Are you feeling a bit overwhelmed by the complexities of social security benefits? You're not alone! Many individuals find the process daunting, but understanding your options can keep you on the right track. Join us as we dive deeper into the nuances of social security benefits analysis and discover what you need to know to maximize your benefits!

Personal Information Verification

Personal information verification is crucial for ensuring accurate processing of Social Security benefits applications. Key elements include the full name of the applicant, date of birth, and Social Security number (issued at birth or naturalization). Address details must include a valid residential address to facilitate communication and service delivery. Employment history documentation, including previous employers and dates of employment, is required for benefit calculation. It is important to provide information related to dependent family members, such as spouse and children, to assess eligibility for additional benefits. Verification of identity may involve presenting government-issued identification, such as a driver's license or passport, as part of the application process.

Benefit Calculation Methodology

The Benefit Calculation Methodology for Social Security involves a complex formula that takes into account an individual's lifetime earnings, specific age at which benefits are claimed, and the cost-of-living adjustments (COLAs) made annually. The Average Indexed Monthly Earnings (AIME) is calculated by considering the highest 35 years of indexed earnings, allowing for inflation adjustments. Once the AIME is determined, the Primary Insurance Amount (PIA) is calculated using a progressive benefit formula that applies different rates to segments of the AIME, with the first $1,115 (as of 2023) being awarded at 90%, the next $6,721 at 32%, and any amount above that at 15%. This methodology ensures that lower earners receive a higher percentage of their pre-retirement income, while higher earners receive a relatively lower percentage. Additionally, the full retirement age (FRA), which varies between 66 to 67 years old depending on birth year, influences the benefit amount received. Early or delayed retirement options are also available, with reductions or increases in monthly benefits respectively, providing individuals with flexibility in when they choose to begin receiving Social Security support.

Eligibility Criteria Evaluation

The eligibility criteria for Social Security benefits, including Supplemental Security Income (SSI) and Social Security Disability Insurance (SSDI), encompass various factors such as age, work history, income level, and disability status. Individuals must typically be aged 18 or older to qualify for SSDI, having earned sufficient work credits through employment, usually requiring at least 40 credits over a span of 10 years. For SSI, applicants must demonstrate limited income and resources, with eligibility thresholds varying by household size and state--maximal resource limits set at $2,000 for individuals and $3,000 for couples. Medical evidence plays a vital role in determining disability, necessitating documentation of severe impairments that hinder basic work activities, as assessed by the Social Security Administration (SSA) based on listings in the Blue Book, which details qualifying conditions. Moreover, individuals must adhere to stringent application processes, often subjecting claims to rigorous reviews and appeals, impacting the total benefits received throughout their lifetime.

Required Documentation Checklist

Social Security benefits analysis requires essential documentation to ensure a thorough review process. Key documents include the birth certificate, which confirms identity and age, and the Social Security card, crucial for identifying the individual within the Social Security Administration (SSA) system. Income statements, including W-2 forms and tax returns from the past two years, help establish financial eligibility for benefits. Medical records, particularly a treating physician's statement, substantiate claims of disability, providing needed details about medical conditions and treatments. Additionally, proof of residence, such as utility bills or lease agreements, verifies the applicant's current living situation, crucial for determining benefits eligibility. Finally, any previous correspondence with the SSA, especially regarding appeals or decisions, ensures a comprehensive understanding of the applicant's history with the program.

Contact Information for Assistance

Social Security benefits analysis requires accurate and accessible contact information for assistance. The Social Security Administration (SSA), based in Woodlawn, Maryland, provides resources for beneficiaries with inquiries regarding their entitlements. Beneficiaries can reach the SSA via the official toll-free number, 1-800-772-1213, available Monday through Friday, from 7 AM to 7 PM EST. Alternatively, local SSA offices can offer personalized assistance; finding your nearest office can be achieved through the SSA's online office locator tool. Key documents to have ready include Social Security cards, tax information, and proof of disability if applicable, as these facilitate the analysis of benefits. Inquiries concerning Medicare can be directed to the Centers for Medicare & Medicaid Services at 1-800-MEDICARE (1-800-633-4227). Understanding eligibility criteria and benefit amounts is crucial, making these resources invaluable for accurate benefits analysis.

