Are you looking to enhance your financial agility and navigate uncertainties with ease? Achieving fiscal flexibility is essential in today's ever-changing economic climate, allowing both individuals and businesses to adapt and thrive. In this article, we'll explore actionable strategies and insights that can help you master your finances and make informed decisions. So, let's dive in and discover the secrets to financial success!

Clear financial goals

Developing clear financial goals is essential for achieving fiscal flexibility. Setting specific, measurable goals, such as saving $10,000 in an emergency fund within 12 months, provides a tangible target for individuals and businesses alike. Understanding income sources, like monthly salaries from jobs or revenue from small businesses, should be analyzed to create a realistic budget. Regular assessments, perhaps quarterly, can help track progress and adjust strategies if necessary. Utilizing financial tools, such as budgeting apps or spreadsheets, ensures accurate monitoring of expenses and savings. Engaging in financial literacy through books or courses enhances knowledge about investments and savings strategies, ultimately fostering a sustainable financial foundation.

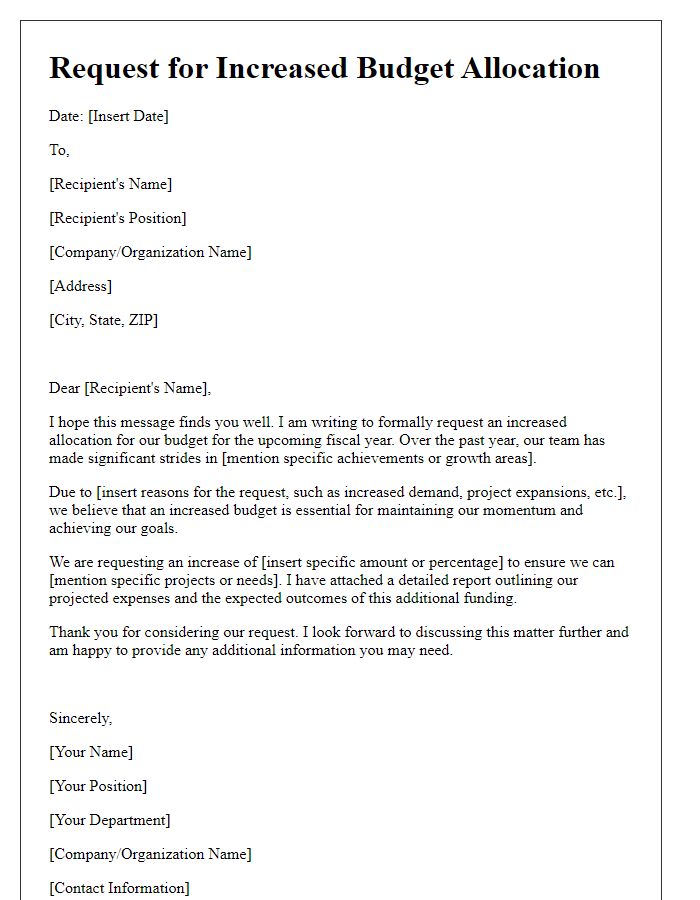

Budget allocation strategies

Implementing effective budget allocation strategies enables achieving fiscal flexibility within organizations. Analyzing historical data (2015-2023) on revenue trends helps identify periods of financial growth or decline. By reallocating resources, such as reducing discretionary spending by 15% or increasing investments in technology by 20%, organizations can enhance operational efficiency. The framework of zero-based budgeting encourages reviewing all expenses for necessity, fostering accountability among departments. Establishing a reserve fund, typically recommended at 10-15% of operating budget, allows for unforeseen expenses or economic downturns, ensuring organizational resilience. Strategic investments in training and development of employees can improve productivity, leading to increased revenue in competitive markets.

