Hey there! We're excited to share the latest insights on our investment performance with you. In this update, we'll dive into how your investments are doing, highlight key achievements, and discuss the market trends that have shaped our performance. Curious to learn more about what's working and what's ahead? Keep reading for all the details!

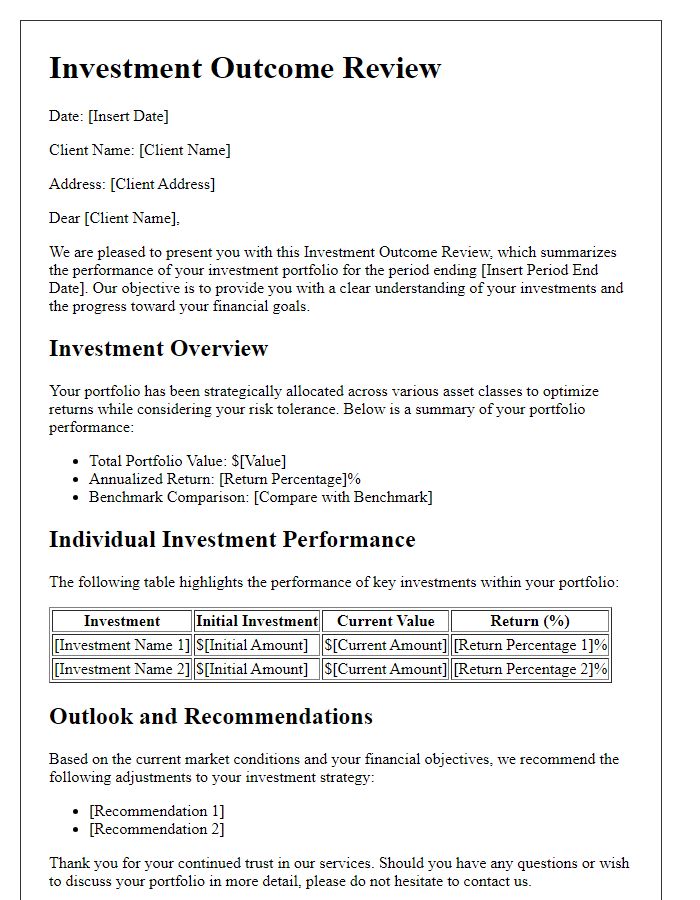

Portfolio Overview

The investment portfolio overview offers essential insights into asset allocation, market performance, and risk exposure. Current holdings, including equities, bonds, and alternative investments, reflect a diverse strategy aimed at maximizing returns. The year-to-date performance, tracked against benchmarks such as the S&P 500 Index, reveals a growth rate of approximately 12%. Noteworthy sector performances include technology stocks, surging by 20%, while the energy sector has faced volatility, showing a decline of 3%. Risk assessments indicate a balanced approach, with a standard deviation of 7%, highlighting the portfolio's resilience in fluctuating markets. This overview provides a comprehensive snapshot of investment health, essential for informed decision-making.

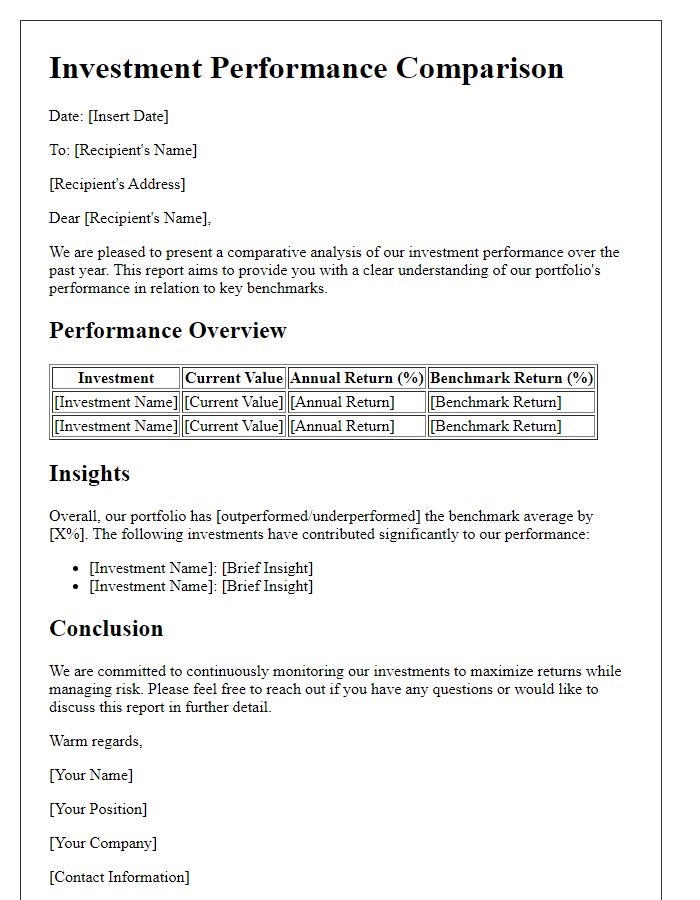

Performance Metrics

Investment performance metrics provide vital insights into portfolio health and growth potential. Key indicators such as annualized returns (percentage gained annually), standard deviation (volatility measure), and Sharpe ratio (risk-adjusted return) illustrate performance effectiveness. Benchmark comparisons, like the S&P 500 (a stock market index representing 500 of the largest U.S. companies), highlight relative performance against market averages. Performance attribution analysis breaks down returns from different sectors (e.g., technology, healthcare) or asset classes (e.g., stocks, bonds), ensuring investors understand contributing factors. Furthermore, visual aids, such as performance charts and graphs, enhance clarity regarding trends over time (monthly or quarterly). Consistently monitoring these metrics allows investors to make informed decisions about asset allocation and risk tolerance.

