Are you curious about the financial well-being of your household? Just like a regular check-up at the doctor's office, your finances need attention to ensure everything is running smoothly. A financial health check-up can help identify areas where you can save, invest, or improve your budgeting strategies. So, let's dive into how you can take charge of your financial futureâread on to discover more!

Personalized Greeting

Personalized financial health assessments can provide individuals with insights into their economic well-being. Such evaluations consider crucial factors like income levels, which may vary regionally (for instance, $56,000 annual median in the United States). They examine expenses, such as housing costs (averaging $1,200 monthly rent in urban areas) and debts, including credit card balances that may exceed $6,000. Additionally, an analysis of savings accounts can reveal the average American savings rate (approximately 7.5% as of 2023). By utilizing these metrics, financial advisors can offer tailored recommendations for budgeting, investments, or retirement planning based on personal financial goals and current market trends.

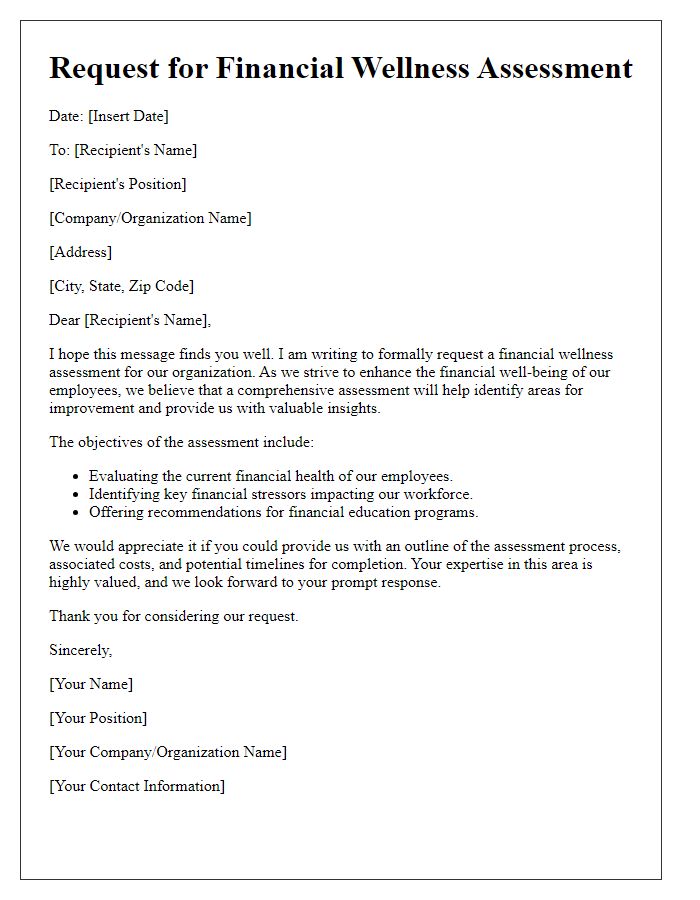

Overview of Objectives

A financial health checkup serves as a comprehensive assessment tool to review personal or organizational finances. Key objectives of this evaluation include identifying spending habits, analyzing savings patterns, and evaluating investment performance. Assessment of debt levels, including credit card balances and loans, ensures a clear picture of financial liabilities. Establishing short-term and long-term financial goals promotes strategic planning for future expenses or retirement. Gaining insights into cash flow management helps in understanding income versus expenses, fostering better financial decision-making. This process may involve utilizing tools such as budgeting software or financial advisors for professional guidance, ensuring a holistic approach to achieving financial stability.

