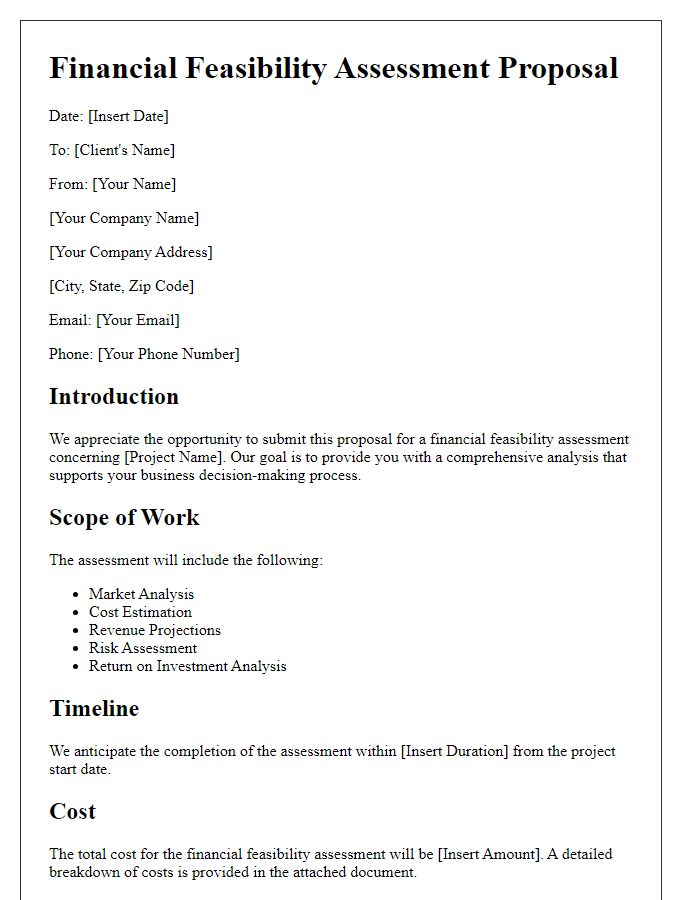

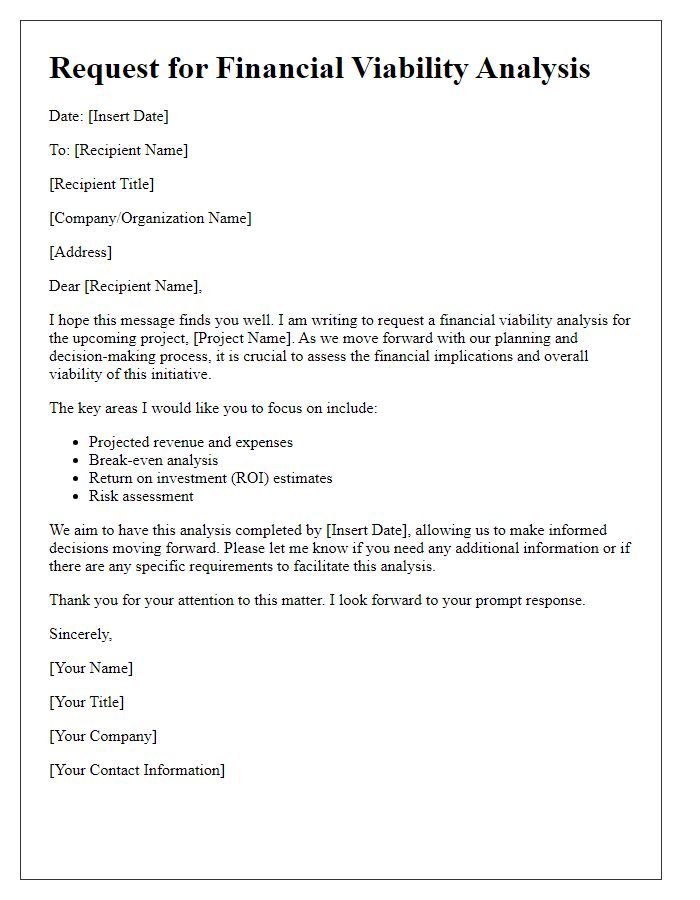

Are you contemplating a financial feasibility study for your project but unsure where to start? Crafting a well-structured letter can set the tone for clear communication with stakeholders and decision-makers. In this article, we'll explore effective letter templates that will help you convey your objectives, outline your project's financial expectations, and garner the support you need. Ready to dive deeper into this essential tool? Keep reading!

