Are you ready to take control of your financial future? Our upcoming personal finance education sessions are designed to empower you with the knowledge and skills you need to make informed decisions. Whether you're looking to budget better, save for a big purchase, or invest wisely, these sessions will provide valuable insights tailored to your needs. So, grab a cup of coffee and join us as we explore the path to financial freedomâread more to find out how you can get involved!

Audience targeting and personalization

Personal finance education sessions tailored to specific demographics can significantly enhance engagement and learning outcomes. Targeting young professionals, for instance, educates them on managing student loan debt, budgeting with entry-level salaries, and building credit scores in urban centers like New York or San Francisco. Mid-career individuals, particularly parents in suburbs like Arlington, Virginia, may benefit from strategies on saving for children's college tuition and retirement planning amid rising living costs. Retirees, especially those in states such as Florida, focus on understanding Social Security benefits and managing healthcare expenses. Personalized content ensures attendees connect with the material, leading to improved financial literacy and better decision-making outcomes.

Clear objectives and outcomes

Personal finance education sessions aim to empower individuals with essential financial knowledge and skills. Key objectives include understanding budgeting, saving strategies, debt management, and investment fundamentals. Participants will learn to create effective budgets using tools like spreadsheets or apps, identify savings goals, and explore various types of debt, such as credit card debt and student loans. Additionally, sessions will cover investment basics, including stocks, bonds, and mutual funds, enabling attendees to make informed decisions. Measurable outcomes consist of participants creating personalized budget plans, establishing emergency savings funds, and demonstrating the ability to assess investment options based on risk tolerance and financial goals. These sessions contribute to building long-term financial literacy and stability within the community.

Engaging and concise language

Personal finance education sessions play a crucial role in enhancing financial literacy, equipping individuals with essential skills and knowledge. Participants explore topics such as budgeting, savings strategies, and investment options, enabling informed decision-making. Interactive activities foster engagement, allowing attendees to practice real-life scenarios, while expert facilitators share valuable insights. The sessions also address debt management and credit scores, empowering individuals to achieve financial goals. With a focus on practical tools and resources, these educational events serve as a stepping stone towards financial independence and economic resilience.

Call-to-action and follow-up details

Personal finance education sessions offer essential insights into managing budgets, understanding credit scores, and investing wisely for future financial stability. Attendees will learn about key concepts such as interest rates (e.g., average credit card rates around 18% in the US), debt management strategies, and the importance of emergency funds (ideally three to six months of expenses). Participants will engage in interactive discussions and case studies to enhance understanding of financial tools and resources. Follow-up sessions will occur bi-weekly to reinforce learning and address questions, providing ongoing support for practical financial decision-making. Registrants are encouraged to bring personal finance questions to these sessions for tailored advice.

Professional layout and contact information

Personal finance education sessions aim to empower individuals with essential money management skills to improve financial literacy. Participants will gain insights into budgeting techniques, debt management strategies, and investment fundamentals. These sessions are tailored to various age groups, from high school students in urban areas to working adults seeking retirement planning knowledge. The facilitator, a certified financial planner with over ten years of experience, will leverage real-life case studies and interactive activities to engage attendees. Key topics include understanding credit scores, navigating savings accounts, and exploring different investment vehicles such as stocks and bonds. Educational sessions are typically held in community centers, libraries, or schools, creating accessible environments for all individuals seeking financial growth.

Letter Template For Personal Finance Education Sessions Samples

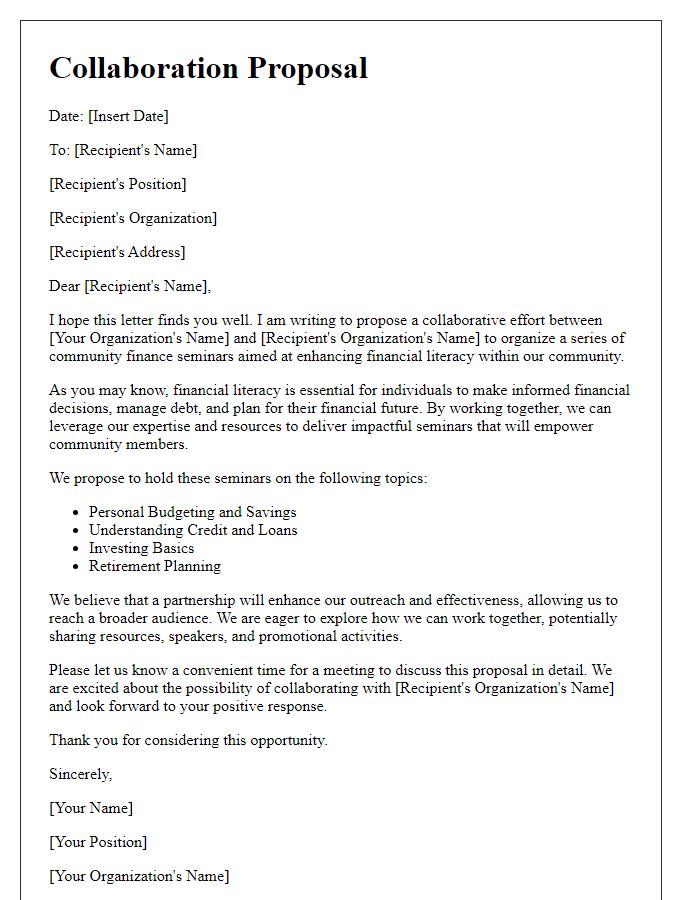

Letter template of collaboration proposal for community finance seminars

Comments