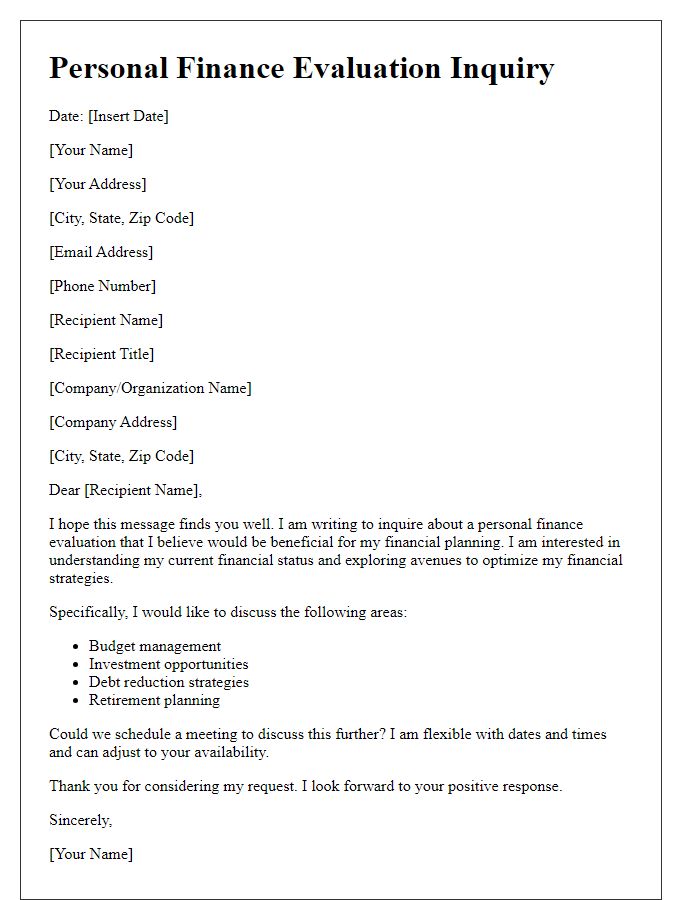

Detailed Financial Assessment

A detailed financial assessment encompasses various critical areas, including income, expenses, assets, and liabilities. Income sources typically include salaries, rental income, and dividends, with a focus on annual earnings, highlighted by recent pay stubs or tax returns. Expenses encompass fixed costs such as mortgage payments or rent, variable costs like groceries and utility bills, and discretionary spending, emphasizing monthly expenditure patterns over the past year. Assets consist of cash reserves, investments, and property values, with a detailed appraisal of current market conditions reflecting real estate's role in overall wealth. Liabilities include credit card debt, student loans, and mortgages, detailing interest rates, monthly payments, and remaining balances. Additionally, savings rates and emergency fund adequacy are evaluated, targeting goals like three to six months' worth of living expenses as a benchmark for financial resilience. This comprehensive overview enables an actionable plan to enhance financial stability and growth.

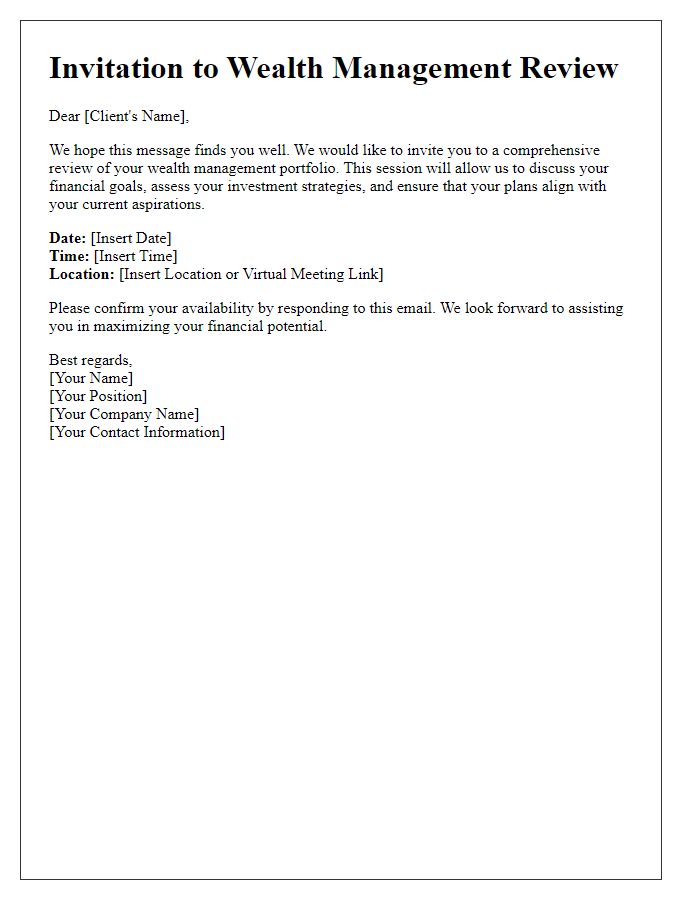

Actionable Recommendations

Financial health checkups can provide individuals with actionable recommendations to improve their economic stability. Key areas to assess include budgeting strategies, which should incorporate the 50/30/20 rule, a guideline that allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. Analyzing savings accounts, including high-yield options such as online bank accounts, can maximize interest earnings, often exceeding 3% annual percentage yield. Debt management strategies may involve consolidation options, such as personal loans with lower interest rates, ideally below 6%. Additionally, reviewing investment portfolios, including retirement accounts like 401(k) plans or IRAs, ensures diversification across asset classes, minimizing risks associated with market fluctuations. Regular assessments, at least quarterly, can help track progress, adjust strategies based on changing financial goals, and adhere to tax regulations.

Contact Information and Next Steps

During a financial health checkup, individuals and families review their fiscal situation, often involving assets, liabilities, income streams, and expenses. Personal finance experts recommend documenting contact information, including email addresses and phone numbers of financial advisors or institutions such as banks and credit unions, ensuring seamless communication. The next steps involve scheduling follow-up appointments or consultations, typically within one month, allowing ample time for necessary adjustments in budgeting and investment strategies. Tracking progress can include setting specific financial goals, such as saving a targeted amount in high-yield savings accounts or reducing credit card debt by a certain percentage within a quarter.

Comments