Planning for educational expenses can feel overwhelming, but it's an essential part of securing a brighter future for both students and families. From tuition fees to textbooks and living costs, understanding how to budget effectively can make all the difference in navigating the academic journey. In this article, we'll explore practical strategies and tips for managing your educational finances with confidence. So, if you're ready to take control of your education expenses, keep reading for some valuable insights!

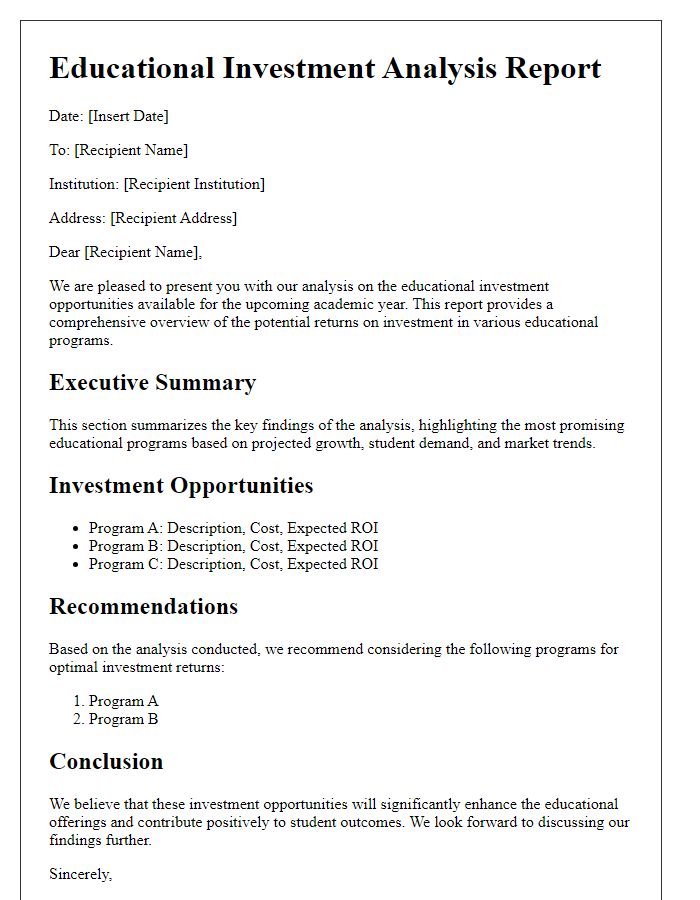

Introduction and Purpose

Educational budgeting is crucial for managing costs related to academic pursuits, such as tuition fees, books, and living expenses. In the United States, the average annual tuition for public four-year universities is approximately $10,000, while private institutions can charge over $30,000 per year. Planning expenses necessitates detailed analysis of financial aid opportunities, scholarships, and student loans, which can total upwards of $28 billion annually. Budgeting also includes considering additional costs such as technology fees, which can reach $1,000, and housing expenses, averaging $12,000 annually in college towns. Establishing a comprehensive educational expense plan ensures students can focus on their studies without the burden of unexpected financial pressures.

