Are you looking to make a meaningful impact through charitable contributions but don't know where to start? Planning your donations can be both rewarding and straightforward, allowing you to support causes you care about while maximizing your tax benefits. In this article, we'll explore practical steps and strategies for effective charitable giving, ensuring your contributions make a lasting difference. Join us as we dive into the world of charitable contribution planning and discover how to align your generosity with your values!

Donor Information and Personalization

The planning of charitable contributions often starts with comprehensive donor information, such as the full name, address, and email details of the benefactor, which are essential for proper acknowledgment and future communication. Understanding donor preferences, priorities, and past giving history can significantly enhance personalization, creating a tailored approach for future engagements. It is also beneficial to identify specific causes or organizations that resonate with the donor's values, such as education, healthcare, or environmental conservation, to foster a stronger connection and commitment. In addition, noting important dates, such as anniversaries or birthdays, can help in crafting personalized communication that reflects appreciation and gratitude. Having this detailed information can facilitate meaningful and impactful relationships between the donor and the charitable organization.

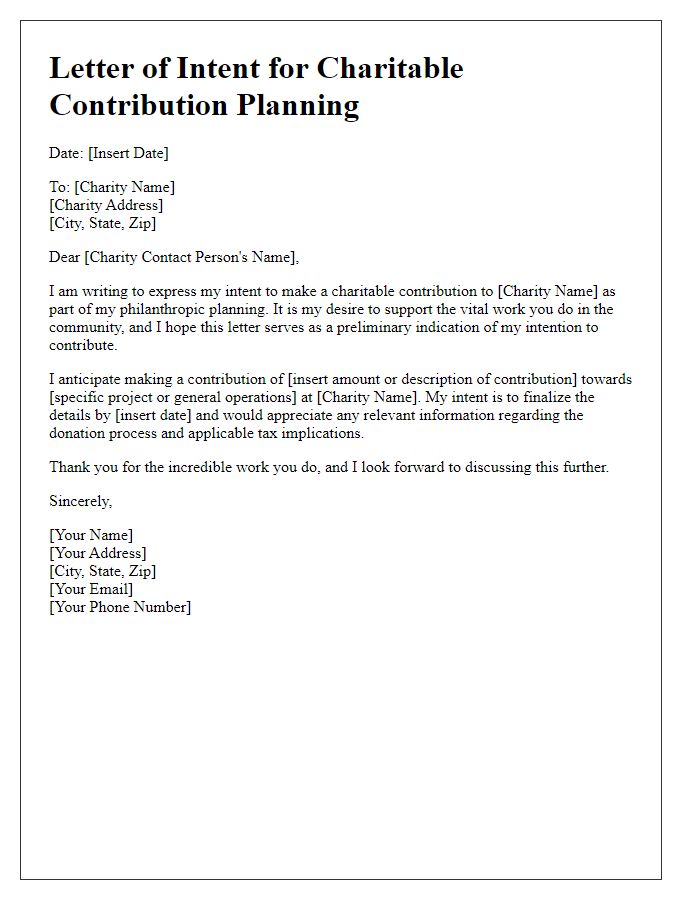

Specific Contribution Details

Planning charitable contributions requires careful detail-oriented assessment to maximize positive impact. Donations can target specific initiatives such as education funds (like the $1,000 scholarship program) for underserved youth in local communities. Contributions might include essential items (like hygiene kits or school supplies) that directly support families in need during events like annual community drives. Other potential allocations could involve partnership with organizations like Habitat for Humanity, enabling funding for home construction projects (averaging $10,000 per house) that transform lives in areas such as Atlanta, Georgia. Establishing a recurring monthly donation plan (e.g., $100) can create sustainable support, allowing charities to plan their outreach effectively and reach more beneficiaries throughout the year. Additionally, utilizing employer matching programs can double the impact of individual contributions, leading to larger aggregate funding for crucial initiatives.

Impact and Purpose Explanation

The impact of charitable contributions, particularly in community-based organizations, significantly influences social progress and sustainability. Donations of various amounts, from individuals and corporations alike, can support critical programs such as food banks, offering assistance to over 10,000 families annually. Purpose-driven initiatives, like educational scholarships, empower underprivileged youth to pursue higher education, often resulting in increased graduation rates by as much as 50%. Furthermore, supporting mental health services provides essential therapy and resources to individuals in need, addressing a growing emotional health crisis that affects approximately 1 in 5 adults in the United States. By planning contributions strategically, donors can amplify their impact, ensuring that their generosity directly contributes to meaningful causes within their communities.

