As tax season rolls around, it's that time of year again when we all need to gather our documents and get our finances in order. Navigating the complexities of tax preparation can be daunting, but with a little guidance, it doesn't have to be. In this article, we'll provide you with essential tips, reminders, and a handy letter template to streamline your tax preparation process. So grab a cup of coffee, settle in, and join us as we make tax season a breeze!

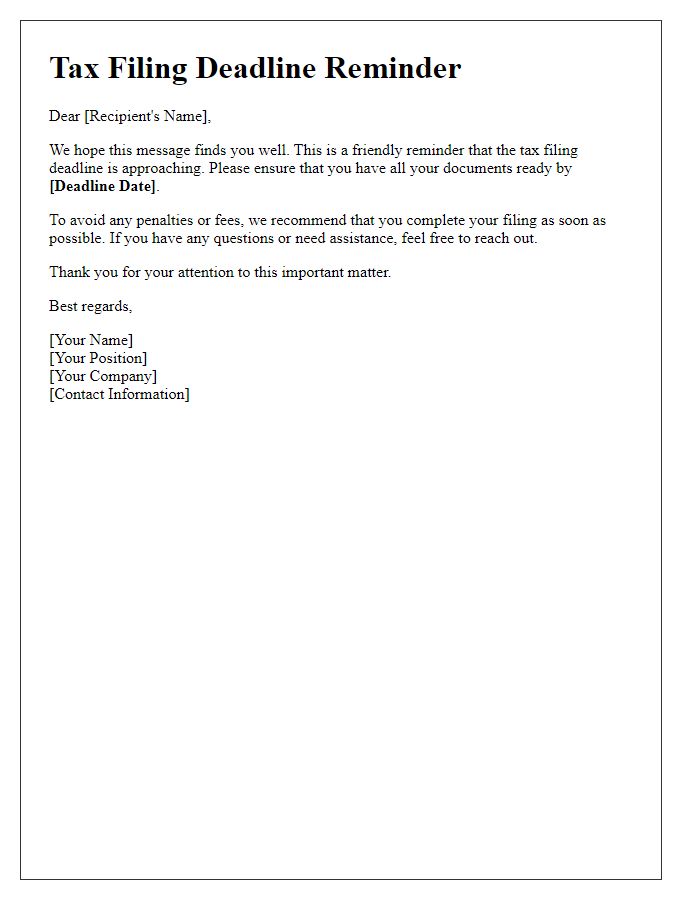

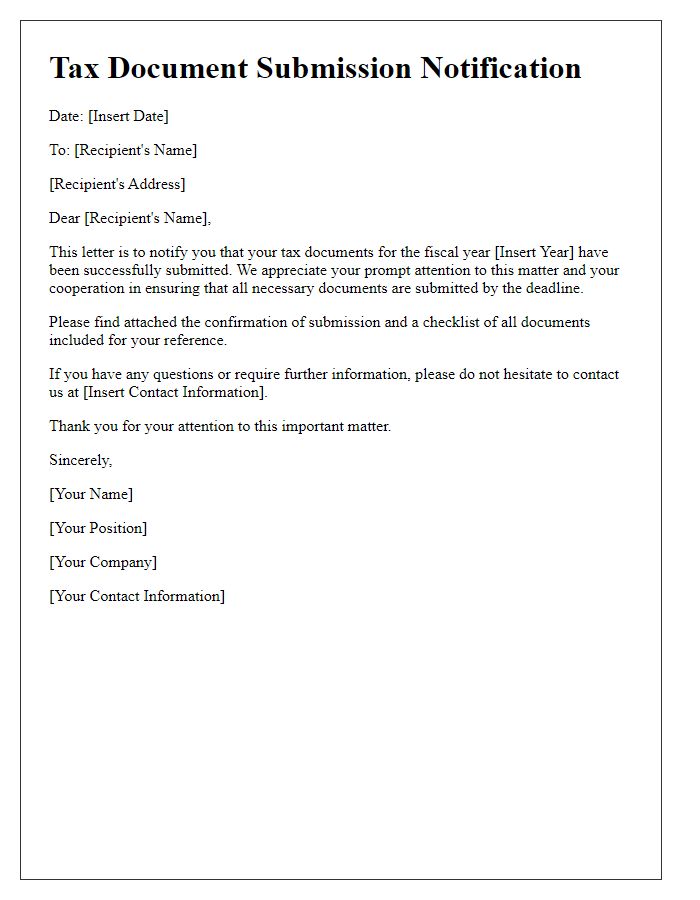

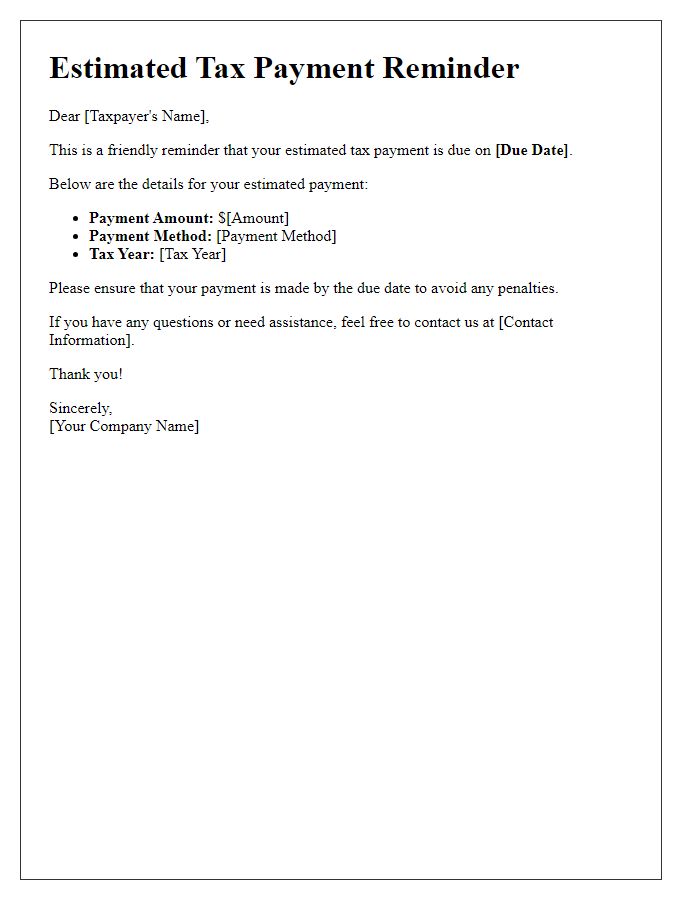

Personalized Greeting

During the tax season, timely reminders are essential for taxpayers to stay organized and compliant. Taxpayers must gather crucial documents (such as W-2 forms from employers, 1099 forms for freelancers, and various deduction-related receipts) by the April 15 filing deadline. Additionally, utilizing tax preparation software or consulting certified public accountants (CPAs) can streamline the filing process. Understanding IRS regulations, such as changes in tax brackets or standard deduction amounts, is vital to ensure accurate reporting. Taxpayers should also consider contributing to Individual Retirement Accounts (IRAs) before the deadline, as this can impact their taxable income for the previous year. Keeping an eye on potential credits, like the Earned Income Tax Credit (EITC) and Child Tax Credit, can maximize return amounts.

Clear Subject Line

Tax season prompts important preparation activities for individuals and businesses. Collecting necessary documents such as W-2 forms (issued by employers detailing annual earnings) and 1099 forms (for freelance or contracted work) is essential. Filing deadlines, typically April 15 in the United States, require timely submission to avoid penalties. Understanding different tax deductions, including educational expenses and medical costs, can maximize potential refunds. Utilizing tax preparation software or services can streamline the process, ensuring compliance with IRS regulations while optimizing financial outcomes for taxpayers.

Deadline Information