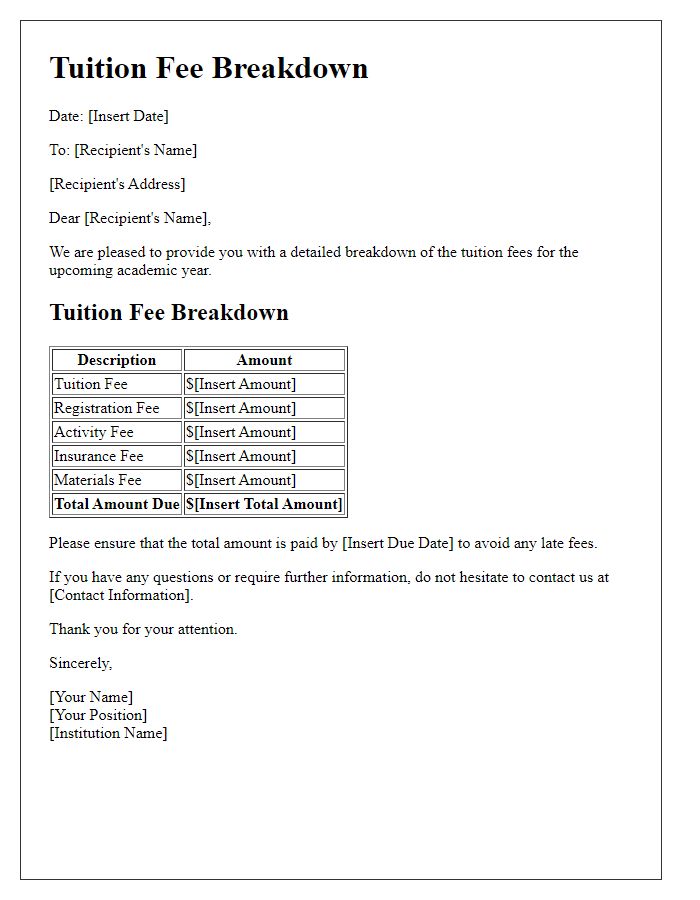

Detailed Cost Breakdown

Educational expenses planning requires a comprehensive cost breakdown to ensure financial preparedness for various academic activities. Tuition fees at universities, such as Harvard ($51,925 annually for undergraduate programs), constitute a significant portion of total costs. Additional charges include mandatory student fees, which may range from $1,000 to $2,000, covering campus facilities and services. Housing expenses, averaging $10,000 per year for on-campus accommodations, demand careful consideration. Additionally, textbooks and supplies can add up, averaging around $500 each semester. Transportation costs, dependent on location, vary widely; students commuting in urban areas might incur monthly public transport expenses of $100-$150, while those living off-campus might face higher costs linked to fuel and parking. Personal living expenses, including food, entertainment, and healthcare, typically require a budget of $2,000 to $3,000 annually. Comprehensive financial planning for educational endeavors necessitates understanding these varied expenses to avoid unforeseen financial burdens.

