Are you feeling overwhelmed by debt and unsure where to turn for help? You're not aloneâmany people find themselves in a similar situation, searching for effective debt management strategies to regain control of their finances. Tackling debt can be daunting, but with the right approach, you can create a path toward financial freedom. Join me as we explore practical tips and actionable steps that can lead you to a brighter, debt-free future!

Personalization

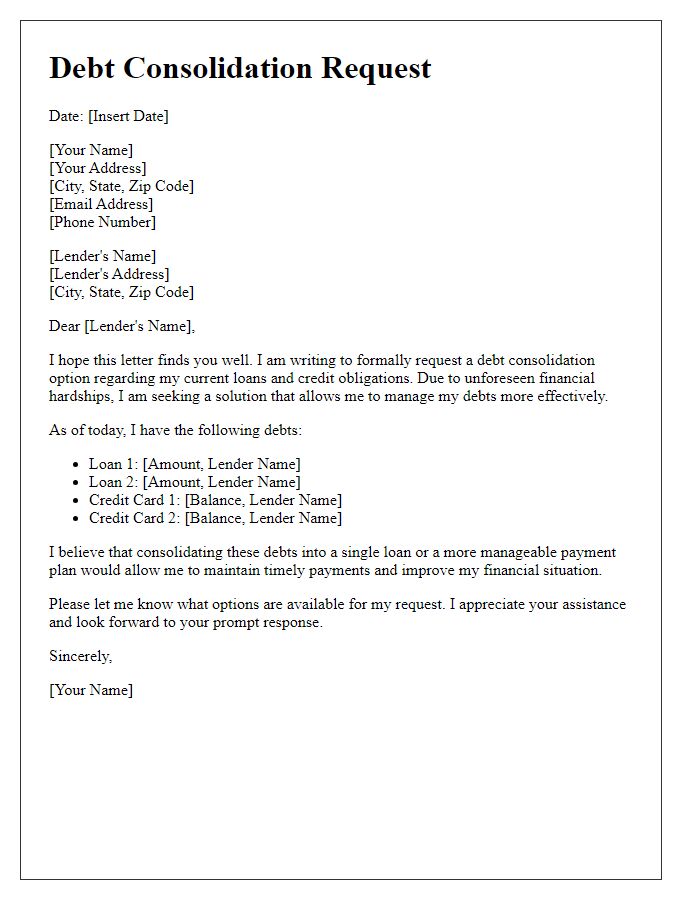

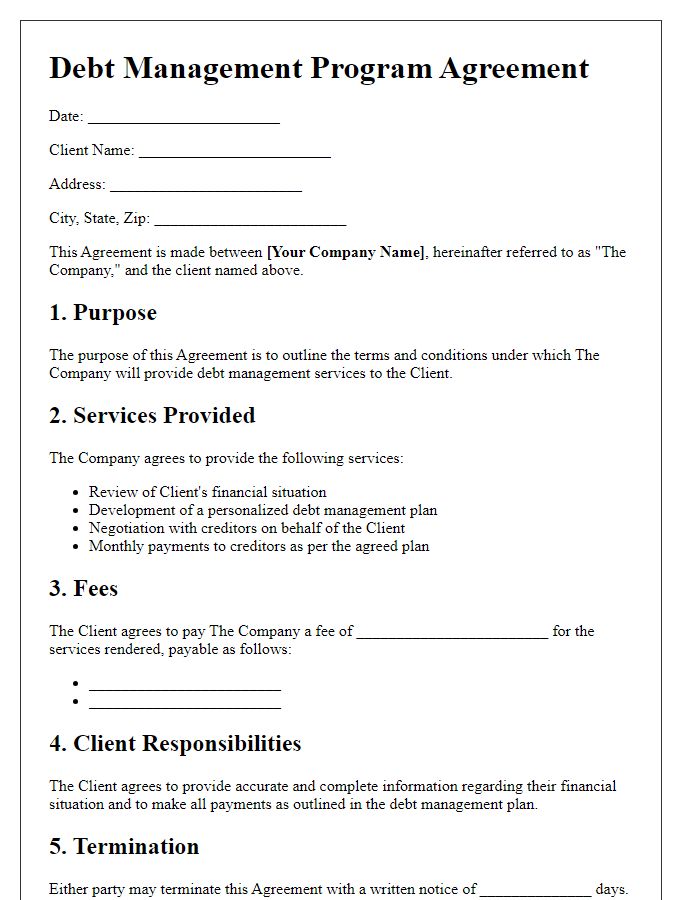

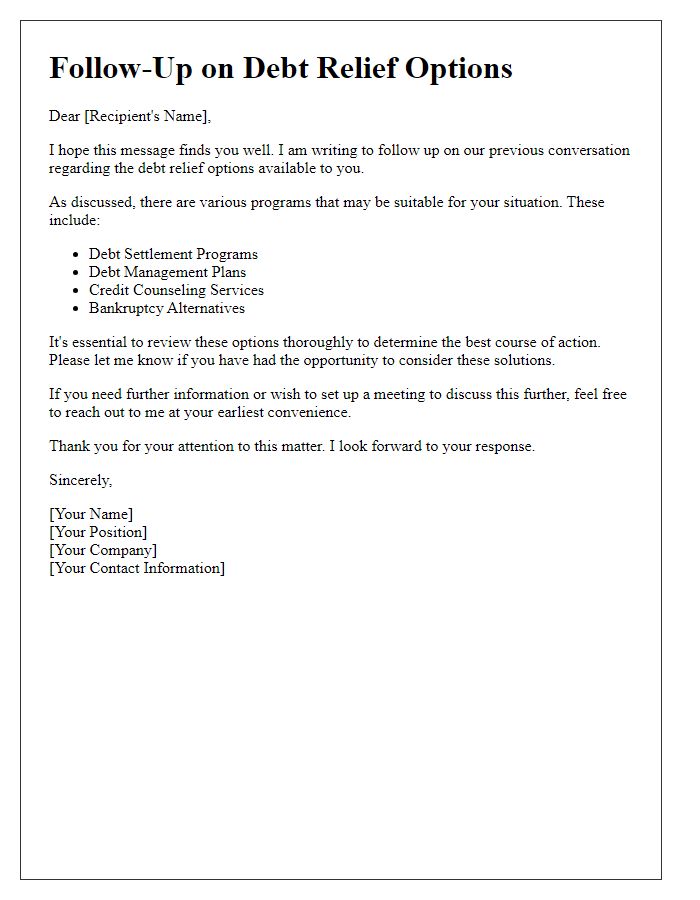

Debt management strategies serve as essential tools for individuals navigating financial challenges, particularly in cases of overwhelming credit card debt, medical bills, or personal loans. Tailored approaches may include debt consolidation, which combines multiple debts into a single loan, often with a lower interest rate, and can simplify repayments. Budgeting techniques play a crucial role, helping users allocate funds effectively across essential expenses and debt payments. Additionally, seeking assistance from non-profit credit counseling agencies, such as the National Foundation for Credit Counseling, offers valuable resources and personalized action plans to address specific financial situations. Implementing the snowball or avalanche methods can also provide impactful ways to reduce outstanding balances, with the former focusing on paying off smaller debts first and the latter prioritizing high-interest debts for long-term savings. Such personalized strategies foster financial stability and empower individuals to regain control of their financial futures.

