When it comes to navigating the complex world of business financial strategies, having a solid foundation is essential for success. Whether you're a seasoned entrepreneur or just starting out, understanding how to effectively manage your finances can significantly impact your growth. From budgeting and investment decisions to optimizing cash flow, every aspect plays a crucial role in your overall strategy. Curious to learn more about how you can enhance your financial approach? Let's dive into the details!

Strategic Financial Goals

Developing strategic financial goals is essential for long-term success in any business environment, especially for organizations operating in competitive markets like technology or retail. Establishing clear objectives (measurable targets) helps guide financial planning, including revenue growth (aiming for a specific percentage increase annually), cost management (reducing expenses by targeted amounts), and investment strategies (allocating a defined percentage of profits to innovative projects). Financial metrics, such as return on investment (ROI), can help assess the viability of these initiatives, enabling management teams to make informed decisions. Regular review of these goals is critical, allowing adjustments in response to changing market conditions or unexpected economic challenges, ultimately fostering sustainable growth and stability.

Revenue Stream Analysis

Revenue stream analysis involves evaluating the various sources of income for a business, such as product sales, services, subscriptions, and investments. Understanding the contribution of each revenue stream is crucial for developing effective financial strategies. For instance, examining trends in annual income from e-commerce platforms like Shopify can reveal customer purchasing behaviors, while analyzing service contracts can uncover opportunities for upselling. Financial metrics, such as recurring revenue rates (e.g., monthly recurring revenue or MRR) and customer lifetime value (CLV), provide insights into revenue sustainability and growth potential. Additionally, assessing market conditions and competitive positioning can guide strategic adjustments to enhance profitability across diversified revenue streams.

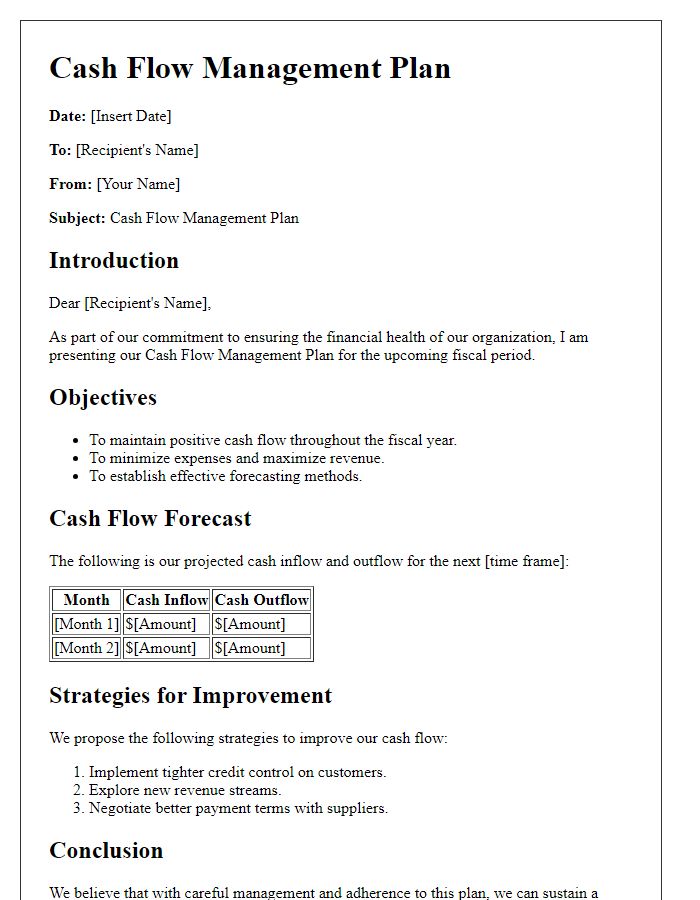

Cost Management Tactics

Effective cost management tactics are crucial for enhancing the financial health of any business, particularly in volatile economic climates. Implementing budget control measures, such as monthly expense reviews (allowable fluctuations of 5% to maintain financial stability), enables organizations to track expenditures meticulously. Regular financial forecasts (quarterly analysis to adjust strategies proactively) identify potential pitfalls and inform smart allocation of resources. Renegotiating contracts with suppliers (targeting at least a 10% reduction in costs), exploring bulk purchasing discounts, and investing in technology solutions (potential reductions in operational costs by 20% through automation) can significantly lower overhead. Emphasizing employee training programs (yielding a return on investment of 300% in efficiency gains) fosters a culture of cost-consciousness, driving innovation in reducing waste while maintaining productivity.

Investment and Growth Opportunities

Investment strategies focus on maximizing returns through various financial instruments. Growth opportunities in the stock market, particularly in sectors like technology and renewable energy, show potential for significant gains, with a projected annual growth rate of over 20% in some instances. Real estate investments in emerging markets, such as Southeast Asia and African countries, can yield substantial rental income and property value appreciation. In addition, diversifying investment portfolios to include bonds, commodities, and emerging cryptocurrencies can mitigate risks and enhance overall performance. Financial analysts suggest allocating at least 10-15% of assets into international markets for better growth opportunities. Understanding current economic indicators, such as interest rates and inflation rates (currently around 3% in the United States), is crucial for making informed investment decisions.

Risk Assessment and Mitigation Plans

Risk assessment involves identifying potential financial pitfalls within a business strategy, such as market volatility or regulatory changes. Effective risk mitigation plans incorporate various strategies, including diversification of investments, cost-cutting measures, and establishing emergency funds. Businesses often conduct scenario analysis to predict the impact of economic downturns, which can inform contingency plans. By evaluating key performance indicators (KPIs) such as cash flow, profit margins, and market share, organizations can proactively address weaknesses. Tailored plans, updated quarterly, ensure that companies stay resilient against unforeseen challenges in dynamic industries.

Comments