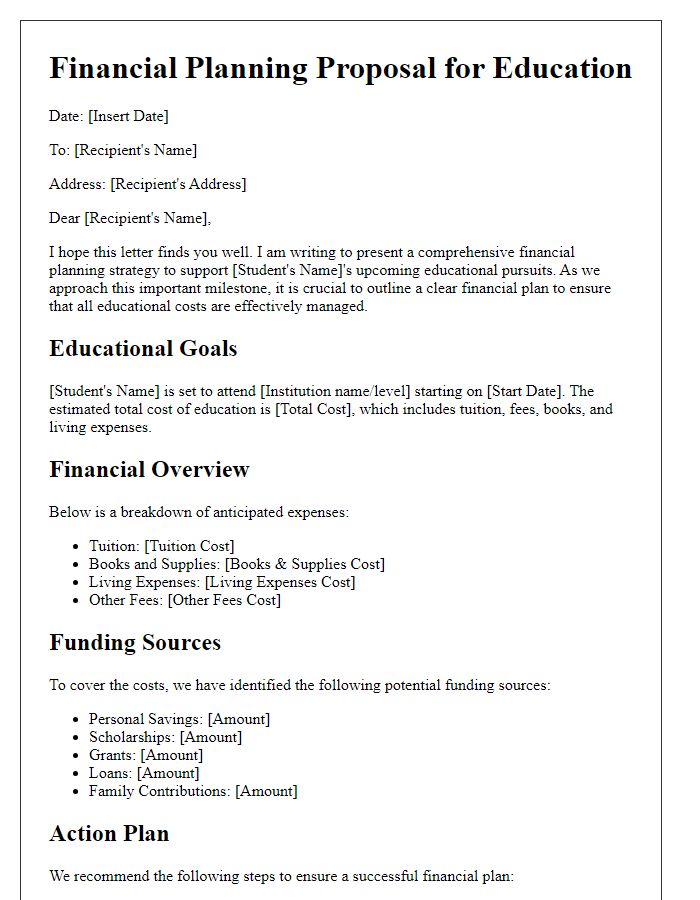

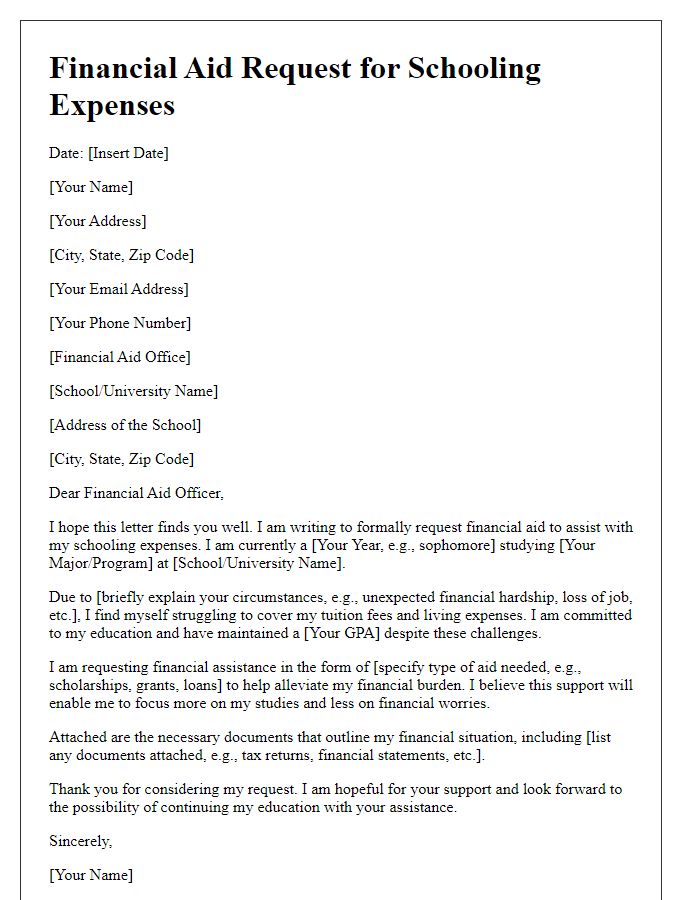

Funding Sources

Educational expenses planning requires a detailed overview of funding sources including scholarships, grants, student loans, and personal savings. Scholarships are financial awards based on academic or extracurricular achievement, provided by institutions, private organizations, or government initiatives. Grants are typically need-based funds awarded by federal agencies like the U.S. Department of Education and do not require repayment. Student loans, unlike grants, must be repaid after graduation, with options like Federal Direct Loans and Perkins Loans available to students at educational institutions. Personal savings often include 529 College Savings Plans designed specifically for future educational expenses. Each of these funding sources plays a crucial role in covering tuition fees, books, supplies, and living costs associated with higher education.

Payment Schedule

Creating a detailed payment schedule for educational expenses is crucial for managing financial planning effectively. Typically, educational institutions, such as universities or colleges, outline their tuition fees, which can range from $15,000 to over $60,000 per year depending on the program and location. Additional costs include textbooks, averaging $600 per semester, along with housing expenses which can vary greatly depending on campus vs. off-campus living. Room and board may range from $8,000 to $15,000 annually. Financial aid opportunities like scholarships, grants, or loans can impact the overall payment timeline, typically extending over a semester (around 16 weeks) or an academic year (two semesters). Setting clear dates for tuition payments, such as September 1 for the fall semester and January 15 for the spring semester, ensures timely financial management. Additional fees, like laboratory or technology fees, might require periodic payments as well. Regular monitoring of expenses can help maintain a sustainable budget throughout the academic journey.

Contact Information

Effective educational expenses planning requires a comprehensive approach to budgeting. Understanding contact information, such as the school's administrative office, financial aid department, and tuition payment hotline, is essential for parents and students. For example, contacting the financial aid office at Central University (with a population of over 20,000 students) can provide insights into available scholarships and grants. Additionally, reaching out to the tuition payment department may unveil essential deadlines (such as impending payment due dates in August) for ensuring timely enrollment. Maintaining organized records of all relevant contacts, including email addresses and phone numbers, fosters efficient communication necessary for navigating financing tuition costs, textbook expenses often exceeding $1,200 annually for undergraduate programs, and other essential fees like lab charges or technology fees.

Comments