Clarity and Conciseness

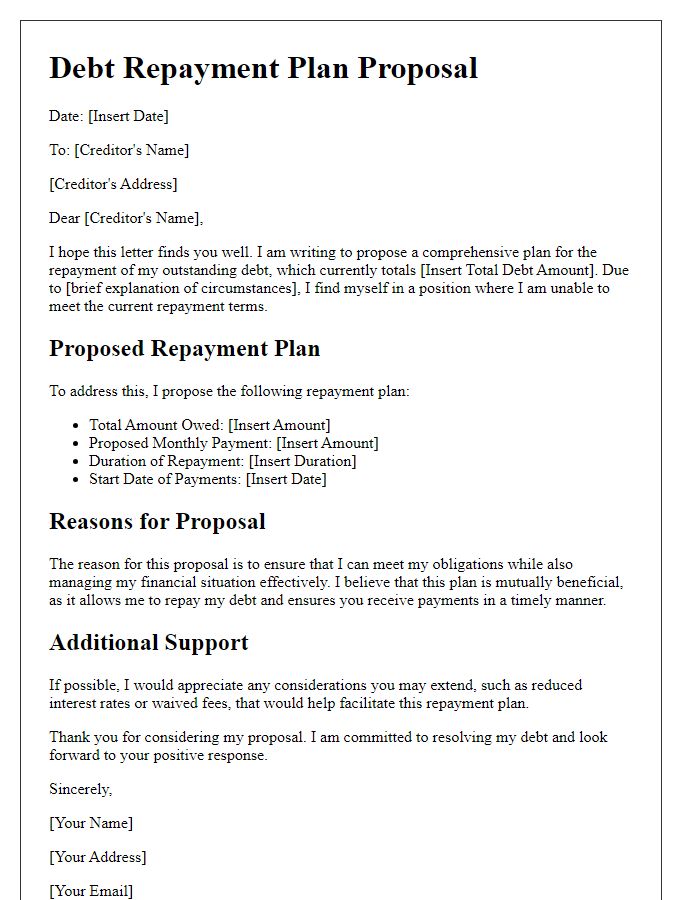

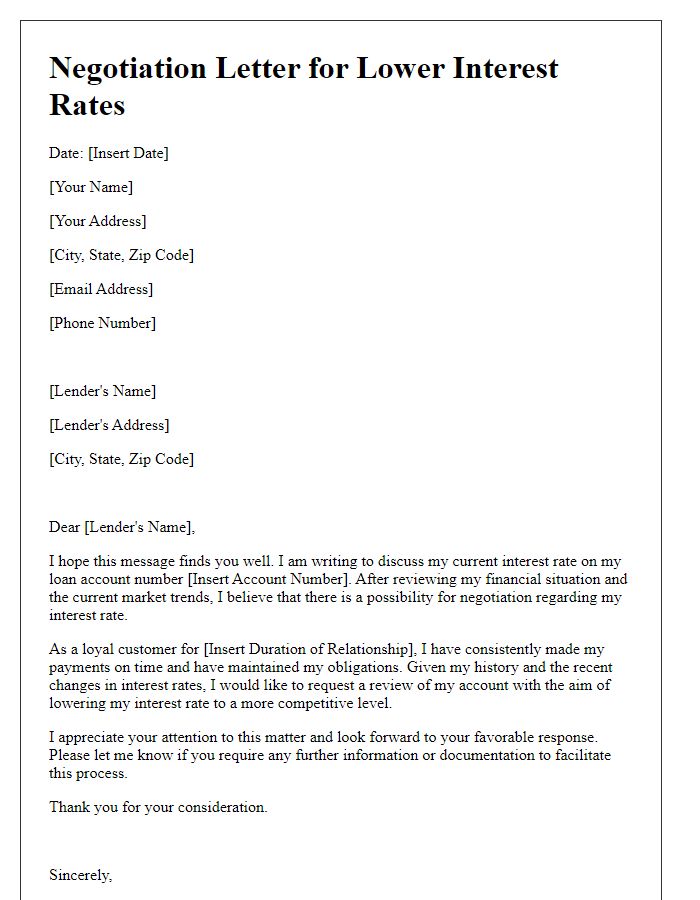

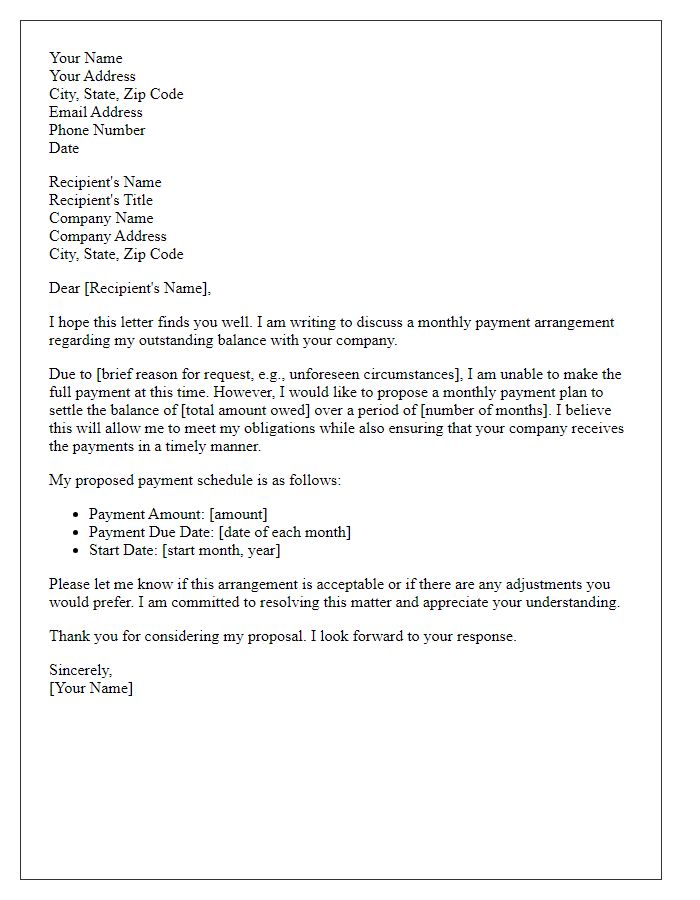

Effective debt management strategies include budgeting, debt consolidation, and negotiation with creditors. A detailed budget should outline monthly income and expenses, allowing individuals to identify areas where they can cut back. Debt consolidation, often through personal loans or balance transfer credit cards, can simplify multiple debts into one manageable payment. Communication with creditors is vital; negotiating lower interest rates or flexible repayment plans can alleviate financial pressure. Additionally, utilizing financial services or credit counseling agencies in cities like New York or Los Angeles can provide guidance and support, helping individuals to achieve debt reduction goals systematically.

Professional Tone

Debt management strategies play a vital role in financial stability and recovery, especially for individuals facing significant liabilities. Structured plans, such as debt consolidation loans and credit counseling services, provide essential pathways to alleviate overwhelming financial burdens. Programs offered by non-profit organizations can guide debtors through negotiation with creditors, potentially reducing interest rates or monthly payments. Tools like budgeting software assist in tracking expenses and income, ensuring adherence to repayment schedules. Moreover, legal avenues, such as Chapter 13 bankruptcy filings in the United States, can offer individuals relief while allowing for the restructuring of debts. Understanding these strategies empowers debtors, enabling informed decisions that lead to improved financial health.

Actionable Steps

