Are you thinking about your retirement and feeling a bit overwhelmed? You're not alone! Many people find it challenging to navigate the complexities of retirement planning, from managing savings to understanding social security benefits. Let's dive into some essential tips and strategies that can help you feel more prepared and confident about your futureâread on to discover the crucial steps you need to take for a secure retirement!

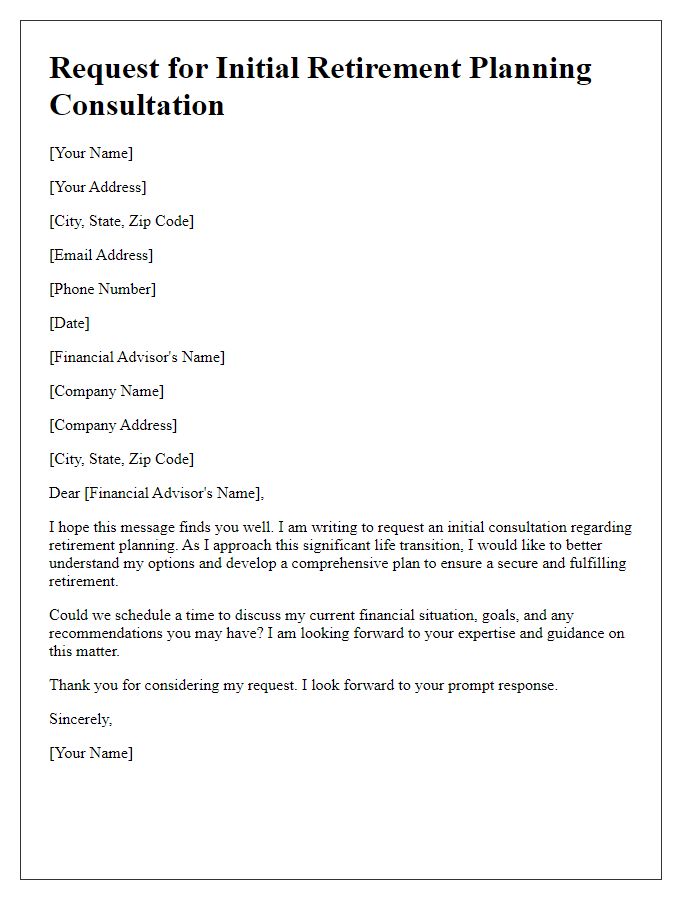

Personalization and Addressee Information

Retirement planning consultations require personalized advice tailored to individual circumstances and financial goals. Understanding specific needs is crucial. Factors such as retirement age, desired lifestyle, and projected expenses influence strategy development. Key documents include income statements, investment portfolios, and social security projections. Notable financial elements include 401(k) plans, IRAs, and potential pension payouts. Consulting with certified financial planners ensures guidance through complex retirement regulations, maximizing benefits such as tax advantages and healthcare options. Personalized investment strategies can enhance retirement security, adapting as market conditions change and life events occur.

Clear Purpose Statement

A retirement planning consultation serves a clear purpose of equipping individuals with the necessary tools and knowledge to achieve financial security during their retirement years. This process involves assessing personal financial statuses, such as income, savings, investments, and pensions, while identifying goals for retirement lifestyle, including travel, hobbies, and living arrangements. Expert advisors provide insights into various retirement accounts, like 401(k)s and IRAs, and discuss strategies for maximizing social security benefits, healthcare costs (including Medicare options), and estate planning considerations. Engaging in this consultation can empower individuals to make informed decisions, aligning their financial resources with their envisioned retirement journey.

Detailed Service Description

Retirement planning consultations provide individuals with comprehensive strategies to secure financial stability post-employment. These services typically include personalized assessments of current financial health, consideration of assets such as retirement accounts like 401(k)s and IRA savings, and evaluation of anticipated expenses including healthcare and living costs in retirement. Expert advisors utilize tools such as cash flow projections and tax optimization techniques to maximize savings and minimize tax liabilities, ensuring a sustainable income stream throughout retirement years, often projected over 20 to 30 years. This planning often includes discussions surrounding Social Security benefits and potential pension payouts from employers, alongside investment strategies to mitigate risks associated with market fluctuations. Regular updates and adjustments to the plan incorporate changes in individual circumstances or economic conditions, ensuring a robust retirement strategy tailored to specific goals, lifestyle expectations, and retirement dates.