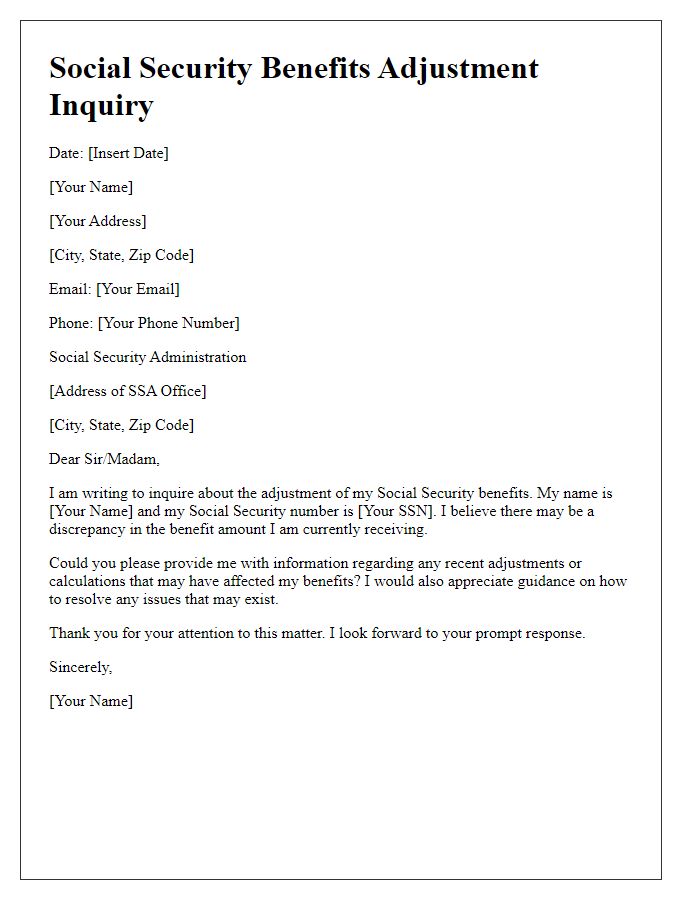

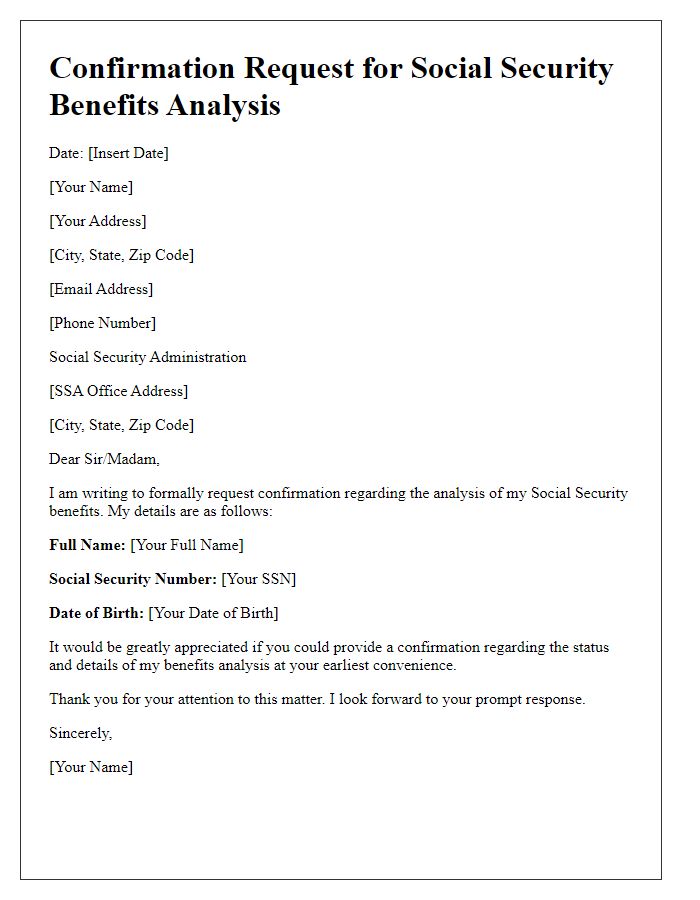

Letter Template For Social Security Benefits Analysis Samples

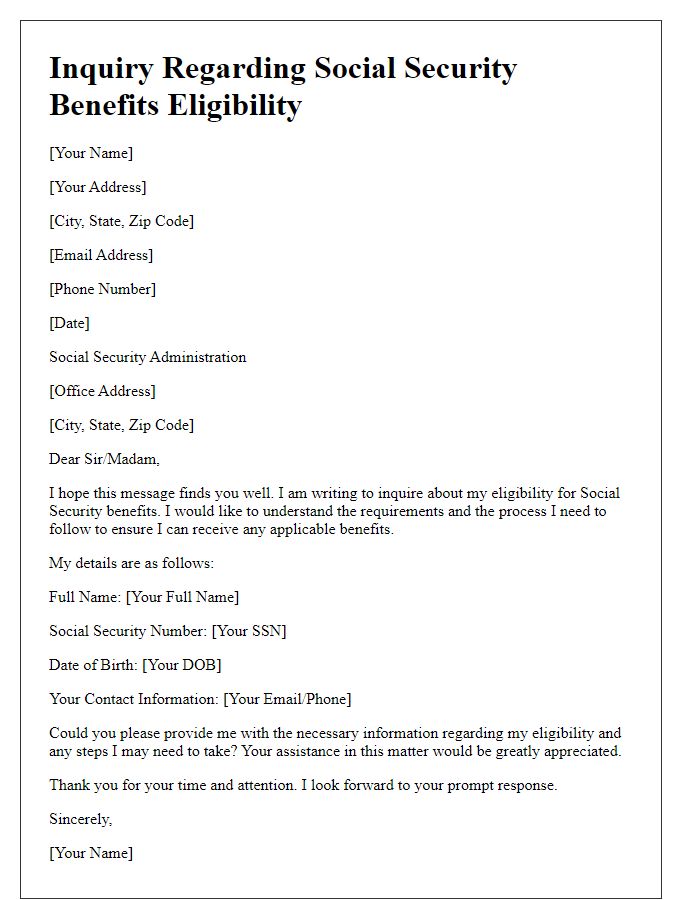

Letter template of Inquiry Regarding Social Security Benefits Eligibility

