Are you feeling overwhelmed by your financial choices? Navigating the complex world of finance can often be challenging, but with the right guidance, you can make informed decisions that align with your goals. In this article, we'll explore essential strategies for achieving financial stability and growth, offering insights tailored to your unique situation. So, grab a cup of coffee and let's delve deeper into the world of professional financial guidance!

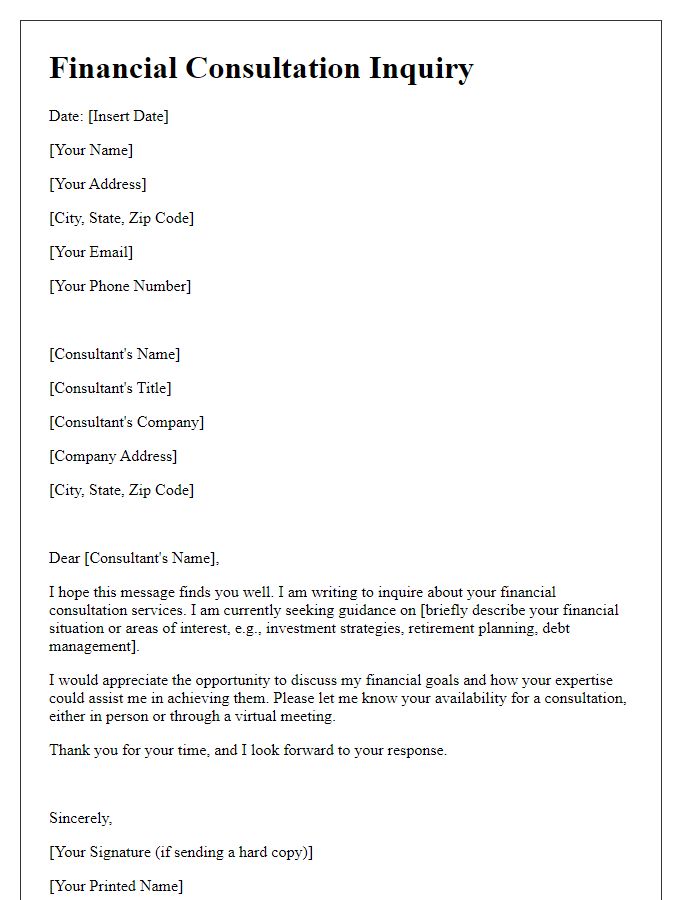

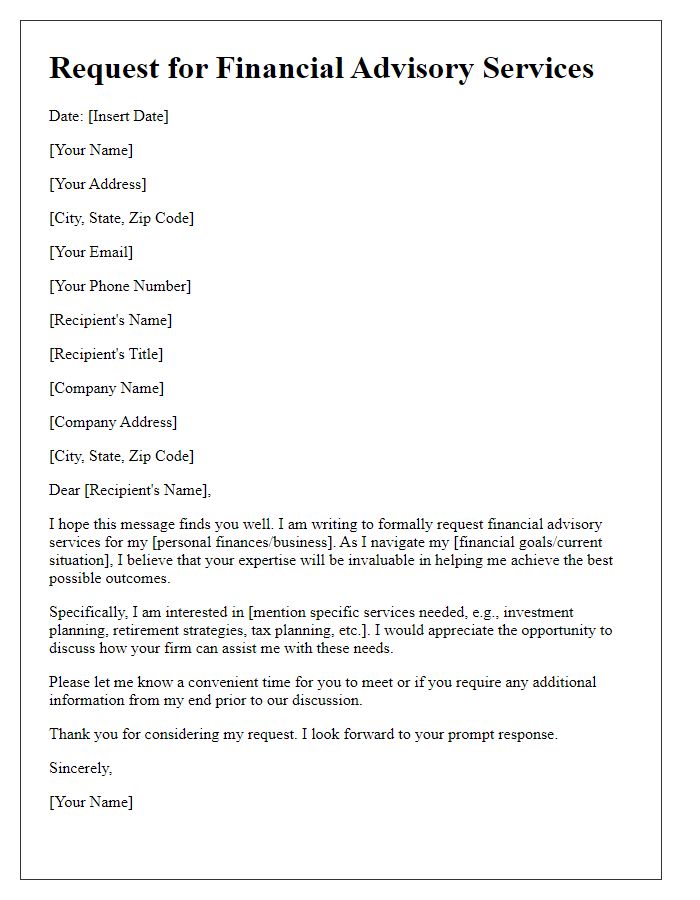

Clear objective statement

Financial planning plays a crucial role in achieving long-term goals, such as home ownership, retirement, or establishing an educational fund for children. Identifying clear objectives, such as saving a specific percentage of income (e.g., 20%) each month or generating a particular return on investment (e.g., 7% annually) ensures that individuals can structure their financial decisions effectively. Tools like budgeting apps or investment calculators can provide insights into monthly expenses and growth projections. Engaging with certified financial planners results in tailored strategies, considering factors like emergency fund requirements (typically 3-6 months' worth of living expenses) and risk tolerance associated with investments.