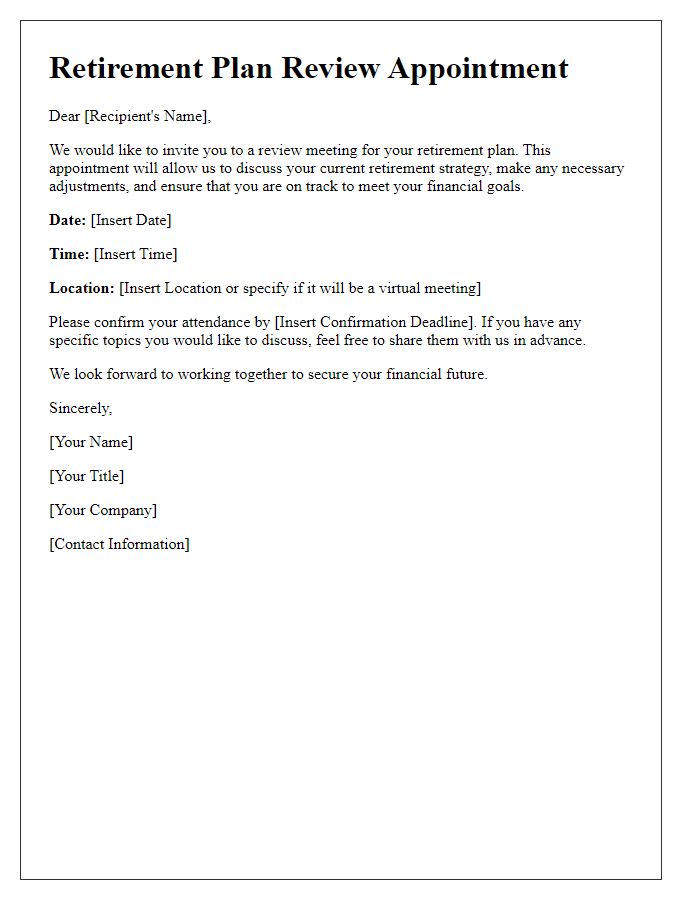

Call to Action and Appointment Scheduling

Retirement planning is essential for ensuring financial stability during the golden years. Individuals, especially those aged 50 and above, face unique challenges such as rising healthcare costs, fluctuating market conditions, and longevity risk. Engaging with a certified financial planner, particularly one with expertise in retirement strategies, can provide valuable insights into investment allocations, such as diversified funds or annuities, and social security optimization. Scheduling a detailed consultation helps assess current savings, ascertain retirement goals, and develop a tailored plan focusing on security, income streams, and estate planning. Taking proactive steps now empowers individuals to achieve a comfortable and secure retirement.

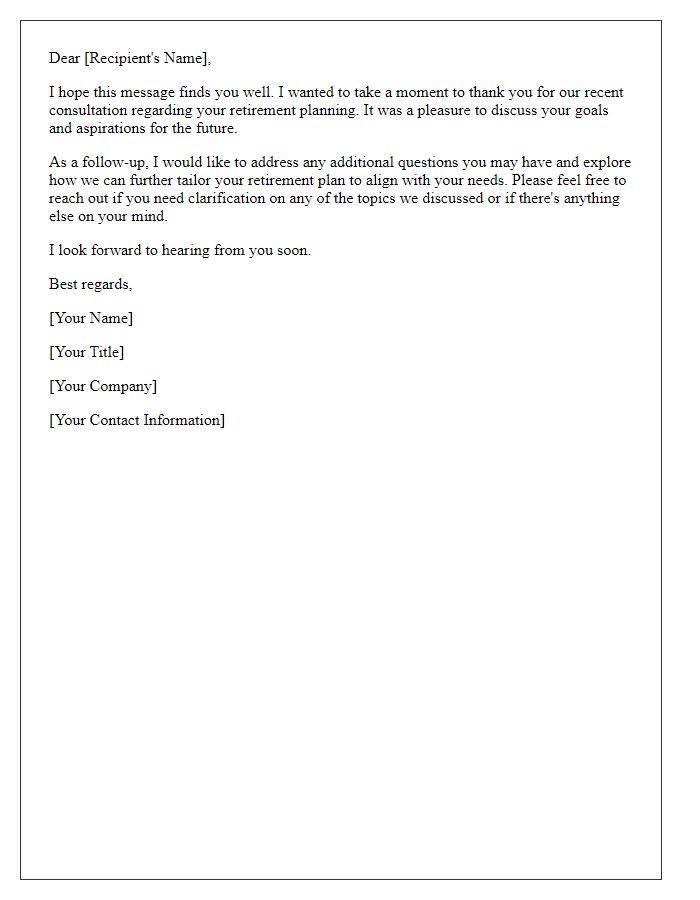

Professional Closing and Contact Information

Retirement planning consultations provide individuals the opportunity to organize their financial future effectively. Skilled professionals assess clients' current financial status, including assets, liabilities, and investments, to devise personalized strategies. During these consultations, essential tools like retirement accounts (such as 401(k) plans or IRAs), investment portfolios, and budgeting methods are discussed. Key milestones, such as Medicare eligibility at age 65 and Social Security benefits, are covered to help clients understand their options. Experts emphasize the importance of early planning, potentially during the peak earning years, to maximize savings and ensure a comfortable retirement lifestyle, enabling individuals to achieve their desired post-career activities such as travel or philanthropy.

Comments