Are you looking to elevate your investment portfolio and maximize your financial growth? In this article, we'll explore proven strategies and practical tips designed to enhance your portfolio's performance effectively. From diversifying your assets to identifying key market trends, we're here to guide you every step of the way. So, let's dive deeper into these strategies and get your portfolio on the road to success!

Clear Investment Goals

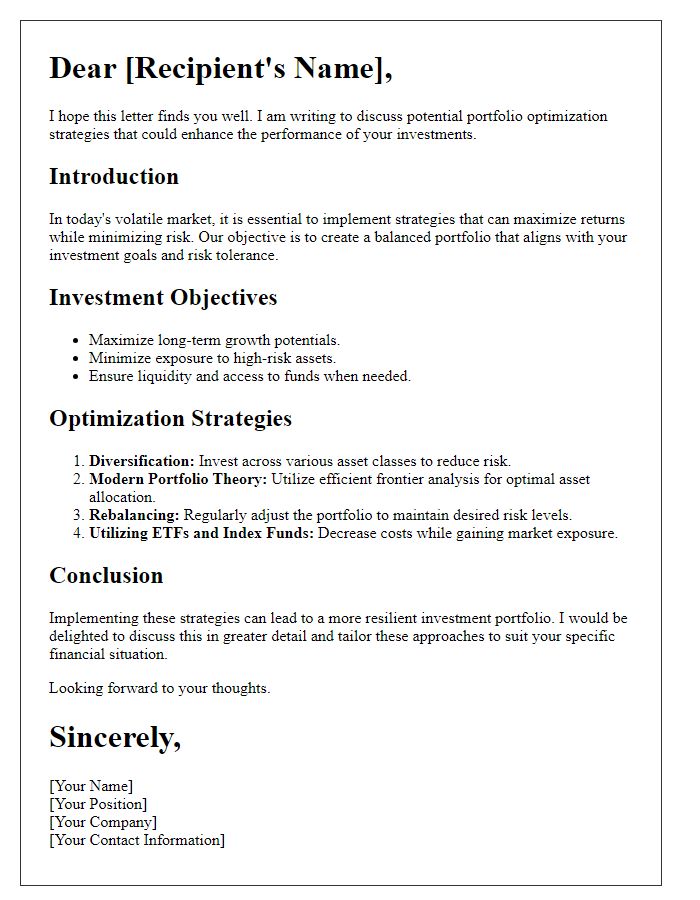

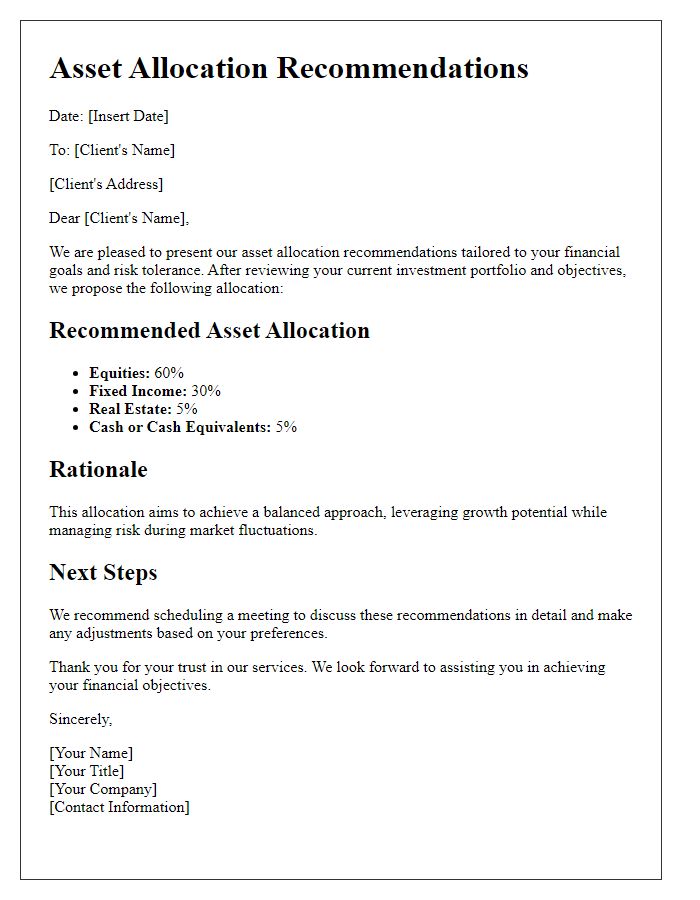

Establishing clear investment goals is crucial for optimizing portfolio performance. Specific objectives, such as targeting a 7% annual return or preserving capital for future generations, guide investment strategies. Time horizons, ranging from short-term (1-3 years) to long-term (10+ years), influence asset allocation decisions. Risk tolerance, determined by factors like age, financial situation, and market volatility, helps in selecting suitable investments. Additionally, diversification across various asset classes, including equities, bonds, and alternative investments, mitigates risks and enhances potential returns. Frameworks like SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound) further refine goals, aligning them with personal financial aspirations.

Diversification Strategies

Diversification strategies enhance portfolio performance by spreading investments across various asset classes, such as stocks, bonds, real estate, and commodities. This approach can minimize risk and protect against market volatility, particularly during economic downturns, like the 2008 financial crisis, when certain sectors experienced significant declines. For example, allocating 60% to equities and 40% to fixed income can provide a balanced risk-reward profile. Alternative investments, like hedge funds or private equity, can further diversify a portfolio. Historical data shows that portfolios with a diversified asset allocation tend to have a higher risk-adjusted return, making them more resilient to market fluctuations. Geographic diversification, such as investing in emerging markets like India or Brazil, can also capture growth opportunities and reduce exposure to domestic economic cycles.

Risk Management Approach

A comprehensive risk management approach is essential for enhancing portfolio performance in investment strategies. Identifying key risks such as market volatility, interest rate fluctuations, and credit risk allows investors to develop tailored strategies for asset allocation. Implementing techniques like diversification across asset classes (equities, bonds, and real estate) minimizes the impact of adverse