Are you looking to enhance your investment strategies? Understanding risk-adjusted return analysis is crucial for evaluating the performance of your assets more accurately. This approach not only considers the returns but also accounts for the risks taken to achieve them, providing a clearer picture of investment efficacy. So, grab a cup of coffee and read on to discover how you can apply this valuable tool to optimize your portfolio!

Detailed financial metrics and ratios

Risk-adjusted return analysis evaluates the profitability of an investment, factoring in the potential risks involved. Key financial metrics such as the Sharpe Ratio, which measures excess return per unit of risk, and the Sortino Ratio, focusing only on downside risk, provide crucial insights into performance relative to volatility. The Treynor Ratio, linking return to market risk, compares an investment's excess return to its beta, quantifying sensitivity to market movements. Additional metrics include the Information Ratio, which assesses the consistency of returns against a benchmark, and Alpha, indicating performance over what is expected given the investment's level of risk. These financial ratios enable investors to make informed decisions regarding investment strategies across diverse portfolios while mitigating risk.

Market and economic environment context

The market environment in 2023 continues to be characterized by volatility and uncertainty, impacting investment strategies across various sectors. Inflation rates, currently averaging 6.5% in the United States, significantly influence consumer spending patterns and central bank policies, including potential adjustments to interest rates by the Federal Reserve. Geopolitical tensions, particularly in Eastern Europe, coupled with supply chain disruptions stemming from the COVID-19 pandemic, have exacerbated market fluctuations, impacting commodities such as oil and natural gas. Additionally, the technology sector faces regulatory scrutiny as governments worldwide grapple with data privacy issues and antitrust laws, potentially affecting innovation and growth trajectories. These factors collectively shape risk-adjusted return expectations, as investors seek to navigate through complex economic landscapes while striving for optimal portfolio performance.

Portfolio diversification and asset allocation

Risk-adjusted return analysis is crucial for evaluating the performance of an investment portfolio, specifically regarding portfolio diversification and asset allocation strategies. Diversification, through including a variety of asset classes such as equities (stocks), fixed income (bonds), real estate, and alternative investments, aims to reduce unsystematic risk. Asset allocation involves the distribution of investments across these classes to optimize returns while minimizing exposure to risk. Metrics like the Sharpe Ratio and Sortino Ratio are used to measure risk-adjusted returns, allowing investors to assess the effectiveness of their strategies over time. An ideal diversified portfolio considers factors such as market conditions, correlation between assets, and individual risk tolerance, ultimately leading to sustainable growth and stability in an investor's financial journey.

Historic performance comparison

Historic performance comparison of investment portfolios plays a crucial role in risk-adjusted return analysis. Portfolios, such as Standard & Poor's 500 (S&P 500) and Dow Jones Industrial Average (DJIA), showcase annualized returns over various timeframes, including 1-year, 5-year, and 10-year intervals. For instance, the S&P 500 recorded an average annual return of approximately 14.3% over the past decade (2013-2023). Metrics like Sharpe ratio, which measures excess return per unit of risk, provide insights into performance adjustments based on volatility. Historical drawdowns, significant drops in portfolio value, are also vital, highlighting maximum declines during market downturns, such as the 2008 financial crisis, wherein the S&P 500 experienced a plunge exceeding 50%. Understanding these performance metrics assists investors in evaluating their portfolios' efficiency in generating returns relative to their risk exposure, fostering informed investment decisions.

Risk management strategies and compliance

Risk management strategies serve as essential frameworks to identify, assess, and mitigate potential losses in financial investments. Compliance refers to adherence to regulatory requirements, industry standards, and internal policies governing risk management practices. In the context of risk-adjusted return analysis, methods such as Value at Risk (VaR), Stress Testing, and Scenario Analysis quantify potential losses under various adverse conditions. Effective strategies may involve diversification across asset classes, use of derivatives for hedging, and maintaining adequate capital reserves to buffer against market volatility. Constant monitoring of compliance metrics ensures alignment with the evolving regulatory landscape, including regulations set forth by the Securities and Exchange Commission (SEC) and the Basel III accord guidelines for banking institutions. This holistic approach not only safeguards investments but also enhances the overall risk-return profile, leading to more informed decision-making.

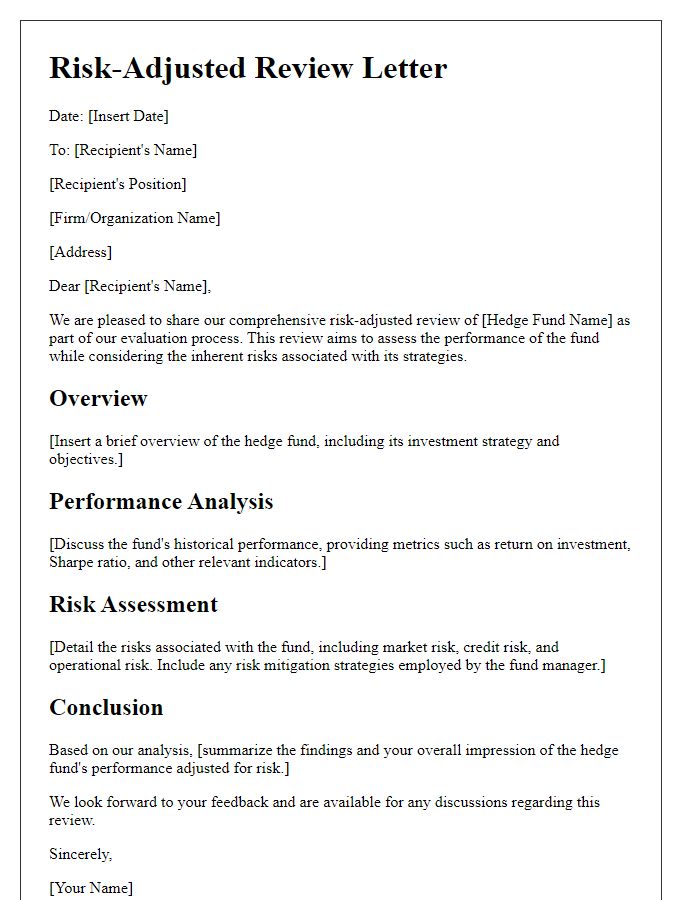

Letter Template For Risk-Adjusted Return Analysis Samples

Letter template of risk-adjusted return evaluation for investment portfolios.

Letter template of risk-adjusted performance assessment for financial strategies.

Letter template of risk-adjusted return calculation for fund management.

Letter template of risk-adjusted return summary for stakeholder reports.

Letter template of risk-adjusted performance metrics for financial advisors.

Letter template of risk-adjusted return findings for compliance purposes.

Letter template of risk-adjusted return strategy discussion for team meetings.

Comments