Tax season deadlines, specifically April 15th for individual tax returns in the United States, are critical for compliance with the Internal Revenue Service (IRS) requirements. Penalties for late filing can amount to 5% of the unpaid tax per month, with a maximum of 25%. Important forms, such as Form 1040 for individual income tax returns and Form W-2 for reporting wages, must be prepared accurately and submitted on time. Additionally, taxpayers should consider filing for an extension, which provides an additional six months to file but not to pay any owed taxes. Gathering essential documents including 1099s, mortgage interest statements, and records of deductions simplifies the filing process and ensures accuracy.

Required Documents List

Tax season preparation necessitates accurate documentation to ensure compliance and optimal return outcomes. Essential documents include W-2 forms from employers, which report annual wages and tax withholdings; 1099 forms for freelancers or independent contractors, detailing income variations; and Schedule K-1 from partnerships or S corporations, presenting each partner's share of income, deductions, and credits. Additional documents may encompass receipts for deductible expenses, bank statements, and records of investments such as brokerage statements. Homeowners should prepare mortgage interest statements, while those with educational expenses need 1098-T forms for tuition. Health care documentation, including 1095-A forms, is required for reporting coverage under the Affordable Care Act. Accurate assembly of these documents facilitates efficient filing of tax returns by April 15th, adhering to IRS regulations.

Contact Information for Assistance

As tax season approaches, individuals often seek assistance regarding tax preparation and filing processes, especially for the April 15 deadline in the United States. Accountants and tax professionals typically provide services ranging from basic filing to complex tax planning strategies that help optimize deductions and credits. Tax resources like the IRS website offer guidelines and tools, while local community organizations may host free tax clinics to assist low-income families. Understanding available assistance avenues, such as the Volunteer Income Tax Assistance (VITA) program and the Tax Counseling for the Elderly (TCE) program, is crucial for those requiring additional support during this time. Proper communication channels, including emails, phone numbers, and office hours, ensure individuals can easily access expert advice and resolve any tax-related queries.

Comments