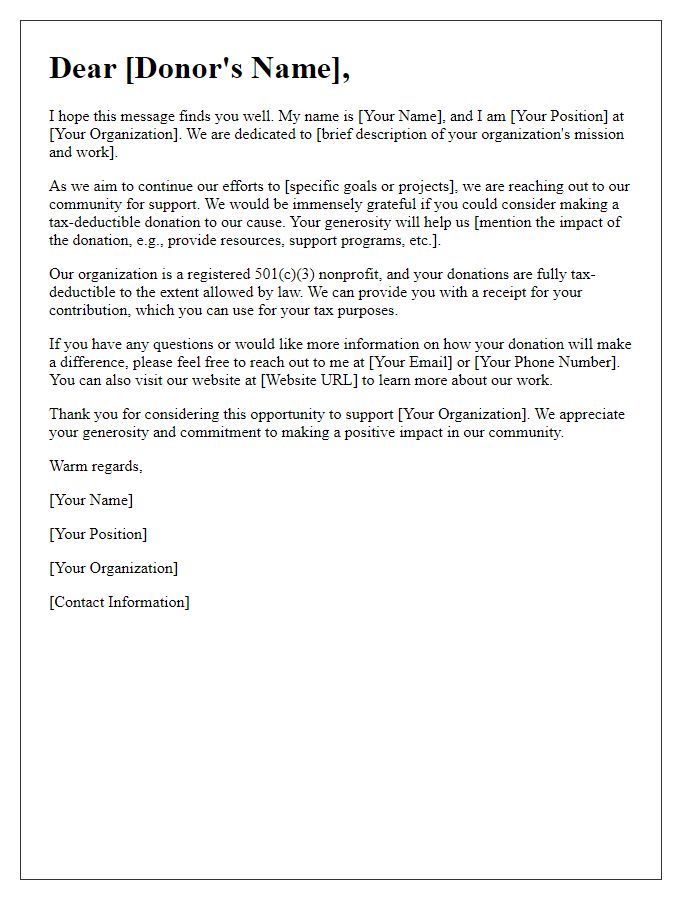

Tax Benefits and Legal Compliance

Charitable contribution planning involves understanding the tax benefits associated with donations to qualified organizations, such as 501(c)(3) non-profits in the United States. Donors can typically deduct contributions from taxable income, which lowers the overall tax liability. For the tax year 2022, individuals can deduct up to 60% of their adjusted gross income (AGI) for cash donations, with lesser limits for non-cash contributions. Legal compliance is crucial; donors must ensure that the recipient organization meets IRS qualifications to avoid penalties. Documenting contributions with receipts and maintaining accurate records is essential for substantiating deductions during tax filings. Additionally, understanding state-specific regulations can affect both the size and the type of deductible contributions.

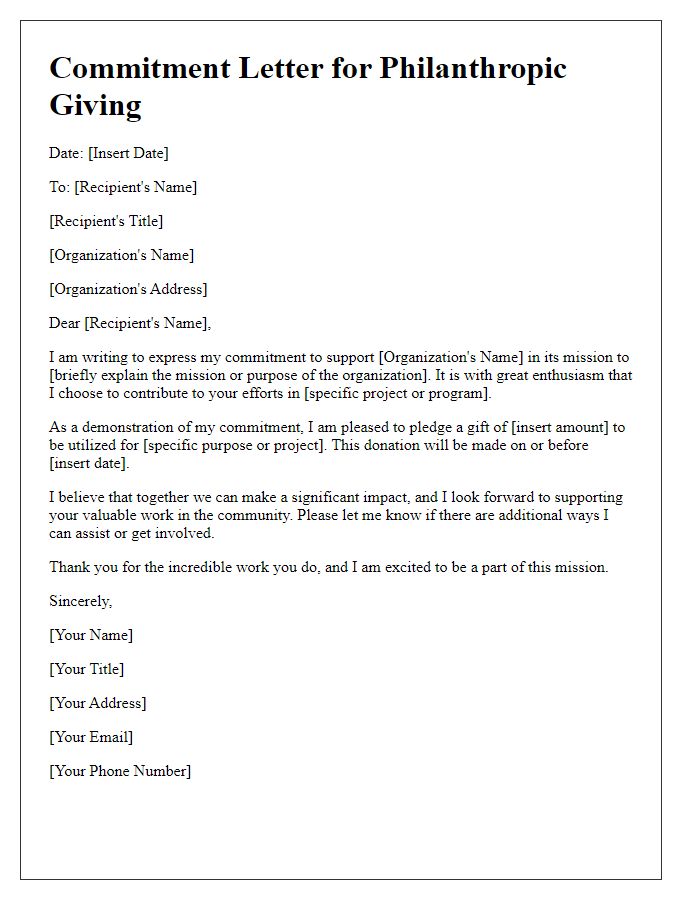

Gratitude and Future Engagement Opportunities

Charitable contributions play a vital role in supporting nonprofit organizations, enhancing community welfare, and fostering social change. Engaging with donors through personalized communication amplifies the impact of giving, building a bridge between generosity and tangible outcomes. Expressing gratitude to donors not only acknowledges their significant support but also fosters lasting relationships, ensuring continued engagement in future initiatives. Opportunities for involvement may include volunteer programs, exclusive donor events, or participation in fundraising campaigns, providing a platform for donors to see the direct effects of their contributions. Highlighting successful projects funded by these contributions, such as community education programs or health initiatives, can inspire donors to envision their role in driving positive change.

Comments