Are you gearing up for contract negotiations and feeling a bit overwhelmed by the financial terms? You're not alone! Many individuals and businesses find themselves puzzled over the nitty-gritty details of these agreements, but the right template can streamline the process and help clarify your objectives. Dive deeper into our article to discover the essential components of a contract negotiation letter and how to effectively advocate for your financial interests!

Clear financial objectives

Establishing clear financial objectives is crucial for successful contract negotiations, particularly in business sectors such as real estate, technology, or service provision. Precise targets, such as projected revenue amounts, total contract value (TCV) levels, and specific profit margins (typically aiming for 15% or higher), create a measurable framework for evaluating offers. Key milestones, like payment schedules with defined deadlines (30, 60, or 90 days post-delivery), enhance transparency and accountability. Additionally, understanding market trends and average industry costs is vital; for instance, knowing that technology services average charges range from $100 to $200 per hour can guide negotiations. Establishing contingency clauses can also safeguard interests; defining compensation terms such as penalties for late payments sets clear expectations. Overall, thorough preparation of financial objectives leads to more favorable contract outcomes and robust partnerships.

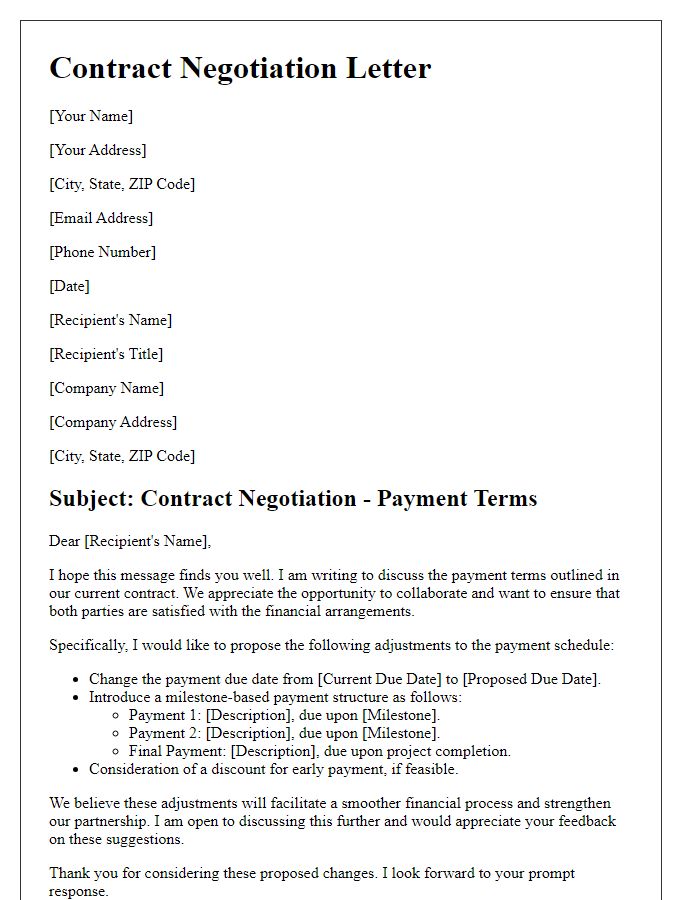

Payment structure and schedule

A well-structured payment schedule can significantly impact negotiation outcomes in contract discussions, particularly regarding financial terms. Detailed payment structures should include specific dates (e.g., quarterly payments on the 1st of January, April, July, or October), clear deliverables tied to each payment (such as project milestones or completion of services), and consequences for late payments (such as penalties or interest rates). Transparent invoicing procedures (for instance, invoices submitted within 15 days post-delivery) enhance trust. Partnerships in sectors like construction or consulting often benefit from established payment percentages upon reaching predefined stages, ensuring both parties maintain financial clarity throughout the contract duration.

Negotiated pricing terms

Negotiated pricing terms can significantly influence the financial outcomes of contracts, impacting both parties involved. These terms, established during negotiations, define the prices for goods and services provided, including any discounts or price adjustments based on market fluctuations. They also encompass payment schedules, specifying milestones and deadlines, which can affect cash flow and financial planning. Additionally, clauses for penalties or incentives based on timely payments may be included, encouraging adherence to the financial agreement. Understanding the importance of these negotiated terms is vital for ensuring fair and beneficial outcomes in contract negotiations.

Contingency clauses and risk mitigation

Contingency clauses play a crucial role in contract negotiation regarding financial terms in various agreements such as real estate transactions, business mergers, and service contracts. These clauses serve as safety nets, addressing unforeseen events like market fluctuations or regulatory changes that may impact financial obligations. For instance, a contract might specify a price adjustment clause if the market value of a property decreases by more than 10% within six months. Risk mitigation strategies in financial negotiations can include warranties, insurance requirements, or performance bonds to safeguard against potential losses or defaults. Essential components of these strategies may encompass clear definitions of liabilities, obligations to inform parties about adverse circumstances, and mechanisms for renegotiation. Overall, well-defined contingency clauses and robust risk mitigation measures are vital for ensuring financial stability and protecting parties' interests in any contractual agreement.