Professional tone and language

In the dynamic world of personal finance, seeking professional guidance is crucial for making informed decisions. Financial advisors provide tailored strategies that align with individual financial goals, such as retirement planning, investment management, and tax optimization. Utilizing tools like risk assessment questionnaires, advisors can identify clients' risk tolerance levels, which helps in constructing a diversified portfolio that may include stocks, bonds, and mutual funds. Industry regulations, such as the fiduciary duty, require financial advisors to act in a client's best interest, thereby enhancing trust. Additionally, market trends and economic indicators, including interest rates and inflation rates, significantly influence financial planning. Staying abreast of financial news and updates can empower individuals to engage meaningfully with their advisors. Effective communication, clearly defined objectives, and regular review of financial plans ensure ongoing alignment with evolving personal circumstances and market conditions.

Detailed financial insights

Comprehensive financial analysis involves assessing income statements, balance sheets, and cash flow statements to evaluate a company's financial health. Detailed insights into ratios like the current ratio (current assets divided by current liabilities) can reveal short-term liquidity, while return on equity (net income divided by shareholder's equity) measures profitability over equity. Evaluating financial performance often involves comparing industry benchmarks, such as the average profit margin of 10% within the manufacturing sector. Additionally, understanding macroeconomic indicators, like the consumer price index, can provide context for inflation rates affecting financial projections. Cross-referencing these financial metrics with historical data from the last five years can enhance decision-making, ensuring strategies align with both market trends and organizational goals.

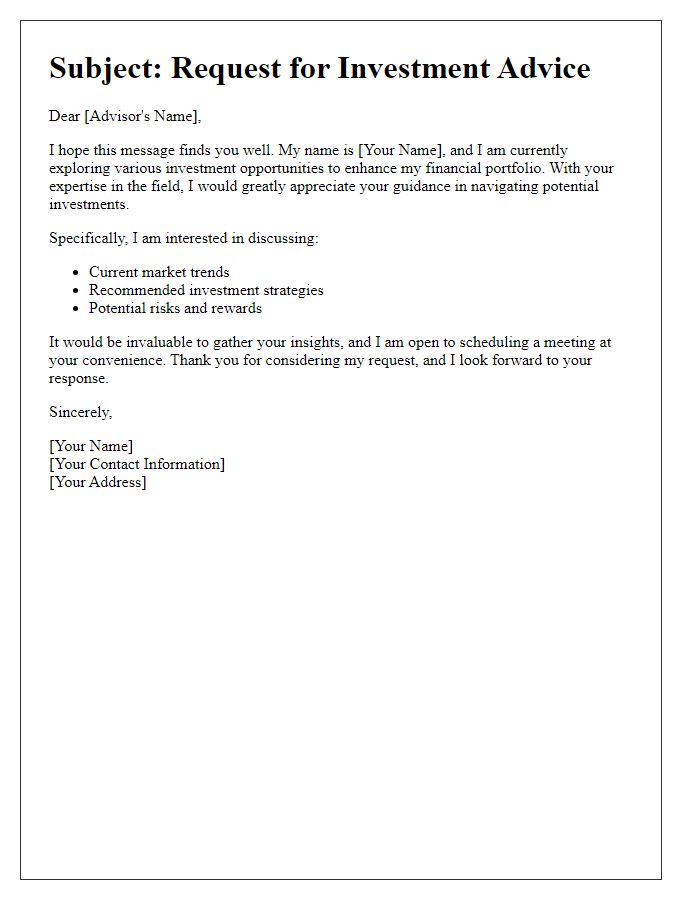

Actionable recommendations

In-depth financial analysis reveals actionable recommendations tailored for long-term fiscal health. Diversification strategies, such as investing in low-cost index funds or sector-specific ETFs, can mitigate risk while maximizing potential returns. Implementing a budget plan, rooted in the 50/30/20 rule--allocating 50% of income to necessities, 30% to discretionary spending, and 20% to savings--ensures adequate liquidity and promotes savings growth. Establishing an emergency fund with three to six months' worth of expenses provides a safety net during unforeseen events, like job loss or medical emergencies. Regular review and adjustment of investment portfolios based on market conditions, identified through performance metrics and economic indicators, enhance asset performance. Tax-efficient investment strategies, utilizing accounts such as Roth IRAs or HSAs, optimize savings while minimizing tax liabilities. Professional consultations with certified financial planners, particularly in estate planning and retirement strategies, further solidify a robust financial framework.

Contact information for further consultation

Professional financial guidance services play a vital role in helping individuals manage their finances effectively. Financial advisors often provide personalized advice tailored to clients' specific needs, whether for retirement planning, investment strategies, or tax optimization. Consulting a certified financial planner (CFP) can enhance decision-making and establish a comprehensive financial plan. For further consultation, potential clients can reach out through various channels: phone numbers typically provided for immediate inquiries, emails for detailed questions, or even online booking systems for appointments. Additionally, professional firms often have a physical location, for instance, in major cities like New York or Chicago, where clients can meet their advisors face-to-face.

Comments