Market Trends and Analysis

Investment performance updates require a comprehensive assessment of current market trends and analytics. For instance, in the third quarter of 2023, global stock markets, particularly the S&P 500 (Standard & Poor's 500), experienced a notable increase of 15% year-to-date due to substantial earnings growth in technology firms such as Apple and Microsoft. The bond market faced pressures as interest rates rose, reaching a decade high of 4.5%, affecting securities like U.S. Treasury bonds. Additionally, geopolitical events, including the ongoing conflict in Ukraine and trade tensions between the United States and China, have resulted in increased volatility, leading to shifts in sectors like energy, where crude oil prices have fluctuated around $90 per barrel. Thorough analysis of these elements provides valuable insights for future investment strategies.

Asset Allocation Strategies

In recent months, asset allocation strategies have showcased significant shifts across various investment vehicles, reflecting market dynamics. The S&P 500 Index, a benchmark for large-cap U.S. equities, has risen approximately 12% year-to-date (YTD) amidst fluctuations in interest rates and inflation concerns. Allocation to fixed-income securities, particularly U.S. Treasury bonds yielding around 3.5% annually, has played a pivotal role in balancing risk, providing stability in volatile conditions. Commodities, especially gold, have seen a surge, trading above $1,900 per ounce, as investors seek hedges against inflationary pressures. Moreover, emerging markets, led by countries like India and Brazil, have attracted attention with growth rates projected at 6% and 3.7%, respectively, underscoring the potential for higher returns in diversified portfolios. Target allocations now reflect a balanced approach, with equities comprising around 60%, fixed income at 30%, and alternative investments at 10%, aiming to enhance overall performance while mitigating risks.

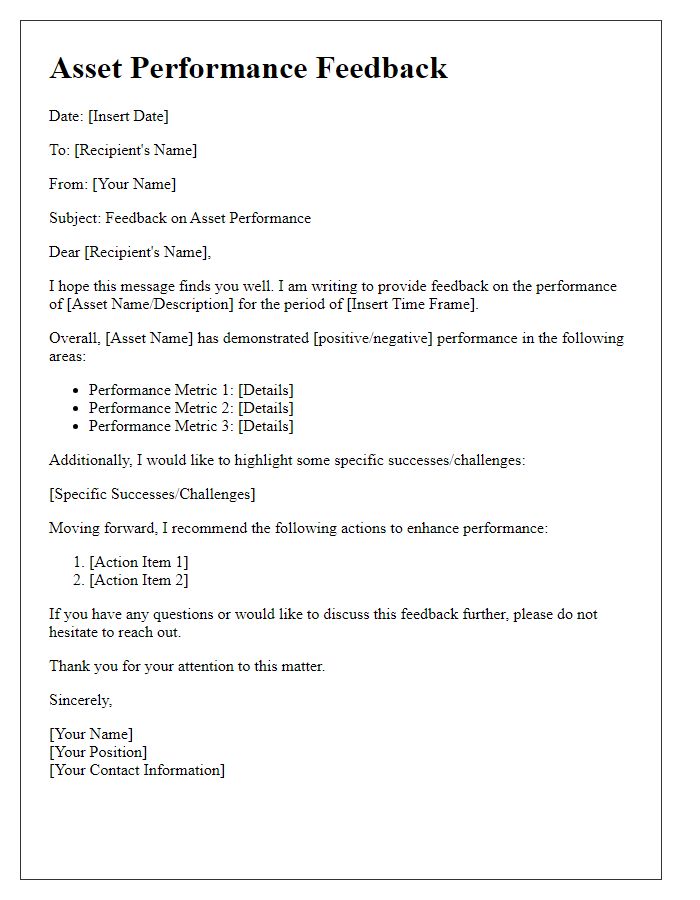

Future Outlook and Recommendations

Investment performance analysis typically highlights key factors influencing market trends and potential growth opportunities for portfolios. Recent economic indicators, such as inflation rates (hovering around 4% as of mid-2023) and interest rate adjustments by the Federal Reserve, play a significant role in shaping the future outlook. Analysts suggest focusing on sectors showing resilience, like technology and renewable energy, anticipated to see increased demand driven by governmental policies aimed at sustainability and innovation. Geographic regions such as Southeast Asia exhibit rapid economic growth potential, with GDP forecasts predicting an increase of 5.5% annually through 2025. Recommendations include diversifying assets across various sectors and geographic locales to mitigate risks while capitalizing on emerging trends. Regularly reassessing portfolio performance in light of global events, such as trade agreements or geopolitical tensions, remains essential for informed decision-making.

Comments