Are you looking to maximize your investment returns? A dividend reinvestment strategy could be the key to growing your wealth over time without even lifting a finger. By reinvesting your dividends back into your portfolio, you can harness the power of compounding to increase your holdings significantly. Join us as we delve deeper into the benefits of this approach and explore how you can implement it effectively!

Purpose and Objective of Reinvestment

The dividend reinvestment strategy enhances long-term wealth accumulation through compound interest effects. Regular dividends, collected quarterly from investment in blue-chip stocks or mutual funds, can be automatically reinvested to purchase additional shares or units. This approach leverages the power of compounding, making it possible for investors to benefit from both capital appreciation of the stock and the income generated from dividends. For instance, in the case of a company with an annual dividend yield of 4% and a steady growth rate of 10%, reinvesting dividends can significantly increase overall returns over a decade. Key benefits include dollar-cost averaging, minimizing transaction costs, and potentially increasing the investor's ownership stake in profitable companies over time. This strategic reinvestment ultimately aligns with the objective of creating a robust, self-sustaining investment portfolio capable of weathering market volatility while reaching financial goals.

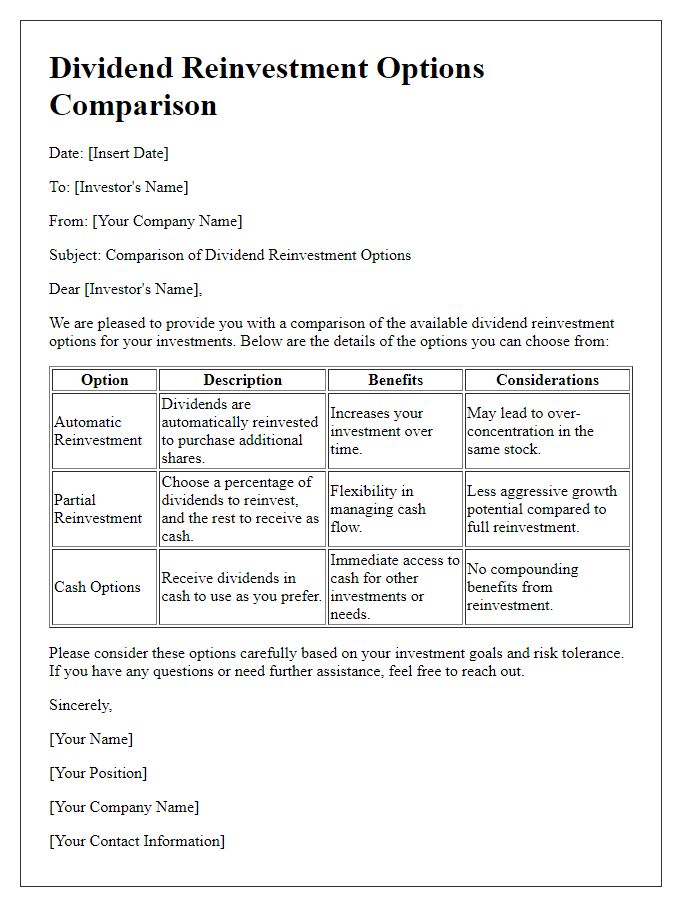

Dividend Reinvestment Options

Dividend reinvestment strategies allow investors to automatically reinvest dividends earned from stocks into additional shares, enhancing portfolio growth without incurring transaction fees. Many companies, particularly in sectors such as utilities or consumer goods, offer Dividend Reinvestment Plans (DRIPs) that enable shareholders to purchase shares at a discount, typically between 1% to 5% off the market price. This strategy can significantly compound returns over time, leveraging the power of dividend growth. Historical performance data shows that companies such as Coca-Cola and Procter & Gamble have consistently increased their dividends over decades, illustrating the potential benefits of DRIPs. Investors interested in maximizing their returns should review the terms of specific DRIP offerings and consider their long-term investment objectives alongside their current financial standing.

Benefits and Potential Risks

Dividend reinvestment strategies offer investors the opportunity to use dividends from stocks to purchase additional shares automatically, enhancing long-term wealth accumulation. This approach benefits from the power of compound growth, where reinvested dividends generate their own earnings, leading to exponential growth over time. Investors often utilize plans offered by companies, such as direct stock purchase plans (DSPPs), which may allow for purchasing shares without brokerage fees. However, potential risks include market volatility, which can affect share prices and overall returns. Additionally, reliance on specific companies for dividends could pose risks if a company reduces or eliminates its dividend payout, impacting the overall investment strategy. Diversification remains crucial to mitigate concentrated risks associated with specific stocks or sectors. Regular monitoring of financial performance indicators and market conditions is advisable to optimize the reinvestment strategy's effectiveness.

Instructions for Enrollment

Dividend reinvestment strategies enable investors to enhance portfolio growth by automatically reinvesting dividends. To enroll, navigate to your investment platform, such as Charles Schwab or Fidelity, and locate the dividend reinvestment option within your account settings. Specific eligibility criteria may vary--often requiring you to hold shares in qualified companies, like Coca-Cola Co. or Johnson & Johnson for a minimum period. After selecting the option, confirm your preference for reinvesting dividends instead of receiving cash payouts, allowing dividends to purchase additional shares or fractional shares automatically. Review terms and conditions thoroughly to understand any associated fees or restrictions. Ensure personal information, including Social Security Number or Tax ID, is accurate to prevent potential delays in transactions.

Contact Information for Further Inquiries

Dividend reinvestment strategies can significantly enhance long-term investment growth for shareholders, particularly through plans offered by companies such as Tesla Inc. This strategy allows investors to reinvest their dividends automatically, increasing the number of shares owned over time without incurring transaction fees. For example, a company may offer a Dividend Reinvestment Plan (DRIP) where dividends--typically declared quarterly, such as in the months of January, April, July, and October--are reinvested into purchasing additional shares. This approach capitalizes on compound growth, potentially leading to exponential increases in total shareholding. Investors seeking further details or clarification regarding enrollment or management of their DRIP can reach out to the company's investor relations department, often located in their corporate headquarters, or utilize designated support email addresses provided in official communications.

Comments