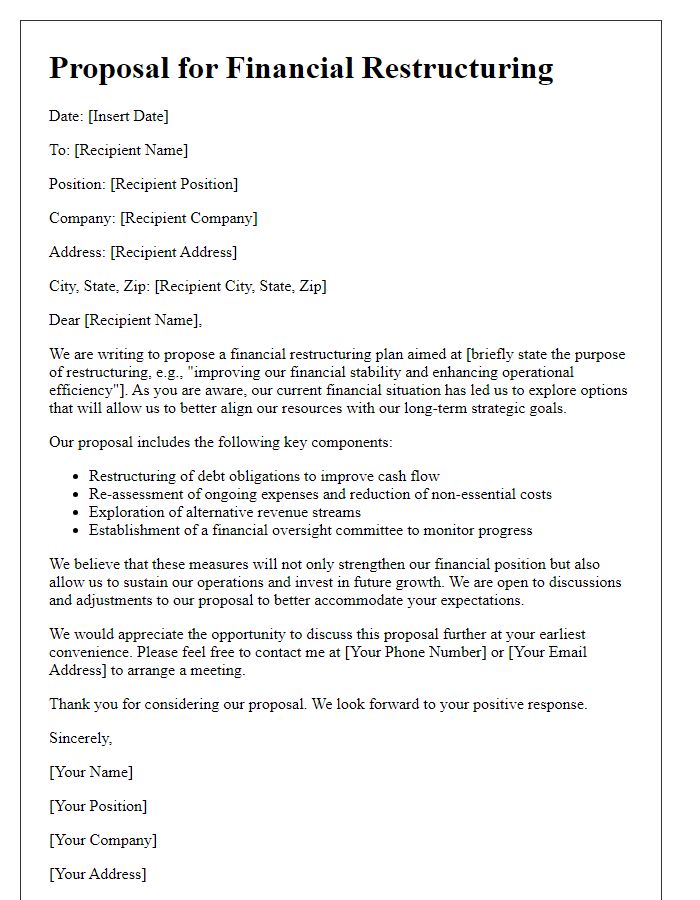

Debt management plans

Effective debt management plans are crucial for achieving fiscal flexibility, particularly for government bodies and corporations seeking to maintain financial stability. These plans integrate budget analysis, cash flow forecasting, and risk assessment to ensure that debts are serviced without compromising essential expenditures. By prioritizing debt repayment strategies, such as refinancing existing obligations or negotiating terms with creditors, entities can mitigate financial strain. Furthermore, adherence to guidelines set by financial authorities, like the International Monetary Fund (IMF) or local treasury departments, can enhance credit ratings, thereby reducing borrowing costs. Implementing strategic frameworks allows organizations to navigate economic fluctuations and invest in opportunities, ultimately securing long-term fiscal adaptability.

Income diversification methods

Income diversification methods, such as investing in multiple asset classes, can enhance fiscal flexibility for individuals and businesses. Strategies include expanding investment portfolios to incorporate stocks, bonds, real estate, and alternative investments like cryptocurrencies or peer-to-peer lending platforms. Establishing multiple income streams, such as freelance work, side businesses, or passive income sources like dividend-paying stocks or rental properties, reinforces financial resilience. Geographic diversification in investments, such as international stocks or foreign real estate, can mitigate local economic downturns. Engaging in continuous education and skill development allows individuals to adapt to market changes and seize new opportunities, ultimately promoting long-term financial stability.

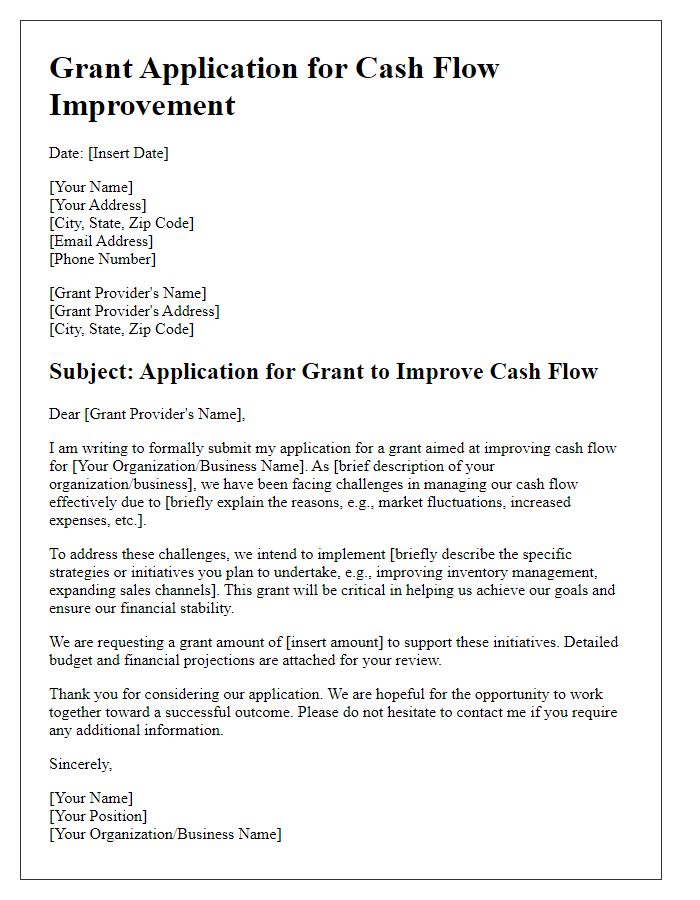

Financial performance metrics

Achieving fiscal flexibility requires a comprehensive understanding of financial performance metrics, such as revenue growth, profit margins, and cash flow indicators. For example, a company may analyze its annual revenue growth rate, ideally targeting a minimum of 10% year-over-year increase to ensure robust expansion. Profit margins, specifically gross (typically above 20% for healthy sectors) and net margins (usually around 5% to 15%), reflect operational efficiency. Cash flow metrics, such as free cash flow (which should be positive) highlight the ability to fund future investments or cover unforeseen expenses. Furthermore, analyzing liquidity ratios like the current ratio (ideally above 1.5) ensures sufficient assets are available to meet short-term liabilities. Monitoring these key performance indicators facilitates strategic decision-making, enabling organizations to adapt to fluctuations in economic conditions while maintaining fiscal agility.

Comments