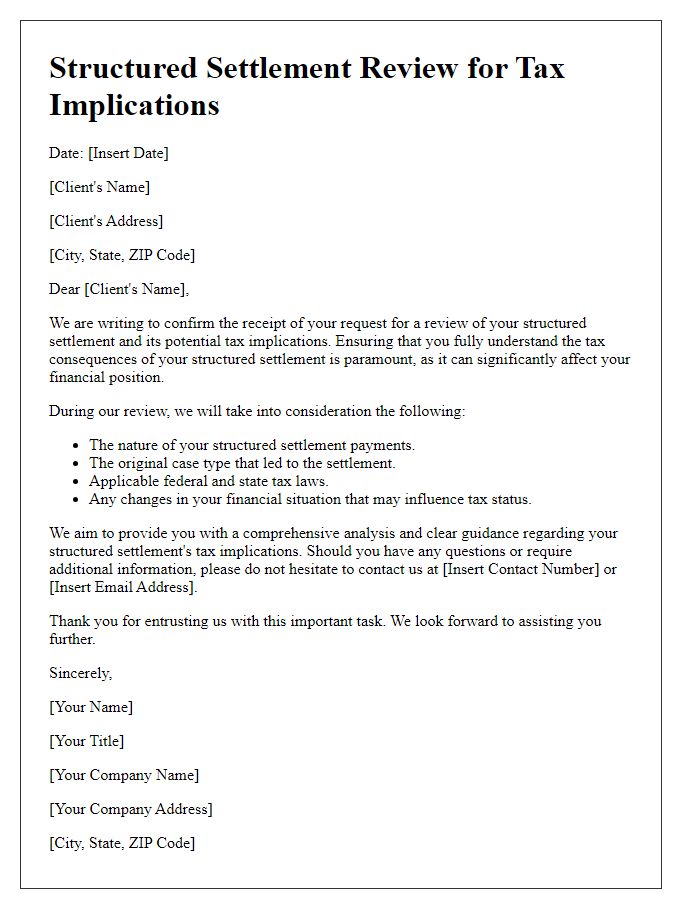

Financial Analysis

A structured settlement analysis provides a comprehensive financial assessment for individuals receiving periodic payments, typically arising from legal settlements such as personal injury cases. This financial evaluation includes quantifying the current value of future payments, applying a discount rate that reflects prevailing market conditions, like the average yield of 10-year U.S. Treasury bonds as of October 2023. It also considers tax implications, particularly the non-taxable status of structured settlement proceeds under the Internal Revenue Code, which can significantly enhance the net financial benefit for recipients. The analysis incorporates projected inflation rates, factored in at an average annualized rate of 2%, affecting the future purchasing power of the settlement payments. By comparing lump-sum payouts versus continuing distributions, clients gain insights to make informed decisions related to their financial futures.

Contact Information

A structured settlement analysis must include pertinent contact information to facilitate effective communication. Key components include the names of all parties involved (such as claimants and their legal representatives), complete mailing addresses (including city, state, and ZIP codes) for each individual or organization, phone numbers for direct communication, and email addresses for efficient correspondence. Additionally, specifying the date of contact can help establish a timeline, while including relevant identifiers like claim numbers or case references can provide context to the structured settlement analysis process. Such details ensure that all stakeholders remain informed and responsive throughout the evaluation.

Letter Template For Structured Settlement Analysis Samples

Letter template of structured settlement analysis for financial planning

Letter template of structured settlement assessment for investment options

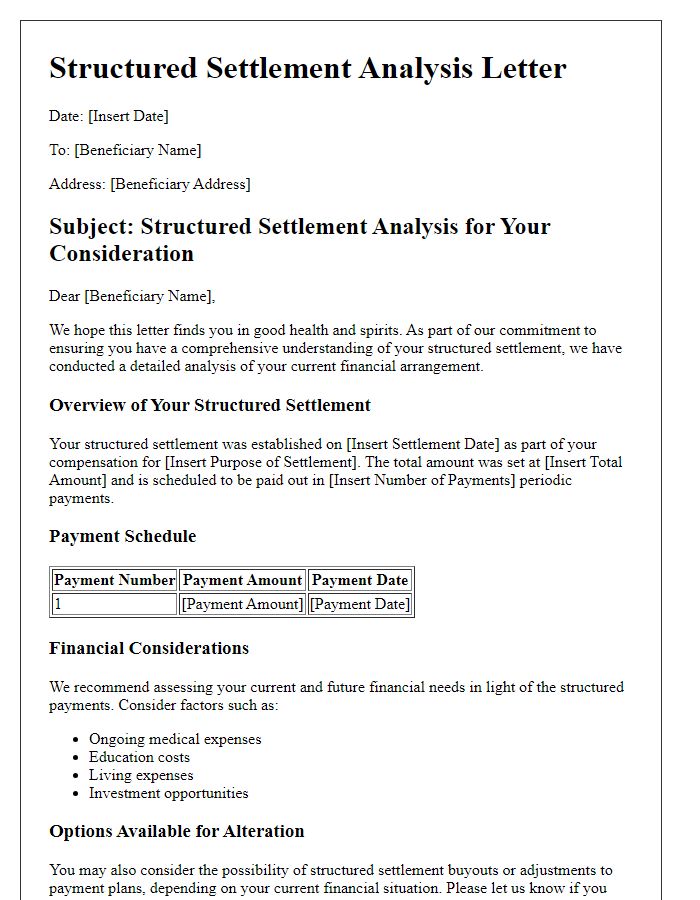

Letter template of structured settlement analysis for beneficiary considerations

Comments