Effective debt management strategies require comprehensive planning and actionable steps to regain financial stability. Establish a detailed budget that outlines monthly income versus expenses, highlighting areas for cost reductions. Prioritize debts by interest rates, focusing first on high-interest debts like credit cards which often exceed 20% APR. Consider exploring debt consolidation options, such as personal loans or balance transfer credit cards that offer lower rates and can simplify payments. Engage with reputable credit counseling services, like the National Foundation for Credit Counseling (NFCC), which provide tailored debt management plans for individuals struggling with debt. Implement a strict savings plan aimed at building an emergency fund, ensuring at least three to six months of living expenses are covered, which can prevent further reliance on credit. Regularly monitor credit reports, checking for errors that could affect scores, with the goal of improving overall credit health. Lastly, commit to continuous financial education to inspire informed decisions and sustainable debt management going forward.

Contact Information

Debt management strategies provide essential guidance for individuals facing financial challenges. Effective budgeting techniques, such as the 50/30/20 rule, allocate income into categories like needs, wants, and savings. Credit counseling organizations, like the National Foundation for Credit Counseling (NFCC), offer professional assistance and debt management plans tailored to personal circumstances. Consolidation loans, which average interest rates lower than credit cards, enable borrowers to combine multiple debts into one payment. In 2022, approximately 11% of adults in the United States sought professional debt relief services, highlighting the growing need for financial education and support in managing debt responsibly.

Comments