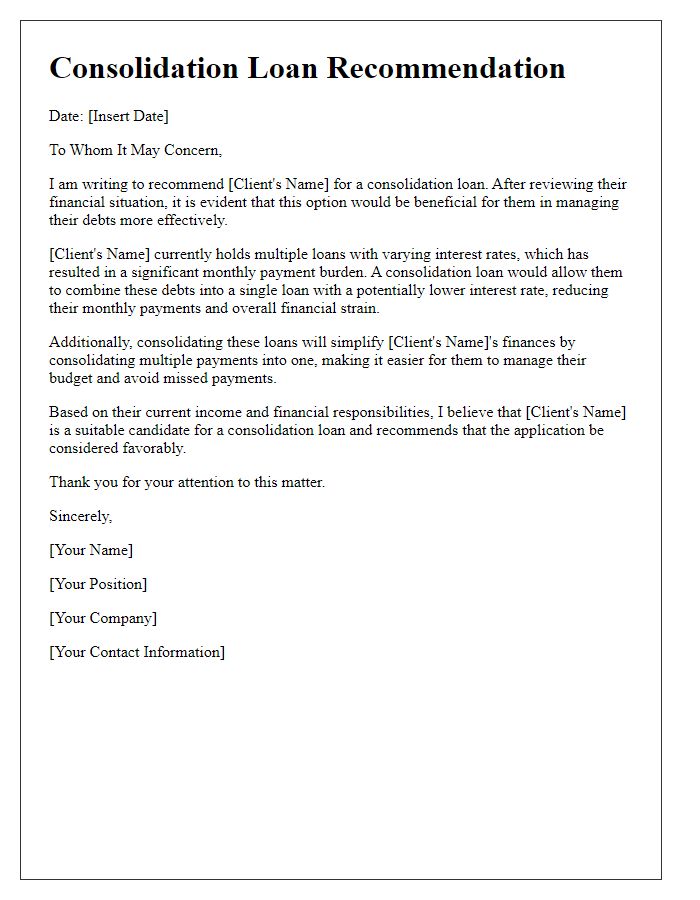

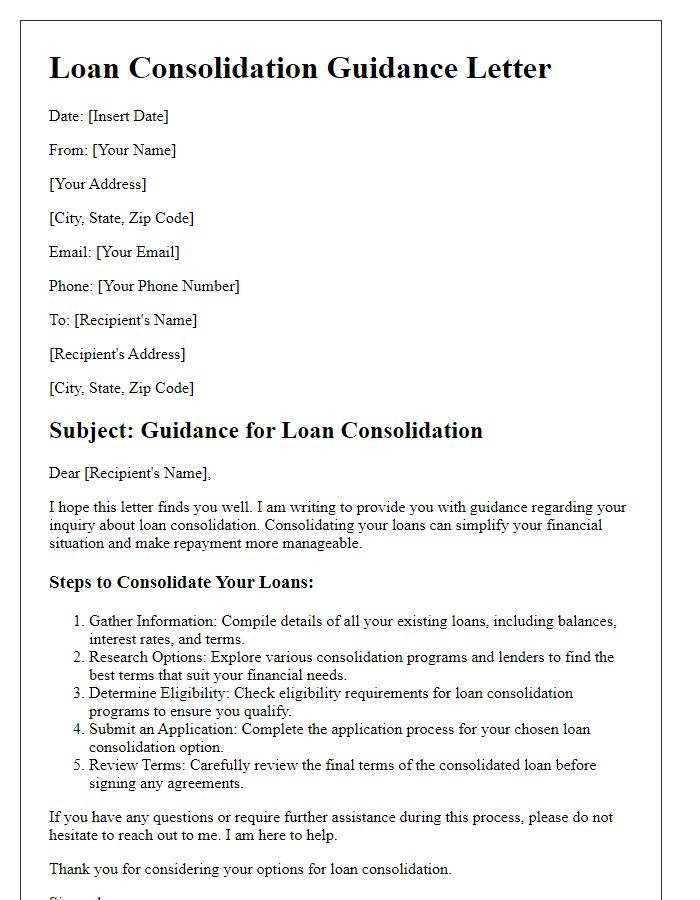

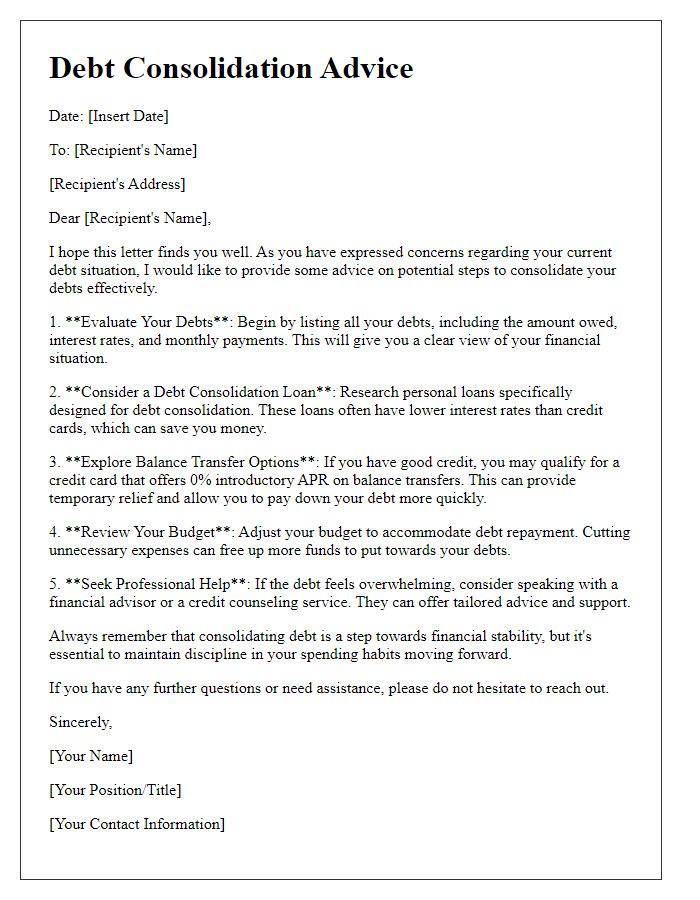

Are you feeling overwhelmed by your multiple loans and considering a consolidation loan? You're not alone; many people are seeking a way to simplify their financial obligations and lighten their monthly burdens. In this article, we'll explore the benefits of consolidation loans, how they can streamline your payments, and what to consider before taking the plunge. So, stay with us as we dive deeper into this topic and help you make an informed decision!

Loan Amount and Interest Rate

Consolidation loans can simplify financial management by combining multiple debts into a single loan. Typically, borrowers seek amounts ranging from $5,000 to $50,000, depending on their total debt. Interest rates for these loans can vary significantly, usually ranging from 4% to 36%, influenced by factors such as credit score, income, and lender policies. These loans might offer fixed or variable rates, which can impact long-term repayment costs. Additionally, many consolidation loans feature terms between 3 to 10 years, thus affecting monthly payment amounts and overall interest paid over the duration of the loan.

Repayment Terms and Conditions

Consolidation loans can significantly simplify debt management by combining multiple outstanding debts into a single loan, often at a lower interest rate. Understanding repayment terms and conditions is crucial for maintaining financial health. Typical repayment periods range from three to ten years (36 to 120 months), depending on the lender's policies and the borrowed amount. Monthly payments are determined by the overall loan amount, interest rate, and repayment duration. Some lenders may offer flexible repayment options, including deferment or forbearance during financial hardship. It is essential to review specific fees such as origination fees (which can be a percentage of the total loan) and prepayment penalties (fees incurred for paying off the loan early) as these can impact total repayment costs. Regular communication with lenders regarding any changes in financial circumstances can help manage repayment effectively and avoid potential pitfalls.

Impact on Credit Score

