As we embark on another fiscal year, it's essential to approach our budget planning with clarity and purpose. Creating a comprehensive budget template not only ensures that we allocate resources effectively but also serves as a roadmap for our financial journey ahead. By considering our organizational goals and potential challenges, we can set a sustainable foundation that promotes growth and stability. Join us as we explore the key components of a successful fiscal year budget planning strategy!

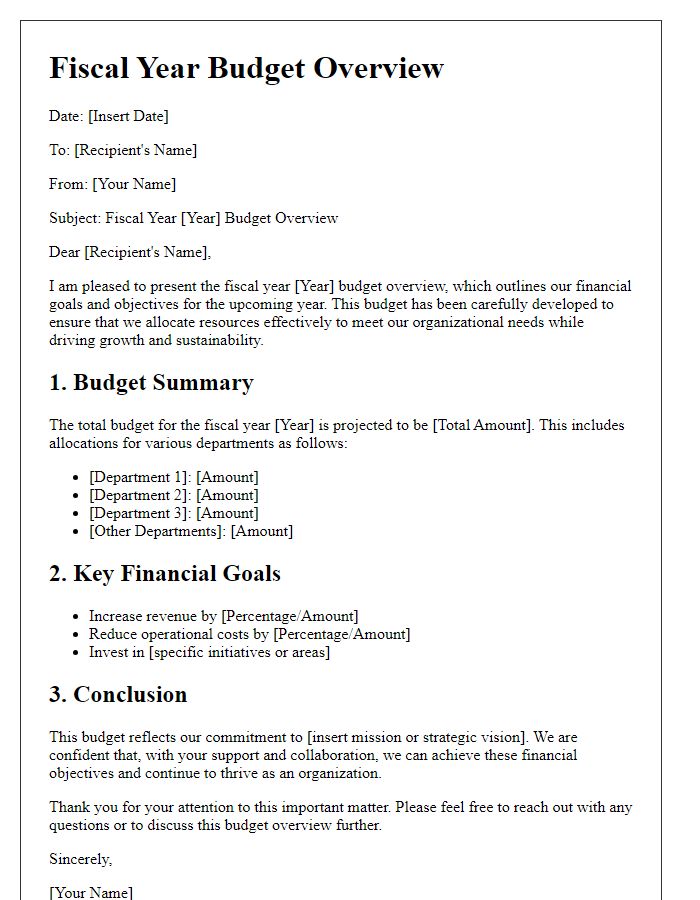

Goal Alignment

Goal alignment in fiscal year budget planning is crucial for ensuring that financial resources are effectively allocated to meet organizational objectives. Clear goals (specific, measurable, achievable, relevant, and time-bound) serve as a foundation for the budgeting process, guiding departments in prioritizing expenditures. Each department (such as marketing, research and development, or human resources) aligns its projected costs with overarching strategic goals, facilitating coherence across the organization. A comprehensive budget that reflects these goals can promote accountability, ensuring that each dollar spent supports both operational efficiency and long-term growth initiatives, ultimately contributing to improved financial health and sustainability. Regular reviews and adjustments during the fiscal year (such as quarterly assessments) can help in realigning goals based on changing market conditions or organizational priorities, maximizing resource utilization.

Revenue Forecasting

Revenue forecasting is a critical aspect of fiscal year budget planning for organizations, such as non-profits and corporations. It involves analyzing historical financial data (typically covering the past three to five years) to predict future income streams from various sources like sales, donations, and grants. Accurate forecasting requires consideration of economic indicators, such as GDP growth rates and unemployment statistics, which can influence consumer spending behavior. Additionally, tools such as regression analysis, trend analysis, and market research reports provide insights to enhance the accuracy of projections. By establishing a clear revenue forecast, organizations can develop a more effective budget, making informed decisions regarding resource allocation for projects and operational expenses.