market movements. Regular monitoring of portfolio performance against benchmarks such as the S&P 500 index or the MSCI World Index enables quick adjustments in response to market changes. Additionally, incorporating tools such as Value at Risk (VaR) analysis provides quantifiable measures of potential losses, aiding in informed decision-making. This proactive stance on risk management not only safeguards capital but also positions the portfolio for sustainable long-term growth.

Performance Metrics and Analysis

Incorporating precise performance metrics is essential for enhancing portfolio performance, especially in investment management. Metrics such as the Sharpe Ratio, which measures risk-adjusted returns, can reveal the efficiency of portfolio strategies by comparing excess returns to portfolio volatility, with optimal values typically above one. The alpha metric indicates the portfolio's outperformance against a benchmark index, while beta measures market sensitivity; an ideal beta of one reflects alignment with market movements. Using periodic analysis, such as quarterly performance reviews, helps investors adjust strategies based on market conditions, identifying trends and anomalies. Additionally, utilizing tools like Excel for financial modeling, alongside software platforms like Bloomberg Terminal for real-time data analysis, can significantly improve informed decision-making. Tracking total return, which aggregates capital gains and income earned, provides a comprehensive view of overall performance, guiding future investment decisions. Continuous monitoring and strategic adjustments are vital in achieving long-term success within a dynamic market landscape.

Continuous Monitoring Plan

A continuous monitoring plan is essential for enhancing portfolio performance, ensuring proactive adjustments to investment strategies. Key performance indicators (KPIs) include metrics such as the Sharpe Ratio, which measures risk-adjusted returns, and Alpha, representing the portfolio's performance against a benchmark index like the S&P 500. Utilizing advanced analytical tools, such as Bloomberg Terminal, allows for real-time tracking of asset performance, macroeconomic indicators, and market trends. Regular reviews, such as quarterly assessments, facilitate the identification of underperforming securities and the potential need for rebalancing. Incorporating risk management practices, including Value at Risk (VaR) calculations, provides insight into potential losses, guiding decisions to optimize asset allocation. Stakeholder communication, through detailed reports and presentations, fosters transparency and alignment with investment goals.

Comments