Are you curious about how well your stock portfolio is performing? Understanding your investments is crucial in today's fast-paced market, and a thorough assessment can provide valuable insights. In this article, we'll delve into the key components of a stock portfolio evaluation and share tips to enhance your investment strategy. So, grab a cup of coffee and let's explore the world of stock assessments together!

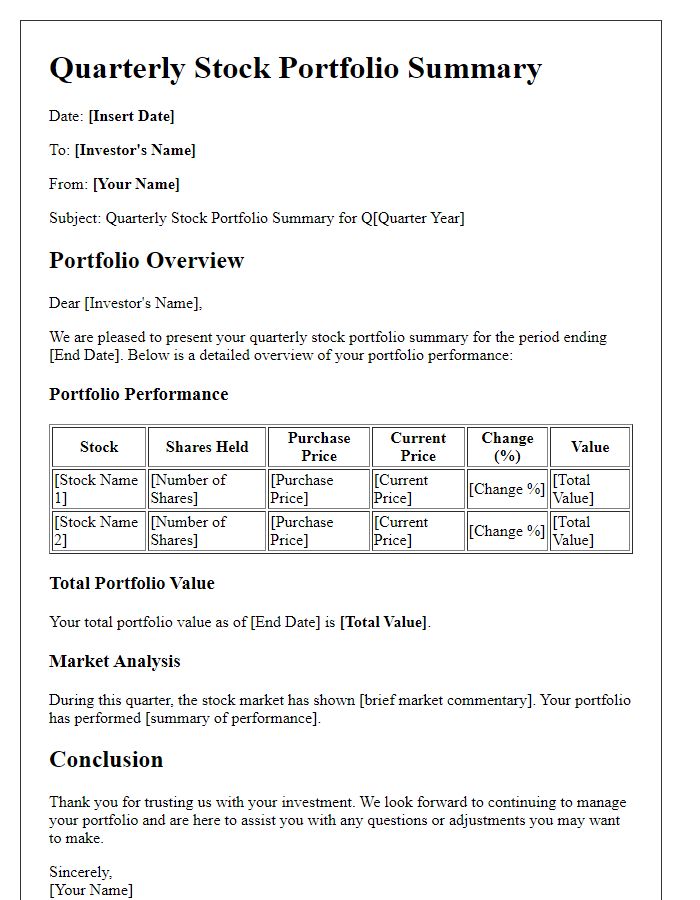

Portfolio Performance Analysis

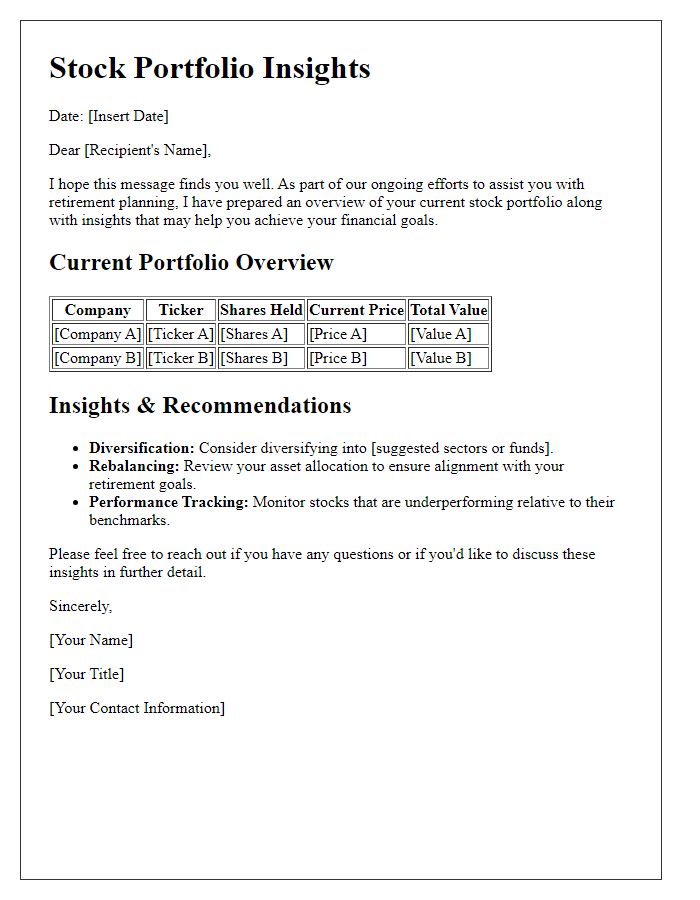

A stock portfolio assessment provides a thorough analysis of investment performance within a specified timeframe, such as one year, while focusing on key metrics like annualized return, volatility, and sector allocation. An assessment typically includes performance benchmarks like the S&P 500 (considered a standard market performance indicator). Critical entities involved in this assessment may include individual stocks, such as Apple Inc. with a current market capitalization exceeding $2 trillion, and ETFs like the Vanguard Total Stock Market ETF, which tracks the performance of the broader U.S. equity market. Additionally, evaluating risk factors across sectors like technology, healthcare, and consumer goods equips investors with insights into potential vulnerabilities and diversification strategies. Performance comparisons against peer portfolios provide context, assisting investors in understanding relative success and areas for improvement in achieving financial goals.