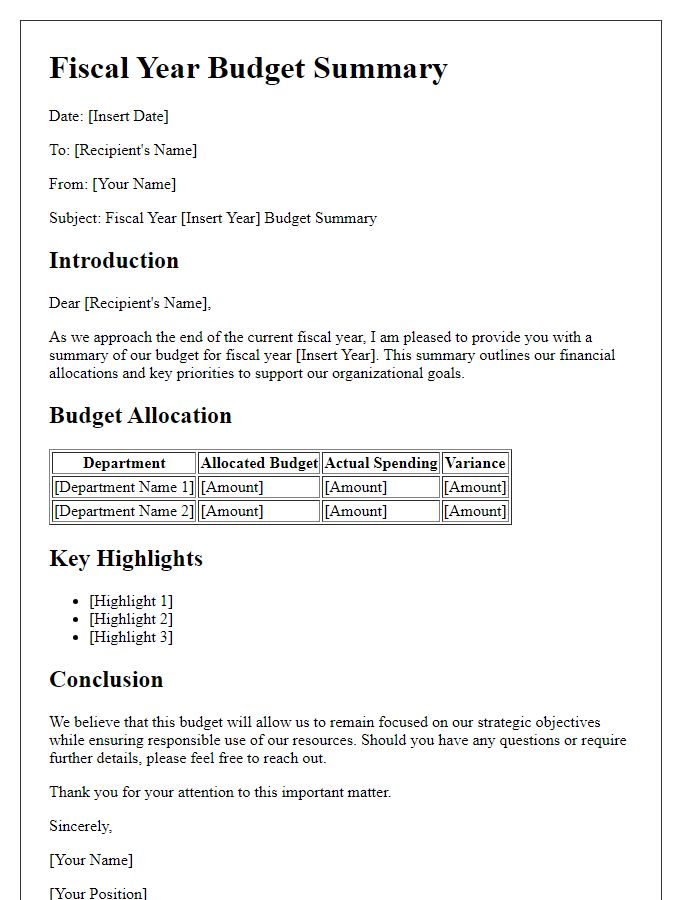

Expense Management

Effective expense management during fiscal year budget planning is crucial for maintaining organizational sustainability. Detailed analysis of historical spending patterns and future financial forecasts helps identify key areas for cost reduction. Departments such as marketing, research and development, and human resources typically require distinct budget allocations, often outlined in percentage terms relative to overall expenses. Fiscal policies implemented by the organization, considering regulations from governing bodies like the IRS (Internal Revenue Service), ensure compliance and accountability in financial reporting. Tools such as budgeting software and financial dashboards facilitate real-time monitoring of expenditures, assisting in making informed decisions to optimize financial resources. Regular reviews and revisions throughout the fiscal year enable adaptive strategies to address unexpected costs or changes in revenue streams.

Risk Assessment

A comprehensive risk assessment is crucial for fiscal year budget planning, particularly in sectors like healthcare and technology. Identifying potential financial risks, such as market volatility or regulatory changes, significantly impacts budgeting strategies. For instance, fluctuations in currency exchange rates, such as the Euro-dollar exchange rate, can affect overseas operations and budgets, particularly for companies with international exposure. Additionally, emerging threats such as cybersecurity breaches in financial data management can lead to substantial unexpected costs, necessitating a specific allocation for risk mitigation. Lastly, natural disasters, prevalent in areas like California, require contingency planning, influencing emergency preparedness budgets. Careful analysis of these risk factors will enhance the overall accuracy and reliability of the fiscal budget.

Performance Metrics

Performance metrics play a critical role in fiscal year budget planning, guiding organizations toward achieving their financial goals. Key performance indicators (KPIs), such as return on investment (ROI) percentage and cost per acquisition (CPA), provide quantifiable measures of success. Departments may analyze historical data, focusing on user engagement rates in digital marketing campaigns, which can increase by 20% or more depending on the timing of promotional activities. Financial forecasting relies heavily on metrics like revenue growth rate, projected at 10% annually for the coming year, and profit margins that influence budget allocations across divisions. Tracking customer satisfaction scores, often linked to increased sales, typically shows a correlation of 15% improved retention rates. Overall, these robust performance metrics serve as invaluable tools in aligning budgetary decisions with organizational objectives and improving resource allocation efficiency.

Comments