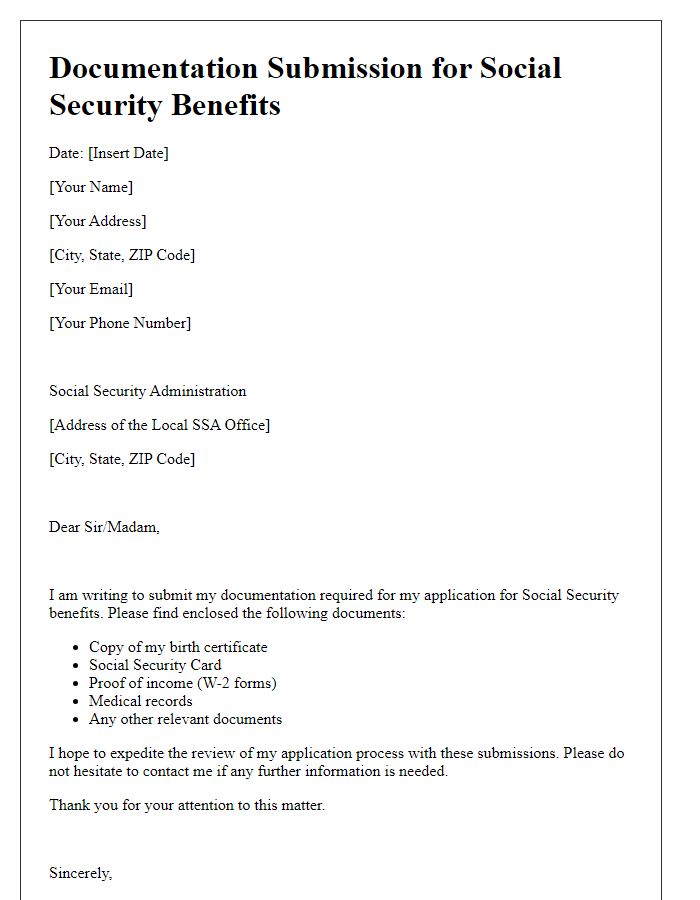

Letter template of Documentation Submission for Social Security Benefits

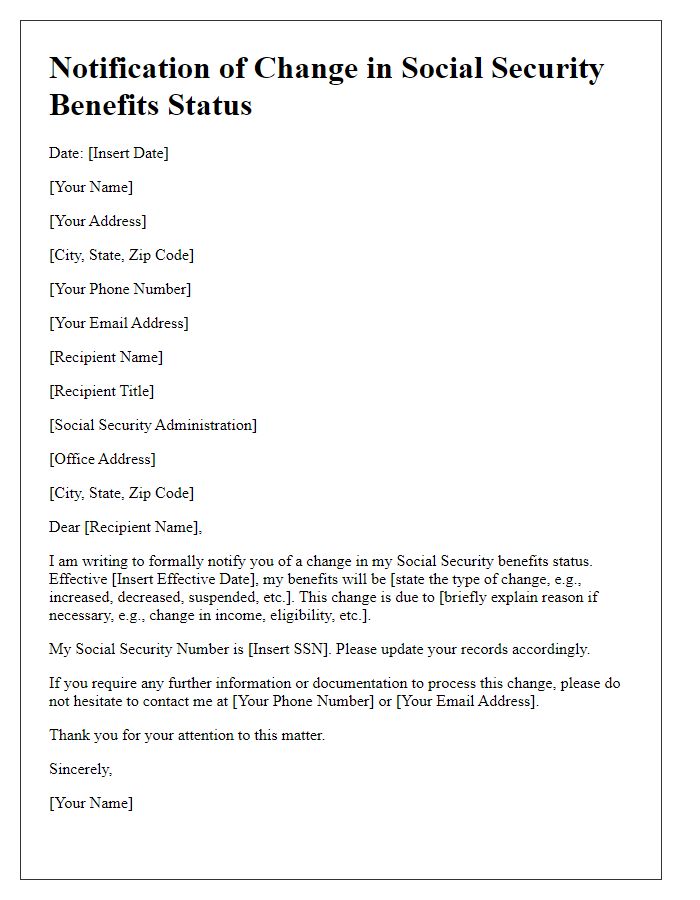

Letter template of Notification of Change in Social Security Benefits Status

Comments