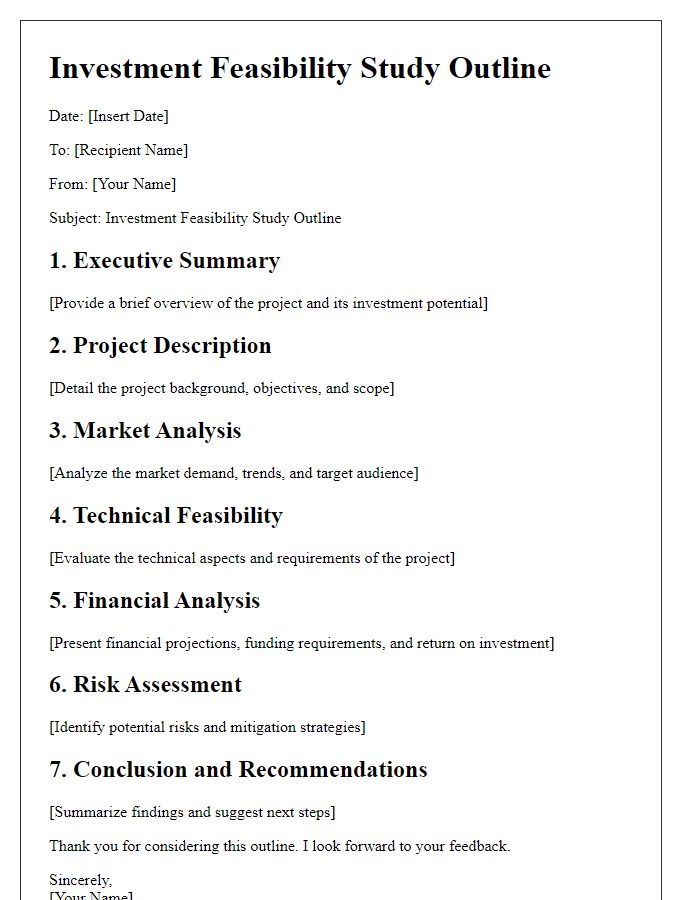

Executive Summary

A financial feasibility study provides an assessment of the viability of a proposed project or business venture (such as a new restaurant in downtown Chicago). It examines projected costs, revenues, and profitability over a specified period, typically five years. Key components include startup costs (like equipment purchase and lease deposits), operational expenses (such as salaries and utilities), and forecasted sales (based on market analysis and foot traffic). Risk factors (economic downturns or competitive pressure) are also evaluated to determine potential return on investment (ROI) and break-even point. Essential financial metrics such as net present value (NPV) and internal rate of return (IRR) are calculated to support decision-making. Reliable data sources, including industry reports and regional economic indicators, bolster the credibility of findings. The aim is to provide stakeholders, including investors and lenders, with clear insights into the financial prospects of the venture.

Market Analysis

Conducting a market analysis for a financial feasibility study involves evaluating several key factors within a targeted industry segment. The industry should be defined by specific metrics such as market size (measured in millions of dollars), growth rate (percentage over a specified period), and competitive landscape (number of key players including both established firms and emerging startups). Geographic location plays a crucial role; for instance, urban centers like New York City (with a population exceeding 8 million) may present different opportunities compared to smaller cities. Understanding consumer demographics (age, income level, and spending behaviors) will inform product development and marketing strategies. Additionally, identifying trends (such as the shift towards sustainable products) can uncover potential market gaps, leading to innovative solutions. Regulatory factors such as local, state, and federal regulations need close examination, as do economic indicators (interest rates, inflation) that may impact financial projections. An exhaustive SWOT analysis (assessing strengths, weaknesses, opportunities, and threats) of competitors will further refine the strategy and highlight potential barriers to entry.

Financial Projections

Financial projections form a critical part of any financial feasibility study, providing a detailed forecast of anticipated revenues, expenses, and profitability over a set time frame, typically three to five years. These forecasts rely on historical data, market analysis, and industry benchmarks to create realistic fiscal expectations. Key components include revenue streams, such as sales volume and pricing strategy, operating expenses, which encompass costs like rent and salaries, and capital expenditure estimates for necessary investments in infrastructure or technology. Furthermore, cash flow analysis evaluates the timing of inflows and outflows, ensuring the business maintains adequate liquidity for its operational needs. Sensitivity analyses can illustrate how various scenarios, such as changes in market demand or operational costs, would impact overall financial health, aiding stakeholders in understanding potential risks and returns. Accurate projections are essential for securing funding from investors or financial institutions, as they demonstrate the viability and sustainability of the business model over the anticipated period.

Risk Assessment

Conducting a financial feasibility study requires thorough risk assessment to identify potential challenges. Key risks involve market volatility, which can impact cash flows, especially in sectors like real estate or technology startups. Regulatory changes may affect operational costs, particularly in industries such as healthcare or renewable energy where compliance is critical. Economic downturns can significantly reduce consumer spending, influencing sales projections. Overestimation of revenues often leads to financial shortfalls. Internal risks also pose threats to project success, including management inefficiencies or lack of skilled workforce. Thorough analysis of these factors ensures that stakeholders make informed decisions regarding project viability.

Conclusion and Recommendations

A financial feasibility study, conducted for the potential investment in renewable energy projects, highlighted key insights regarding economic viability and strategic direction. The analysis revealed projected annual returns of 12% over a 20-year timeline, surpassing traditional energy sector benchmarks. Essential considerations included initial capital outlay, estimated at $3 million, and operational costs averaging $500,000 annually. Additionally, local government incentives, particularly in regions like California, offer tax credits amounting to $300,000, improving overall project attractiveness. Recommendations urge stakeholders to prioritize phased implementation, beginning with the solar farm project in Riverside, California, given its favorable sunlight exposure. Collaborating with experienced energy consultants will ensure regulatory compliance, facilitating a smoother project rollout. Ensuring robust financial planning, with a focus on cash flow management, will enhance long-term sustainability and profitability in the evolving energy landscape.

Comments