Confidentiality and non-disclosure agreements

Confidentiality and non-disclosure agreements (NDAs) play a vital role in contract negotiations within various industries, protecting sensitive financial information shared between parties. These legal documents ensure that proprietary data, such as revenue figures, cost structures, and trade secrets, remain secure from competitors. Specific clauses, such as the duration of confidentiality (often ranging from two to five years) and the definition of confidential information, are essential to clearly outline obligations. Parties may also include provisions for the handling of data breaches to mitigate risks associated with unauthorized disclosures. Successful implementation of NDAs fosters trust, enabling smoother negotiations for financial terms while safeguarding both parties' interests.

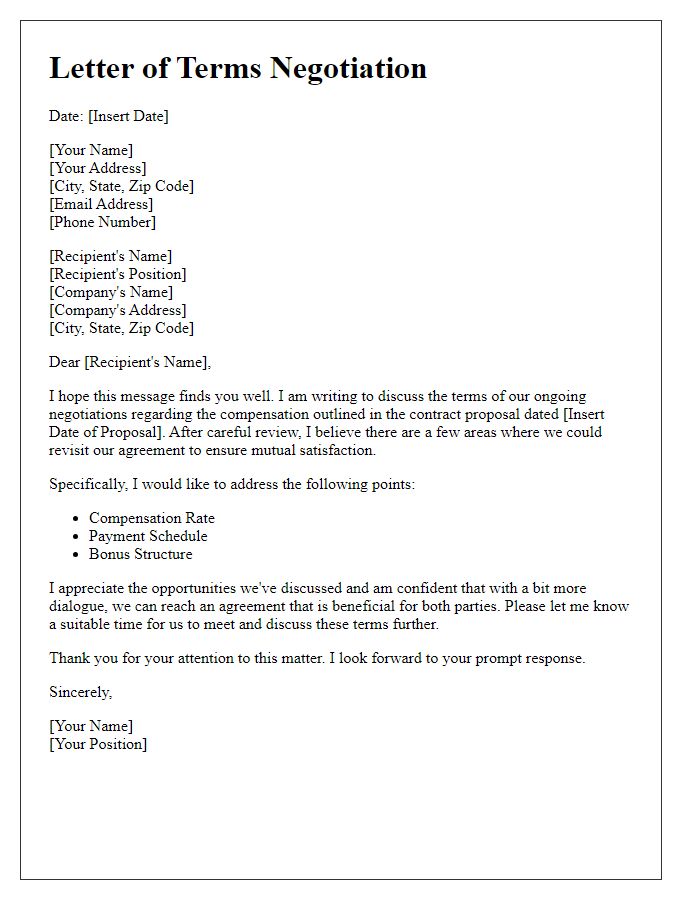

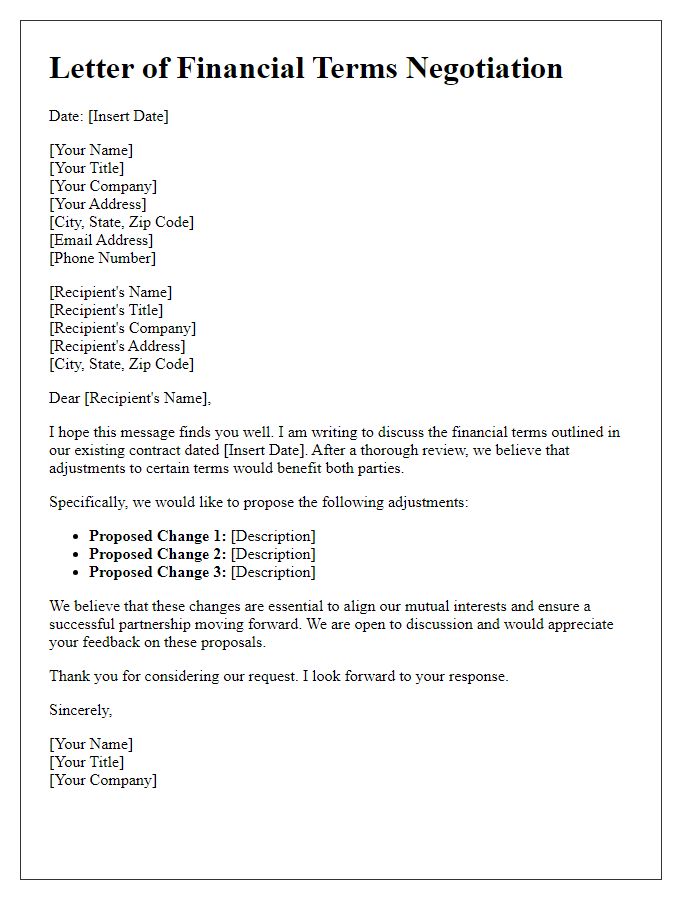

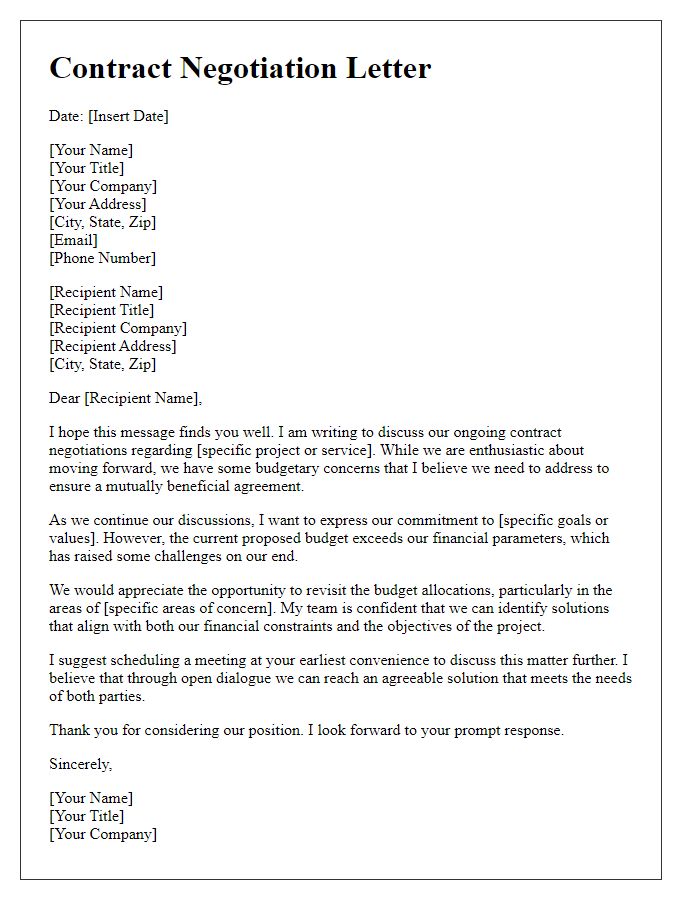

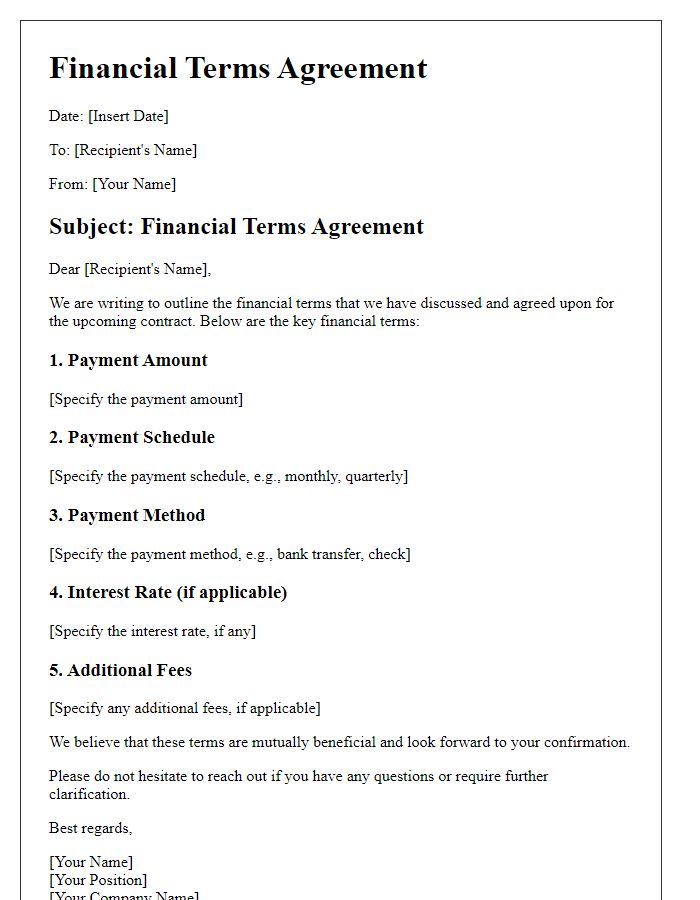

Letter Template For Contract Negotiation Financial Terms Samples

Letter template of terms negotiation regarding compensation in contracts

Comments