Risk Assessment and Management

Conducting a risk assessment for a stock portfolio, particularly one comprising diverse equities from various industries such as technology, healthcare, and renewable energy, is essential for financial stability. The analysis includes evaluating market volatility, with historical data indicating fluctuations of over 20% in specific sectors like biotechnology, impacting investor sentiment. Risk management strategies, such as diversification across low-correlation assets like international stocks or bonds, can mitigate potential losses. Additionally, using tools such as stop-loss orders to limit downside risk, and conducting regular portfolio reviews, ensure alignment with investment goals. An understanding of macroeconomic factors, including inflation rates and interest rate changes governed by institutions like the Federal Reserve, further enhances portfolio resilience.

Market Trends and Projections

In 2023, stock portfolio assessments are heavily influenced by changing market trends, reflecting fluctuations in major indices such as the S&P 500 and Dow Jones Industrial Average. Investor sentiment is shaped by key events, including Federal Reserve interest rate decisions and ongoing geopolitical tensions, such as the Russia-Ukraine conflict. Sector performance varies, with technology stocks, particularly those in AI and cloud computing, showing significant growth projections, while energy stocks fluctuate due to volatile oil prices. Economic indicators, including unemployment rates and inflation (currently at approximately 3.7% annually), further inform investment strategies. Analysts recommend diversification across emerging markets in Asia, especially in China and India, to capture growth opportunities while managing risks associated with established markets. Regular portfolio rebalancing is essential to optimize returns based on these trends and projections.

Investment Objectives Alignment

A stock portfolio assessment is crucial for evaluating how well current investments align with individual investment objectives, which may include growth, income generation, or capital preservation. Analyzing specific stocks, such as technology giants Apple and Microsoft, can reveal whether these align with an aggressive growth strategy targeting high returns over a five to ten-year horizon. Additionally, dividend-paying stocks like Johnson & Johnson and Procter & Gamble can illustrate alignment with income generation goals for investors seeking steady cash flow. Portfolio diversification metrics should also be reviewed, considering the balance among sectors like healthcare, consumer goods, and technology to manage risk effectively. Tools such as risk assessment matrices and performance comparison charts can provide insights into historical performance and potential future returns, ensuring that the investment strategy remains sound and compliant with individual financial objectives.

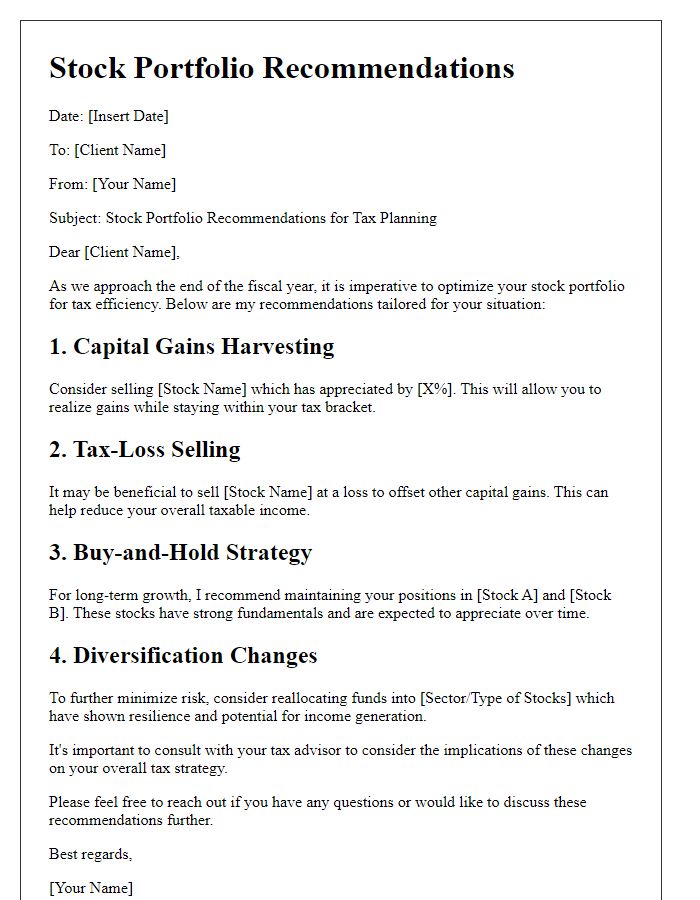

Recommendations and Strategic Adjustments

A stock portfolio assessment encompasses an analysis of the various investments within a financial portfolio to evaluate performance and make informed recommendations. Key metrics such as return on investment (ROI), risk levels, and sector performance need to be examined comprehensively. For example, high-performing sectors like technology witnessed an average ROI of 15% in 2022, while energy sectors fluctuated with an ROI as low as 2%. Identifying underperforming stocks, such as those in retail struggling against e-commerce giants, allows for strategic adjustments. Diversification is crucial; consider reallocating funds towards emerging markets, such as Southeast Asia, which showed an increased growth potential of 5% to 7% in contrast to stagnant developed markets. Additionally, incorporating ETFs (Exchange-Traded Funds) can help mitigate risks associated with individual stocks, providing broader market exposure. Timely adjustments may include setting stop-loss orders to protect gains and re-evaluating investment objectives every quarter.

Letter Template For Stock Portfolio Assessment Samples

Letter template of stock portfolio adjustment suggestions for diversification

Comments