Consolidation loans can significantly impact credit scores for individuals seeking financial relief. On one hand, applying for a consolidation loan may result in a hard inquiry, typically decreasing a credit score by a few points temporarily. However, successful management of the consolidation loan can enhance credit scores over time by lowering credit utilization ratios--especially if high credit card debts are paid off. Improved payment history through consistent, on-time payments (ideally 35% of the FICO score calculation) can further boost scores. Conversely, failure to meet payment obligations may lead to negative marks, such as missed payments and defaults, significantly harming credit ratings. Overall, the ultimate effect varies by individual financial behavior and loan management strategies.

Financial Goals and Budgeting

Consolidation loans serve as a strategic financial tool, allowing individuals to combine multiple debts into a single loan, typically resulting in lower interest rates. Achieving financial goals becomes more attainable through organized budgeting techniques. Assessing monthly income alongside essential expenses such as housing (averaging $1,500 in urban areas) creates a clearer understanding of discretionary spending. Establishing an emergency fund with at least three to six months' worth of living expenses, often recommended by financial advisors, provides a financial cushion during unexpected events. Additionally, tracking expenditures using budgeting apps can highlight areas for cost reduction, supporting debt repayment efforts while improving overall financial health. Accessing resources, such as financial counseling services or debt management programs, can further enhance the effectiveness of a consolidation loan strategy.

Risks and Alternatives

A consolidation loan can simplify financial management by combining multiple debts into a single payment, often at a lower interest rate. However, potential risks exist. For instance, depending on the terms, consolidating high-interest debt into a longer repayment period can lead to paying off more interest over time. Additionally, missed payments may result in negative impacts on credit scores. Alternatives to consider include debt snowball or avalanche methods, which prioritize repayment strategies to tackle debts effectively without the need for a consolidation loan. Financial counseling services can also provide tailored advice for individual financial situations. Exploring various options before committing is crucial for long-term fiscal health.

Comments